Deductible vs. Out-of-Pocket Max: Health Insurance Basics

A deductible is the amount you'll have to pay for medical care at the beginning of your insurance policy. The out-of-pocket max is the most you'll pay for medical expenses in a year.

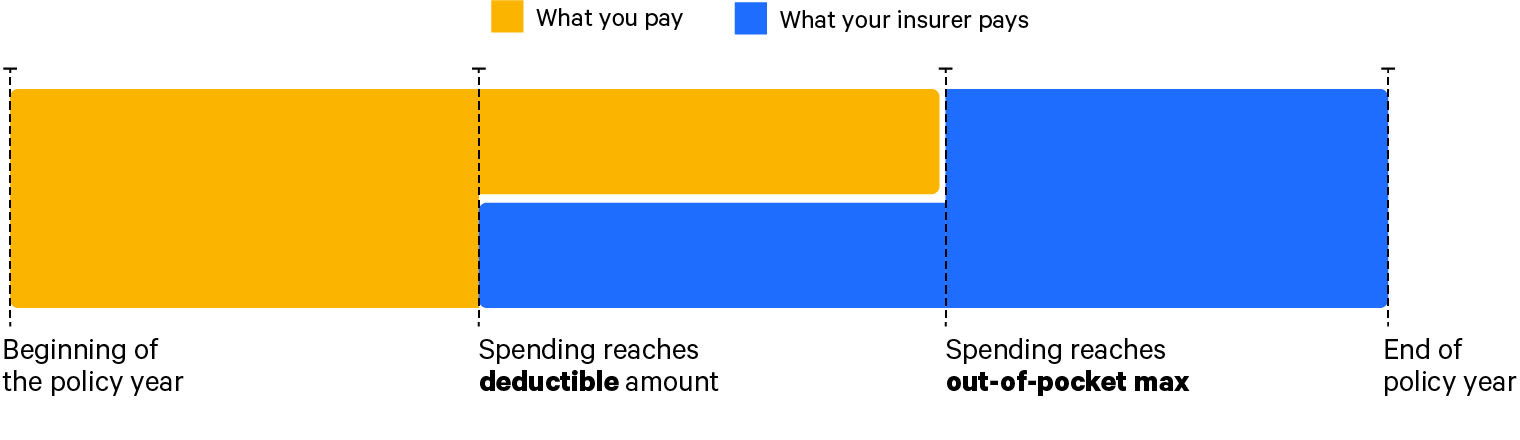

For each policy year, you'll pay the full cost of most medical care until your total spending reaches the deductible amount. After your spending reaches the out-of-pocket max, the insurance company will pay all costs for covered health care services.

Find Cheap Health Insurance in Your Area

What's the difference between a deductible and an out-of-pocket limit?

The deductible and the out-of-pocket max are two health insurance terms that tell you how much you'll pay for medical care, when you'll have to pay full price at the doctor and when your insurance will cover the full bill.

- At the start of your policy before you reach your deductible, you'll pay the full cost for most medical care, with a few exceptions .

- After your medical spending reaches your deductible, you'll split the cost of healthcare with your insurance plan. This is called either your coinsurance or copay. For example, you could pay 30% of the bill for an MRI or a flat cost of $50 to see a doctor.

- After your spending reaches the out-of-pocket max, the insurance company will pay for all your medical costs. Your out-of-pocket maximum is important after you've had many medical expenses during a policy year.

What does annual deductible mean?

A health insurance deductible is the amount of money you pay for medical care before your insurance plan starts contributing to the cost.

For example, if your deductible is $1,000, you'll pay in full for the first $1,000 of your health care, with a few exceptions. Your insurance company will keep a running total of how much you pay, and when you hit $1,000, your insurance will pay for part of your health services.

If you need an X-ray and haven't met your deductible yet, you pay the full $250 bill. After your medical spending reaches $1,000, the same X-ray could cost you $50, with the insurance company paying the other $200.

In health insurance, the deductible works on an annual basis, and after your new policy year begins, the running total of what you've paid will reset to zero.

