Farm Bureau Insurance Review

Great service and affordable rates make Farm Bureau a good choice for home and auto insurance.

Find Cheap Homeowners Insurance Quotes in Your Area

Is Farm Bureau insurance good?

Farm Bureau is great for people who want excellent customer service.

Farm Bureau's home and auto insurance rates are affordable, although it may not be the cheapest option. And Farm Bureau offers lots of discounts to help lower your costs.

You need a Farm Bureau membership to buy its insurance. Everyone can gain membership, not just farmers. But you must pay an annual membership fee, usually less than $100.

One downside to Farm Bureau is that it only offers a few ways to upgrade your home or auto policy. Those who want extra protection, like gap insurance or identity theft protection, may need to look elsewhere.

Rating | |

|---|---|

| Price | |

| Coverage | |

| Customer service | |

| Unique value |

Pros and cons

Pros

Inexpensive quotes

Exceptional customer service

Helpful local agents

Cons

Specialized coverage

Can't compare quotes online

Not the cheapest option for people on a budget

Farm Bureau home insurance review

Farm Bureau is a good choice for home insurance because of its reliable customer service.

Great customer service will make your life easier if something happens to your home. However, Farm Bureau's home insurance rates are just average.

Farm Bureau homeowners insurance rates

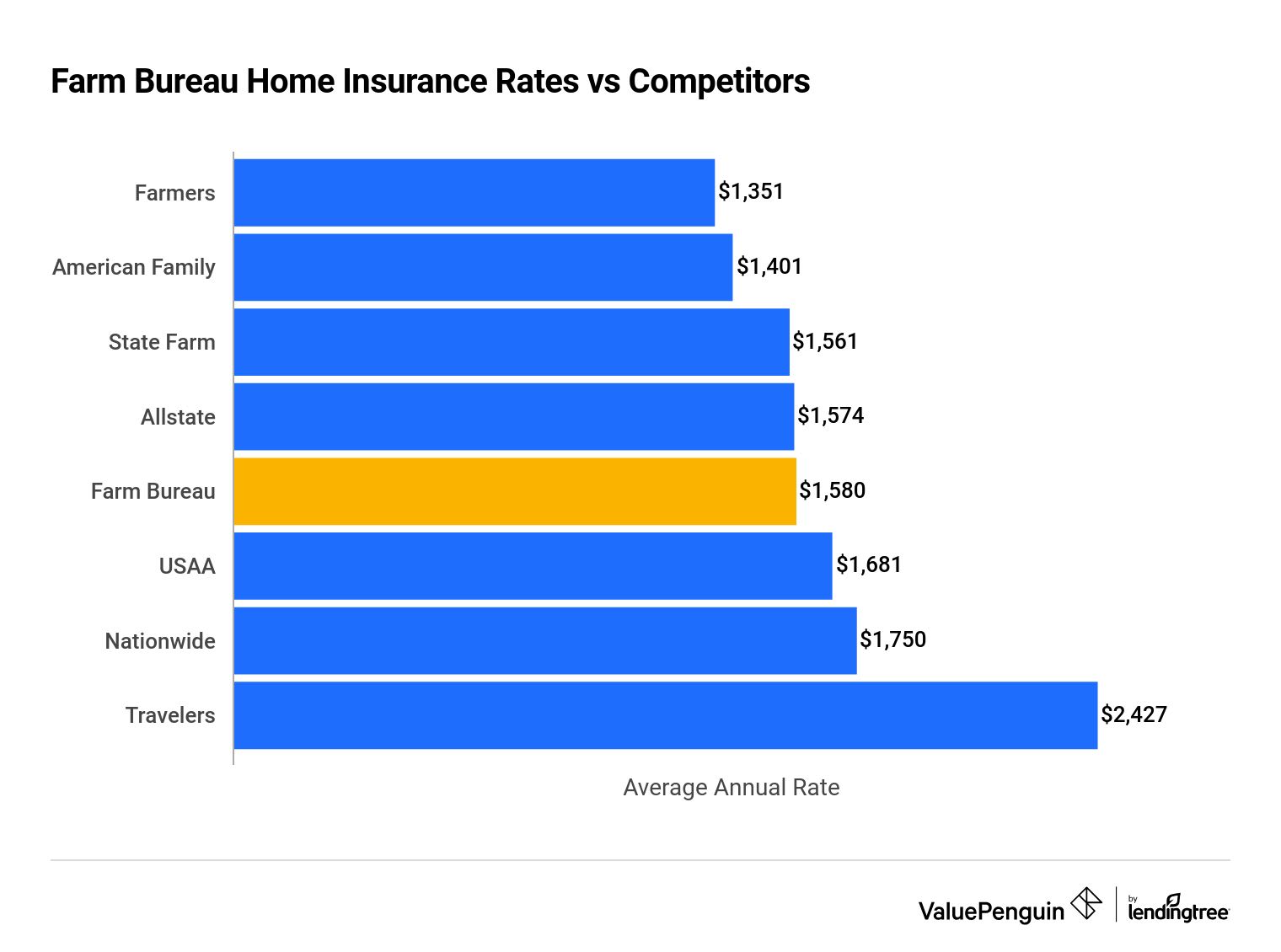

Farm Bureau home insurance costs around $1,580 per year. That's about 2% lower than average.

