Who Has the Cheapest Auto Insurance Quotes in Sacramento, CA?

Geico is the most affordable option for Sacramento drivers, with an average rate of $111 per month for full coverage and $33 per month for minimum coverage.

Compare Car Insurance Rates in Sacramento

Best cheap car insurance companies in Sacramento

Every driver will get different rates based on their driving history, what car they drive and where they live, so we always recommend getting multiple quotes to find the best deal for you.

Cheapest car insurance in Sacramento: Geico

Geico has Sacremento's cheapest full-coverage car insurance. The company's average rate in the city is $111 per month.

Geico's rate is 29% cheaper than the Sacramento average of $157 per month and $25 less per month than the second-cheapest option, Progressive.

Compare Car Insurance Rates in Sacramento

Cheapest full-coverage car insurance in Sacramento

Company | Monthly rate | |

|---|---|---|

| Geico | $111 | |

| Progressive | $136 | |

| Mercury | $141 | |

| AAA | $162 | |

| State Farm | $164 |

*USAA is only available to current and former military members and their families.

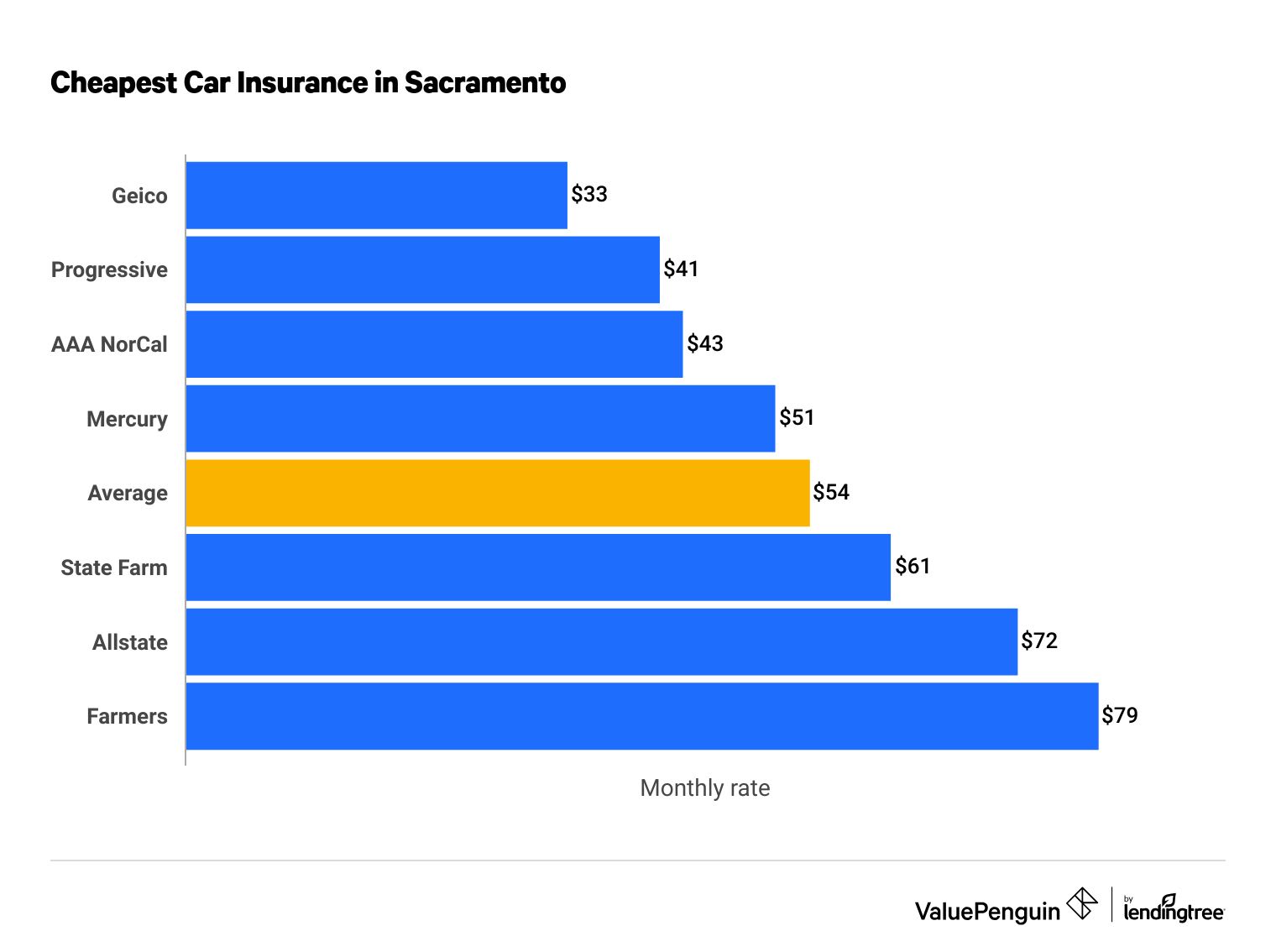

Cheapest liability insurance quotes in Sacramento: Geico

Geico has the cheapest rates for minimum-coverage policies in Sacramento, at $33 per month on average.

Progressive and AAA also offer cheaper-than-average rates, $41 and $43 per month, respectively. Both are cheaper than the city average of $54 per month.

Compare Car Insurance Rates in Sacramento

Cheapest minimum-coverage car insurance in Sacramento, CA

Company | Monthly rate | |

|---|---|---|

| Geico | $33 | |

| Progressive | $41 | |

| AAA | $43 | |

| Mercury | $51 | |

| State Farm | $61 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for young drivers: Geico

Geico is the cheapest option for teen drivers in Sacramento, with an average price of $102 per month for minimum coverage. For full coverage, Geico and State Farm both have the lowest rates of $290 per month.

Younger drivers are less experienced behind the wheel and not as skilled at assessing risk, so they usually pay substantially more for car insurance than older adults. An 18-year-old driver pays an average of $140 per month for minimum coverage, which is two and a half times as much as a 30-year-old.

Cheapest car insurance for teens

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $102 | $290 |

| State Farm | $116 | $290 |

