Best Cheap SR-22 and FR-44 Insurance in Florida

Geico and Farmers offer the cheapest FR-44 and SR-22 insurance in Florida.

Find Cheap SR-22 Auto Insurance Quotes in Florida

Drivers in Florida may need SR-22 insurance if they have committed a serious traffic violation, like driving without insurance or reckless driving. An FR-44 is required in Florida after a DUI or DWI.

An SR-22 or FR-44 filing is a form that your insurance company sends to the Florida DMV to prove that you have the state-required liability insurance.

Best SR-22 and FR-44 insurance in FL

Cheap SR-22 and FR-44 insurance in Florida

Farmers and Geico usually offer the cheapest rates for Florida drivers who need SR-22 or FR-44 insurance.

The cost of an SR-22 or FR-44 filing is low — usually between $15 and $50. But your insurance rates will go up if you need one of these filings.

SR-22 and FR-44 insurance cost more than standard auto insurance because of the traffic violations associated with the filings. FR-44 is usually more expensive than SR-22 due to the severity of a DUI conviction, as well as the higher liability insurance requirements.

SR-22 for driving without insurance

SR-22 for reckless driving

SR-22 for an accident

FR-44 for DUI

Geico has the cheapest SR-22 insurance in Florida if you've been caught driving without insurance. A minimum coverage policy from Geico costs $36 per month, which is 70% cheaper than average.

The second-cheapest company, State Farm, charges twice as much for the same coverage: $81 per month.

SR-22 insurance in Florida after driving without insurance

Company | Monthly rate | |

|---|---|---|

| Geico | $36 | |

| State Farm | $81 | |

| Travelers | $88 | |

| Farmers | $105 | |

| Mercury | $110 |

SR-22 for driving without insurance

Geico has the cheapest SR-22 insurance in Florida if you've been caught driving without insurance. A minimum coverage policy from Geico costs $36 per month, which is 70% cheaper than average.

The second-cheapest company, State Farm, charges twice as much for the same coverage: $81 per month.