Although Farm Bureau is typically cheaper than average, most homeowners can find more affordable coverage elsewhere. Farmers, American Family, State Farm and Allstate all tend to have cheaper home insurance quotes.

Find the Cheapest Home Insurance Quotes in Your Area

Farm Bureau doesn't offer online quotes, so you have to contact an agent for rates. This may seem inconvenient, but Farm Bureau's agents have a reputation for being very helpful and friendly. It's one of the main benefits of choosing Farm Bureau as your insurance company.

Farm Bureau home insurance rates vs. competitors

Company | Annual rate | ||

|---|---|---|---|

| Farmers | $1,351 | ||

| American Family | $1,401 | ||

| State Farm | $1,561 | ||

| Allstate | $1,574 | ||

| Farm Bureau | $1,580 | ||

*USAA is only available to military members, veterans and their families.

You must pay for Farm Bureau membership to buy home insurance from Farm Bureau.

The cheapest level of membership typically costs $100 or less per year. Make sure to consider the membership fee when comparing insurance rates.

Farm Bureau home insurance coverage options

Farm Bureau offers fewer coverage options than many companies.

But it does include several important ones.

Replacement cost coverage pays up to 125% of your coverage limits if your home has significant damage after a major emergency, like a fire.

Also called personal property insurance, this coverage protects high-value items like jewelry, cameras and electronics.

Umbrella insurance increases your liability coverage to protect you if a major accident happens on your property.

Equipment breakdown coverage protects appliances like your furnace, air conditioner, water heater, electrical systems or TVs.

In addition, Farm Bureau offers standard home insurance coverages. It protects the structure of your home and your belongings. It also covers some living expenses if an emergency forces you out of your home and offers liability protection.

Farm Bureau home insurance discounts

Farm Bureau offers homeowners somewhat standard discounts for home insurance.

None are particularly uncommon, but they can help you lower your rates.

This is Farm Bureau's bundling discount for buying multiple policies. For example, you can combine car, boat or motorcycle coverage with your home policy.

Farm Bureau discounts vary across states. Not all discounts may be available with your local Farm Bureau chapter.

Farm Bureau agents typically meet with you at least once a year to review your insurance needs and coverages. The company calls this process "Super Check." This is a chance to find new discounts you can qualify for and adjust your coverage to match your needs.

Farm Bureau auto insurance reviews

Farm Bureau has affordable rates for most drivers and lots of discounts to help you save money.

However, it only offers a few coverage add-ons. It may not be the best option if you need extra protection. For example, it doesn't offer coverage if you're a rideshare driver. And people with a car loan or lease can't get gap coverage.

How much is Farm Bureau car insurance?