This could mean that your health care costs will be higher in the first part of the calendar year until you hit your deductible amount. Then for the rest of the year, you'll get the cost-sharing benefits of your insurance plan, and you'll pay less for covered health care services.

What does out-of-pocket maximum mean?

An out-of-pocket maximum is a cap on what you'll have to pay for covered health care services in a year.

For example, if your out-of-pocket max is $5,000, the amount you pay for your deductible, copayments and coinsurance will be added together, and when the running total reaches $5,000, your health insurance company will start to pay the full cost for all covered health care services.

Your out-of-pocket max helps protect you if you need expensive medical care such as surgery or cancer treatment .

Your out-of-pocket limit also works on an annual basis, and the total resets to zero in the new policy year. You'll still need to pay the monthly cost of the insurance plan, even after your medical spending reaches the out-of-pocket max.

Deductible vs. out-of-pocket max insurance timeline

How much you've spent on your medical care determines if you should be paying attention to your plan's deductible or out-of pocket max.

Watch your medical spending toward your deductible at the beginning of the year. Your out-of-pocket maximum will often only be relevant well after you reach your deductible.

Phase 1: Before you reach your deductible

In the first part of your policy year, you'll pay the full cost for most health care services. This can include doctor visits when you're sick, tests such as an MRI and more. You'll pay for all of these services in full until your total expenses add up to your deductible amount.

You'll pay for most of your medical care before you reach your deductible. So the deductible of your health insurance plan can have a big impact on your budget and access to coverage.

For example, if you have a high-deductible health plans and break your leg, you could have thousands of dollars of medical bills and still not reach the deductible amount. This could mean you're paying for health insurance without ever receiving the benefits of cheaper medical care.

Exceptions to the deductible

Free preventive care, like checkups and health screenings, is included in most health insurance plans. This means before you reach your deductible you won't pay when you need some basic types of health care.

Some insurance plans also have exceptions to the deductible for some health services. For example, a plan that says generic drugs are excluded from the deductible would mean these drugs are affordable as soon as the plan begins. You could pay around $15 for each refill at the pharmacy, without first needing to meet your deductible.

Phase 2: After you meet your deductible amount

Once you've met your deductible, you'll split your health care bill with your insurance company. How much you'll pay for covered services is based on the copayment or coinsurance rates of your policy.

You'll pay a part of the bill such as a 15% coinsurance or a $50 copay. The insurance company will pay the rest of the bill.

The amount of money you're spending on health care is usually lower during this period of coverage because you'll be paying only a portion of your health care costs. The running total of how much you spend continues to add up, and if your expenses reach your out-of-pocket maximum, you'll move to phase three of your health insurance policy.

Phase 3: After you reach your out-of-pocket maximum

After your total medical spending adds up to your policy's out-of-pocket maximum, your insurance will pay 100% of the cost of covered health services.

The out-of-pocket max is most important if you need ongoing medical care or expensive treatments. In these situations, choosing a plan with a lower out-of-pocket max is the best way to lower your total costs.

Even if you're healthy and don't expect to need expensive medical care, the out-of-pocket max gives you a safety net to protect you from the high costs of a surprise injury or illness.

Health care costs can add up quickly, and this maximum spending limit can help you avoid extremely high medical bills that can lead to medical debt or bankruptcy.

Find Cheap Health Insurance in Your Area

How much is a typical deductible?

The average health insurance deductible is $5,241 for a Silver plan purchased on the health insurance marketplace.

Deductibles are usually lower if you get their health insurance through their job. The average deductible is $1,735 for an individual with an employer health insurance plan.

- Amount spent on covered doctors, treatments and health services

- What you spend on copayments or coinsurance

- Monthly cost of insurance

- Spending for out-of-network services or other uncovered health services

Health insurance plans can have a wide range of deductible amounts.

- On one end, there are no-deductible health insurance plans where the cost-sharing benefits of your insurance policy begin right away.

- In contrast, high-deductible health plans mean that you're responsible for a large portion of your health care costs before the insurance company contributes.

