Country Financial Insurance Review: Good Rates & Support

Country Financial has cheap car insurance, but home coverage prices are high.

Find Cheap Auto Insurance Quotes in Your Area

Country Financial is a good and affordable option for car insurance, as long as you don't need a wide variety of coverage options, such as rideshare coverage or custom equipment coverage. The company's home insurance is expensive, though it does offer less-common options for earthquake and sewer backup protection. If you choose either home or auto, you'll be able to benefit from well-rated customer service.

Pros and cons

Pros

Cheap car insurance rates

Good customer service

Cons

Affordable home insurance

Wide set of coverage options

Country Financial auto insurance review

Country Financial offers rates that are considerably cheaper than average. You can further lower those rates with discounts for being engaged, installing an anti-theft device or working in certain professions.

Although the company doesn't offer the widest set of ways to customize coverage, you can add rental and trip interruption coverage, $800 of coverage for personal effects like a phone or laptop and coverage specifically for your windows, windshield and headlights.

Bottom line: Country Financial's blend of lower prices, solid coverage options and strong customer service means it is a good option for most drivers to look into.

Country Financial car insurance quotes

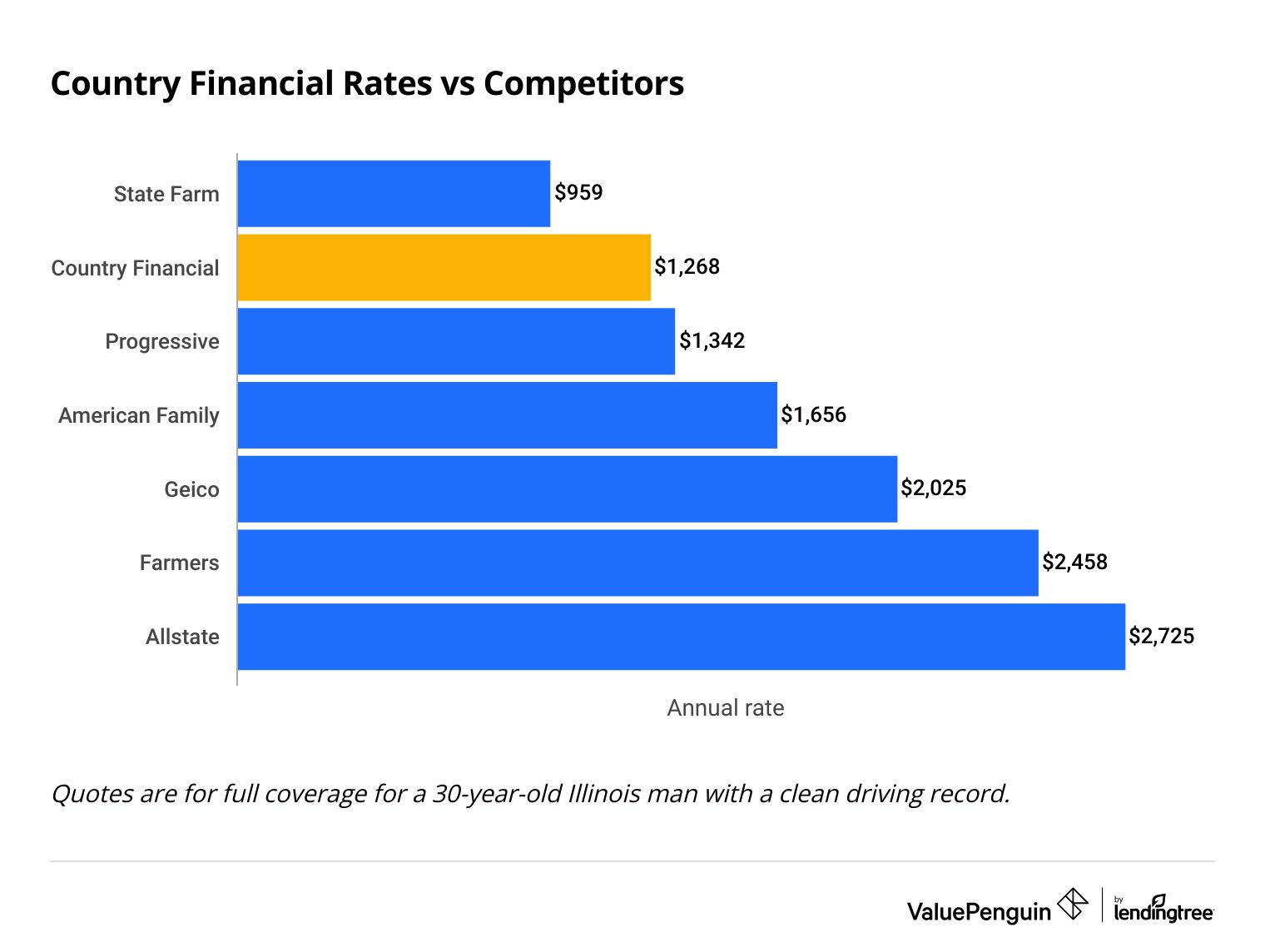

Country Financial has some of the lowest rates compared to major insurers. The company's rates are 29% cheaper than average for full coverage insurance and 33% cheaper for minimum coverage policies.

Find Cheap Auto Insurance Quotes in Your Area

Country Financial has lower rates than Progressive, Geico and Allstate, among others. Of the companies we analyzed, only State Farm is cheaper.

Country Financial annual car insurance rates vs. competitors

Company | Full coverage | Minimum coverage |

|---|---|---|

| State Farm | $959 | $377 |

| Country Financial | $1,268 | $459 |

| Progressive | $1,342 | $472 |

| American Family | $1,656 | $600 |

| Geico | $2,025 | $862 |

| Allstate | $2,725 | $930 |

| Farmers | $2,458 | $1,114 |

Country Financial auto insurance discounts

Country Financial policyholders can further reduce their auto insurance rates with discounts for safe driving and devices that make cars safer. Country Financial also offers discounts for things that have nothing to do with driving, like being engaged and having a certain occupation.

Anti-theft: To qualify for this discount, your vehicle must be equipped with an alarm or other anti-theft device.

Advanced quote discount: If you get a quote before your current policy ends, you will receive a discount.