SR-22 insurance in Florida after driving without insurance

Company | Monthly rate | |

|---|---|---|

| Geico | $36 | |

| State Farm | $81 | |

| Travelers | $88 | |

| Farmers | $105 | |

| Mercury | $110 |

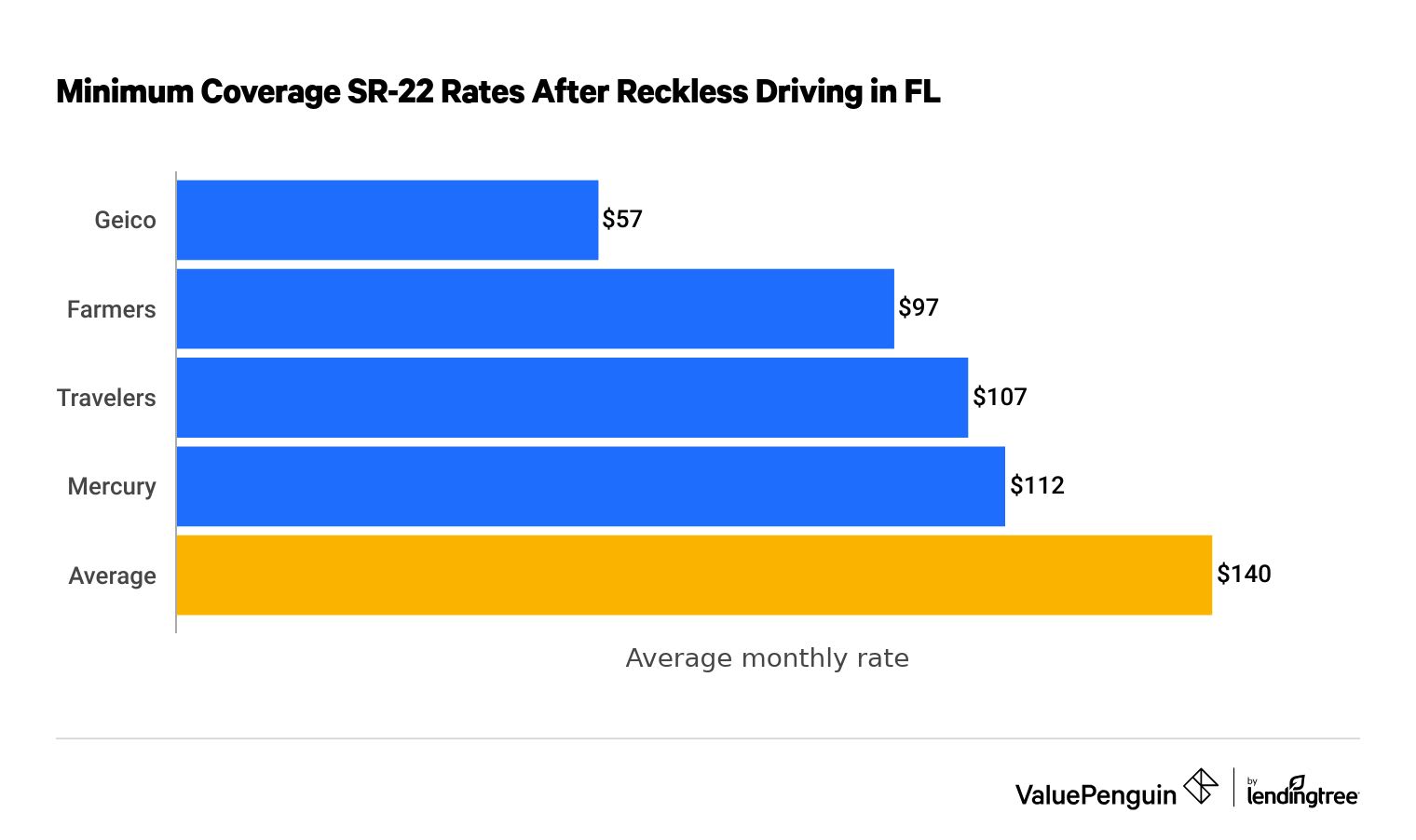

SR-22 for reckless driving

Geico offers the best cheap SR-22 insurance in Florida after a reckless driving conviction. A minimum coverage policy from Geico costs $57 per month, which is 60% cheaper than average in Florida.

