Amica Insurance Review: Auto, Home & Renters

Amica has highly rated customer service, but its rates and coverage options don't stand out.

Find Cheap Auto Insurance Quotes in Your Area

Amica is a good insurance company that offers great customer service. Amica's car insurance rates are expensive, but home and renters insurance rates are fairly average. It offers upgraded car and home policies for people looking for extra coverage. But you can find the same coverage options at most major companies.

We recommend Amica if you're willing to pay more for very dependable service.

Editor's rating breakdown | |

|---|---|

| Price | |

| Coverage | |

| Customer service | |

| Unique value | |

Pros and cons

Pros

Quick and easy claims process

Lots of discounts

Cons

Expensive car insurance

Few unique coverage options

Amica car insurance

Amica's car insurance quotes are expensive, but its service is very highly rated by drivers.

Amica auto insurance quotes

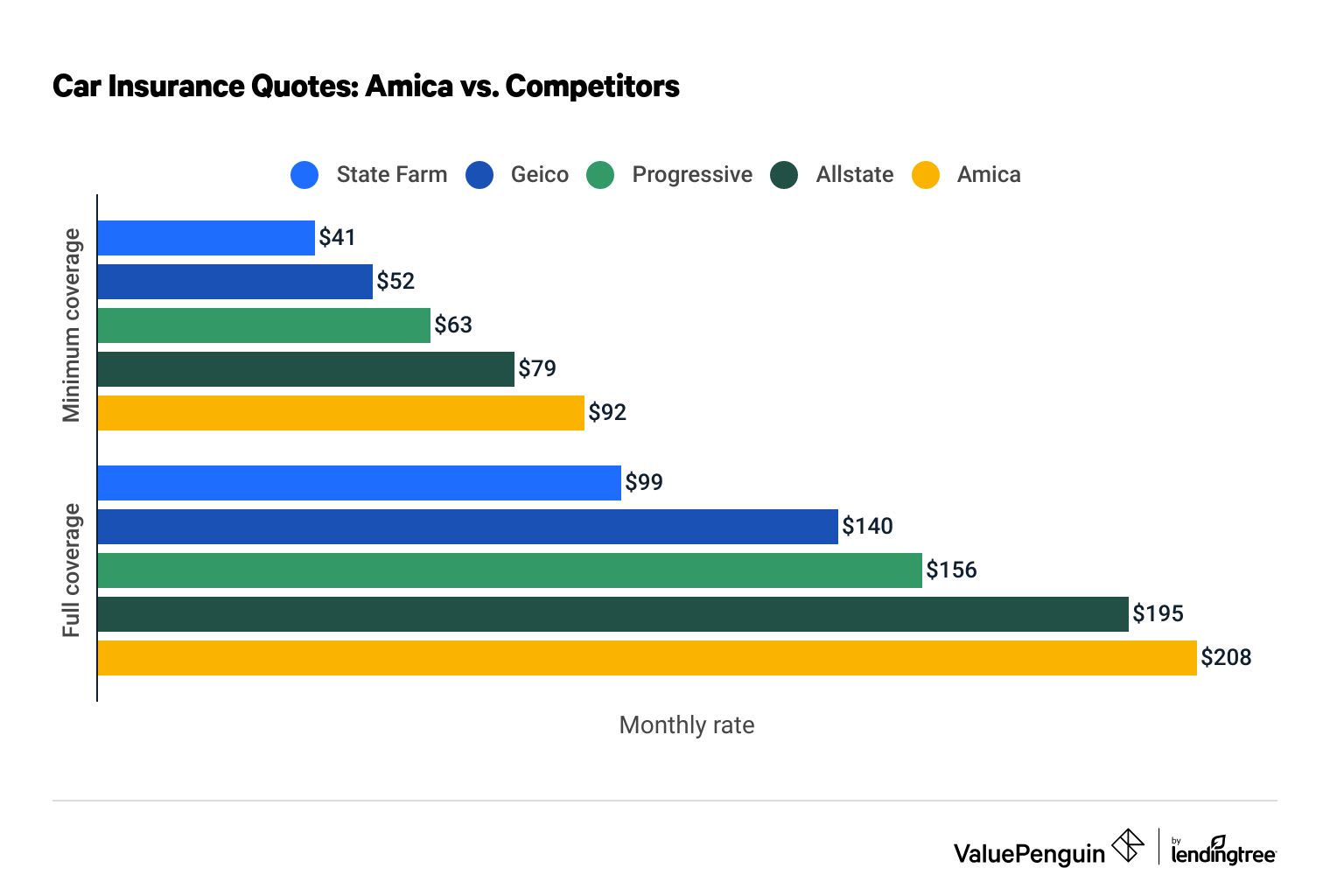

Auto insurance quotes from Amica are much more expensive than other national insurance companies.

A full-coverage policy from Amica costs around $208 per month, which is 30% more expensive than average.

Minimum-coverage car insurance from Amica is also very pricey at $92 per month. That's 41% more expensive than its competitors.

Bundle & Save

Auto

Home

Amica's car insurance rates are also expensive for young drivers and people with traffic violations on their records. That means most drivers can find cheaper insurance elsewhere.

Amica car insurance quotes vs. competitors

Full coverage

Minimum coverage

Company | Monthly rate | |

|---|---|---|

| State Farm | $99 | |

| Geico | $140 | |

| Progressive | $156 | |

| Allstate | $195 | |

| Amica | $208 |

Full coverage

Company | Monthly rate | |

|---|---|---|

| State Farm | $99 | |

| Geico | $140 | |

| Progressive | $156 | |

| Allstate | $195 | |

| Amica | $208 |

Minimum coverage

Company | Monthly rate | |

|---|---|---|

| State Farm | $41 | |

| Geico | $52 | |

| Progressive | $63 | |

| Allstate | $79 | |

| Amica | $92 |

Amica car insurance coverage

Along with standard coverage options, Amica allows customers to add to their policies with individual coverage options or its Platinum Choice Auto program.

Drivers who choose a standard policy from Amica can add:

