Best and cheapest health insurance in Connecticut

Cheapest health insurance companies in Connecticut

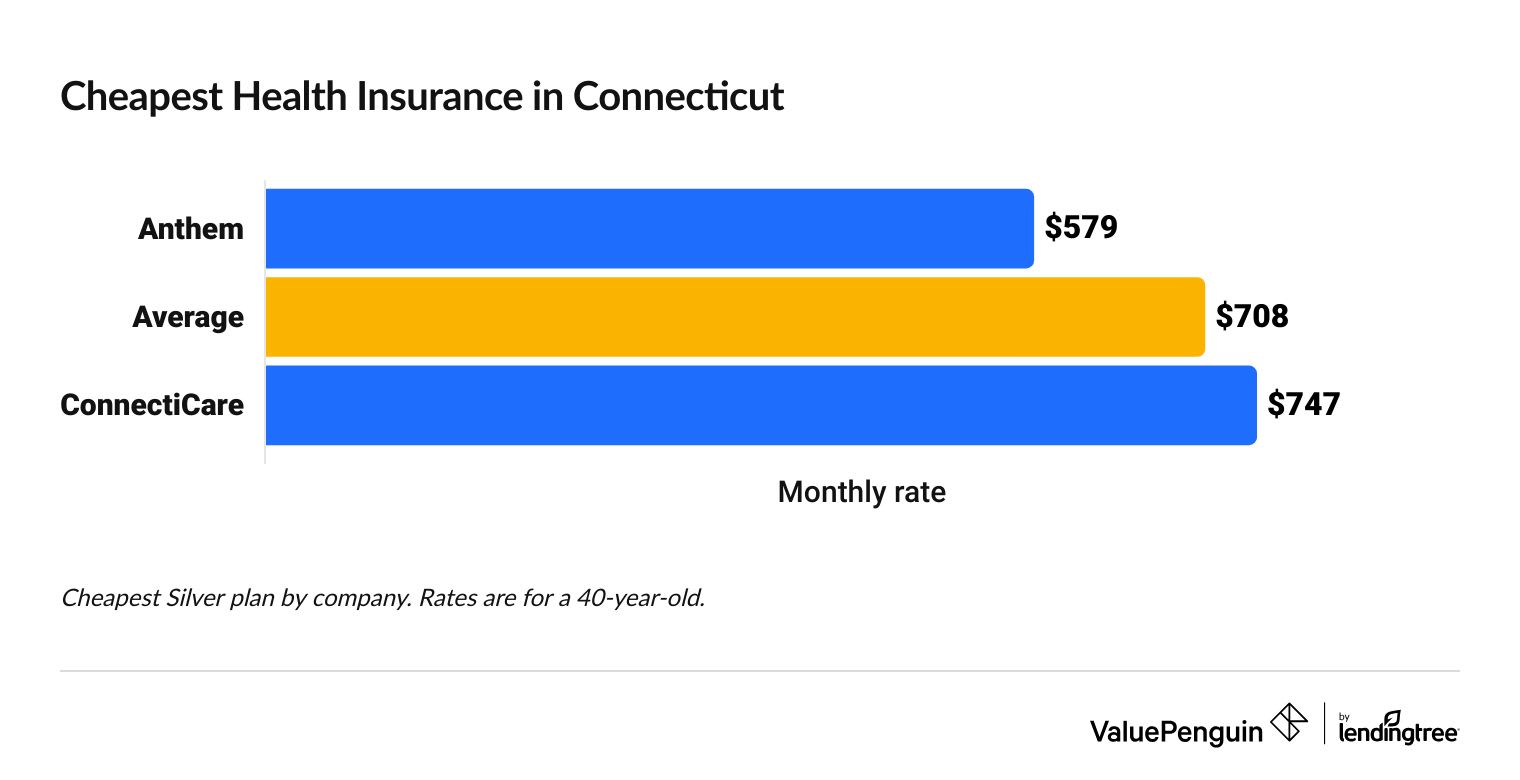

Anthem Blue Cross and Blue Shield has the cheapest health insurance in CT, at $579 per month before discounts.

Find Cheap Health Insurance Quotes in Connecticut

Cheap health insurance in CT

Company |

Cost

| |

|---|---|---|

| Anthem | $579 - $744 | |

| ConnectiCare | $747 - $847 | |

- Anthem BCBS has the cheapest health insurance in every part of Connecticut. The company also gives customers access to the largest network of doctors in the nation.