SR-22 insurance in Florida after reckless driving

Company | Monthly rate | |

|---|---|---|

| Geico | $57 | |

| Farmers | $97 | |

| Travelers | $107 | |

| Mercury | $112 | |

| State Farm | $142 |

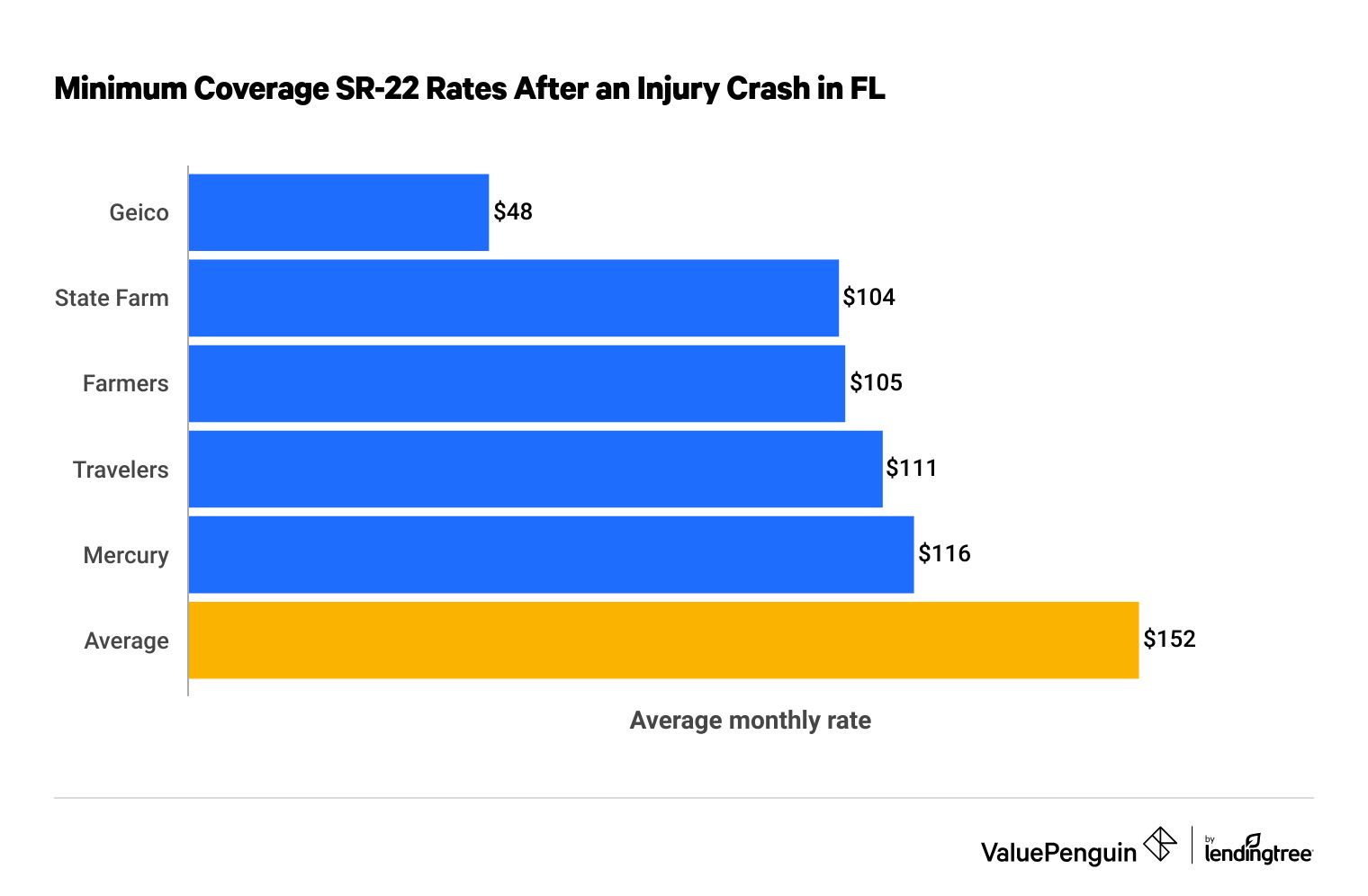

SR-22 for an accident

If you caused an accident that injured someone while you didn't have insurance, you'll find the cheapest rates with Geico. At $48 per month, a minimum coverage policy from Geico is 68% cheaper than the statewide average. The second-cheapest company, State Farm, costs twice as much as Geico for the same coverage.

