SR-22 Insurance: Compare Quotes and Find Cheap Coverage

State Farm has the cheapest widely available SR-22 insurance quotes, at around $227 per month after a DUI.

Find Cheap Auto Insurance Quotes in Your Area

Best cheap SR-22 insurance companies

An SR-22 form proves you have the minimum amount of auto insurance your state requires. You only need an SR-22 if your state or a court orders you to get one. This typically happens after a serious driving violation like a DUI or driving without insurance.

Depending on why you need an SR-22, your state may also suspend your driver's license. In that case, you'll need an insurance company to file an SR-22 before you can get your license back.

To find the best cheap SR-22 car insurance, ValuePenguin collected quotes from 13 auto insurance companies across 10 states. Quotes are for a full-coverage policy with higher liability limits than required in each state and comprehensive and collision coverage.

Our editors chose the best companies based on cost, customer service reviews, coverage options and availability.

Best national company for SR-22 insurance: State Farm

-

Editor's rating

- Cost after a DUI: $227/yr

State Farm is an excellent choice for SR-22 insurance because of its low rates and dependable customer service.

-

Affordable SR-22 insurance

-

Excellent customer service

-

Great for bundling policies

-

Lots of discounts

-

Not all drivers can buy a policy fully online

-

Limited coverage options

State Farm has low SR-22 rates for drivers with a DUI, at around $227 per month. That's $107 per month less than the average rate of $334.

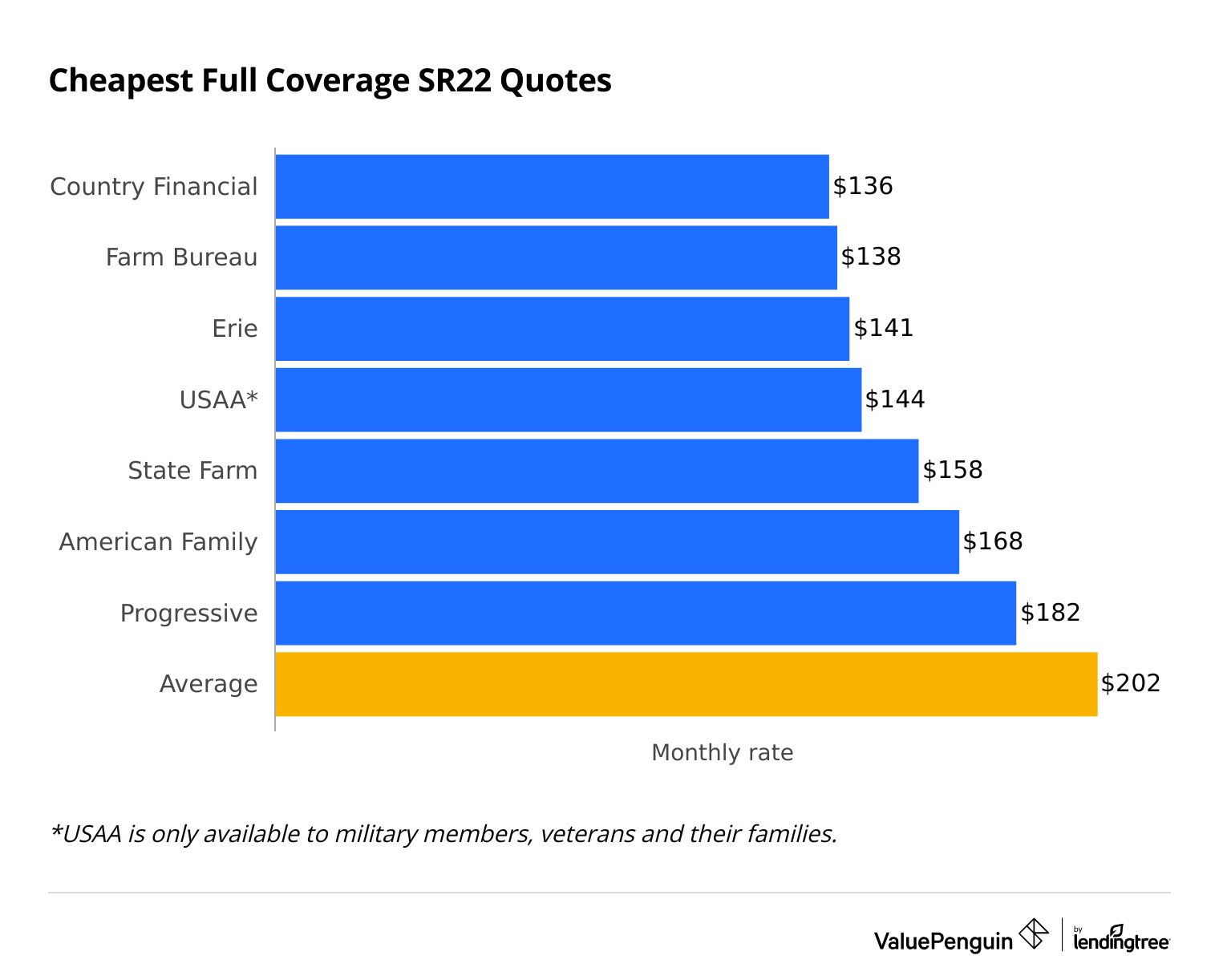

Full coverage from State Farm costs $158 per month for drivers without a DUI, on average. That's cheaper than average by $44 per month.