Amica Platinum Choice car insurance coverage

Amica's Platinum Choice policy may be a good option for drivers looking for extra rental car reimbursement.

It automatically includes Prestige rental coverage, which will pay up to $5,000 towards your car rental if your car is damaged in a covered accident. There's no daily limit on how much of the $5,000 you can use.

The Platinum Choice package also comes with full glass coverage and credit monitoring. Drivers can add any of the standard coverage options to this policy, as well.

Amica is a mutual insurance company, which means it’s owned by its policyholders. As a result, any profits are returned to its customers, not to investors.

When you sign up for Amica, you’ll have the option of a dividend policy or a standard policy. The dividend policies cost more, but they could also provide an annual payout. The company says a typical dividend payment can range from 5% to 20% of your annual rate.

You can use dividend payments however you want — you don’t have to apply the dividend to your auto insurance bill. While dividends aren’t guaranteed, Amica has a long track record of paying them out to policyholders.

Amica auto insurance discounts

Amica offers nearly all of the standard car insurance discounts you would expect from a major company, which can help make its car insurance more affordable.

However, you won’t find many discounts at Amica that aren't available with other insurance companies.

Driver discounts

- Claim-free: Go three years without recording a claim (excludes glass and towing).

- Driver training: Complete an approved driving course (exclusive to drivers under 21 years old) or defensive driving course.

Policy discounts

- Autopay: Set up your account to bill you automatically.

- E-discount: Sign up to receive bills and information online rather than through the mail.

- Loyalty: Be insured with Amica for two years.

- Multi-car: Insure multiple cars on one insurance policy.

- Multipolicy: Bundle your auto insurance with another insurance policy offered by Amica, like home or renters.

- Paid in full: Pay for your entire policy before your first bill is due.

Vehicle discounts

- Adaptive headlights: Have headlights that adapt to driving in different conditions.

- Anti-theft: Install an approved anti-theft device in your car.