Engaged couple: If you are engaged, your partner is over 21 years old and you insure all eligible vehicles through Country Financial, then you can receive the engaged couple discount.

Good driver discount: Reduce your rates by avoiding accidents and tickets for three years.

Good student and college graduate discount: Students with at least a B average can qualify for a discount.

Multipolicy: Purchasing auto, homeowners or other insurance policies through Country Financial qualifies you for a multipolicy discount. You also may be eligible for this discount if you have some other investment product through Country Financial. The multipolicy discount can extend to unmarried children under the age of 25.

Defensive driver: Completing a state-approved defensive driving course can save you up to 5% on your Country Financial auto insurance premiums.

Multicar: Insuring more than one car with Country Financial qualifies you for the multicar discount. If parents qualify, this discount extends to children who are unmarried, are under the age of 25 and live away from home.

Occupational discount: Full-time K-12 teachers, firefighters, police officers, EMTs and paramedics can qualify for an occupational discount.

Simply Drive discount: Drivers under 18 receive a discount for completing an online course for teen drivers.

Country Financial coverage

Country Financial provides most of the standard coverage options for auto insurance, including:

- Liability (both bodily injury and property damage) coverage

- Personal injury protection and medical payments coverage

- Comprehensive and collision coverage

- Uninsured and underinsured (both bodily injury and property damage) coverage

Country Financial also offers some extra options to add to your insurance policy.

The Keeper

This is Country Financial's version of new-car replacement coverage. If your car is totaled in a covered incident and it's up to 4 model years old, then this coverage will pay for a brand-new car of the same make and model.

Emergency roadside assistance

This reimburses you up to $100 to pay for services if you run out of gas, break down or have some other sort of roadside incident. Emergency roadside assistance can cover towing, fuel delivery and repair costs.

Safety glass coverage

If you have comprehensive coverage with a deductible, then you can buy safety glass coverage. With this add-on, Country waives your deductible if you need to repair or replace your car's windows, windshields and light covers (which is normally covered by comprehensive insurance).

Personal effects coverage

This endorsement covers items that are stolen from your car. Speak to a Country Financial representative for coverage details; some items, such as certain electronics, may not be covered. Policyholders are reimbursed up to $800.