State Farm also offers an excellent discount for bundling policies, along with some of the cheapest home insurance in the country. That makes it a great choice for drivers looking to bundle their home and auto insurance policies.

In addition to a large bundling discount, State Farm offers lots of ways for drivers with an SR-22 to save on insurance. You can get a discount for completing a defensive driving course or installing an anti-theft device in your car.

State Farm also has a safe driving program called Drive Safe & Save. This program tracks your driving behaviors and rewards good habits with a discount of up to 30%.

Cheapest SR-22 insurance overall: Country Financial

-

Editor's rating

- Cost after a DUI: $213/mo

Country Financial has the best SR-22 rates for most drivers.

-

Cheapest SR-22 insurance quotes

-

Reliable customer service

-

Helpful local agents

-

Only available in 19 states

-

Few coverage add-ons

-

Bad for bundling due to expensive home insurance rates

Country Financial has the cheapest rates for drivers with a DUI that need an SR-22. Full coverage costs around $213 per month, which is $121 per month less than average.

And a full coverage SR-22 policy from Country Financial costs around $136 per month for drivers without a DUI conviction. That's $66 per month cheaper than average.

Country Financial customers are typically happy with their experience with the company. It earned a very high score on J.D. Power's claims satisfaction survey. The company also gets one-quarter as many complaints as expected, according to the National Association of Insurance Commissioners (NAIC). That means you can expect Country Financial to help you get back on the road quickly after a crash.

Country Financial offers enough coverage for most drivers. But it has fewer add-ons than other companies. For example, you can't get gap insurance if you have a loan or lease on your car.

In addition, Country Financial is only available in 19 states, so not everyone can get a policy.

Best SR-22 insurance for drivers with military connections: USAA

-

Editor's rating

- Cost after a DUI: $221/yr

USAA is the best option for military members, veterans and their families who need SR-22 car insurance.

-

Inexpensive SR-22 insurance

-

Top-rated customer service

-

Numerous discounts

-

Only available to drivers with military ties

USAA offers low-cost SR-22 auto insurance and some of the best customer service in the insurance industry. However, only active-duty military members, veterans and some of their family members can get car insurance from USAA.

People with a DUI pay around $221 per month for full coverage, which is $113 per month cheaper than average. A full coverage SR-22 policy from USAA costs around $144 per month for a driver without a DUI conviction.

USAA consistently earns a very high score on J.D. Power's claims satisfaction survey. That means you can expect a quick and easy claims process after an accident.

Cheapest SR-22 insurance quotes

State Farm is the most affordable national company for SR-22 insurance.

A full coverage SR-22 policy from State Farm costs just $158 per month. That's 22% less than the average of $202 per month.

You may find even cheaper SR-22 car insurance quotes from mid-size companies like Country Financial. However, mid-size companies typically aren't available everywhere.

Find Cheap Auto Insurance Quotes with SR-22

When setting your insurance rates, companies consider how likely you are to cause an accident or make a claim. Because you typically need to get an SR-22 after a major driving offense, companies believe you're more likely to cause an accident in the future. For that reason, you'll likely see higher rates after an SR-22.

Cheap SR-22 auto insurance rates

Company | Monthly rate | ||

|---|---|---|---|

| Country Financial | $102 | ||

| Farm Bureau | $107 | ||

| State Farm | $114 | ||

| Erie | $121 | ||

| American Family | $137 | ||

*USAA is only available to military members, veterans and their families.

Not every car insurance company offers SR-22 insurance. Having to get SR-22 shows you're a risky driver. So, your company may cancel your coverage or increase your rates if you need an SR-22.

If your company drops you, you'll need to find a new company to file the SR-22.

Nonstandard SR-22 insurance companies

Nonstandard insurance companies like The General and SafeAuto specialize in offering coverage to high-risk drivers. This includes people who need an SR-22. If you can't get a policy from a typical insurance company, nonstandard companies are one option to consider.

It's worth trying to get a quote from a standard company, even if it takes extra effort to find one that will cover you.

Nonstandard insurance companies typically have fewer coverage options or discounts than major companies. And their customer service is often poor, so getting your car fixed after a crash may be difficult.

How to find cheap SR-22 insurance

To find cheap SR-22 car insurance quotes, you should shop for rates from multiple companies, look for discounts and drop unnecessary coverage.