- Electronic stability: Have an electronic stability control feature.

- Forward-collision warning: Have a feature that helps you avoid accidents.

- Passive restraint: Get a discount if your car has airbags.

Young driver discounts

- Good student: Maintain a B average in either high school or college if you’re a student or you have a student on your policy.

- Legacy family discount: Amica’s legacy discount allows drivers under 30 years old to save money if their parents have been insured with Amica for at least five years. To get this discount, drivers must have their own car insurance policy and vehicle.

- Student away at school: Save if you have a child on your policy who is at school and away from home without a vehicle.

Amica home insurance

Amica's home insurance prices are about average. But if something goes wrong, homeowners have the support of Amica’s award-winning customer service team.

Amica home insurance quotes

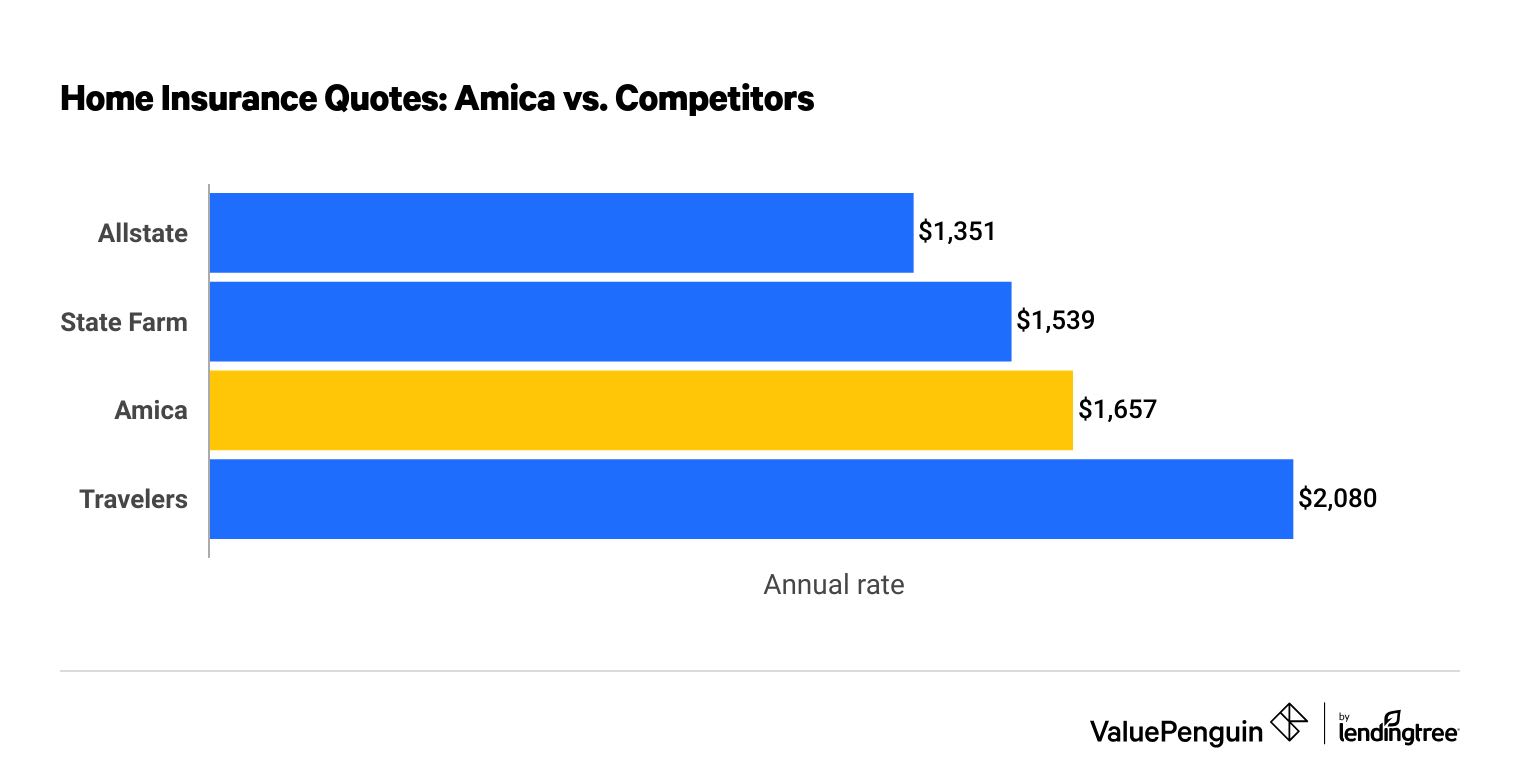

Home insurance quotes from Amica are average compared to other major home insurance companies.

Coverage from Amica costs $1,657 per year, or $138 per month, on average.

Bundle & Save

Auto

Home

Although Amica's home insurance quotes aren't expensive, homeowners can find cheaper coverage elsewhere. For example, a policy from Allstate costs $306 less per year than the same coverage from Amica.

Home insurance rates: Amica vs. competitors

Company | Annual rate | |

|---|---|---|

| Allstate | $1,351 | |

| State Farm | $1,539 | |

| Amica | $1,657 | |

| Travelers | $2,080 |

Amica home insurance coverage