Deductibles can also vary for family health insurance plans. Most plans will have what's called an embedded deductible where each person's deductible also counts toward the overall family deductible. If only one person reaches their deductible, the better insurance benefits begin for that person only. If the family deductible is reached, cost-sharing benefits begin for everyone in the household.

How much is a typical out-of-pocket max?

The average out-of-pocket maximum is $8,900 for a typical Silver plan purchased on the health insurance marketplace.

For health insurance plans through an employer, the average out-of-pocket maximum is $4,346.

Plans on the health insurance marketplace usually have a higher out-of-pocket maximum than plans through an employer. However, the federal limit on an out-of-pocket maximum prevents it from becoming too high. For 2025 plans, the out-of-pocket maximum can't be higher than $9,200 for an individual and $18,400 for a family for all insurance plans on the health insurance marketplace.

- Payments toward deductible

- What you spend on copayments or coinsurance

- Monthly cost of insurance

- Spending for out-of-network services or other uncovered health services

Does your deductible count toward the out-of-pocket maximum?

Yes, the amount you spend toward your deductible counts toward what you need to spend to reach your out-of-pocket max. So if you have a health insurance plan with a $2,000 deductible and a $5,000 out-of-pocket maximum, you'll pay $3,000 after your deductible amount before your out-of-pocket limit is reached.

Choosing the best health insurance policy

The deductible and out-of-pocket max are two very important factors when deciding which health insurance plan is right for your needs.

- In general, you'll pay more each month to pay less for your medical care through lower deductibles, out-of-pocket maximums, copayments or coinsurance. These higher monthly costs may be worth it if you're expecting to need significant medical care in the upcoming year.

- Choosing a plan with lower monthly payments can be good for those who are young and healthy, but it means higher deductibles, higher out-of-pocket maximums and higher copayments or coinsurance for health services.

Comparing health insurance quotes can help you balance how much you pay each month compared to how much coverage you get with the policy's yearly deductible amount, cost-sharing benefits and out-of-pocket maximum.

Deductible vs. out-of-pocket max vs. coinsurance

Deductible

- Low amount: Low deductibles usually mean higher monthly bills, but you'll get the cost-sharing benefits sooner.

- High amount: High deductibles can be a good choice for healthy people who don't expect significant medical bills.

Out-of-pocket max

- Low amount: A low out-of-pocket maximum gives you the most protection from major medical expenses.

- High amount: Having a high out-of-pocket max gives you the biggest risk that you'll face very high medical costs if you need significant health care.

Coinsurance and copay

- Low amount: Lower coinsurance and copayments can help you reduce your spending if you need moderate amounts of medical services and you don't expect to reach the out-of-pocket max.

-

High amount: Affordable plans with higher coinsurance and copayments can help you save money if you don't expect to need significant medical care.

Frequently asked questions

Why is an out-of-pocket max higher than a deductible?

An out-of-pocket maximum is always higher than (or equal to) a deductible. The deductible is the first threshold you reach at the beginning of the policy year, and after you reach your deductible, the cost-sharing benefits of the insurance policy begin. The out-of-pocket maximum is the next threshold, and when your total spending reaches the out-of-pocket maximum, your plan begins covering the full cost for included health services.

What happens when you meet your out-of-pocket maximum?

After your total health care spending toward the deductible, copayments and coinsurance reaches the out-of-pocket max, your health insurance policy will start paying 100% of the cost of covered health services.

How can your deductible and out-of-pocket max help you pay less?

Choosing a high-deductible plan is one way for young, healthy or low-risk people to save on health insurance because they will spend less on monthly bills and are less likely to have high medical costs. If you have significant medical needs, choosing a plan with a low deductible and out-of-pocket maximum can help you pay less overall because even though you'll pay more each month, you'll get better cost-sharing benefits.

Sources

Average deductibles and out-of-pocket maximums are based on the most recent analysis from Kaiser Family Foundation (KFF). Averages are based on 2024 marketplace health insurance plans and 2023 employer-based plans. The average out-of-pocket maximum is based on the benefits of a Standard Silver plan in states that use HealthCare.gov, excluding Delaware, Louisiana and Oregon.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.