Dairyland Insurance Review: 2024 Rates and Ratings

Dairyland has expensive car insurance with below-average customer service, but is a better choice for motorcycle coverage.

Find Cheap Auto Insurance Quotes in Your Area

Is Dairyland insurance good?

Dairyland is often not a top option for car insurance. The company's rates are considerably more expensive than average. Dairyland does have several nice coverage add-ons, but its customer service is below average.

However, Dairyland is a better choice for motorcycle insurance because it's not expensive and lets you add a range of extra coverages to your policy.

Pros and cons

Pros

Cheap motorcycle insurance

Good set of extra coverage options

Offers coverage to high-risk drivers

Cons

Poor customer service

Expensive car insurance

Few discount options

Dairyland car insurance review

Dairyland is usually not a good choice because it's an expensive option for car insurance.

It only has a modest number of discounts to lower those rates and doesn't offer a large number of extra coverage options.

Dairyland car insurance quotes

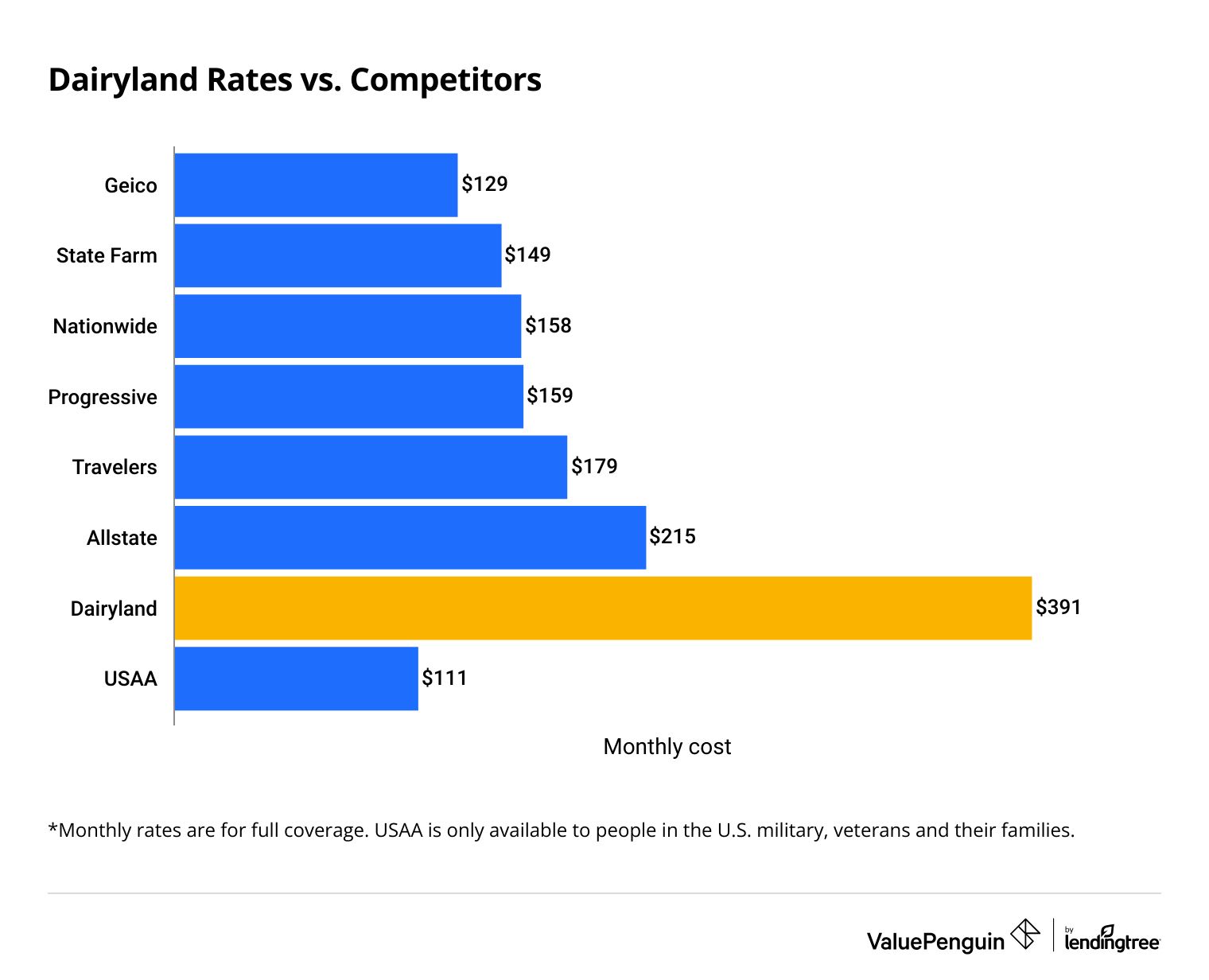

Dairyland car insurance is much more expensive than average, both for full and minimum coverage.

The company's average rate for full coverage is $391 per month, more than twice the average rate. Minimum coverage from Dairyland is $196 per month, on average, but you can regularly get that coverage from other companies for less than $100 per month.

Find Cheap Auto Insurance Quotes in Your Area

Dairyland auto quotes vs. competitors

Minimum coverage

Full coverage

Company | Monthly rate | |||

|---|---|---|---|---|

| Geico | $129 | |||

| State Farm | $149 | |||

| Nationwide | $158 | |||

| Progressive | $159 | |||

| Travelers | $179 | |||

*USAA is only available to military members, veterans and their families.

Minimum coverage

Company | Monthly rate | |||

|---|---|---|---|---|

| Geico | $129 | |||

| State Farm | $149 | |||

| Nationwide | $158 | |||

| Progressive | $159 | |||

| Travelers | $179 | |||

*USAA is only available to military members, veterans and their families.

Full coverage

Company | Monthly rate | |||

|---|---|---|---|---|

| Geico | $55 | |||

| State Farm | $64 | |||

| Nationwide | $76 | |||

| Progressive | $60 | |||

| Travelers | $86 | |||

*USAA is only available to military members, veterans and their families.