Amica offers homeowners two ways to protect their homes — Standard Choice Home coverage and Platinum Choice Home coverage.

Amica Standard Choice Home coverage

Amica’s Standard Choice home insurance coverage offers all of the basic protection you'd expect — like paying to repair damage to your home and furniture after a fire.

Homeowners looking for more coverage can choose from a handful of add-ons. However, Amica's options are fairly basic, meaning most other insurance companies offer them.

Amica Platinum Choice Home coverage

Amica's Platinum coverage includes all of the basic and optional coverages you get with the Standard Choice plan. It also includes:

Amica also sells earthquake and flood insurance. Having your home insurance policy bundled with an earthquake or flood policy can make the claims process much easier if your home is damaged by a natural disaster.

Amica home insurance discounts

Amica offers homeowners basic insurance discounts, which are fairly common among major insurance companies.

Homeowners can save by:

- Bundling your home insurance policy with another Amica insurance policy.

- Avoiding a home insurance claim for three years or more.

- Having a policy with Amica for two or more years.

- Installing a sprinkler system, fire alarm or burglar alarm.

- Installing a temperature monitoring system or a gas- or water-leak detection system.

- Insuring a new or recently remodeled home.

- Receiving policy updates and bills by email.

- Signing up for automatic payments.

Amica renters insurance

Amica's renters insurance rates are just average. But it offers more discounts than other major companies, along with excellent customer service.

