Ameriprise Insurance Review

Ameriprise is a company worth considering because of its good home insurance coverage and the potential for affordable rates.

Find Cheap Auto Insurance Quotes in Your Area

Ameriprise policies, which are sold through American Family CONNECT, offer solid auto and home insurance coverage, generally cheap rates and a few practical endorsements you can use to supplement your coverage.

While you might be able to find comparable rates and better coverage from other companies, Ameriprise will suit the needs of most people, although it doesn't really stand out.

Its customer service reputation is uneven depending on what you're insuring. Ameriprise home insurance customers tend to get notably better customer service than their auto insurance counterparts.

Pros and cons

Pros

Good customer service for homeowners

Reasonable rates after a DUI

Good bundling discount options

Cons

Few car insurance coverage options

Poor customer service for auto insurance

Ameriprise insurance: Our thoughts

Ameriprise tends to offer affordable, no-frills auto and home insurance policies, but it may be easier to find a cheaper policy if you're looking for homeowners coverage rather than auto.

Whether you're shopping for homeowners or auto insurance, Ameriprise offers standard policies at rates that are cheaper or equal to competitors' prices.

Ameriprise has a decent reputation for customer service, but your experience may depend on what protection you're buying. Ameriprise gets few customer complaints for its homeowners insurance but gets more for its auto insurance coverage.

Auto insurance takeaway: Ameriprise is worth investigating, especially if you have a DUI (driving under the influence) conviction. However, you're likely to find comparable auto insurance rates and coverage with other national insurers. You should compare quotes to find your best offer before committing to Ameriprise.

Homeowners insurance takeaway: You should look into Ameriprise if you have a newer home with good security and safety features, as the company's already-competitive rates tend to reward homes with these qualities.

Ameriprise auto insurance

Ameriprise offers basic car insurance coverage with slightly below-average prices. But if you have a DUI, its rates are notably cheaper than average.

