Costco Insurance Review: Auto and Home

Costco isn't the best choice for auto or home insurance. It's expensive and its customer service is bad.

Find Cheap Auto Insurance Quotes in Your Area

Overall, Costco insurance isn't a good option for most people. Costco car insurance, which comes from American Family's "Connect" brand, is expensive and has bad customer service ratings. Discounts can lower your rate, and the company does offer good add-on options. Costco's home insurance also usually has decent rates.

ValuePenguin rates every insurance company by factoring in prices, customer service, extra coverage options and any other unique value. Key metrics for each of those are combined using a unique formula to produce a rating out of five stars to show you the best insurers in the country.

Pros and cons

Pros

Executive Members get extra perks

Free roadside assistance

May be able to guarantee your renewal

Cons

Expensive car insurance rates

Bad customer service

No usage-based discount

Costco car insurance

Costco car insurance is expensive and its coverage doesn't stand out.

Costco offers some nice perks and discounts, but you can probably find a better deal with another auto insurance company.

Costco's policies come from American Family Connect, part of American Family Insurance (AmFam). So when you pay a bill, make a change, or file a claim, you'll work with AmFam Connect, not with Costco.

Costco auto insurance quotes

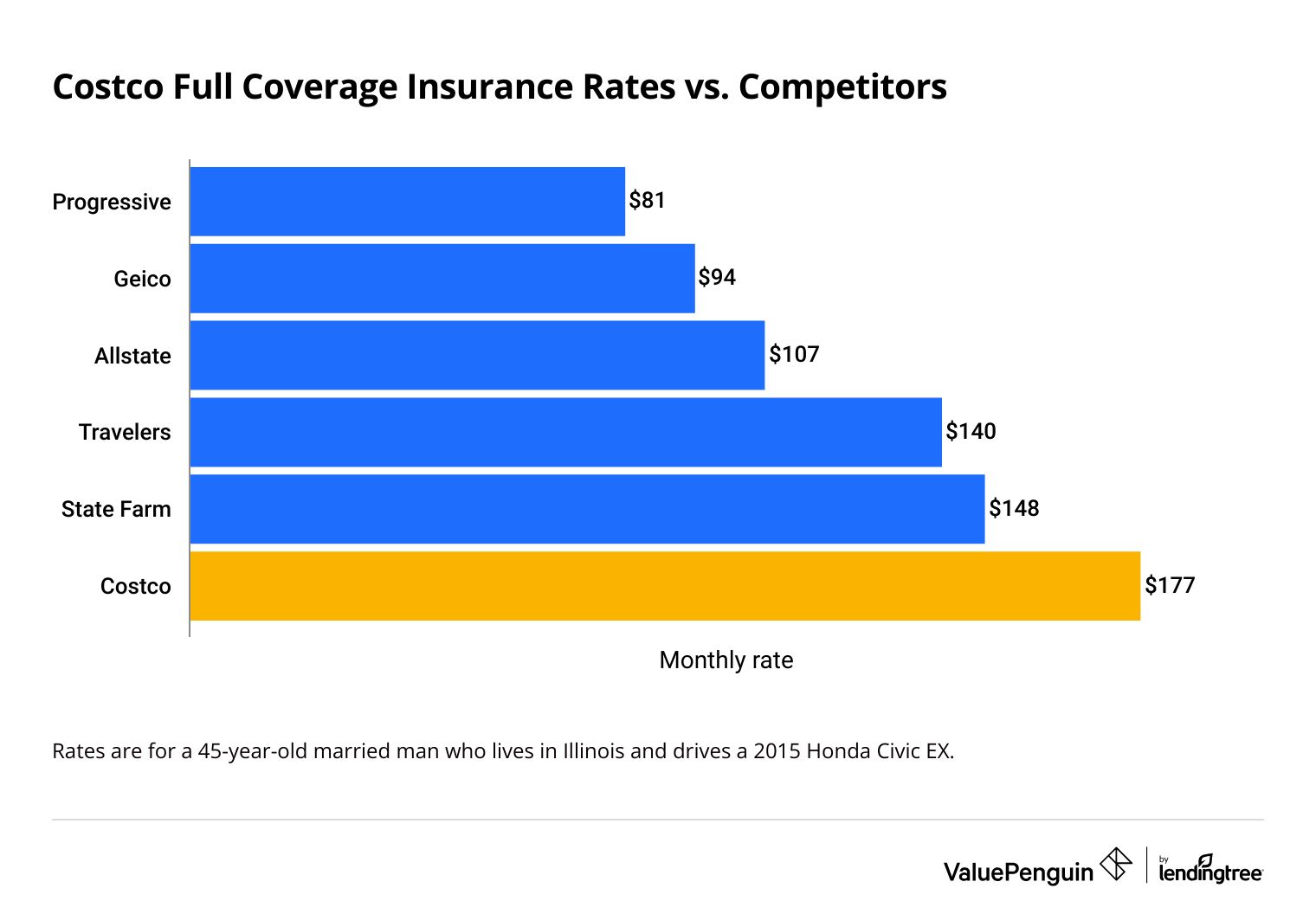

A full coverage policy from Costco costs $177 per month, on average

Costco is expensive compared to other car insurance companies.

Find Cheap Auto Insurance Quotes in Your Area

Rates for minimum-coverage car insurance are high, too. A minimum coverage policy from Costco costs $85 per month, on average. The same coverage from Geico or Progressive is $55 per month.

Monthly Costco auto insurance rates

Full coverage

Minimum coverage

Company | Full coverage rate | |

|---|---|---|

| Progressive | $81 | |

| Geico | $94 | |

| Allstate | $107 | |

| Travelers | $140 | |

| State Farm | $148 | |

| Costco | $177 |

Average monthly rates for a 45-year-old married man living in Illinois and driving a 2015 Honda Civic EX.

Full coverage

Company | Full coverage rate | |

|---|---|---|

| Progressive | $81 | |

| Geico | $94 | |

| Allstate | $107 | |

| Travelers | $140 | |

| State Farm | $148 | |

| Costco | $177 |

Average monthly rates for a 45-year-old married man living in Illinois and driving a 2015 Honda Civic EX.

Minimum coverage

Company | Minimum coverage rate | |

|---|---|---|

| Geico | $55 | |

| Progressive | $55 | |

| Allstate | $69 | |

| State Farm | $69 | |

| Travelers | $79 | |