| Mercury | $126 | $340 |

| Progressive | $119 | $416 |

| Allstate | $196 | $422 |

Teen drivers can get much cheaper rates by sharing a policy with a parent or family member, taking a supplementary driving safety course or qualifying for a good student discount.

Cheapest car insurance for people with a speeding ticket: Geico

Geico has the cheapest car insurance for Sacramento drivers after a speeding ticket, at $173 per month. That's 7% less than any other major company and 25% cheaper than average in the city.

Cheapest car insurance after a speeding ticket

Company | Monthly rate |

|---|---|

| Geico | $173 |

| Mercury | $186 |

| AAA NorCal | $204 |

| State Farm | $252 |

| Progressive | $262 |

Insurance companies have found that aggressive or reckless driving behavior like speeding often correlates with making insurance claims more often, so you'll pay more after a speeding ticket. After a ticket, we found an average rate increase of 48% across all the companies we looked at in Sacramento.

Cheapest car insurance in Sacramento after an accident: Mercury

In Sacramento, Mercury is the cheapest auto insurance company after being at fault in a car crash. The company offers average rates of $212 per month, a savings of $70 per month compared to the next-cheapest company, Progressive.

Cheapest car insurance after an accident

Company | Monthly rate |

|---|---|

| Mercury | $212 |

| Progressive | $282 |

| Geico | $283 |

| State Farm | $326 |

| AAA NorCal | $328 |

Insurance companies often raise rates after you're involved in an at-fault accident because drivers who've caused a crash before are statistically more likely to do so again in the future. On average, rates more than double in Sacramento after an accident.

Cheapest car insurance for drivers with a DUI: Mercury

Mercury offers the cheapest rates in Sacramento for drivers following a DUI, at an average price of $232 per month. Drivers in the city pay an average of $438 per month after a DUI conviction.

Cheapest car insurance for Sacramento drivers with a DUI

Company | Monthly rate |

|---|---|

| Mercury | $232 |

| Geico | $280 |

| Progressive | $328 |

| Farmers | $358 |

| AAA NorCal | $581 |

Driving while under the influence is among the most serious commonly committed driving infractions, and it comes with harsh penalties, often including losing your license. Getting a DUI in Sacramento will nearly triple your rates, on average.