Dairyland is also a very expensive option if you have issues like a DUI or an accident. But the company does offer SR-22 coverage, which can be required if you get a DUI. You should look around for lower rates, but Dairyland could be an option if you're having trouble finding coverage.

Dairyland auto insurance discounts

Dairyland offers many of the standard auto insurance discounts you will find with major insurance companies. But it doesn't have a large list of ways to save or any uncommon discounts.

If you have multiple cars on your policy, you'll get a lower rate on each.

If you have a home and it's insured, you can get a discount on your rates.

You get a discount if you install an anti-theft device on your car.

If you've been with your previous insurance company for at least six months, you can get a break on your rates. In some states, you can get this discount even if you had a lapse in coverage.

You'll be able to save money if you take a defensive driving course.

If you pay less frequently than every month, you'll have a slightly smaller overall bill. You can pay quarterly, every six months or once a year.

Dairy auto insurance coverage

Dairyland offers only a few extra coverage options you can add to your policy.

Dairyland offers roadside assistance for events like a dead battery, flat tire, or breakdown. It can also help with more mundane issues, like just running out of gas or locking your key in your car.

If your car breaks down, you can have someone pick up your car and tow it to a mechanic.

Rental reimbursement will pay money toward your rental if your car is in the shop after an incident that's covered.

Dairyland auto insurance reviews and ratings

Dairyland car insurance generally gets average to below average ratings for its customer service.

Dairyland also has an A+ or "Superior" financial strength rating from AM Best. That means the company is on good financial footing and should have the funds to pay out claims.

Dairyland motorcycle insurance

Dairyland has some of the cheapest motorcycle insurance available, with a good set of coverage options.

Dairyland motorcycle insurance quotes

Dairyland's average rate for full-coverage motorcycle insurance is around $22 per month. That's one-third less than national average rate, making it one of the cheapest options for motorcycle coverage.