| Costco | $85 |

Average monthly rates for a 45-year-old married man living in Illinois and driving a 2015 Honda Civic EX.

Costco's minimum limits might be higher than the minimum limits required in your state. That means drivers in some states may have to buy more coverage than the state minimum.

For example, drivers in Illinois are only required to have $20,000 in property damage liability, which pays for the damage you cause to another person's car or property if you hit them. But the lowest limit available from Connect is $25,000.

Costco car insurance benefits and discounts

Costco members automatically get a discount on American Family Connect insurance. Costco Executive Members also get a few extra perks.

Roadside assistance: This includes up to $75 for each time you break down and does not cover the cost of the battery or fluids. You can get roadside assistance from most companies, but you usually have to pay for it.

A guaranteed option to renew their policies: With this benefit, you'll always have the option to renew your policy, no matter how many accidents or tickets you have. Typically, insurance companies can choose not to renew your policy when it runs out if your driving record is bad. Even with this perk, though, you might see your rates go up. You just won't lose your coverage completely.

Costco Executive members get a 2% back each year on some purchases as an annual reward, up to $1,000.

But the 2% annual Costco reward doesn't apply to car insurance payments.

That means you won't get 2% of your car insurance cost back each year, because your policy isn't actually directly from Costco.

American Family car insurance benefits and discounts

If you buy your car insurance from Costco, you're also eligible for the benefits and discounts that American Family offers.

One notable benefit is that American Family offers zero-deductible windshield repair, so you won't have to pay to have your windshield fixed. Another is accident travel expense coverage, which pays for your out-of-pocket costs for travel or lodging if your car breaks down more than 100 miles from home.

American Family Connect also offers a range of discounts.

Premier safety

If you're a good driver with no accidents or tickets on your record, you are eligible for extra savings. Drivers in California also have an extra "good driver" discount available.

Defensive driving

If you take a defensive driving course that's approved by your state's Department of Motor Vehicles (DMV) or has another qualifying accreditation, you might earn a discount.

Safety features

Cars equipped with modern safety and anti-theft features — like air bags, anti-lock brakes and anti-theft devices — may get a discount.