SR-22 quotes in FL after an injury crash with no insurance

Company | Monthly rate | |

|---|---|---|

| Geico | $48 | |

| State Farm | $104 | |

| Farmers | $105 | |

| Travelers | $111 | |

| Mercury | $116 |

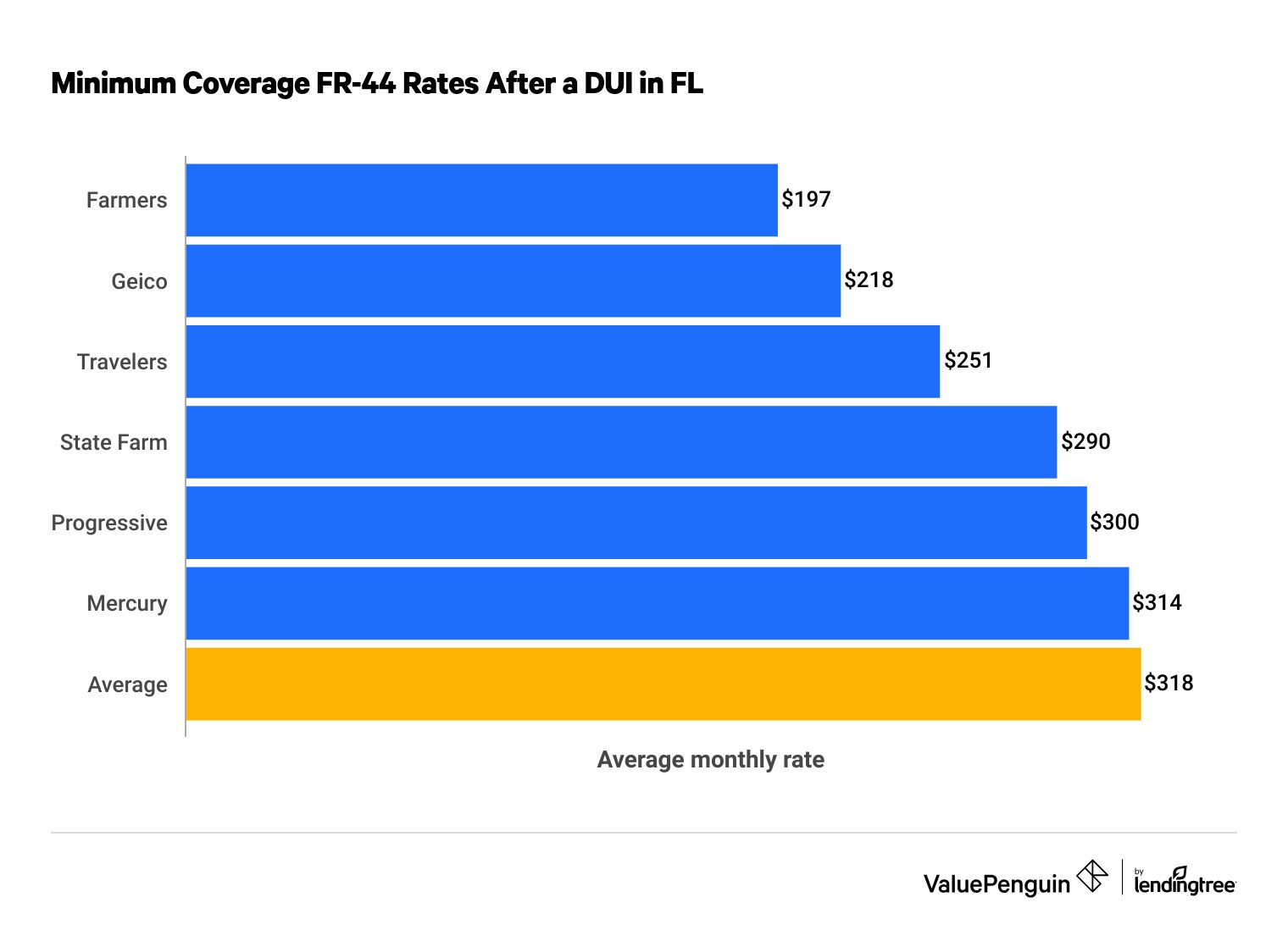

FR-44 for DUI

Farmers has the cheapest FR-44 insurance in Florida for drivers with a DUI on their record. A from Farmers costs $197 per month, which is 38% cheaper than average.

FR-44 insurance in Florida after a DUI

Company | Monthly rate | |

|---|---|---|

| Farmers | $197 | |

| Geico | $218 | |

| Travelers | $251 | |

| State Farm | $290 | |

| Progressive | $300 |

Find Cheap SR-22 Auto Insurance Quotes in Florida

The best way to get cheaper SR-22 or FR-44 insurance in Florida is by comparing quotes from multiple companies. Though you'll always get more expensive quotes as a high-risk driver, each company evaluates your driving history differently, so it's the easiest way to find cheap rates.

You should also check if your insurance company offers any discounts you can take advantage of. Many companies offer discounts for paying your annual bill in full, signing up for automatic payments or taking a defensive driver course.

FR-44 vs. SR-22

If you're a high-risk driver in Florida, the state may suspend your license and require you to get SR-22 or FR-44 insurance in order to reinstate your driving privileges.

Do I need SR-22 or FR-44 insurance in Florida?

Drivers who have committed serious traffic violations may need to get SR-22 or FR-44 insurance in Florida.

You may need SR-22 insurance in Florida if:

- You were caught driving without insurance

- You got a ticket for reckless driving

- You got in an accident that caused injuries while uninsured

You may need FR-44 insurance in Florida if:

- You were caught driving under the influence (a DUI) or driving while intoxicated (a DWI)

What are FR-44 and SR-22 insurance in Florida?

SR-22 and FR-44 insurance aren't separate types of auto insurance. SR-22s and FR-44s are forms that your insurance company will need to file with the Florida DMV on your behalf. These forms act as proof of coverage, letting the state know you have a Florida car insurance policy that meets the minimum requirements to drive legally in Florida.