- But it's important to compare plans to make sure you get the right fit. Anthem sells two Silver plans in every county in CT. It's worthwhile to compare them to see which is better for you.

Best health insurance companies in Connecticut

Anthem is the best health insurance company in Connecticut.

Anthem has a strong 4-out-of-5-star rating from ValuePenguin editors. These ratings measure customer satisfaction, cost, coverage and unique offerings. Plus, Anthem gets significantly fewer complaints than an average company its size.

It's a good idea to choose a company with a strong customer service reputation because you may have an easier time filing a claim down the road.

Best-rated health insurance companies in Connecticut

Company |

Editor rating

|

ACA rating

|

|---|---|---|

| Anthem Blue Cross and Blue Shield | 4.0 | |

| Connecticare | 4.0 |

Find Cheap Health Insurance Quotes in Connecticut

- Anthem is a Blue Cross Blue Shield company. That means Anthem customers have access to the Blue Cross Blue Shield network, which has 1.7 million doctors and hospitals nationwide.

- ConnectiCare is run by EmblemHealth. EmblemHealth also sells health insurance in Connecticut under the name ConnectiCare Benefits.

Worst health insurance in Connecticut: ConnectiCare

ConnectiCare isn't a good health insurance choice for most people in Connecticut.

ConnectiCare's plans are more expensive than Anthem's. Plus, the company has poor customer satisfaction. ConnectiCare gets three times the number of complaints expected for a company its size.

ConnectiCare also only sells one Silver plan in Connecticut, which limits your choices. In contrast, Anthem offers two different Silver plans, so you can compare options and find one that works for you.

How much is health insurance in Connecticut?

Health insurance in Connecticut costs $708 per month at full price or $153 per month after discounts, on average.

- Gold plans have expensive monthly rates, but low costs you'll have to pay when you visit the doctor. Bronze plans have cheap rates, but you'll pay more for medical care. Silver plans offer a balance between the two.

- Health insurance rates increase as you get older. Costs go up slowly in your 20s and 30s before rising dramatically in middle age.

- What you pay for health insurance depends on the amount of money you make. Typically, you'll pay less if you earn less.

Save on Connecticut health insurance with discounts

Connecticut residents who qualify for discounts pay $153 per month for marketplace coverage, on average.

That's $555 per month cheaper than the Connecticut state average.

Nearly 9 out of 10 people who buy health insurance through Access Health CT qualify for discounts, called subsidies or premium tax credits. The size of your discount changes with your income, so you'll save more if you make less. About one-fifth of those who buy coverage through the Connecticut health insurance marketplace pay less than $10 per month.

To qualify for subsidies, you need to earn between $15,606 and $60,240 per year as a single person (between $31,200 and $124,800 for a family of four). You can use your subsidy toward any Bronze, Silver or Gold plan through Access Health Connecticut. But if you can get Medicaid, you won't be able to get subsidies.

Cheap health insurance in Connecticut by city

Anthem has the cheapest health insurance everywhere in Connecticut.

But just because a plan is cheap doesn't mean it's the best option for you. It's still a good idea to compare all your options to find the right coverage for your needs.

Cheapest health insurance by CT county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Fairfield | Anthem Silver Standard Pathway | $724 |

| Hartford | Anthem Silver Standard Pathway | $605 |

| Litchfield | Anthem Silver Standard Pathway | $632 |

| Middlesex | Anthem Silver Standard Pathway | $665 |

| New Haven | Anthem Silver Standard Pathway | $665 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Connecticut

Best health insurance by plan tier

The best plan tier for you depends on the amount of care you think you'll need in the coming year and your financial situation.

Gold plans are best for people who have ongoing health problems. These plans have expensive rates, but you'll pay less when you go to the doctor.

Silver plans are the best option if you usually only see the doctor a few times a year. These plans balance reasonable rates with middle-of-the-road costs you're responsible for paying when you go to the hospital.

Bronze plans are a good choice if you're in good health, and you can easily afford to pay an unexpected medical bill from your savings. These plans have cheap monthly rates, but you pay a lot more when you go to the doctor.

Bronze, Silver and Gold plans should cover most of the same medical services. That's because plan tiers only have to do with your rate and the portion of your medical bill you're responsible for paying.

Gold plans: Best if you have frequent medical issues

| Gold plans pay for about 80% of your medical care. |

Gold plans have high rates and cheap costs you pay when you get care.

That makes Gold plans a good option if you expect to need a lot of medical care in the coming year. But, Gold plans don't make financial sense if you have normal health needs.