Garage

Parking inside a garage can lower your car's risk of being stolen or damaged by a storm or vandalism. In some areas, if you park in a garage, you'll save money. Costco doesn't advertise where this discount is available, so make sure to ask when you're getting a quote.

Students

If you're a full-time student under 25 years old with a "B" grade average or better, you could get a good student discount. You might also get a cheaper rate if your child is a student who goes to school more than 100 miles from home and doesn't have a car with them.

Multi-car

Insuring more than one car gets you a discount on both.

Bundling

If you buy more than just your car insurance with Costco Connect, you might qualify for a bundling discount. This is an especially big discount if you insure both your car and house, but it could apply to other insurance policies, too.

Costco car insurance coverages

Connect insurance from Costco gives you access to all the basic car insurance coverages, including liability coverage for bodily injury and property damage, collision and comprehensive coverage, and medical payments or personal injury protection.

But Costco auto insurance doesn't give you a lot of flexibility with your coverage.

Other companies give you more options for coverage levels. And Costco only has a few optional coverages for extra protection.

Roadside assistance and towing

Roadside assistance helps pay for repairs when you're stuck on the side of the road, like when you have a dead battery, lock your keys in your car or get a flat tire. It covers up to $75 per incident. It's free if you have a Costco Executive Membership.

Gap insurance

Gap insurance pays for the difference between what you owe on your lease or auto loan and the replacement cost of the car if it is totaled in an accident.

Rental car reimbursement

Rental car reimbursement pays for a rental car while your vehicle is being repaired after an accident. It covers up to $30 per day and $900 per incident.

Costco home insurance

Costco has decent rates for home insurance, but it still isn't the best choice.

Just like with Costco car insurance, Costco homeowners insurance has bad customer service.