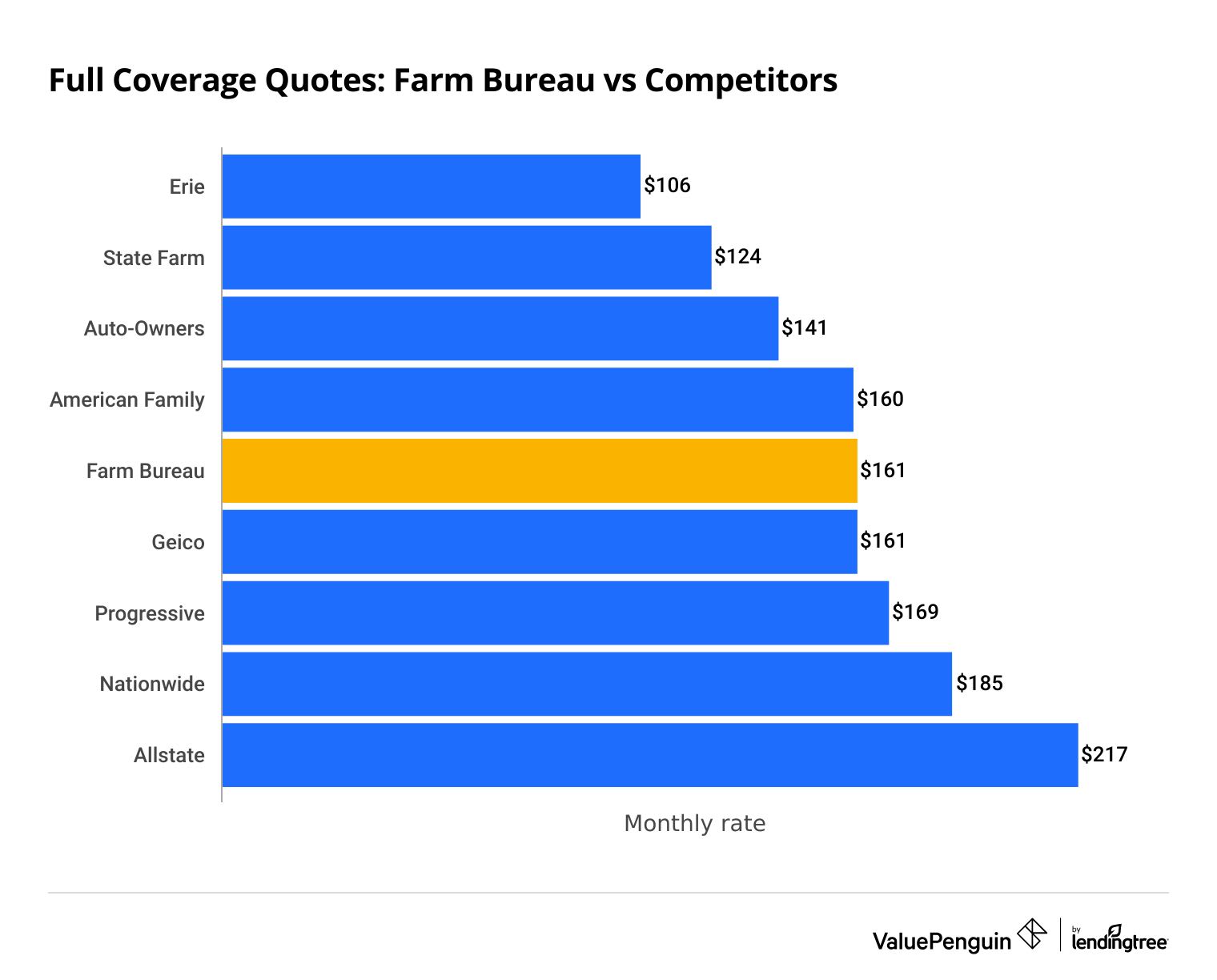

Full coverage car insurance from Farm Bureau costs $161 per month, on average.

Although it's $3 per month cheaper than the national average, you can probably find cheaper rates elsewhere.

However, Farm Bureau offers some of the cheapest rates for drivers who only need liability coverage. At around $46 per month, Farm Bureau's liability-only policies cost $18 per month less than average.

Find the Cheapest Car Insurance Quotes in Your Area

Erie and Auto-Owners are both cheaper than Farm Bureau for most drivers. However, both companies are only available in a limited number of states.

Farm Bureau car insurance rates vs. competitors

Full coverage

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| Erie | $106 | ||

| State Farm | $124 | ||

| Auto-Owners | $141 | ||

| American Family | $160 | ||

| Travelers | $160 | ||

| Farm Bureau | $161 | ||

Full coverage

Company | Monthly rate | ||

|---|---|---|---|

| Erie | $106 | ||

| State Farm | $124 | ||

| Auto-Owners | $141 | ||

| American Family | $160 | ||

| Travelers | $160 | ||

| Farm Bureau | $161 | ||

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| Erie | $41 | ||

| Auto-Owners | $43 | ||

| Farm Bureau | $46 | ||

| State Farm | $50 | ||

| American Family | $61 | ||

Farm Bureau also offers great prices for young drivers and people with a recent accident on their record.

Rates after an accident

$222/mo

$244/mo

National average full coverage policy after an at-fault accident

Rates for teens

$131/mo

$202/mo

National average liability-only policy for an 18-year-old driver

Farm Bureau auto insurance coverage

Farm Bureau offers far fewer coverage add-ons than most major car insurance companies.

Farm Bureau customers can pay extra to add:

-

Replacement cost coverage: Pays to replace cars up to four or five years old with a brand-new model.

- Roadside assistance: Offers emergency roadside assistance, including towing and fuel delivery services after an accident or breakdown.

Farm Bureau also has standard coverage options, like comprehensive and collision coverage. However, you can't get popular add-ons like rental car reimbursement or gap insurance.

