Cheapest Car Insurance in Texas (Best Rates in 2024)

Texas Farm Bureau has the best cheap car insurance in Texas, at $86 per month for full coverage and $33 per month for minimum coverage.

Find Cheap Auto Insurance Quotes in Texas

Best cheap car insurance in Texas

How we chose the top companies

Best and cheapest car insurance in Texas

- Cheapest full coverage: Texas Farm Bureau, $86/mo

- Cheapest minimum liability: Texas Farm Bureau, $33/mo

- Cheapest for young drivers: Texas Farm Bureau, $64/mo

- Cheapest after a ticket: Texas Farm Bureau, $86/mo

- Cheapest after an accident: State Farm, $124/mo

- Cheapest for teens after a ticket: Texas Farm Bureau, $64/mo

- Cheapest after a DUI: Texas Farm Bureau, $166/mo

- Cheapest for poor credit: Texas Farm Bureau, $195/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Texas Farm Bureau has the best mix of great customer service and cheap rates in Texas. However, it doesn't offer online quotes, so you'll have to contact a local agent to compare rates.

State Farm is the best company in Texas for drivers looking to quickly compare quotes online. It has reliable customer service, although it's typically more expensive than Texas Farm Bureau.

Cheapest Texas car insurance rates: Texas Farm Bureau

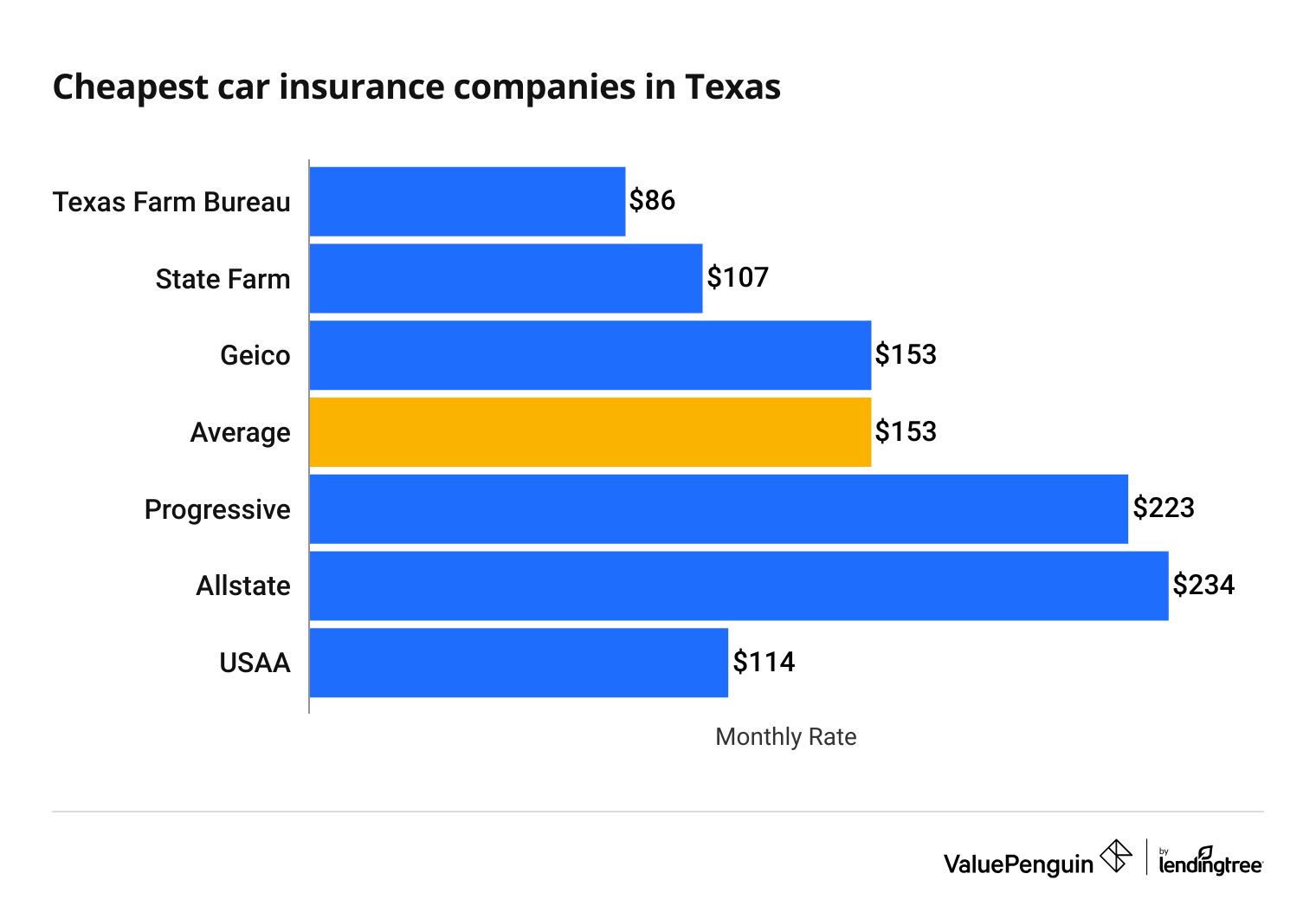

Texas Farm Bureau, State Farm and USAA are the cheapest full coverage insurance companies in Texas, with rates less than $115 per month.

In Texas, the average cost of a full-coverage policy is $153 per month.

Find Cheap Auto Insurance Quotes in Texas

Cheap full coverage auto insurance companies in Texas

Company | Monthly rate | ||

|---|---|---|---|

| Texas Farm Bureau | $86 | ||

| State Farm | $107 | ||

| Geico | $153 | ||

| Progressive | $223 | ||

| Allstate | $234 | ||

| USAA* | $114 | ||

*USAA is only available to current and former military members and their families.

Cheapest liability auto insurance in Texas: Texas Farm Bureau

Texas Farm Bureau offers the cheapest rate in Texas, at $33 per month for minimum-liability coverage. That's 42% cheaper than the average cost of minimum coverage in Texas.