Ameriprise auto insurance quotes

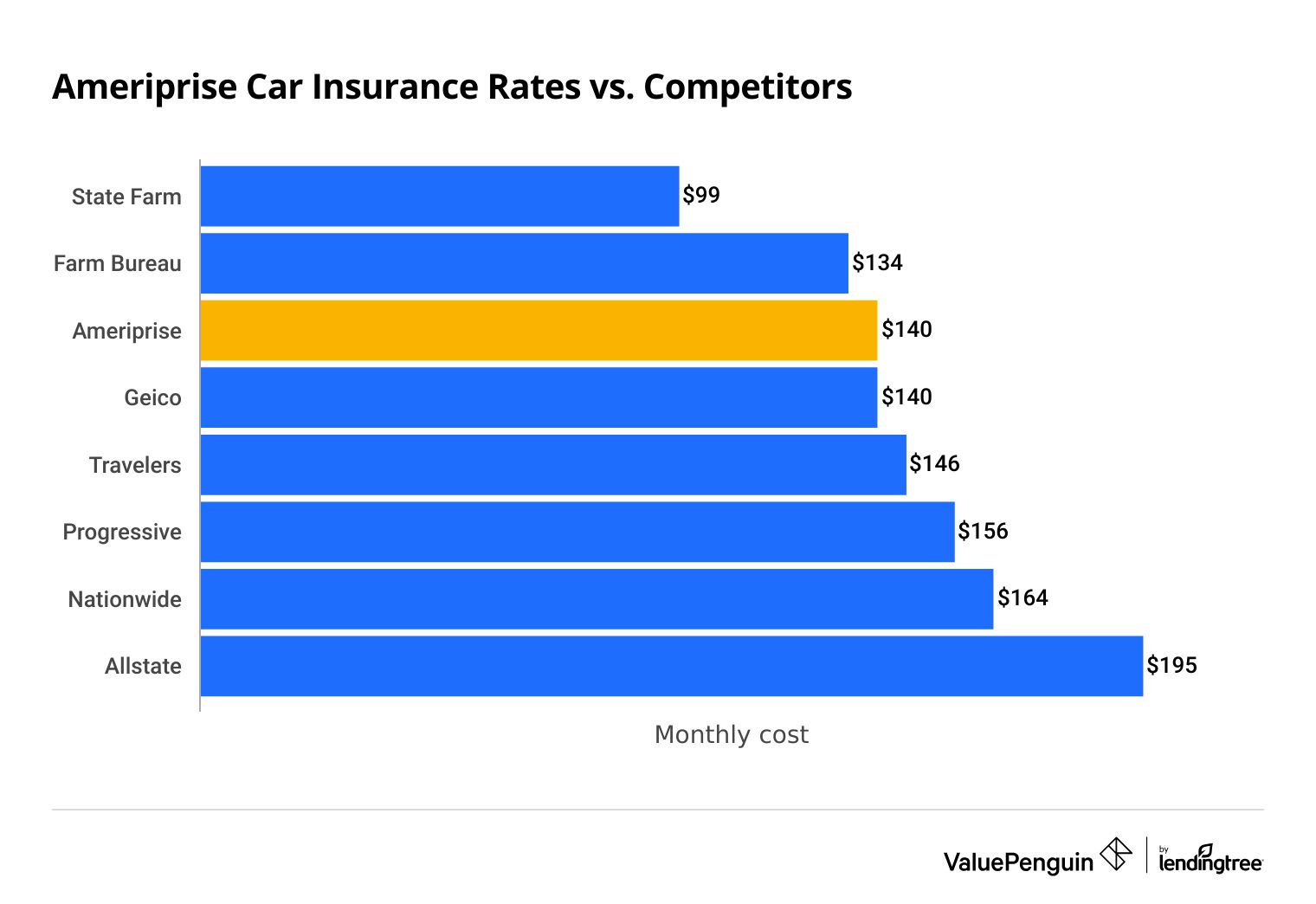

Ameriprise quotes are generally cheaper than average. For full coverage, the average rate — $140 per month — is 5% less than the average of many of the largest companies in the country.

