American Strategic (ASI) Home Insurance Review

Competitive discount package can't make up for high rates and poor customer service reviews.

Find Cheap Homeowners Insurance Quotes in Your Area

American Strategic Insurance (ASI) provides moderate- to high-priced homeowners insurance policies and receives poor marks for coverage options and customer service. However, it has a strong financial backing as a majority-owned subsidiary of Progressive Insurance, making it a stable, if somewhat overpriced, option.

Pros and cons

Pros

Bundling insurance policies, like home and auto

Backed by Progressive Insurance

Cons

Poor customer service

Expensive home insurance rates

American Strategic Insurance (ASI) home insurance: Our thoughts

ASI's homeowners insurance policies are high-priced, given the company's fairly typical coverage options, but it does provide some competitive discounts for coverage choices that can help you get a better rate.

For example, in New Mexico, you can get a 15% discount for paying your annual policy in full up front, plus a 10% discount for maintaining a personal umbrella policy.

ASI also partners with auto insurance companies, including its owner Progressive, to provide discounts for bundling your homeowners and auto insurance in select locations. Bundling discounts are not uncommon in homeowners insurance, but ASI separates itself with a useful single-deductible policy for your auto and home insurance bundle.

ASI operates through independent insurance agents rather than providing online quotes, although it does provide options to manage your policy or make payments online. The agent model gives customers a single point of contact, but the company has a poor customer service reputation. ASI rates poorly in customer reviews, receives an above-average number of complaints and is one of the worst-performing home insurance firms with regard to customer satisfaction ratings.

Bottom line:

If you prioritize working with an established insurer and can take full advantage of ASI's discounts, then it may be worth getting a quote from American Strategic Insurance. Otherwise, you're likely to find a cheaper policy with better customer service from one of its rivals.

