Who Has The Cheapest Auto Insurance Quotes in Dallas, TX?

State Farm is the cheapest company for car insurance in Dallas, at $87 per month for full coverage and $38 per month for minimum coverage.

Find Cheap Auto Insurance Quotes in Dallas

Best cheap car insurance companies in Dallas, TX

To help you find the best cheap car insurance in Dallas, ValuePenguin compared thousands of car insurance quotes from the top companies in Texas. We rated the cheapest companies based on factors like cost, coverage and customer service.

Minimum liability quotes meet the Texas state minimum requirements of $30,000 in bodily injury liability per person and $60,000 per accident plus $25,000 in property damage coverage. Full coverage quotes have higher liability limits plus comprehensive and collision coverage.

Cheapest car insurance in Dallas: State Farm

State Farm is the cheapest company for full coverage in Dallas, at $87 per month.

Rates with State Farm are 46% lower than the average price citywide.

Farm Bureau and USAA also have affordable rates, at $107 and $117 per month, respectively. But keep in mind that USAA only offers coverage to people affiliated with the military.

Find Cheap Auto Insurance Quotes in Dallas

Cheapest full coverage car insurance

Company | Monthly rate | |

|---|---|---|

| State Farm | $87 | |

| Farm Bureau | $107 | |

| Geico | $125 | |

| Progressive | $253 | |

| Allstate | $287 |

*USAA is only available to current and former military members and their families.

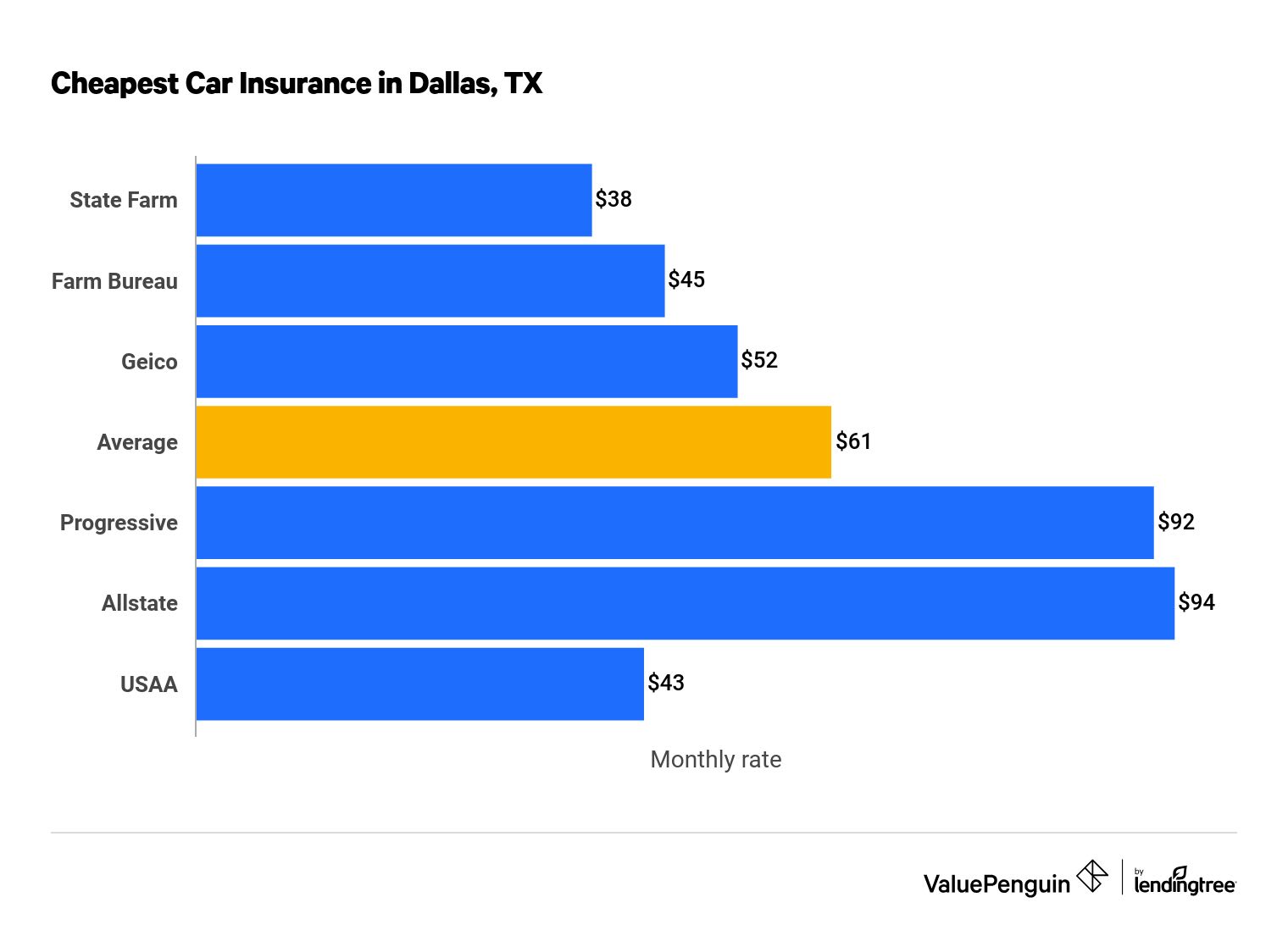

Cheap liability insurance quotes in Dallas, TX

State Farm has the cheapest minimum liability car insurance quotes in Dallas, with an average rate of $38 per month.

