How SR-22 Insurance in Illinois Works and What it Costs

Find Cheap SR-22 Auto Insurance Quotes in Illinois

In Illinois, SR-22 forms are filed on your behalf by your insurance company. The SR-22 certifies to the Illinois Driver Services Department (DSD) that you carry at least the state-required car insurance coverage.

This is a requirement to have a license reinstated after being convicted of a serious driving offense, such as a DUI. It may also be required if you're caught driving without insurance, had a license suspended for failure to pay child support or have excessive tollway fare evasions.

Even if you don't own a vehicle, you’ll need to file an SR-22 to reinstate a suspended license.

How do I get SR-22 insurance in Illinois?

Getting SR-22 insurance in Illinois is similar to purchasing normal auto insurance. Most people who need an SR-22 have had their insurance canceled as a result of having their license suspended or revoked. If you still have an existing policy, you may be able to add an SR-22 through your existing insurance company. Call your insurer to determine if they offer this option.

Find an authorized insurer or contact your current carrier. If you're applying for a new policy online, through the phone or in person with an agent, you'll typically have the option to specify that you require an SR-22. Not all insurance companies in Illinois offer SR-22 insurance, so you may need to purchase coverage from a specialized insurance provider.

Pay the SR-22 filing fee. Your insurer will usually charge a flat fee between $15 and $50 when they file the SR-22 form on your behalf.

Have an insurer file proof of insurance on your behalf. Once you've purchased coverage, your new insurance provider will send the SR-22 form to the Illinois Secretary of State — you can’t send it yourself. After the form is processed, which can take up to 30 days, you will be able to have your driver's license and vehicle registration reinstated.

Receive confirmation. It's possible to verify that the Illinois DSD has received your SR-22 form — and whether you can resume driving — by calling 217-782-3720 and providing your driver's license and Social Security numbers. If your license has been reinstated, you can start driving immediately; you don't need to wait for the paperwork to arrive in the mail.

You must continuously maintain an SR-22 for three years, and it's recommended to renew your SR-22 insurance at least 45 days before your policy expires. If you have not renewed your insurance 15 days before its expiration date, your insurer is legally required to notify the state of Illinois.

If your policy lapses, your license and registration will be suspended immediately, and you'll have to restart the reinstatement process.

Once your three years are up, you can cancel your SR-22 insurance and look for the cheapest prices for standard car insurance.