DUI convictions are very serious, and the liability insurance requirements for FR-44 insurance in Florida are much higher than for SR-22 insurance.

SR-22 vs. FR-44 insurance requirements in Florida

SR-22 requirements

- Bodily injury liability: $10,000 per person/$20,000 per accident

- Property damage liability: $10,000 per accident

- Personal injury protection: $10,000 per accident

FR-44 requirements

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $50,000 per accident

- Personal injury protection: $10,000 per accident

Florida also has stricter requirements in regard to paying for FR-44 insurance. Unlike with standard insurance, you can't make monthly payments for an FR-44 policy. You'll usually need to pay for at least six months of insurance at a time, though this requirement may be relaxed when you renew your policy.

How long do I need FR-44 or SR-22 insurance in Florida?

In most cases, you'll need to have an SR-22 or FR-44 for at least three years in Florida before you can get a standard car insurance policy.

However, the length may vary based on the reason you need a proof-of-insurance filing, so you should check with the Florida DMV.

If your policy lapses or is canceled during this period and you are uninsured, your license will likely be suspended again and you'll have to pay a fee to have it reinstated. In some cases, your filing may be required to be in force for three consecutive years, so if your policy lapses, you'll need to have SR-22 or FR-44 insurance for another three years.

If you move out of state during the period that you're required to file an SR-22 or FR-44 in Florida, that requirement doesn't go away. You'll need to contact your insurance company about getting an out-of-state filing on your behalf, as coverage needs to remain in place in the state.

Nonowner SR-22 and FR-44 insurance in Florida

If you're required to have an SR-22 or FR-44 filing to reinstate your license in Florida, but you don't own a car, you'll need to buy a nonowner insurance policy.

A nonowner SR-22 or FR-44 insurance policy is similar to a standard auto insurance policy in that it includes bodily injury and property damage liability coverage. It offers coverage whenever you drive a car that you don't own, like if you borrow a friend's vehicle. Your insurance company can add an SR-22 or FR-44 endorsement to a nonowner policy and submit a filing to the state so you can have your license reinstated.

A nonowner insurance policy doesn't require PIP coverage, and it can be much cheaper than a regular car insurance policy. You just need to make sure that the liability limits of your nonowner policy meet Florida's SR-22 or FR-44 insurance requirements.

Frequently asked questions

How much does an SR-22 cost in Florida?

An SR-22 filing usually costs between $15 and $50 in Florida. However, your car insurance rates will likely go up because of the violation that caused you to need SR-22 insurance.

For example, minimum coverage SR-22 insurance costs an average of $121 per month if you've been caught driving without insurance. Florida drivers who cause an accident with injuries while uninsured pay $152 for the same coverage, on average.

What is the difference between SR-22 and FR-44 in Florida?

An SR-22 in Florida is for serious traffic tickets, like reckless driving, while FR-44 insurance is only for DUI or DWI convictions. The other main difference between SR-22 and FR-44 insurance is that drivers with an FR-44 filing are required to have higher liability limits on their car insurance.

How long is an FR-44 required in Florida?

FR-44 and SR-22 insurance are usually required for three years in Florida. The length can vary depending on the reason you need to file proof of insurance, so you should check with the DMV to confirm how long you need to keep your SR-22 or FR-44 in place.

How much is FR-44 insurance in Florida?

Minimum coverage FR-44 insurance costs $318 per month for Florida drivers with a DUI, on average. Farmers offers the cheapest FR-44 rate, at $197 per month.

What are the FR-44 requirements in Florida?

Drivers who are required to get FR-44 insurance need to have $100,000 of bodily injury liability coverage per person and $300,000 per accident, $50,000 of property damage liability and $10,000 of personal injury protection. These limits are higher than the Florida minimum requirements. Drivers are also required to have their insurance company file an FR-44 form with the Florida DMV.

Methodology

To find the best cheap SR-22 and FR-44 car insurance rates in Florida, ValuePenguin gathered quotes from seven of the top companies in the state, across all residential ZIP codes. Rates are for a 30-year-old single man with good credit who drives a 2015 Honda Civic EX.

SR-22 rates include the minimum liability and PIP limits required in Florida. FR-44 rates are based on the minimum requirements for drivers with an FR-44, which include higher liability limits than the state minimums.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.