That's 37% cheaper than the city average. The average cost of car insurance in Dallas is $61 per month for a minimum liability policy.

Find Cheap Auto Insurance Quotes in Dallas

Car insurance in Dallas tends to be more expensive than the average cost of car insurance in Texas, which is $48 per month.

But you can still find savings by shopping around for the best rates. Going with State Farm will save you $662 per year when compared with the most expensive insurer, Allstate.

Best cheap liability car insurance in Dallas

Company | Monthly rate | |

|---|---|---|

| State Farm | $38 | |

| Farm Bureau | $45 | |

| Geico | $52 | |

| Progressive | $92 | |

| Allstate | $94 | |

| USAA* | $43 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for young drivers in Dallas: Farm Bureau

Farm Bureau has the cheapest car insurance quotes in Dallas for teen drivers.

A minimum liability policy from Farm Bureau costs around $87 per month for an 18-year-old driver, or $181 for full coverage. Both of these prices are more than 60% cheaper than average.

Monthly car insurance rates for young Dallas drivers

Company | Liability only | Full coverage |

|---|---|---|

| Farm Bureau | $87 | $181 |

| Geico | $120 | $271 |

| State Farm | $131 | $263 |

| Progressive | $441 | $1,303 |

| Allstate | $474 | $1,205 |

The best way for a teen driver to save on car insurance is to share a policy with their parents, which will reduce their rates by hundreds of dollars each year.

If staying on your parents' policy isn't an option, be sure to ask your insurer about common auto insurance discounts like student-away-from-home or good student discounts.

Cheapest car insurance for people with a speeding ticket: State Farm

State Farm has the best price for full coverage in Dallas after a speeding ticket. Its average rate of $87 per month is 51% lower than the city average.

State Farm tends to have the best car insurance rates after a driving incident.

Cheapest Dallas car insurance after a speeding ticket

Company | Monthly rate |

|---|---|

| State Farm | $87 |

| Farm Bureau | $107 |

| Geico | $148 |

| Allstate | $287 |

| Progressive | $311 |

Speeding tickets raise the average cost of insurance in Dallas by about 10%. Insurers have found that drivers with a speeding ticket on their record are slightly more likely to file a claim.

Cheapest car insurance in Dallas after an accident: State Farm

State Farm offers the best prices for Dallas drivers who have an at-fault accident on their record, with an average rate of $105 per month for full coverage. That's 58% less than the average rate in the city.

Farm Bureau is a distant second for cheap post-crash rates, with an average of $172 per month. But that's still a $912 savings over the course of a year, compared to an average policy.

Cheapest car insurance after an accident

Company | Monthly rate |

|---|---|

| State Farm | $105 |

| Farm Bureau | $172 |

| Geico | $199 |

| Progressive | $385 |

| Allstate | $453 |

Cheapest car insurance for drivers with a DUI: State Farm

State Farm has the cheapest rates for Dallas drivers with a recent DUI, charging just $144 per month for full coverage. That's close to half the average overall rate of $248.

Cheapest Dallas car insurance after a DUI

Company | Monthly rate |

|---|---|

| State Farm | $144 |

| Farm Bureau | $211 |

| Geico | $221 |

| Progressive | $288 |

| Allstate | $449 |

Driving under the influence (DUI) is a serious offense — so serious, in fact, that the insurers in Dallas raise average rates by 53%.

Cheapest quotes for drivers with poor credit: Farm Bureau

Farm Bureau has the cheapest quotes for Dallas drivers with poor credit. Full coverage car insurance from Farm Bureau costs $241 per month for these drivers, which is 30% cheaper than the city average.

Cheapest car insurance for poor credit in Dallas

Company | Monthly rate |

|---|---|

| Farm Bureau | $241 |

| Geico | $335 |

| Allstate | $406 |

| Progressive | $438 |

| State Farm | $453 |

Having a bad credit score doesn't have anything to do with your driving ability. However, insurance companies believe that drivers with poor credit are more likely to file a claim in the future, making them more expensive to insure.

In Dallas, drivers with poor credit pay $183 more per month for full coverage insurance than people with a good credit score.

Cheapest quotes for teens after an incident: Farm Bureau

Farm Bureau also has the cheapest car insurance rates in Dallas for teens with a speeding ticket or an at-fault crash on their record.

A minimum coverage policy from Farm Bureau costs $87 per month for an 18-year-old driver with a single speeding ticket on their record, which is the same as the rate for a driver with a clean record. After an accident, Farm Bureau's average rate increases to $125 per month, which is still 62% cheaper than average.