Compare Motorcycle Insurance Quotes

Dairyland isn't the cheapest option in every state, but it is in several large ones, like Texas and Florida.

Dairyland motorcycle quotes vs. competitors

Company | Monthly rate | ||

|---|---|---|---|

| Dairyland | $22 | ||

| Progressive | $23 | ||

| Harley-Davidson | $24 | ||

| Geico | $36 | ||

| Allstate | $37 | ||

| Nationwide | $55 | ||

Dairyland motorcycle insurance discounts

Dairyland has a good set of motorcycle insurance discounts, several of which are easy to get. That means you can reduce the company's already low rates.

If you take a motorcycle rider course through the Motorcycle Safety Foundation, you can get a break on your rates.

If you've been a Dairyland customer for more than a year and get a new bike, you can get a discount on rates.

You'll pay a lower rate if you insure multiple bikes with Dairyland.

If you own a home, you could qualify for a discount on your Dairyland motorcycle coverage.

If you're part of the Harley Owners Group (H.O.G.), you'll get a break on your rates. You'll also get a discount if you're part of another motorcycle club or association.

You'll get a discount on your policy if you switch from another company.

Dairyland motorcycle insurance coverage options

Dairyland has a good set of extra motorcycle coverage options you can add to your policy.

This makes sure your motorcycle is repaired with original manufacturer parts.

Helps pay for a rental car when yours is in the shop.

Covers upgrades you made to your bike. Standard policies often won't pay the full value of your motorcycle after you make improvements.

Provides 24-hour towing and roadside service for events such as running out of gas, a dead battery, losing your key, a flat tire and low oil.

Will pay for a new bike if yours is three years old or newer and is totaled.

Provides medical coverage if another rider on your bike is hurt when you're at fault in an accident.

Dairyland insurance claims

The only way for Dairyland policyholders to file a claim is over the phone. Drivers must call the 24/7 claims service to begin the process. Dairyland Insurance's phone number is 800-334-0090.

Additionally, existing customers can make payments, download ID cards and view policy documents online by signing in to the My Dairyland insurance website or via the Dairyland app.

Frequently asked questions

Is Dairyland insurance good?

Dairyland is generally not a good option for car insurance because it's expensive. It can be worth looking at if you're having trouble getting coverage. Dairyland is a good option to consider for motorcycle coverage because it has low rates in many states and good coverage options.

Why is Dairyland so expensive?

One reason Dairyland is more expensive than average is that the company specializes in covering high-risk drivers. This often raises prices for all of a company's policies.

Does Dairyland offer renters insurance?

Dairyland does not underwrite its own renters insurance, but it will connect you with other companies that can.

Methodology

To compare the cost of Dairyland's auto and motorcycle insurance policies, ValuePenguin gathered hundreds of quotes for typical customers.

For the auto insurance review, quotes are for a 30-year-old man living in South Carolina with a 2015 Honda Civic EX.

Coverage | Minimum coverage | Full coverage |

|---|---|---|

| Bodily injury liability | $25,000/$50,000 | $50,000/$100,000 |

| Property damage liability | $25,000 | $25,000 |

| Uninsured motorist bodily injury | $25,000/$50,000 | $50,000/$100,000 |

| Underinsured motorist bodily injury | Not included | $50,000/$100/000 |

| Uninsured motorist property damage | $25,000 | $25,000 |

| Comprehensive and collision | Not included | $500 deductible |

For the Motorcycle insurance review, quotes are for a 45-year-old man who rides a 2018 Honda CMX500 Rebel. Coverage for the policies is more than the state minimum.

- Bodily injury liability: $50,000/$100,000

- Property damage liability: $25,000

- Comprehensive and collision: $500 deductible

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $25,000 per accident

- Medical payments: $5,000

- All other coverages:Not included unless legally required

Auto insurance quotes used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only, Your own quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.