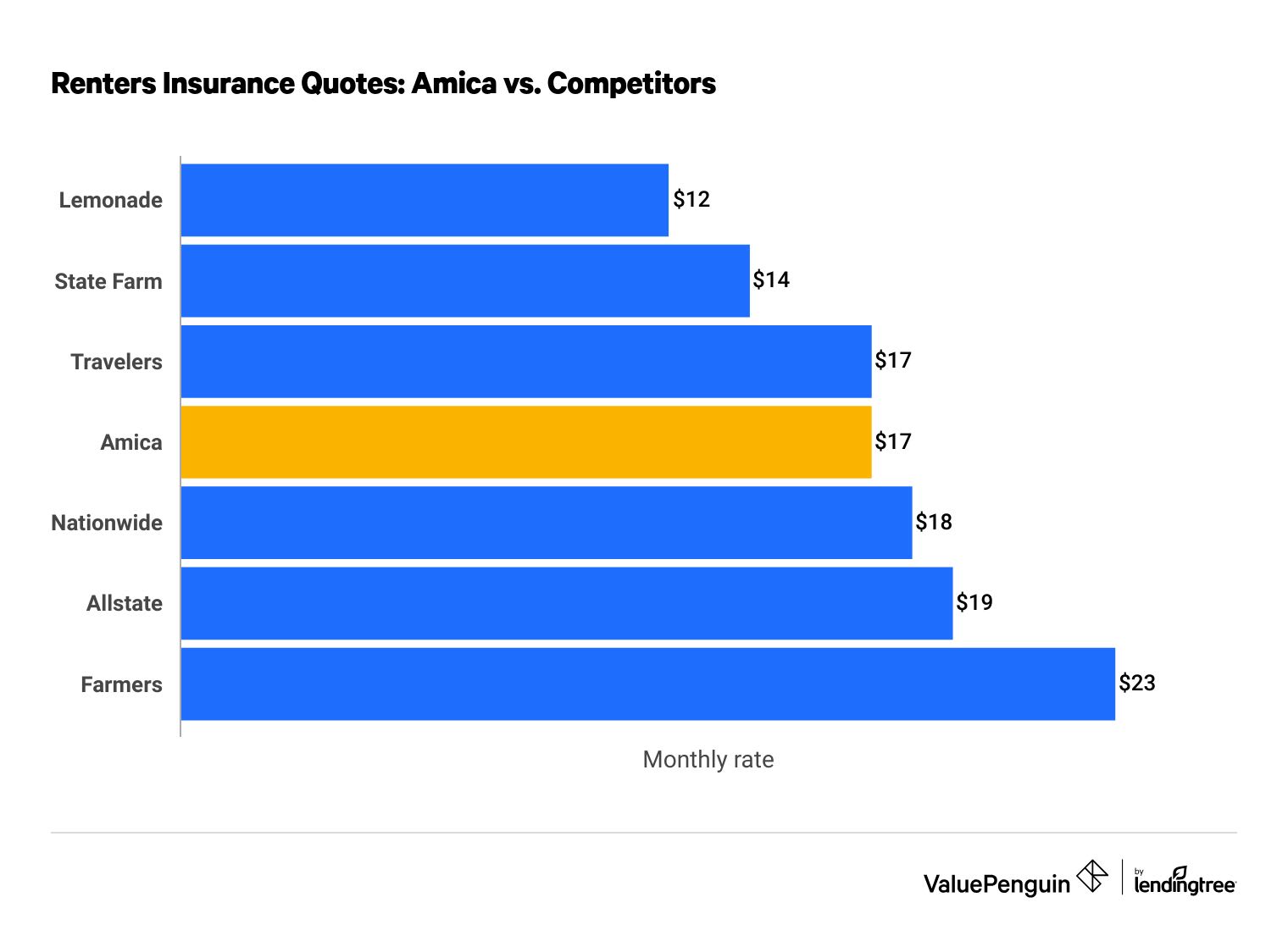

Amica renters insurance quotes

Renters insurance from Amica costs around $17 per month, which is only 1% more expensive than average.

Bundle & Save

Auto

Home

Renters on a budget can find much cheaper coverage at Lemonade, which costs $5 less per month than Amica.

Amica renters insurance rates vs. competitors

Company | Monthly cost | |

|---|---|---|

| Lemonade | $12 | |

| State Farm | $14 | |

| Travelers | $17 | |

| Amica | $17 | |

| Nationwide | $18 |

Amica renters insurance coverage

Amica's basic renters insurance has all of the protection you would expect from your policy. It will help replace your things if they're damaged in a covered event or pay your legal bills if you hurt someone by accident. It will also cover your living expenses if your home becomes unlivable.

Amica offers a few ways for renters to upgrade their coverage, too. But Amica's add-ons aren't unique — they're offered by most major insurance companies.

- Identity theft protection

- Replacement cost coverage

- Valuable items coverage

Amica also offers flood insurance for renters. You should consider buying a flood insurance policy if your home is located near a large body of water or in an area with severe storms.

Amica renters insurance discounts

Amica offers more discounts for renters than most other insurance companies.

That can help make its rates more affordable for tenants who value excellent service.

- Automatic payment discount: Get a discount when you sign up to make payments automatically.