Costco home insurance quotes

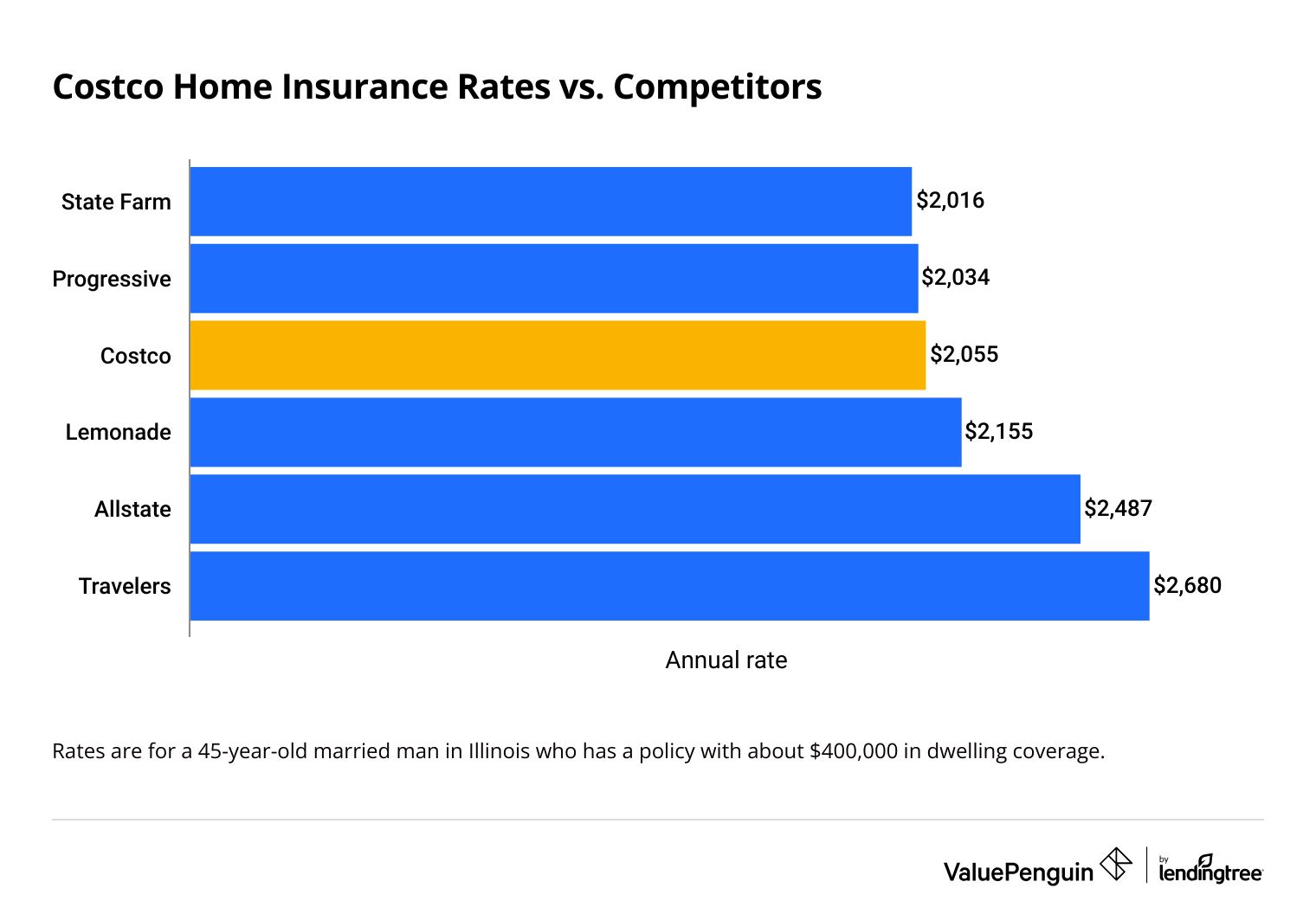

Costco home insurance costs $2,055 per year, on average.

The company's rates for home insurance aren't as expensive as its auto insurance rates. But State Farm and Progressive are still cheaper and better choices for most people.

Find Cheap Homeowners Insurance Quotes in Your Area

Annual cost of Costco home insurance

Company | Annual cost | |

|---|---|---|

| State Farm | $2,016 | |

| Progressive | $2,034 | |

| Costco | $2,055 | |

| Lemonade | $2,155 | |

| Allstate | $2,487 | |

| Travelers | $2,680 |

Average annual rates for a 45-year-old man in Illinois with a policy that has about $400,000 in dwelling coverage.

Costco homeowners insurance benefits and discounts

Just like with car insurance, Costco members automatically get a discount on Connect home insurance.

Costco Executive members get several added benefits from American Family Connect.

- Glass repair or replacement: If a window on your home gets broken, your Costco home insurance could pay up to $1,000 for it to be repaired or replaced.

- Home lockout help: Your home policy automatically comes with 24/7 help if you're locked out of your house. Your policy will pay up to $100 for a locksmith up to twice per year.

These benefits don't cost extra for Costco members, and you don't have to pay your deductible when you use these coverages.

American Family home insurance discounts

Along with the Costco membership discount, American Family offers a handful of ways to lower your rates.

New homes

Newer homes withstand damage better, so they automatically get a discount. You can also save if you're buying a home that is new to you.

Protective devices

Having safety devices like smoke alarms, dead bolts, security alarms, sprinkler systems, monitored fire or security systems, and fire extinguishers can lower your rate.

Updated roof

If it's newer, your roof might help you lower the cost of your home insurance. Newer roofs can withstand damage better, so they get cheaper rates.

Bundling

Buying both auto and home insurance from Costco can save you on both policies. You might also save by buying other kinds of insurance, like an umbrella policy.

Costco home insurance coverages

Costco and American Family Connect provide all of the standard coverage options that you would expect from a home insurance policy.

- Personal liability insurance

- Loss of use coverage

- Medical payments coverage

American Family also has optional coverages that can be added to your policy to give you extra protection.

Scheduled personal property

This is for expensive jewelry or artwork. It allows you to list them individually on your policy and gives you more coverage.

Water backup

This protects your home and belongings from damage due to sewer backup or sump pump failure.

Identity theft

If your identity is stolen, this option pays up to $5,000 to help you recover it.

Refrigerated property

If your home loses power, food in your fridge and freezer could spoil. This coverage pays you for the cost of spoiled food.

Earthquake insurance

This add-on pays for damage caused by earthquakes. If you live in a high-risk area, you may need to buy a separate policy for this.

Mine subsidence

This pays for damage if the land under or near your home shifts because of old mining tunnels. If you live in an area where mining used to be common, this coverage is a good idea.