Find Cheap Auto Insurance Quotes in Your Area

Ameriprise full and minimum rates vs. competitors

Minimum liability | Full coverage | |

|---|---|---|

| State Farm | $41 | $99 |

| Farm Bureau | $43 | $134 |

| Ameriprise | $53 | $140 |

| Geico | $52 | $140 |

| Travelers | $63 | $146 |

| Progressive | $63 | $156 |

| Nationwide | $69 | $164 |

| Allstate | $79 | $195 |

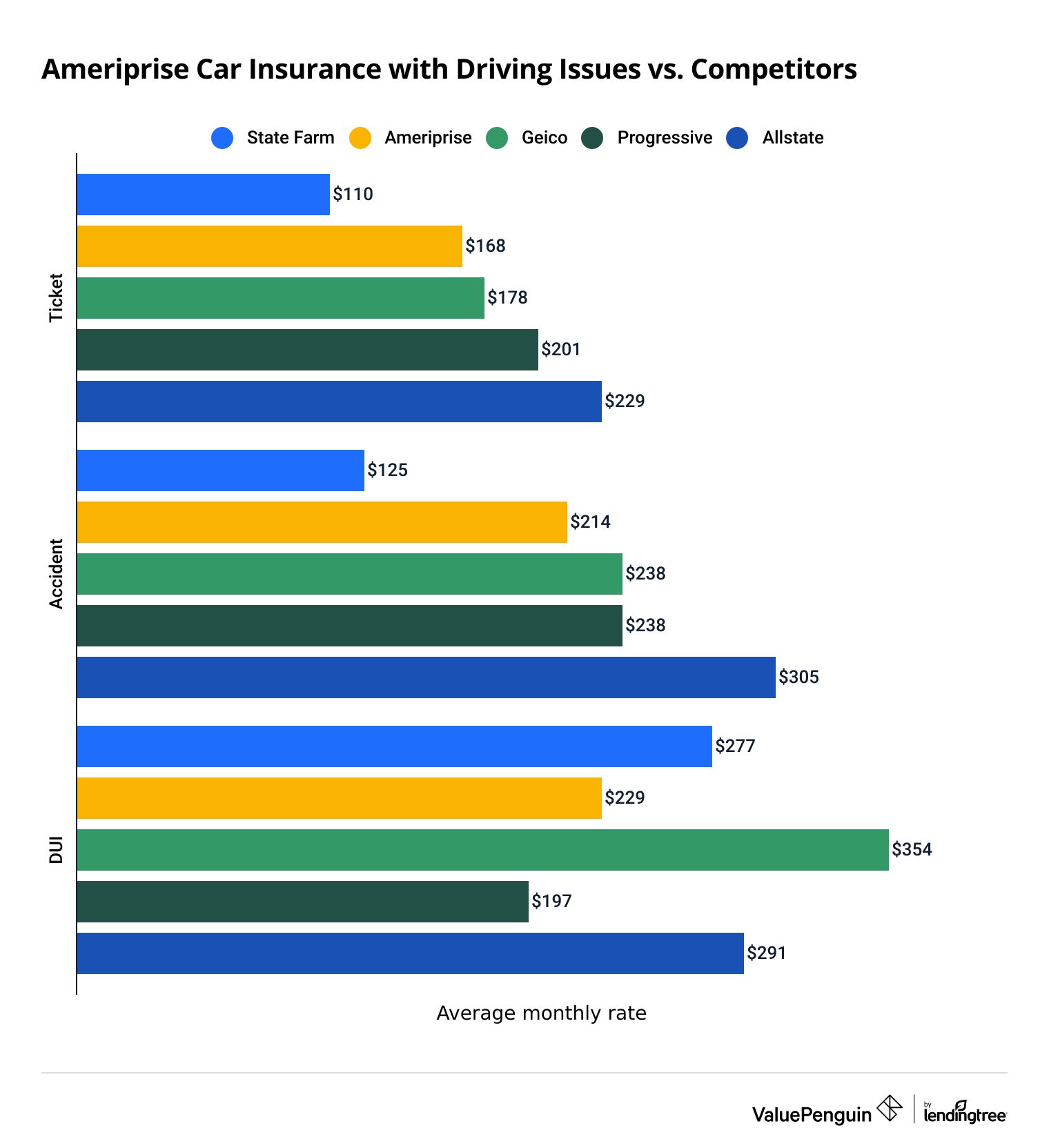

Rates for drivers with a ticket or accident are roughly in line with the company’s other rates. However, you can get rates that are 15% lower than average if you have a DUI.

Rates with a DUI

Rate | Increase (%) | |

|---|---|---|

| Progressive | $197 | 26% |

| Travelers | $218 | 49% |

| Ameriprise | $229 | 64% |

| Farm Bureau | $252 | 88% |

| State Farm | $277 | 180% |

| Allstate | $291 | 49% |

| Nationwide | $309 | 88% |

| Geico | $354 | 153% |

Ameriprise auto insurance discounts

Ameriprise offers a variety of auto insurance discounts you can earn with safer driving choices and bundling with other insurance policies.

Discount | How you get it |

|---|---|

| Premiere safety discount | Avoid an accident, traffic violation or claim for four years. |

| Defensive driver | Take a refresher course on defensive driving approved by your state DMV. |

| Vehicle safety features | Have safety features in your vehicles such as anti-lock brakes and airbags. |

| Garaging | Keep your vehicle overnight in a garage. |

| Students discounts | Young drivers who have good grades can get discounts. Students who live away from home won't be considered full drivers in terms of how rates are calculated, so parents will pay less when their child is away at school. |

| Multivehicle | Insuring more than one vehicle could make you eligible for lower rates. |

| Tenure | Stay with Ameriprise for three years or more. |

| Safe driving (only in California) | Have an accident-free driving record for three years. Even being in an accident for which you weren't at-fault can prevent you from getting this discount. |

If you're someone who is a careful driver and takes good care of their vehicle, you have the potential to get a number of discounts. Just note that Ameriprise's discounts may only be available in certain states.

Ameriprise also provides bundling discounts for combining auto insurance with its homeowners and umbrella policies.

The more policies you bundle, the bigger your discount will be, and these bundles can be formed in a variety of ways. You can bundle your auto and home insurance for a discount, but you can also bundle either the home or auto policies with an umbrella policy.

Ameriprise auto insurance coverage

Ameriprise offers a nice set of ways to add extra coverage to your car insurance policy and includes some perks for free. All policies with comprehensive and collision coverage include things like fixing windshield cracks at no cost, accident forgiveness and stolen key coverage.

- Glass repair deductible waivers: If your windshield can be repaired, from cracks on a road trip, for instance, your policy deductible is waived. This does not apply to full windshield replacement.

- Stolen key coverage: Stolen car keys are covered, with no deductible for replacements totaling less than $250.

- Lifetime renewability: If you’re an Ameriprise client, the company will not cancel a policy and always allow you to renew. That’s the case even if you have multiple accidents.

Ameriprise has a number of extra benefits that you can add separately to your policy, namely towing and rental car coverage.