Other cheap car insurance companies include USAA and State Farm, but USAA is only available to current and former military members and their families.

The average cost of car insurance in Texas is $48 per month for a minimum-liability policy.

Cheap Texas liability car insurance quotes

Company | Monthly rate |

|---|---|

| Texas Farm Bureau | $33 |

| State Farm | $40 |

| Geico | $63 |

| Progressive | $84 |

| Allstate | $87 |

| USAA* | $40 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Texas

Find the best cheap Texas car insurance near you

Cheapest car insurance quotes for Texas teens: Texas Farm Bureau

Drivers in their teens are more likely to get into accidents than drivers with more experience. That's why insurance companies charge them higher insurance rates.

An 18-year-old in Texas pays nearly triple what a 30-year-old does for a minimum-coverage policy.

Texas Farm Bureau offers Texas teens the best car insurance rates for minimum coverage and full coverage. A minimum-coverage policy from Texas Farm Bureau costs $64 per month, and full coverage costs $143 per month.

Cheap Texas auto insurance companies for young drivers

Company | Liability only | Full coverage |

|---|---|---|

| Texas Farm Bureau | $64 | $143 |

| State Farm | $137 | $305 |

| Geico | $156 | $338 |

| Allstate | $188 | $406 |

| Progressive | $386 | $1,110 |

| USAA | $83 | $205 |

Teen drivers should get full-coverage insurance if they drive a newer car and can afford it, but there is a big cost difference.

Minimum coverage averages $169 per month, compared to $418 per month for full coverage. However, full coverage includes collision and comprehensive coverage to pay for damage to your car. That can be useful for teens, who are more likely to get into an accident.

Cheap Texas car insurance rates after a ticket: Texas Farm Bureau

Texas Farm Bureau has the cheapest full-coverage rates for Texas drivers with a speeding ticket. The company charges $86 per month, which is much cheaper than average.