Vehicle rental and trip interruption

This option covers the cost of a rental car if you need temporary transportation after a covered incident, such as a car accident. The trip interruption part of this coverage pays for transportation, lodging and meal costs if you have an accident more than 100 miles from your home. For both types of expenses, Country Financial will reimburse you up to $800 for each covered loss.

Country Financial home insurance review

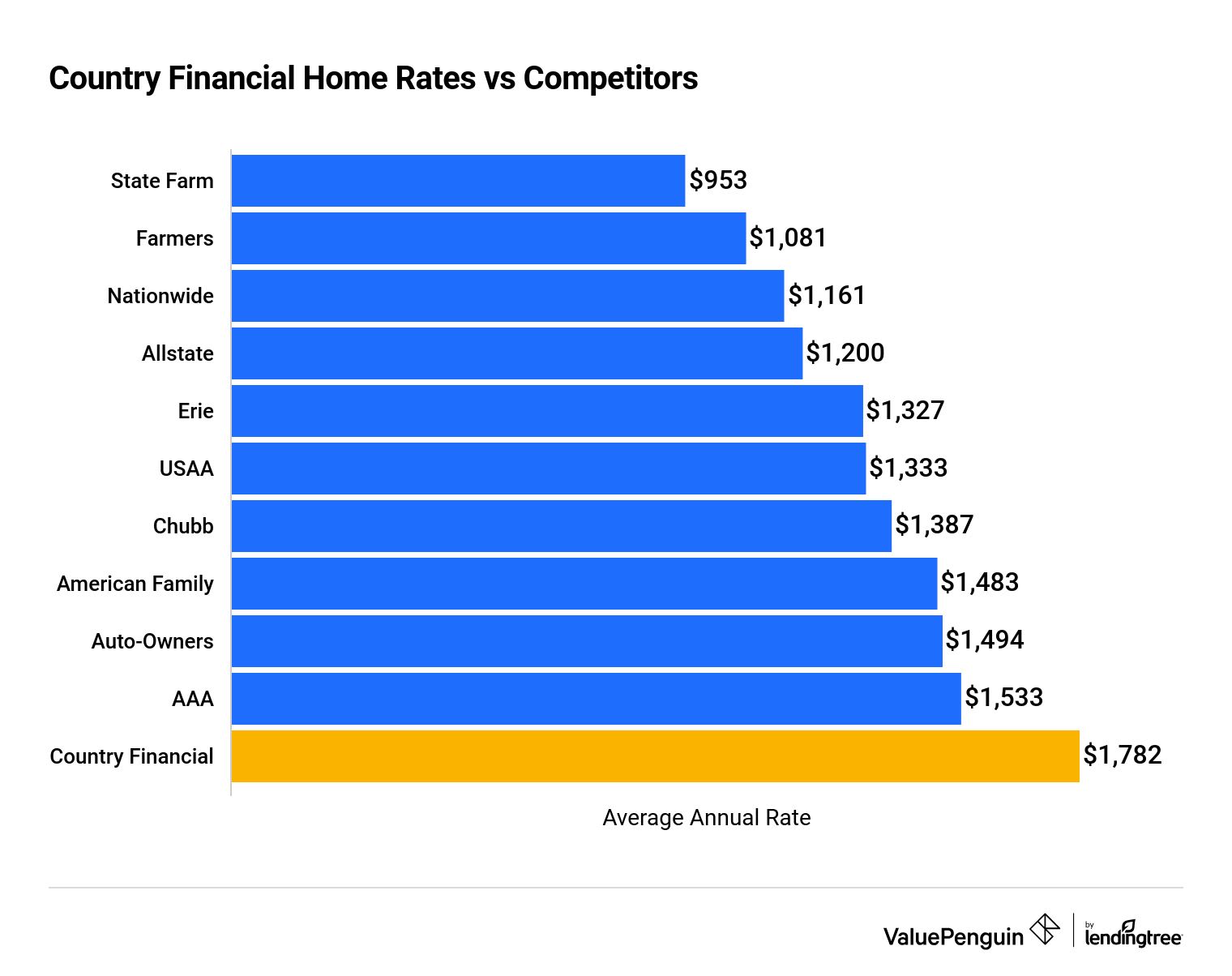

Country Financial's prices for home insurance are notably high, 33% more expensive than average among its top competitors. Country Financial's customer service for home insurance is fairly good, though you can't get a quote online.