- Accident travel expense coverage: Ameriprise will make a contribution to your out-of-pocket expenses for travel or accommodation if you were involved in an accident more than 100 miles from your home.

- Rental car insurance: This pays for the cost of a covered rental vehicle, up to certain limits. You can only get this if your car is damaged by something your policy covers.

- Towing: Policies cover the cost of towing a disabled vehicles and include roadside assistance.

You can also get the standard set of coverages with an Ameriprise policy.

- Bodily injury and property liability coverage

- Collision and comprehensive coverage

- Medical payments and personal injury protection

- Uninsured and underinsured motorist liability coverage

- Gap coverage

Ameriprise home insurance

Ameriprise home insurance has a good set of coverage options at slightly cheaper-than-average rates. If you decide to get coverage from Ameriprise, your policy will be underwritten by its partner, American Family Insurance.

While the coverage and discounts offered in Ameriprise's homeowners insurance policies aren't unique, they are practical and convenient.

Unlike many other insurance companies with cheaper rates, you don't need to buy extra liability coverage for slander and libel with Ameriprise.

Ameriprise homeowners insurance quotes and discounts

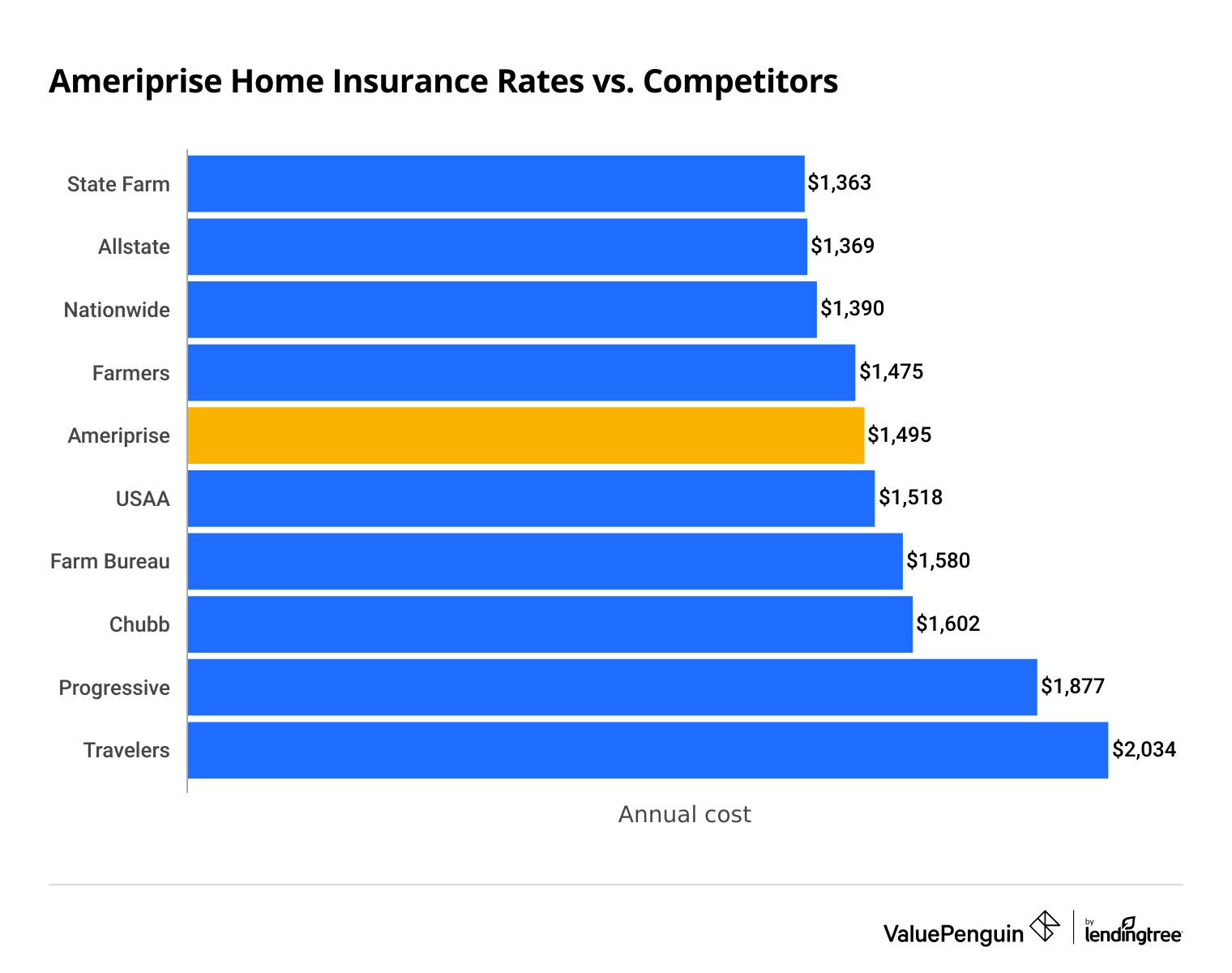

Ameriprise's home insurance rates are about 5% cheaper than average when compared to those from larger U.S. insurers.