Average auto insurance rates in Texas go up by 12% for a driver who has a speeding ticket. But companies determine rate changes differently. You may not see an increase with State Farm or Texas Farm Bureau.

Best car insurance rates in Texas after a ticket

Company | Monthly rate |

|---|---|

| Texas Farm Bureau | $86 |

| State Farm | $107 |

| Geico | $183 |

| Allstate | $234 |

| Progressive | $292 |

| USAA | $129 |

Cheapest car insurance after an accident in Texas: State Farm

State Farm, Texas Farm Bureau and USAA are the cheapest car insurance companies in Texas if you've caused an accident. State Farm is the best deal, with an average rate of $124 per month.

Your driving history can have a big effect on how much you pay for insurance. If you cause an accident in Texas, insurance companies will raise your rates for full coverage by an average of 53%.

Best car insurance rates in Texas after an accident

Company | Monthly rate |

|---|---|

| State Farm | $124 |

| Texas Farm Bureau | $137 |

| Geico | $247 |

| Progressive | $345 |

| Allstate | $374 |

| USAA | $172 |

Cheapest car insurance for teens after a ticket or accident

Texas Farm Bureau has the cheapest car insurance quotes for teen drivers in Texas after a speeding ticket or accident.

A minimum-coverage policy from Texas Farm Bureau costs $64 per month after a single speeding ticket. That's $111 per month cheaper than average in Texas.

Teen drivers that have caused an accident pay $92 per month for minimum coverage from Texas Farm Bureau. That's $131 less per month than the state average.

Most affordable car insurance for teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Texas Farm Bureau | $64 | $92 |

| State Farm | $137 | $154 |

| Geico | $174 | $230 |

| Allstate | $188 | $342 |

| Progressive | $392 | $400 |

| USAA | $94 | $122 |

Young drivers in Texas can expect minimum-coverage rates to increase by 3% after a speeding ticket and 32% after an accident.

Best cheap Texas auto insurance rates with a DUI: Texas Farm Bureau

Texas Farm Bureau, USAA and State Farm are the most affordable companies for drivers with a DUI (driving under the influence) conviction or who require an SR-22. Full coverage from Texas Farm Bureau costs $166 per month, which is 29% cheaper than the state average.

In general, Texans with a DUI citation could see their rates go up 54%.

Cheap Texas car insurance companies after a DUI

Company | Monthly rate |

|---|---|

| Texas Farm Bureau | $166 |

| State Farm | $167 |

| Progressive | $259 |

| Geico | $275 |

| Allstate | $368 |

| USAA | $172 |

Cheapest car insurance for drivers with poor credit: Texas Farm Bureau

Texas Farm Bureau is also the cheapest company for drivers with poor credit, with an average rate of $195 per month for full coverage.

Cheapest Texas auto insurance companies if you have poor credit

Company | Monthly rate |

|---|---|

| Texas Farm Bureau | $195 |

| Allstate | $330 |

| Progressive | $374 |

| Geico | $409 |

| State Farm | $605 |

| USAA | $196 |

Texas drivers with low credit scores tend to pay more for insurance than those with good credit.

Your credit score doesn't reflect your driving ability. But insurance companies have found that drivers with poor credit are more likely to file a claim. This means you usually pay more if you have poor credit.

Best car insurance companies in Texas

USAA and State Farm are the best auto insurance companies in Texas, thanks to cheap rates and top customer service ratings.

The best car insurance companies balance affordability and dependable service to give drivers great value. USAA is only available to members of the military, veterans and some members of military families.

Top insurance companies in Texas

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 881 | A++ | |

| State Farm | 842 | A++ | |

| Geico | 835 | A++ | |

| Texas Farm Bureau | 873 | A- | |

| Allstate | 824 | A+ | |

| Progressive | 819 | A+ |

Auto insurance in Texas: Minimum-liability insurance requirements

Texas requires drivers to have a minimum amount of liability insurance, sometimes written as 30/60/25. Other types of coverage are optional, like collision, comprehensive, personal injury protection and uninsured motorist coverage.