Compare quotes from multiple companies: There's a difference of $151 per month between the most and least expensive SR-22 insurance companies for full coverage.

In addition, every insurance company considers different factors when determining your car insurance rate. So, the cheapest company for you may differ from your family, friends or neighbors.

Qualify for discounts: The largest discount you can typically get is a multi-policy discount, which can lower your car insurance bill by 5% to 25%. Some discounts are easy to get and can add up if you can take advantage of more than one. These include paperless billing, early shopping and automatic payment discounts.

If you're committed to improving your driving habits, you could consider signing up for a usage-based safe driving program. These programs use your phone or a plug-in device to track your driving behavior. If you get a good score, you could save up to 40%, depending on your chosen company.

Get rid of coverage you don't need: For example, if you own your car outright and it's over eight years old or worth less than $5,000, it may not be worth it to have comprehensive and collision coverage. Together, these coverages can cost around $75 per month

Another option is to get rid of medical payment coverage if you have a low-deductible healthcare plan. Or you could remove rental car reimbursement if you have another vehicle you could use after an accident.

How to get SR-22 insurance

It's essential to request an SR-22 from your insurance company quickly once you find out you need one. That's because the court or state usually sets a deadline for filing the form. The state may suspend your license if you don't meet the deadline.

- Contact your company or switch insurance companies. Drivers typically find out they need an SR-22 form during a court hearing. If the judge orders you to file an SR-22 form, you must contact your insurance company or find a new one that offers SR-22 insurance.

- Pay the filing fee. Your insurance company usually charges you a fee for filing the SR-22. This typically ranges between $15 and $50.

- Your insurance company files the SR-22. Your company will need to file this document for you with your state's Department of Motor Vehicles.

- Get confirmation. Once your insurance company files the SR-22, the DMV may take up to two weeks to process the request. The department may process electronic forms more quickly than ones sent through the mail.

How much does an SR-22 cost?

If you need an SR-22 certificate, you must pay your insurance company a fee of around $15 to $50 to file a document with the state.

This fee differs by company and state. Your rates will usually go up as well.

An SR-22 will have less of an effect on your insurance if the cause was minor. For example, drivers with a speeding ticket pay around $279 per month for full coverage SR-22 insurance. People with a DUI conviction pay $373 per month for the same coverage.

Find Cheap Auto Insurance Quotes for SR-22

State Farm and USAA are typically the cheapest major insurance companies for full coverage SR-22 insurance.

Monthly cost of full coverage SR-22 insurance by state

Speeding with SR-22

Accident with SR-22

DUI with SR-22

State average | Cheapest company | ||

|---|---|---|---|

| California | $268 | Geico | $194 |

| Colorado | $283 | State Farm | $158 |

| Florida | $364 | State Farm | $154 |

| Georgia | $213 | Farm Bureau | $132 |

| Illinois | $395 | State Farm | $129 |

Speeding with SR-22

State average | Cheapest company | ||

|---|---|---|---|

| California | $268 | Geico | $194 |

| Colorado | $283 | State Farm | $158 |

| Florida | $364 | State Farm | $154 |

| Georgia | $213 | Farm Bureau | $132 |

| Illinois | $395 | State Farm | $129 |

Accident with SR-22

State average | Cheapest company | ||

|---|---|---|---|

| California | $324 | Geico | $225 |

| Colorado | $349 | State Farm | $170 |

| Florida | $445 | State Farm | $166 |

| Georgia | $255 | Farm Bureau | $130 |

| Illinois | $556 | State Farm | $136 |

USAA is not included because it is only available to military members, veterans and their families.

DUI with SR-22

State average | Cheapest company | ||

|---|---|---|---|

| California | $482 | Nationwide | $252 |

| Colorado | $382 | State Farm | $158 |

| Florida | $432 | State Farm | $169 |

| Georgia | $330 | State Farm | $201 |

| Illinois | $478 | Travelers | $139 |

USAA is not included because it is only available to military members, veterans and their families.

Some states require proof of future coverage. That means you'll need to pay your bill in full instead of making monthly payments.

While it's rare, you might not be able to find coverage at all after certain violations. Most states offer high-risk plans if you need help finding SR-22 car insurance. You can typically get these plans through a local insurance agent.

SR-22 insurance filing fee

The cost of filing an SR-22 depends on the state where you live. It often costs about $25 but can range from $15 to $50. Your auto insurance company files the SR-22 for you and then includes the cost in your bill.

You may need an SR-22 for several years, but the filing cost is a one-time fee.

You won't have to pay each time you renew your car insurance. However, if your auto insurance policy lapses, you'll have to pay the fee again when you get new coverage. Your new insurance company must send proof of coverage to your state.

What is SR-22 insurance?

An SR-22 is a document your car insurance company files that shows you have enough car insurance.