Find Cheap Homeowners Insurance Quotes in Your Area

As homeowners insurance rates can vary by location, you should compare Ameriprise prices against other home insurance companies in your area. If you want to get a quote online, you may be able to, but you’ll often have to connect with an agent.

Ameriprise home insurance rates vs. competitors

Average annual rate | |

|---|---|

| State Farm | $1,363 |

| Allstate | $1,369 |

| Nationwide | $1,390 |

| Farmers | $1,475 |

| Ameriprise | $1,495 |

Discount options

Like most other insurers, Ameriprise has discounts that you can use to lower the cost of your policy, if you qualify. Although the discounts Ameriprise home insurance offers aren't uncommon in the homeowners insurance marketplace, there's a good chance you could get at least a couple.

Besides bundling your home insurance policy with another form of protection, you could save money on your Ameriprise home insurance policy in other ways.

- Age of home: Newer homes generally qualify for a larger discount.

- Claims free: In select states, you can get a discount if you haven't filed a claim in the last five years.

- Home safety: You may qualify for discounts by making your home more secure using devices such as smoke alarms and security systems.

- Tenure: In select states, you may get a discount for remaining an Ameriprise customer for a certain period of time.

- Renovation: You could get discounts if you've recently replaced major components of your home, such as the roof, heating and cooling systems, and electrical and plumbing systems.

Ameriprise homeowners insurance coverage

Ameriprise's home insurance rates are similar to its competitors, but what differentiates it is the expanded coverage it can provide for your home.

In addition to the protections afforded by a standard Ameriprise home insurance policy, you can upgrade your protection with a variety of useful add-ons. The standout is replacement cost coverage for your personal property. If your belongings are damaged or stolen, you'd be reimbursed without consideration of the item's depreciated value.

- Identity theft protection: Covers up to $5,000 of expenses related to recovering from identity theft.

- Food spoilage protection: Reimburses you up to $500 for costs related to food spoiled by a covered peril.

- Service line coverage: Pays to repair damage to utility and sewer lines on your property, even if the damage is from tree roots or rust.

- Equipment breakdown coverage: Will pay to replace appliances like washing machines or your air conditioning system in the case of sudden failures.

- Wildfire loss prevention and response protection: Available for free in certain states, covering things like removing flammable debris from your home or setting up sprinklers.

- Mine subsidence insurance: If you live in an area that has a history of subterranean ore mines, this coverage protects your home from damage caused by cave-ins or other earth movements.

Ameriprise customer reviews, complaints and financial strength

You can generally expect good customer service from Ameriprise for homeowners insurance, but you may get less favorable service for auto insurance.

Ameriprise home insurance gets a little more than half the complaints expected for an average company its size, according to data from the National Association of Insurance Commissioners (NAIC). Conversely, its auto insurance protection tends to garner about 11% more complaints than average.

If you're looking for security from a financial strength perspective, Ameriprise is a stable choice. Its main insurance property and casualty subsidiary, IDS Property Casualty, has been assigned a financial strength rating of "A" by AM Best, indicating Ameriprise has a strong ability to pay out claims.

Frequently asked questions

Does Ameriprise sell car insurance?

Not anymore. Ameriprise sold its auto and home insurance business to American Family in 2019, and it was rebranded as American Family CONNECT in 2020.

Does Costco own Ameriprise?

No. Costco used to sell Ameriprise home and auto insurance to its customers. In 2019, Ameriprise sold that business to another insurer, American Family, which you can now buy coverage from at Costco. Costco has never owned either insurer.

Methodology

To compare the cost of Ameriprise car insurance, ValuePenguin used car and home insurance rates from American Family Insurance. Quotes are from more than 20 states where the company does business.

Rate date is from Quadrant Information Services. Quotes were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.