Farm Bureau mutual dividend policies

Some of Farm Bureau's local chapters are "mutual insurance companies." That means Farm Bureau's customers own these chapters.

You may occasionally get dividends if your Farm Bureau chapter is a mutual company. You can use these funds for anything.

However, the company's financial standing determines dividends. So they're not guaranteed. Farm Bureau determines if it will offer a dividend payment based on its performance in any given year.

Farm Bureau car insurance discounts

Farm Bureau offers many of the standard car insurance discounts you'd expect from a major company.

Farm Bureau also offers a program called SuperCheck. With this program, an agent reviews your policy once a year to ensure you get all the discounts you qualify for.

Get an affinity group discount if you belong to a qualifying organization or university alumni group.

Save money when you install an approved anti-theft device in your car.

Get a discount when you drive for a long time without filing a car insurance claim. The time requirement varies by state.

Farm Bureau members who renew their Farm Bureau's Member's Choice policies get a loyalty credit.

Students who earn a B average or higher can get a discount.

Bundle your auto and home insurance with Farm Bureau to earn a discount.

Adding multiple cars to your Farm Bureau policy could lower the insurance cost for each vehicle.

Get a discount when you drive less than 7,500 miles per year.

This discount varies by payment history, plan and method. You could save by paying your annual bill upfront or signing up for automatic payments.

Complete Farm Bureau's young-driver safety program to earn a discount. You must be under 25 years old to earn this discount.

Farm Bureau's discounts are different, depending on the state. Not all discounts may be available with your local Farm Bureau chapter.

Driveology by Farm Bureau

In addition, Farm Bureau offers the Driveology program, which can help safe drivers save money.

This program monitors your driving habits using a small device that you plug into your car. If Farm Bureau determines you're a safe driver, you can get a discount of up to 30% off your car insurance.

Farm Bureau membership also comes with several discounts unrelated to car insurance. You may save on:

- Agricultural equipment

- Vacations, including hotel stays and rental cars

- Prescriptions

- Tickets at some entertainment venues

Farm Bureau insurance reviews and ratings

Farm Bureau's customer reviews are generally positive.

Customers typically describe their community-based agents as very helpful and compassionate.

Farm Bureau insurance ratings

Source | Rating |

|---|---|

| A.M. Best | A |

| J.D. Power | 1st place |

Farm Bureau was also ranked first in J.D. Power's 2022 U.S. Auto Insurance Study for the Southeast and Texas regions.

Farm Bureau customers can expect a smooth claims process.

For example, the Texas Farm Bureau gets 88% fewer auto insurance complaints than average similar-sized companies, according to the National Association of Insurance Commissioners (NAIC). And it gets 98% fewer home insurance complaints than competitors.

Farm Bureau has an excellent ability to pay out customer insurance claims, according to AM Best's Financial Strength Rating. Farm Bureau has an A financial strength rating from AM Best The A means Farm Bureau shouldn't have a problem paying customer claims.

If you need to file a claim, call 800-226-6383.

Farm Bureau is in all 50 states and Puerto Rico. However, it only underwrites and sells its own insurance policies in some areas.

In 19 states, a local Farm Bureau subsidiary underwrites policies. In the remaining states, a regional Farm Bureau affiliate serves customers, or local Farm Bureau members may get discounted rates at a partner company.

Partner insurance companies include large national companies such as Nationwide and Country Financial. One exception is Hawaii, where the local Farm Bureau does not offer auto insurance policies.

Frequently asked questions

Is Farm Bureau a good insurance company?

Yes, Farm Bureau has competitive rates and dependable customer service. That makes it a good option for home and auto insurance.

What kind of insurance does Farm Bureau sell?

Farm Bureau typically sells home, auto, farm/ranch and life insurance, among other types of coverage. However, availability varies by state.

Is Farm Bureau cheap?

Yes, Farm Bureau offers affordable car insurance rates for most drivers. Home insurance rates are a little cheaper than average.

Methodology

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings. They should be used for comparative purposes only. Your quotes may be different.

To find the cost of Farm Bureau auto insurance, ValuePenguin compared quotes across all 50 states. Rates are for a 30-year-old single man with a good credit score and clean driving record who owns a 2015 Honda Civic EX.

Rates are for a full coverage policy with comprehensive and collision coverage along with higher liability limits than the state requirement.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000

- Uninsured and underinsured motorist coverage: $50,000 per person and $100,000 per accident

- Comprehensive and collision deductible: $500

Home insurance rates are based on thousands of quotes across 17 states, in which Farm Bureau is one of the 15 largest home insurance companies. Rates are for homes of average age and value in each state and are compared to other major companies.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.