Coverage | Limit |

|---|---|

| Bodily injury (BI) liability insurance | $30,000 per person and $60,000 per accident |

| Property damage (PD) liability insurance | $25,000 per accident |

It's a good idea to increase your coverage limits above the required minimums if you can afford it.

Minimum-liability insurance is cheap, but if you're involved in a serious car accident, your insurance company will only cover you up to the amounts on your policy. You'll be responsible for paying any medical bills or car repair costs that are more expensive than your car insurance limits.

Minimum-liability vs. full-coverage car insurance in Texas

If you're looking for the cheapest car insurance possible, buy a policy that only meets Texas minimum state requirements for liability insurance.

These quotes meet the legal insurance requirements in Texas, which include $30,000 in bodily injury liability per person and $60,000 per accident, along with $25,000 in property damage coverage. But you don't get any coverage beyond what's required.

Minimum-liability policies are cheap, but they may not protect you much after an accident.

For example, after a major crash, the other driver's medical bills could top the $30,000 bodily injury coverage limit. You would have to pay for costs above the limit.

And minimum-liability policies don't cover damage to your car. For that, you need comprehensive and collision insurance, which are included in a full-coverage policy.

Cost of Texas auto insurance over time

The cost of car insurance in Texas has gone up 49% since 2019.

Rate increases in Texas peaked in 2022 and 2023, when prices went up 25% and 18%, respectively.

That followed three years when rates were mostly stable between 2019 and 2021.

The increases in car insurance rates in 2022 and 2023 are primarily because of higher repair costs after the COVID-19 pandemic. Another major cause was higher claim rates due to rebounds in driving.

Among major Texas insurers, Farmers and Liberty Mutual have had the biggest increases, while USAA, Incline Insurance and Home State had rates go up the least.

Thus far in 2024, insurance rates have seen only a modest increase of about 1.4%, and seven of the top 10 insurers haven't raised rates at all.

Average cost of car insurance in Texas by city

Marfa has the cheapest car insurance in Texas, with an average rate of $125 per month for full coverage. North Houston is the most expensive city for auto insurance, at $195 per month.

Texas drivers pay an average of $153 per month for a full-coverage policy. But average rates can vary by $70 per month for full coverage, depending on where you live.

City | Monthly rate | % from average |

|---|---|---|

| Abbott | $131 | -14% |

| Abernathy | $155 | 1% |

| Abilene | $139 | -9% |

| Abram | $167 | 9% |

| Ace | $157 | 3% |

Frequently asked questions

Who has the cheapest car insurance in Texas?

Texas Farm Bureau has the cheapest rate for liability-only coverage, at $33 per month. It also has the cheapest rate for full coverage, at $86 a month. Your rate will be different based on where you live, your car and your driving history.

How much is car insurance in Texas?

The average price of car insurance in Texas is $58 per month for minimum coverage. Rates for full coverage average $153 per month.

Why is auto insurance so expensive in Texas?

Car insurance in Texas is not as expensive as in some states. A full-coverage policy in Texas is 7% cheaper than the national average. Minimum coverage in Texas is 10% cheaper than the national average. However, Texas also has several major cities with lots of traffic, which leads to higher risks of car accidents and theft. Drivers living in these areas may have more expensive rates.

How much car insurance do I need in Texas?

The minimum car insurance required in Texas is often referred to as 30/60/25. That means coverage for bodily injury liability at $30,000 per person and $60,000 per incident, plus $25,000 of property damage liability coverage.

Methodology

ValuePenguin collected thousands of quotes from ZIP codes across Texas for the largest insurance companies. Rates are for a 30-year-old man with good credit who drives a 2015 Honda Civic EX.

Unless otherwise noted, rates are for a full-coverage policy with collision, comprehensive and liability coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Auto insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.