Coverage options from Country Financial are meager, with the most significant one being guaranteed replacement cost coverage, which pays the full cost to repair your home, regardless of inflation due to demand.

Bottom line: Country Financial's homeowners insurance is only worth considering if you already have a relationship with the company or you're set on guaranteed replacement cost coverage and unable to find it elsewhere.

Country Financial home insurance rates

We found the cost of home insurance at Country Financial to be more expensive than at competing insurers. It offers the highest quote among the home insurers ValuePenguin analyzed, $1,782 per year for a home worth a little less than $200,000.

Find Cheap Homeowners Insurance Quotes in Your Area

Country Financial home insurance rates vs. competitors

Company | Annual cost | |

|---|---|---|

| State Farm | $953 | |

| Farmers | $1,081 | |

| Nationwide | $1,161 | |

| Allstate | $1,200 | |

| Erie | $1,327 | |

| USAA | $1,333 | |

| Chubb | $1,387 | |

| American Family | $1,483 | |

| Auto-Owners | $1,494 | |

| AAA | $1,533 | |

| Country Financial | $1,782 |

Home insurance discounts

Country Financial's standard discounts may help partially offset its high cost of home insurance. You may qualify for a multipolicy discount or find savings if you've recently updated parts of your home, such as the alarm system or roof.

- Multipolicy/bundle

- Safe heat (no wood stove or fireplace)

- New roof

- New wiring

- Alarm

- Hail-resistant roof

- New home

Coverages

Country Financial offers a somewhat thin set of home insurance options. While there aren't any glaring gaps in terms of basic coverages, it doesn't have much to set it apart.

The most appealing optional perk available at Country Financial is extended replacement cost coverage. This means Country will pay for the entire cost of restoring your home, even if the cost of labor or materials is higher than normal. This option should appeal to homeowners who live in areas susceptible to large-scale natural disasters, such as hurricanes or wildfires, and provides a level of flexibility not offered by most of the largest insurers.

Optional coverages available from Country Financial include:

- Extended or guaranteed replacement cost coverage

- Sump pump and sewer backup coverage (up to $25,000)

- Identity theft protection

- Earthquake coverage

- Flood insurance (National Flood Insurance Program policies only)

Country Financial customer service ratings

Country Financial has good customer service ratings for auto and homeowners insurance. The company receives an impressively low number of complaints according to the National Association of Insurance Commissioners (NAIC), suggesting customers tend to be happy with the service they receive at Country Financial.

Customer complaints to the Better Business Bureau generally focused on a lack of responsiveness, notably in the claims process.

Rating | Score |

|---|---|

| NAIC complaint index - auto | 0.26 |

| NAIC complaint index - homeowners | 0.29 |

| AM Best financial strength rating | A+ |

NAIC complaint index scores compare the number of complaints a company gets to the share of the market it has. An average score is 1.00. The AM Best financial strength rating grades companies on their financial stability, which could become a factor after a large-scale natural disaster.

Frequently asked questions

Is Country Financial a good insurance company?

Country Financial is a good insurance company. It offers low car insurance rates for coverage that should be enough for most drivers. It also offers strong customer service.

Who owns Country Financial insurance?

Country Financial is a privately owned company and a subsidiary of the Illinois Agricultural Association, a bank in Illinois.

Is Country Mutual the same as Country Financial?

Yes, Country Mutual Insurance Co. is a part of Country Financial.

Methodology

ValuePenguin gathered thousands of home and car insurance quotes from Illinois, the state where Country Financial does more than half its business. The sample driver is a 30-year-old man with a clean driving record and a 2015 Honda Civic.

Coverage | Minimum coverage | Full coverage |

|---|---|---|

| Bodily injury liability | $25,000/$50,000 | $50,000/$100,000 |

| Property damage liability | $20,000 | $25,000 |

| Uninsured motorist bodily injury | $25,000/$50,000 | $50,000/$100,000 |

| Underinsured motorist bodily injury | not included | $50,000/$100,000 |

| Comprehensive deductible | not included | $500 |

| Collision deductible | not included | $500 |

The sample home is worth $194,500 and was built in 1977.

Home and auto rates were collected using Quadrant Information Services. Your rates may differ, as our rates, which were publicly sourced from insurer filings, should be used for comparative purposes only.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.