You can also get coverage for the service lines that run into your home, like electrical and water lines, and for appliances and machinery that breaks down. The coverage options that you can buy will depend on where you live, so check your quote carefully for your options.

Costco insurance reviews and ratings

Costco has low customer satisfaction and overall poor reviews.

Costco insurance is actually from American Family Connect. That means that American Family's customer service will impact your experience the most, not Costco's.

Costco ratings at a glance

- NAIC complaint index : 4.43

- BBB customer rating : 1.25 / 5

- AM Best financial strength rating : A (Excellent)

Unfortunately, AmFam Connect has poor reviews when it comes to its customer service. Overall, it has more than four times as many complaints as expected for a company its size, according to the National Association of Insurance Commissioners (NAIC).

Customers on the Better Business Bureau (BBB) only give Connect 1.25 out of 5 stars. Most complaints are about billing issues or the company's claims process, including how much was paid after a claim and how long the process took.

That means it may take AmFam Connect customers longer to repair damage and get back to normal after a loss.

The BBB does give Connect an A+ rating overall, though. That shows that the company responds to complaints and issues. However, customers don't appear to be satisfied with how AmFam Connect handles the complaints.

However, American Family Connect is financially strong, with an A or "Excellent" rating from AM Best. That means the company is likely to be able to pay out claims and shouldn't have financial problems.

American Family also has a limited number of agents, with 3,000 across the country. In comparison, State Farm, the largest insurance company, has 19,000 agents nationwide. AmFam might not be the best company if you want access to an in-person agent.

Frequently asked questions

Is Costco insurance good?

Costco insurance is not a good choice for most people. The company has poor customer satisfaction, and its auto insurance rates are expensive. Costco home insurance isn't as expensive as Costco car insurance, but it's not the cheapest option. And you can find better service with another company.

How much cheaper is Costco auto insurance?

Costco car insurance is not cheap. A full coverage policy costs an average of $177 per month. If you want cheap car insurance, get rates from bigger companies like State Farm, Progressive and Geico.

Is Connect the same as American Family Insurance?

American Family owns Connect, but they're not exactly the same company. Anyone can buy insurance from American Family, as long as you qualify. But you can only buy a Connect policy through a partnership, like the ones American Family has with Costco and Ameriprise Financial.

Methodology

To evaluate the quality of Costco's insurance offerings, ValuePenguin experts considered cost, coverage options and customer service. The sample quotes are for a Costco Executive member.

Auto insurance methodology

To compare auto insurance quotes, ValuePenguin collected rates from five of the largest cities in Illinois for a 45-year-old married man with an average credit score and a clean driving record who owns a 2015 Honda Civic EX.

Quotes are for a policy with the following limits:

Minimum coverage

Full coverage

Coverage | Limit |

|---|---|

| Bodily injury liability | $25,000/$50,000 |

| Property damage liability | $25,000 |

| Uninsured/underinsured motorist bodily injury | $25,000/$50,000 |

| Medical payments | $5,000 |

| Comprehensive and collision | Waived |

Minimum coverage

Coverage | Limit |

|---|---|

| Bodily injury liability | $25,000/$50,000 |

| Property damage liability | $25,000 |

| Uninsured/underinsured motorist bodily injury | $25,000/$50,000 |

| Medical payments | $5,000 |

| Comprehensive and collision | Waived |

Full coverage

Coverage | Limit |

|---|---|

| Bodily injury liability | $50,000/$100,000 |

| Property damage liability | $50,000 |

| Uninsured/underinsured motorist bodily injury | $50,000/$100,000 |

| Medical payments | $5,000 |

| Comprehensive and collision | $500 deductible |

Home insurance methodology

To compare home insurance quotes, ValuePenguin experts collected rates from five of the largest cities in Illinois for a 45-year-old married man with an average credit score and no claims.

Quotes are based on the following limits:

Coverage | Limit |

|---|---|

| Dwelling coverage | $400,000 |

| Personal liability | $100,000 |

| Medical payments | $5,000 |

| Deductible | $1,000 |

*Dwelling coverage is the average across all properties.

A separate wind/hail deductible was applied when required.

Our customer service evaluations are in part based on ratings from AM Best, the Better Business Bureau (BBB), and the National Association of Insurance Commissioners (NAIC).

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.