ASI home insurance quote comparison

Find Cheap Homeowners Insurance Quotes in Your Area

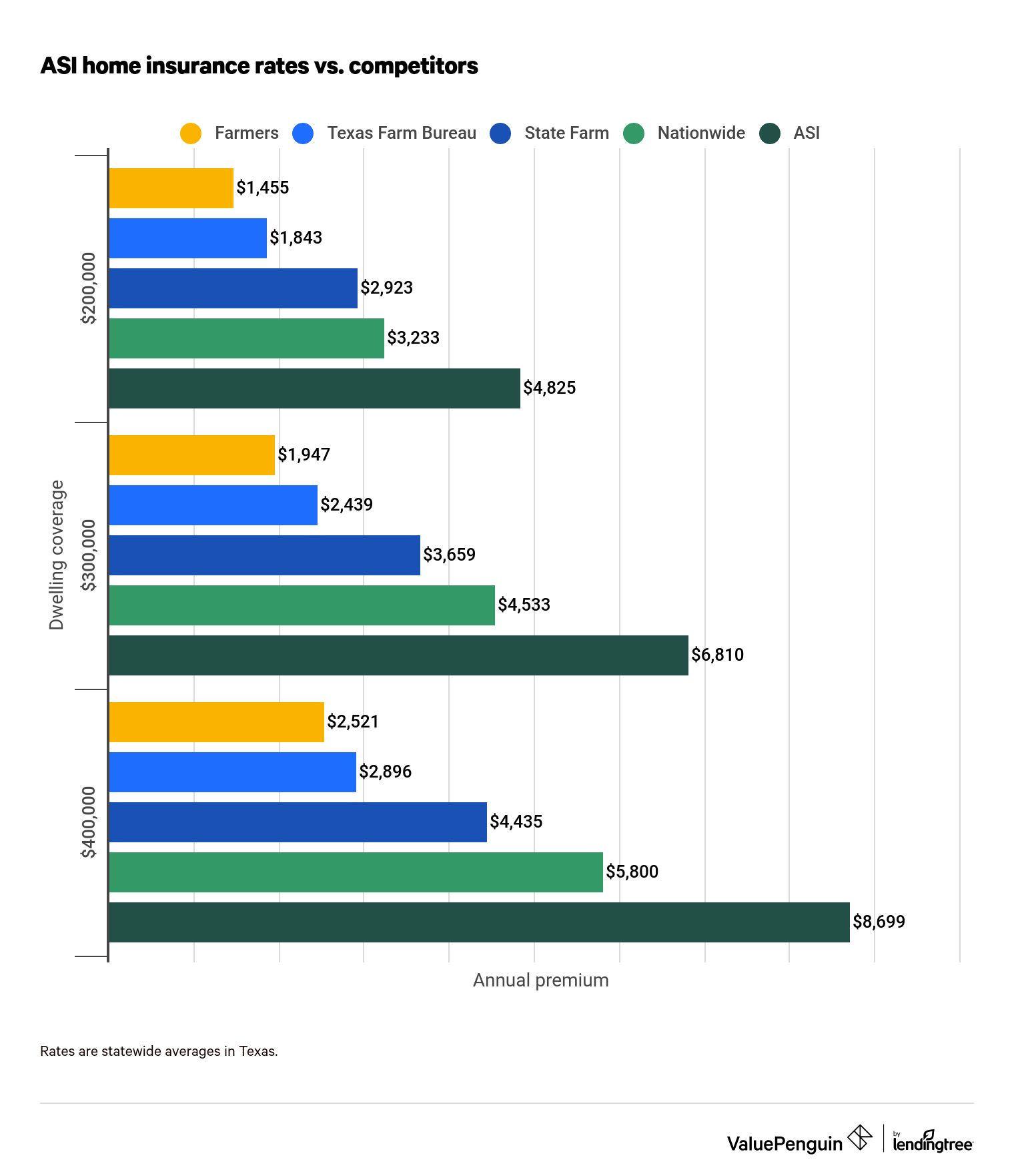

Compared to other major insurers, ASI's homeowners insurance quotes tend to range from moderate to expensive. If you're considering purchasing insurance from ASI, you should ask your agent about utilizing some of the company's discounts to narrow the gap in price between competitors.

Find Cheap Homeowners Insurance Quotes in Your Area

ASI homeowners insurance rates vs. competitors

Dwelling Coverage Amount | ASI | Farmers | Nationwide | State Farm | Texas Farm Bureau |

|---|---|---|---|---|---|

| $200,000 | $4,825 | $1,455 | $3,233 | $2,923 | $1,843 |

| $300,000 | $6,810 | $1,947 | $4,533 | $3,659 | $2,439 |

| $400,000 | $8,699 | $2,521 | $5,800 | $4,435 | $2,896 |

ASI Florida home insurance rates

ASI has much more competitive rates for Florida home insurance. We found an average price of $2,356 per year for a $300,000 dwelling coverage policy from ASI — 32% less than the average we found in Florida.

That's about equal to the price we found at State Farm, though still 49% more expensive than the cheapest insurer in the state, Tower Hill.

Dwelling coverage amount | ASI | Citizens | State Farm | Tower Hill | Universal |

|---|---|---|---|---|---|

| $200,000 | $1,782 | $5,670 | $1,756 | $1,069 | $1,952 |

| $300,000 | $2,356 | $8,023 | $2,349 | $1,586 | $2,925 |

| $400,000 | $2,759 | $10,517 | $2,964 | $2,008 | $4,403 |

ASI policy coverage and discounts

ASI's homeowners insurance policies provide coverage options that are typical of major insurers and don't separate ASI from competitors. ASI's standard coverage policy includes the following.

Covered by ASI | Coverage details |

|---|---|

| The structure of your home | Covers damage to the structure of your home in the event of a covered peril |

| Attached structures | Covers damage to structures attached to your home, like a garage or shed |

| Personal belongings | Covers damage to or theft of the contents of your home |

| Additional living expenses | Covers the cost of staying elsewhere if your home is temporarily uninhabitable, such as room and board |

| Personal liability coverage | Protects you and your family from lawsuits for bodily injury or property damage to others |

| Medical payments | Covers medical costs in the event guests are injured on your property |

| Optional floaters for valuable items | Increased coverage can be purchased for high-value items such as jewelry or art |

For example, if you're a resident of Florida and you purchase homeowners insurance with a flood endorsement, the entirety of a flood claim can be settled through ASI.

Other optional offerings include a HomeShield package and flood insurance. HomeShield broadly increases limits and coverage for many of the components of the standard policy. Flood insurance is generally not included in homeowners insurance policies, but you can purchase National Flood Insurance Program coverage as an endorsement to your policy through ASI. This can help streamline the claims process.