Monthly minimum coverage quotes after a traffic violation

Company | Accident | Ticket |

|---|---|---|

| Farm Bureau | $125 | $87 |

| State Farm | $151 | $131 |

| Geico | $174 | $133 |

| Progressive | $477 | $439 |

| Allstate | $859 | $474 |

Young drivers with an accident on their record pay much more for insurance. On average, an accident will cause an 18-year-old's insurance rates to go up by 41%.

Cheapest car insurance for married drivers: Farm Bureau

Married drivers in Dallas will find great rates at Farm Bureau, where a full coverage policy costs just $80 per month. That's 46% cheaper than the average price for married drivers.

State Farm typically doesn't give married drivers a discount, but its rates are already very affordable, so it's worth considering too.

Married drivers statistically get into fewer accidents than single drivers do, so many insurers charge them lower rates. Rates for married drivers in Dallas are 8% less expensive than rates for single drivers.

Cheapest Dallas car insurance for married drivers

Company | Monthly rate |

|---|---|

| Farm Bureau | $80 |

| State Farm | $87 |

| Geico | $141 |

| Progressive | $237 |

| Allstate | $249 |

Best car insurance companies in Dallas

USAA has the best-rated car insurance in Dallas, based on its excellent customer service reviews and affordable rates.

However, most drivers aren't eligible for USAA insurance. You'll only qualify if you've served in the U.S. military, or if your parent or spouse has had USAA coverage at some point.

Drivers that aren't eligible for USAA can find great service at State Farm and Farm Bureau.

Best car insurance in Dallas

Company |

Editor's rating

|

|---|---|

| USAA | |

| State Farm | |

| Farm Bureau | |

| Geico | |

| Allstate | |

| Progressive |

The best insurance company will have dependable service in addition to affordable prices.

Great service will make your life much easier if you're ever in an accident and need to make a claim. A dependable insurance company will answer your questions and make sure you're compensated quickly and fairly after you file a claim.

Average car insurance cost in Dallas by neighborhood

Drivers living in downtown Dallas pay the highest car insurance rates in the city, while those in Farmers Branch have the cheapest insurance rates.

Car insurance rates will vary depending on which part of Dallas you live in. Drivers in Farmers Branch pay around $143 per month for full coverage insurance, which is $46 per month cheaper than coverage for people living downtown.

ZIP code | Average monthly cost | % from average |

|---|---|---|

| 75098 | $144 | -11% |

| 75201 | $164 | 1% |

| 75202 | $168 | 3% |

| 75203 | $170 | 5% |

| 75204 | $156 | -4% |

Minimum car insurance requirements in Texas

In Texas, drivers are required to have a certain amount of bodily injury liability and property damage liability coverage, which is sometimes referred to as 30/60/25.

- Bodily injury liability: $30,000 per person, $60,000 per accident

- Property damage liability: $25,000 per accident

While this amount is enough to be legally insured, drivers should consider increasing their coverage beyond the minimum limits, as extra liability protection is not expensive. We also recommend considering collision and comprehensive insurance, which protect your car against damage.

Drivers in Texas are also allowed to buy personal injury protection (PIP). If you don't have good health insurance to cover injuries from a car accident, you should strongly consider PIP for your policy.

Full coverage insurance protects your car from damage, whether it occurs in a crash or in another scenario. A full coverage policy includes collision and comprehensive coverage.

- Collision coverage: Collision coverage pays for damage to your car after a collision — no matter who was responsible for the accident.

- Comprehensive coverage: Also known as "other-than-collision coverage," comprehensive coverage protects your car from noncollision damage, such as damage from a wild animal, theft or fire.

Frequently asked questions

What is the average cost of car insurance in Dallas, TX?

The average cost of car insurance in Dallas is $61 per month for a minimum coverage policy and $163 per month for full coverage.

Who has the cheapest car insurance in Dallas?

State Farm has the cheapest car insurance for most drivers in Dallas. A liability-only policy from State Farm costs $38 per month, which is 37% cheaper than average. Full coverage from State Farm costs $87 per month, which is 46% cheaper than average.

Who has the best car insurance in Dallas?

USAA is the best-rated car insurance company in Dallas. It has a reputation for great customer service and cheap quotes. However, USAA only sells insurance to people affiliated with the military. Other drivers should consider State Farm or Farm Bureau, both of which offer reliable service and affordable rates.

What car insurance is required in Dallas?

Dallas drivers are required to have car insurance with liability limits of at least 30/60/25. This means you need $30,000 of bodily injury liability per person and $60,000 per accident, along with $25,000 of property damage liability per accident.

Is Dallas car insurance expensive?

Yes, car insurance in Dallas is more expensive than average. A full coverage policy costs $163 per month, which is 20% more expensive than the Texas state average.

Methodology

To find the best cheap car insurance in Dallas, TX, we collected quotes from six of the most popular insurance companies in Texas. Rates are for a 30-year-old single man with good credit and no accident history who drives a 2015 Honda Civic EX.

Full coverage policies include comprehensive and collision coverage, plus higher liability limits than the state requires.

Coverage | Limit |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.