In Connecticut, Gold plans cost an average of $887 per month and have a $1,657 deductible.

Silver plans: Best for average medical needs

| Silver plans pay for about 70% of your medical care. |

Silver health plans have moderate rates and average costs that you're responsible for paying when you go to the doctor. Consider a Silver plan if you have average medical needs and expect to see the doctor no more than a few times in the coming year.

You may qualify for extra discounts if you earn a low income.

In Connecticut, Silver plans cost an average of $708 per month and have a $5,000 deductible.

Bronze plans: Best if you're healthy and have savings

| Bronze plans pay for about 60% of your medical care. |

Bronze plans have cheap rates, but you have to pay a lot of money before most coverage starts.

Consider a Bronze plan if you're in good health and you can easily afford to pay a large medical bill from your savings.

In Connecticut, Bronze plans cost an average of $615 per month and have a $6,615 deductible.

More discounts and free health insurance in CT

Connecticut residents who earn a low income may qualify for free coverage or extra discounts.

HUSKY health insurance (Medicaid): Best for free coverage

If you live in Connecticut and make about $21,000 per year or less ($44,000 per year or less for a family of four), you can get free health insurance, called Medicaid or HUSKY health insurance. Pregnant women and families with children under the age of 19 may qualify with higher household incomes.

Silver plans with cost-sharing reductions (CSRs): Best for discounted coverage

| Silver plans will pay 73% to 94% of your medical costs if you have a low income. |

You may qualify for extra discounts, called cost-sharing reductions (CSRs), if you earn between $15,060 and $37,650 per year as a single person and you have a Silver health plan.

Cost-sharing reductions aren't available if you have a Gold or Bronze plan.

Cost-sharing reductions cover most of the costs you're responsible for paying when you go to the hospital, such as your deductible, copays and coinsurance.

Are health insurance rates going up in CT?

Health insurance rates increased by 7% from 2024 to 2025, on average. Gold plans had the highest jump, at 9%. Bronze and Silver plans both went up by 6%.

Tier | 2024 | 2025 | Change |

|---|---|---|---|

| Bronze | $583 | $615 | 6% |

| Silver | $665 | $708 | 6% |

| Gold | $811 | $887 | 9% |

Monthly costs are for a 40-year-old.

Plans from the Connecticut health insurance marketplace have to cover certain benefits, called minimum essential coverage. That includes care for pregnant women and newborns, mental health services, prescription drug coverage and more.

Marketplace plans also offer important protections, such as caps on how much you'll spend each year for medical care, called an out-of-pocket maximum. In addition, companies can't consider your health history when setting rates or approving coverage if you buy insurance through the state marketplace.

Short-term health insurance in Connecticut

Short-term health insurance isn't available in Connecticut because of strict state-level rules.

If you need to get coverage outside November 1 through January 15, called open enrollment, it's a good idea to see if you qualify for a special enrollment period.

You may qualify for a special enrollment period if you've recently moved to a new state, married, divorced or lost your existing coverage. is also an option if you recently lost your job. Keep in mind that COBRA tends to cost more than a regular marketplace plan.

Frequently asked questions

Who has the best cheap health insurance in Connecticut?

Anthem Blue Cross and Blue Shield has the best cheap health insurance in Connecticut. Its Silver plans start at $579 per month, the cheapest of any company in CT. Anthem gets significantly fewer complaints than an average company its size, according to the NAIC.

How do you get health insurance in CT?

You can buy health insurance in Connecticut through the state marketplace, called Access Health Connecticut. You may qualify for discounted coverage if you earn a low income.

What is the most popular health insurance in Connecticut?

Anthem sells the most plans of any company in Connecticut, with about 45% of all health insurance plans in the state. .

Methodology

Connecticut health insurance rate data for 2025 is from Access Health CT, Connecticut's state health insurance marketplace. Rates are for a 40-year-old with a Silver plan, unless otherwise noted.

Rates for plans with subsidies are from the Centers for Medicare & Medicaid (CMS) and include everyone who qualified for advance premium tax credits (APTCs) on their monthly bills during 2024 open enrollment.

ValuePenguin chose the best health insurance in Connecticut by reviewing each company's rates, coverage, customer satisfaction and unique features. Each company was assigned a score out of 5 stars based on the data.

Other sources include HUSKY Health Connecticut, KFF, the National Association of Insurance Commissioners (NAIC) and S&P Global Capital IQ.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.