SR-22 insurance isn't an actual policy. However, the policy you get after the insurance company files your SR-22 is sometimes called "SR-22 insurance."

States require proof that you have liability insurance. This is because liability coverage pays for any injuries or property damage you cause while driving. Minimum SR-22 insurance typically won't pay for your injuries or damage to your car.

You only need SR-22 insurance if the state believes you're a high-risk driver.

This can happen if:

- You have a DUI or DWI conviction

- You cause an accident while driving without auto insurance

- You have multiple traffic offenses, or you have too many traffic offenses in a short period

- You drive with a revoked or restricted license

Your state may suspend your driver's license if it believes you're a high-risk driver. Either your state DMV or a court will require you to get an SR-22. Once the insurance company files the document, you can get your license back and start driving again.

Nonowner SR-22 insurance

If you don't own a vehicle, you can buy non-owner SR-22 insurance. Non-owner car insurance covers drivers who don't own a vehicle, so you have insurance coverage even when renting or borrowing a car.

If you already have non-owner car insurance, contact your insurance company and ask it to file an SR-22 on your behalf. This will let you reinstate your license.

Non-owner car insurance is only available through some insurance companies. You may need help finding coverage, particularly with tickets or accidents on your driving record.

How long do you need SR-22 insurance?

You typically must have an SR-22 certificate of financial responsibility for three years.

However, the time frame can range from two to five years, depending on your state and why you need an SR-22. The SR-22 is valid as long as your car insurance policy is active.

If you cancel the policy or it lapses, your insurance company must notify the state. The state will suspend your license, and this time frame won't count toward the required filing period.

For example, if you must have the SR-22 for three years but cancel your insurance after one year, the state will suspend your license. Once you reinstate your insurance and license, the clock starts again, and you'll need to have the SR-22 on file for another two years.

You usually need to have SR-22 insurance for a set period. But the court or state may extend your filing period if you get another ticket. Your insurance company may raise your rates again because it sees you as a riskier driver.

Once you no longer need an SR-22 form, your auto insurance company files an SR-26 form. It can do this automatically through an electronic filing.

Other types of SR-22 insurance

Depending on your state and traffic violation, you may have to file a different document showing financial responsibility.

SR-21 insurance

An SR-21 is similar to an SR-22 in that it's a document your insurance company files that shows you have enough coverage. The state may require an SR-21 after you cause an accident that results in injuries or damage costing more than $1,000, or death.

SR-22A insurance

Missouri, Georgia and Texas require an SR-22A when drivers repeatedly violate financial responsibility laws. This form requires drivers to have a policy paid in full for at least six months.

FR-44 insurance

Florida and Virginia have the FR-44, also known as the SR-44, for drivers with a DUI conviction. It's essentially the same as the SR-22. But you must have twice as much coverage as the state minimum requirement.

SR-50 insurance

Only Indiana uses the SR-50 filing. It provides proof of coverage and allows you to reinstate your license if it's suspended.

Frequently asked questions

How much is SR-22 insurance per month?

The average cost of SR-22 insurance is $172 per month for a full-coverage policy. However, drivers with traffic tickets on their record can expect to pay more.

Does SR-22 insurance cover any car that I drive?

Yes, just like standard auto insurance, SR-22 insurance will cover you in any car you drive. However, if you don't own a car, you have to get non-owner SR-22 insurance. This covers you in any car you drive. But it gets more complicated regarding whose insurance pays for what if you need to make a claim.

How do I find out when my SR-22 expires?

You can find out when your SR-22 expires by contacting your local DMV. SR-22 insurance usually expires after three years. But the duration can vary based on your driving record and the state you live in.

Does Progressive offer SR-22 insurance?

Yes, Progressive offers SR-22 insurance. The average cost of SR-22 insurance from Progressive is $192 per month for a full coverage policy. That's $20 per month higher than the average cost of SR-22 insurance.

Does State Farm offer SR-22 insurance?

State Farm typically offers SR-22 insurance. It's often a great choice because It's the cheapest national company for SR-22 insurance and also offers excellent customer service.

Methodology

To find the cheapest SR-22 insurance, ValuePenguin gathered insurance rates from 14 national and regional auto insurance companies across ten states.

All quotes are for full coverage for a 30-year-old single man who owns a 2015 Honda Civic EX and needs an SR-22 on file with his state's Department of Insurance. Speeding ticket rates are for a single ticket for driving 11-15 mph over the speed limit. Accident rates are for a crash causing over $2,000 in damage.

Full coverage quotes include comprehensive and collision coverage and higher liability limits than the state average.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision deductible: $500

Florida full coverage quotes after a DUI include higher liability limits to meet Florida state requirements.

Rates were provided by Quadrant Information Services and sourced from public insurer filings. Your rates will likely differ, as these are only for comparison purposes.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.