- Bundling discount: Save up to 15% off your renters insurance rate when you also buy car insurance from Amica.

- Claim-free discount: Earn a discount if you've avoided filing a claim for three years or longer.

- Loyalty discount: Get a discount if you've been insured with your current company for two years or longer.

- Paperless discount: Earn a discount when you receive policy documents and bills via email.

Amica Insurance reviews and ratings

Amica has excellent customer service reviews for car, home and renters insurance.

Amica’s customers praise it for having agents who are quick to process claims, knowledgeable and friendly. In fact, Amica was ranked second in J.D. Power’s Auto Claims Satisfaction Study and its Home Insurance Study. The only company that scored higher than Amica is USAA, which isn't available to most people.

Amica customer service ratings

Reviewer | Car | Home & Renters |

|---|---|---|

| J.D. Power | 903 | 849 |

| NAIC | 0.49 | 0.13 |

| AM Best | A+ | A+ |

Amica policyholders can expect a smooth claims process for auto, home and renters insurance. The National Association of Insurance Commissioners (NAIC) reports that Amica receives considerably fewer complaints than the typical insurance company. Negative reviews of Amica cite issues with the company’s car insurance rates rather than its agents or service.

While Amica isn’t as large as some national insurance companies, it has an exceptional ability to pay out claims. Amica received an A+ rating from AM Best, which awards letter grades based on a company’s ability to meet its financial obligations. The A+ signifies that Amica has excellent financial health and is the second-highest rating available.

Contact Amica customer service

Amica customer service is available 24 hours a day, 7 days a week.

Current and potential customers can call the main Amica insurance phone number — 800‑242‑6422 — to file a claim, get a quote, ask questions about their policies or speak to a billing representative.

Current Amica auto insurance customers in need of roadside assistance can call 866-286-9968.

Amica can also answer questions via the live chat feature on its website. Live chat is only available during set hours, so it may not be an option if you need to reach someone late at night.

Frequently asked questions

Is Amica a good insurance company?

Yes, Amica is a good insurance company. Although you will likely find cheaper coverage elsewhere, Amica has excellent customer service. That means Amica customers can expect a quick and easy claims experience if they're ever in an emergency.

How good is Amica at paying claims?

Amica customers are generally happy with the company's claims process, which means the company has a good track record of taking care of its customers. Amica earned the second-highest score on J.D. Power's Auto Insurance Claims Study and its Home Insurance Study. It also receives far fewer complaints than its competitors, according to the NAIC.

In addition, Amica has an A+ financial strength rating from AM Best. That means it has an excellent ability to pay out claims, even in difficult economic situations.

What states does Amica cover?

Amica insurance is available in 49 states across the U.S. and Washington, D.C. The only state where Amica doesn't sell auto, home or renters insurance is Hawaii.

Which is better, Amica or State Farm?

State Farm is a better choice for people shopping for the cheapest rates, while Amica has superior customer service. That means Amica customers will probably have a faster, easier claims process.

Methodology

To compare Amica car insurance quotes, ValuePenguin gathered rates from all 50 states and Washington, D.C. Rates are for a 30-year-old man with a clean driving history and a good credit score who drives a 2015 Honda Civic EX.

Full-coverage rates include higher liability limits than required by each state, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person/$100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured/underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Medical payments or PIP: $10,000

- Comprehensive and collision deductible: $500

To compare Amica home insurance quotes, we collected rates from ZIP codes across four states. Rates are for a 45-year-old married man with a good credit score, who owns a home built in 1977 with the following coverage limits.

- Dwelling coverage: $229,700

- Liability coverage: $100,000

- Medical payments: $5,000

- Deductible: $1,000

Auto and home insurance analysis used rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should only be referenced for comparative purposes.

To compare Amica renters insurance quotes, rates were collected from all 50 states and Washington, D.C. Rates are for an unmarried 25-year-old man with no pets or roommates, with the following coverage limits.

- Personal property: $30,000

- Personal liability: $100,000

- Guest medical protection: $1,000

- Deductible: $500

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.