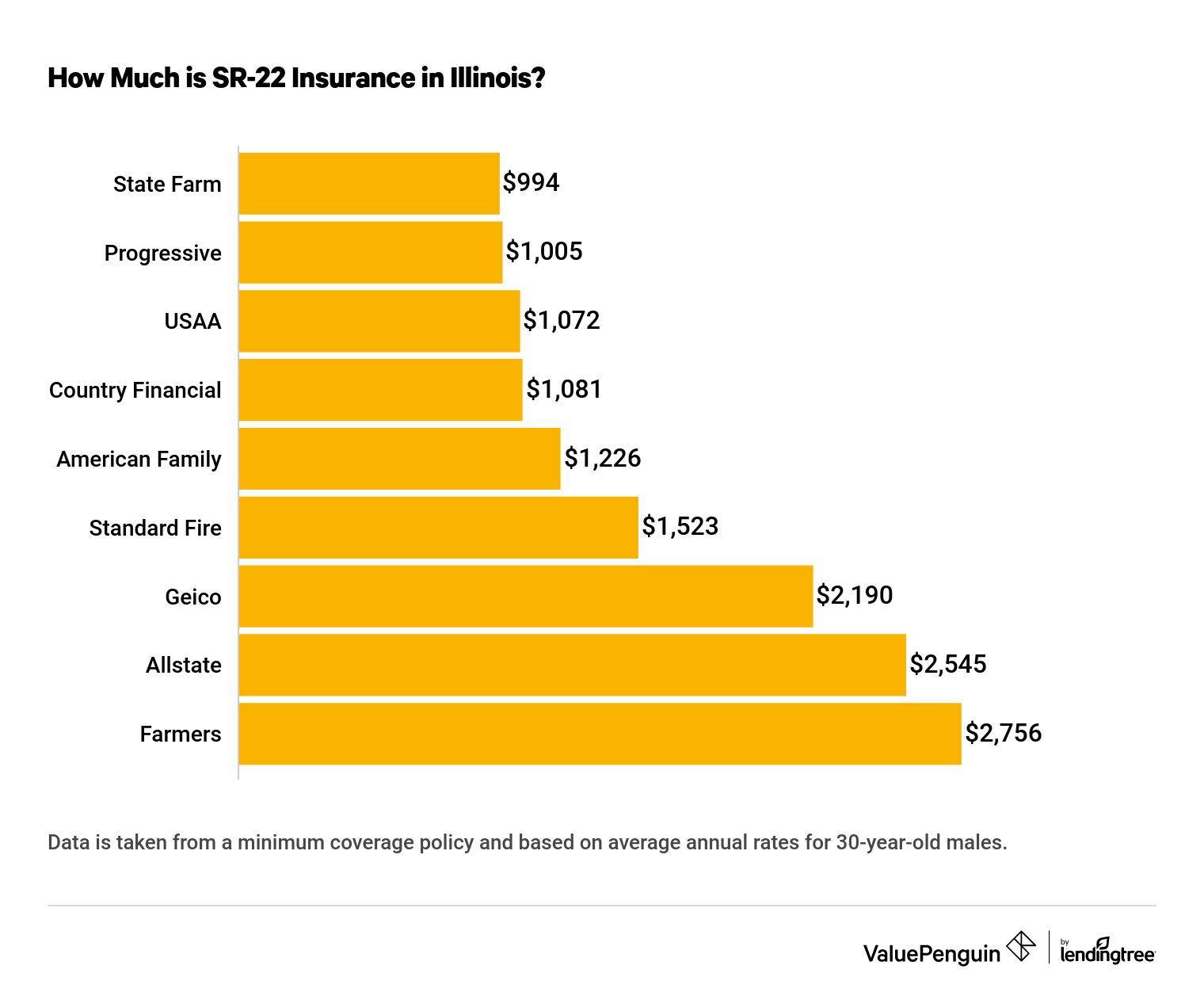

Cost of SR-22 insurance in Illinois

Unfortunately, auto insurance companies generally charge more if you require an SR-22. The high cost isn't strictly due to filing the form. An SR-22 requirement is a strong indicator of someone being a risky driver; as such, you're unlikely to find a truly cheap option.

An Illinois driver with a recent DUI and an SR-22 requirement can expect to pay 50% to 80% more than the same driver without a DUI or SR-22. For example, State Farm had the best quote for our sample driver at an annual rate of $994 with an SR-22. That’s 65% higher than their quote for a driver without the SR-22.

Find Cheap SR-22 Auto Insurance Quotes in Illinois

In the table of car insurance quotes below, we've compared the average annual premium for a 30-year-old male with no SR-22 against a 30-year-old male with an SR-22 filing and prior DUI, along with the percent increase in rates for each insurer.

Insurer | Avg. cost per year with SR-22 and DUI | % increase after DUI | |

|---|---|---|---|

| State Farm | $994 | 65.12% | |

| Progressive | $1,005 | 15.25% | |

| USAA | $1,072 | 116.57% | |

| Country Financial | $1,081 | 45.10% | |

| American Family | $1,226 | 77.94% | |

| Standard Fire (Travelers) | $1,523 | 40.89% | |

| Geico | $2,190 | 70.43% | |

| Allstate | $2,545 | 65.37% | |

| Farmers | $2,756 | 48.73% |

It's always a good idea to shop around for car insurance, and drivers who require an SR-22 should be especially thorough.

What is an SR-22 in Illinois?

An SR-22 is a paper or digital form that an insurer sends on your behalf to the government, certifying that you have an active auto insurance policy that meets Illinois' minimum liability insurance requirements.

Illinois requires liability of at least $25,000 for injury or death of one person in an accident, $50,000 for injury or death of more than one person in an accident and $20,000 for damage to property of another person.

If you're convicted of a serious driving offense, including a DUI, driving without insurance or failing to pay damages for a traffic accident in which you were at fault, you may be required to file an SR-22 to maintain your driving privileges.

What offenses can lead to an SR-22 in Illinois?

You can be required to get an SR-22 for various reasons in Illinois. Most involve having your license suspended, though not all are strictly related to driving.