Cheapest car insurance for young drivers after an incident: Geico

Geico has the lowest rates in Sacramento for 18-year-old drivers after an accident or speeding ticket. The company's average rate for minimum coverage is $114 per month after a ticket and $140 per month after an accident.

Cheapest car insurance for young drivers after an incident

Company | Speeding rate | Accident rate |

|---|---|---|

| Geico | $114 | $140 |

| Progressive | $153 | $155 |

| Mercury | $164 | $171 |

| State Farm | $185 | $194 |

| AAA NorCal | $208 | $228 |

A ticket raises rates for teen drivers by 32% compared to a clean record, while an accident raises rates by 49%.

Cheapest car insurance for married drivers: Geico

Geico is the top option for married drivers looking for the most affordable full coverage in Sacramento. The company's average rate of $94 per month with a one car is 34% cheaper than the city average.

Cheapest car insurance for married Sacramento drivers

Company | Monthly rate |

|---|---|

| Geico | $94 |

| Progressive | $107 |

| Mercury | $125 |

| AAA NorCal | $162 |

| Allstate | $164 |

Car insurance companies have found that married drivers are less likely to take risks while driving and that they make fewer claims, so you'll often find that your insurance rates drop after you get married. Geico drops rates 15% for married drivers in Sacramento, while Progressive offers the largest discount at 22%.

Married drivers may be able to reduce their rates even more by sharing a policy with their spouse and qualifying for a multicar discount.

Best car insurance companies in Sacramento

State Farm and AAA have the top-rated car insurance in Sacramento, based on a combination of customer service, coverage options and low rates.

Customer service is a particularly important part of your coverage, even if it's not something you will have to look at when selecting a policy. When you have to file a claim, good customer service will help you get back to normal faster and could save you money while you wait for your car to be repaired.

Company |

Editor's rating

|

|---|---|

| AAA NorCal | |

| State Farm | |

| Geico | |

| Farmers | |

| Allstate | |

| Mercury | |

| Progressive |

Average car insurance cost in Sacramento, by neighborhood

The cheapest insurance in Sacramento is found in ZIP code 95831, which includes the Pocket neighborhood, while the most expensive is in ZIP code 95814, in the heart of downtown.

One factor that can impact car insurance rates is where you live — even within a single city. You might pay more for car insurance if car theft is common in your area or if your neighborhood has lots of narrow or fast-moving roads.

City | Average monthly cost | % from average |

|---|---|---|

| 90001 | $188 | 5% |

| 90002 | $198 | 11% |

| 90003 | $197 | 11% |

| 90004 | $229 | 28% |

| 90005 | $226 | 27% |

What's the best car insurance coverage in Sacramento, CA?

Full-coverage policies are sometimes required if you have a lease or loan on your car. We also recommend them if the cost of replacing your vehicle would be a severe financial hardship to you or your car is worth more than $5,000.

- Comprehensive coverage: Pays for damage to your car that's caused by something other than a crash, such as falling rocks or a house fire. It also covers theft.

- Collision coverage: Pays for damage to your car due to a collision, regardless of how many people were involved or whether you were at fault.

Frequently asked questions

How much is car insurance in Sacramento?

The average price of minimum-coverage car insurance in Sacramento is $54 per month, while full coverage costs an average of $157 per month. Geico has the lowest rates for both kinds of policies.

Who has the cheapest car insurance in Sacramento?

Geico has the lowest rates for minimum coverage in Sacramento, at $33 per month, and full coverage, $111 per month.

What's the best car insurance company in Sacramento?

AAA and State Farm have the best-rated car insurance in Sacramento. Each company has a strong combination of good coverage options, low rates and good customer service.

Methodology

ValuePenguin collected data from the largest insurance companies in California. Quotes are for a 30-year-old man with a 2015 Honda Civic EX and good credit.

Minimum-coverage policies include the legally required limits in California. Full coverage includes more than those minimums, plus comprehensive and collision.

Coverage type | State minimum | Full coverage |

|---|---|---|

| Bodily injury liability | $15,000 per person/$30,000 per accident | $50,000 per person/$100,000 per accident |

| Personal injury protection | — | $10,000 |

| Property damage liability | $5,000 per accident | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | — | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | — | $500 deductible |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.