ASI home insurance discounts

If you own a car or can qualify as a low-risk customer, ASI provides a variety of potential discounts that can reduce premiums by as much as 55% from the base price.

Car owners are eligible for one of ASI's best perks, as they can bundle their homeowners insurance with an auto policy written with an ASI-preferred partner and become eligible for a discounted premium.

In addition, depending on your state, bundling may also include a unique single-deductible option. So if a covered peril affects both your home and vehicle, you will only pay your vehicle deductible out of pocket. Preferred partners include Progressive Home Advantage, Geico and USAA. Discounts for this bundle can vary, but a standard preferred partner discount in New Mexico would reduce your home insurance premium by approximately 10%.

ASI also offers discount opportunities for third-party products for water leak detection, fire protection and burglar protection. If you're purchasing ASI homeowners insurance, we recommend you examine these options, as they can save you money on your home insurance premium as well. For example, ASI offers a 15% discount on leakSMART water monitoring systems, the installation of which will qualify you for a discount on your insurance premium.

Additional homeowners insurance discounts from ASI include the following.

Discount | Eligibility |

|---|---|

| Nonsmoker Discount | All residents of the home must be nonsmokers. |

| Protective Device Discount | Install devices such as burglar alarms and smoke detectors. |

| New Purchase Discount | Purchase a new home. |

| New Construction Discount | Purchase a recently built home. |

| Secured Community/Building Discount | Live in a gated home or community with extra security. |

| Electronic Policy Discount | Elect to receive your policy documents through email. |

| Window/Opening Protection Discount | Purchase and install impact-resistant windows. |

| Paid-in-Full Discount | Pay for your entire 12-month policy up front. |

| Umbrella Discount | Maintain an umbrella liability policy. |

The degree to which ASI's home insurance discounts will affect your premium can vary depending on your situation and your location. For example, in New Mexico, the electronic policy discount is only $10, while the discount applied to paid-in-full policies is approximately 15%. However, combining the right discounts can result in substantial savings.

ASI ratings and customer service reviews

American Strategic Insurance ratings for customer service and policy options are generally either poor or, at best, don't stand out from the competition. Negative reviews frequently cite poor customer service relating to claim resolutions, including incidents in which ASI canceled policies prematurely, was unresponsive to claim requests or did not accurately assess damage to the home.

Further, ASI's complaint ratio, compiled by the National Association of Insurance Commissioners, is 1.05 versus a national average of 1.00. This means the company receives slightly more complaints than average.

J.D. Power's home insurance customer satisfaction ratings also ranked ASI as typical. The company received a score of 821/1,000, which puts it slightly below the national average of 824.

From a financial perspective, ASI and its affiliates are considered in "Superior" financial condition, receiving an "A+" rating from AM Best.

ASI structure and affiliates

ASI operates as a collective group of insurance subsidiaries under the parent company ARX Holding Corp., for which Progressive is a controlling shareholder. The following companies are part of the ASI group. If you are seeking homeowners insurance coverage from ASI, you may work with one of these various affiliates, depending on your location.

- American Strategic Insurance Corp.

- ASI Assurance Corp.

- ASI Preferred Insurance Corp.

- ASI Select Insurance Corp.

- Progressive Property Insurance Co.

- ASI Select Auto Insurance Corp.

- ASI Lloyds

- ASI Services Inc.

- ASI Home Insurance Corp.

- Sunshine Security Insurance Agency

- ASI Underwriters

- ASI Underwriters of Texas Inc.

Filing a claim with ASI

Given ASI's poor customer service ratings, you should be aware of what your coverage entails and be persistent in seeking appropriate payments when filing a claim. Customer reviews of the claims process consistently mention inaccurate assessments of damage and unresponsiveness by the claims department.

These experiences belie ASI's claims of a guaranteed 48-hour response rate and a 24/7 emergency claims service team. If you are an ASI policyholder, you can file your claim through the company by calling its phone number at 866-274-5677 or logging in to its online claims center.

Methodology

To find the average cost of home insurance from ASI and its competitors, we compared the price of homeowners insurance statewide in Florida and Texas, two of ASI's biggest markets.

We based our analysis on a home with $300,000 of dwelling coverage, $150,000 of personal property coverage and $30,000 of loss of use coverage. The policies also include $100,000 of liability protection.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.