Offenses that can lead to an SR-22 in Illinois

- Serious traffic infraction, such as a DUI

- Multiple smaller traffic infractions, like speeding or running red lights

- Driving without insurance three or more times

- Being at fault in an accident while driving without insurance

- Failure to pay damages after you were at fault in an accident

- Failure to pay child support

- Failure to continuously maintain a previous SR-22 for three years

- Excessive tollway fare evasions

Non-owner SR-22 insurance

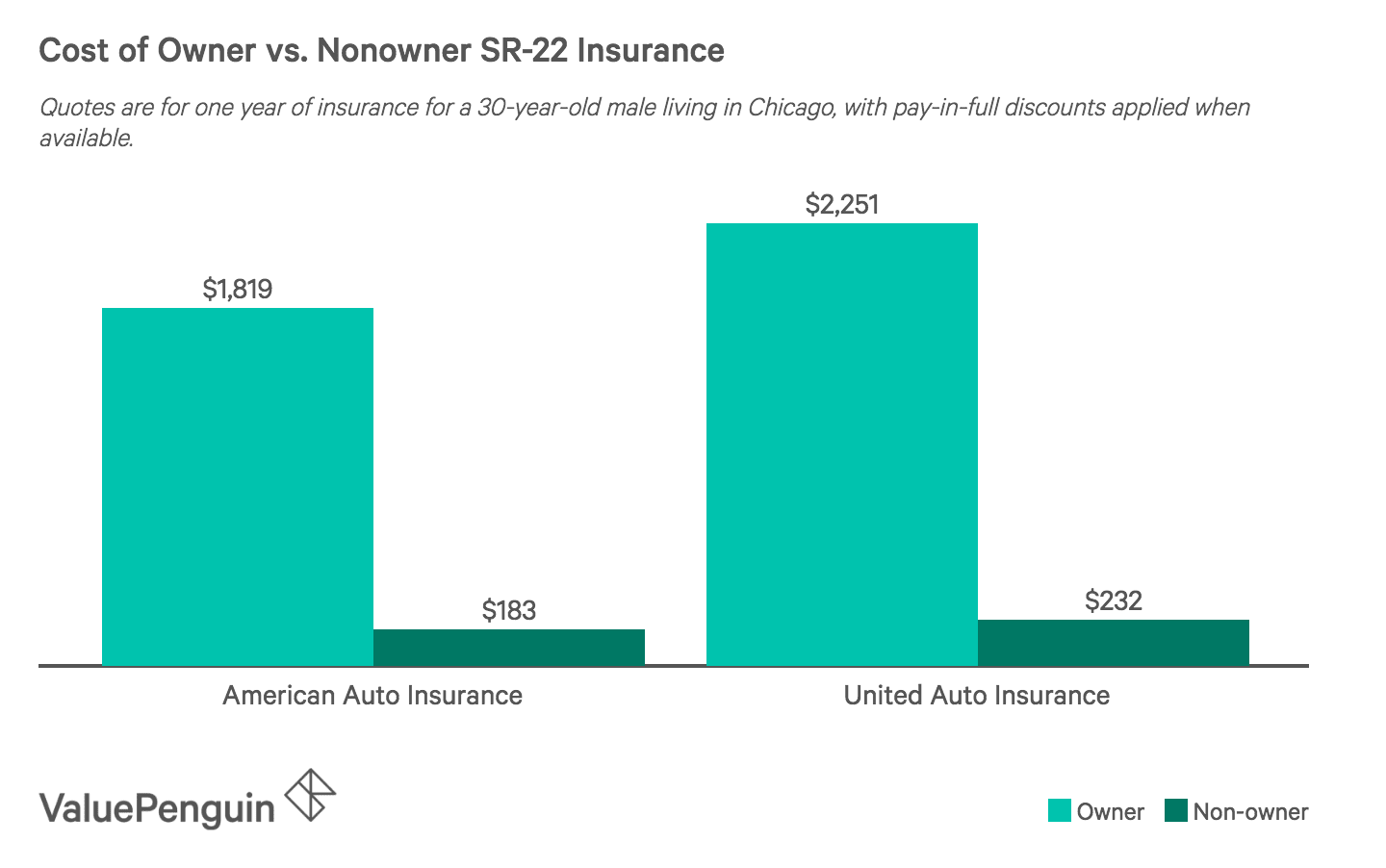

If the cost of SR-22 insurance is too high and you don't need to regularly drive a particular vehicle (or you don’t own one), an alternative to standard SR-22 insurance is non-owner coverage.

Non-owner SR-22 insurance is cheaper because it provides liability coverage only and protects you while driving someone else's car if you use it occasionally.

Non-owner SR-22 coverage is the most affordable way to satisfy the SR-22 insurance requirement for the three years you must have it. However, to qualify for non-owner SR-22 coverage, you must not own a car, nor can you use the car of someone you live with, like your roommate or spouse. So if you own a car now, you'd have to sell it to qualify for non-owner coverage.

Alternatives to SR-22 insurance

There are a few alternatives to filing an SR-22 available in Illinois, though they are costly. You must still maintain the standard car insurance requirements, but you can deposit $70,000 in cash, securities, a surety bond or a real estate bond as a guarantee.

Additionally, if you move out of state, you can file an affidavit that will waive your responsibility of filing an SR-22 in Illinois. However, most states have SR-22 or similar requirements, so chances are you'll still need to purchase SR-22 coverage in your new home.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.