Best Cheap Health Insurance in Michigan (2025)

Blue Care Network of Michigan has the best health insurance in Michigan. The cheapest plan costs $398 per month before discounts.

Find Cheap Health Insurance Quotes in Michigan

Best and cheapest health insurance in Michigan

test

test

test

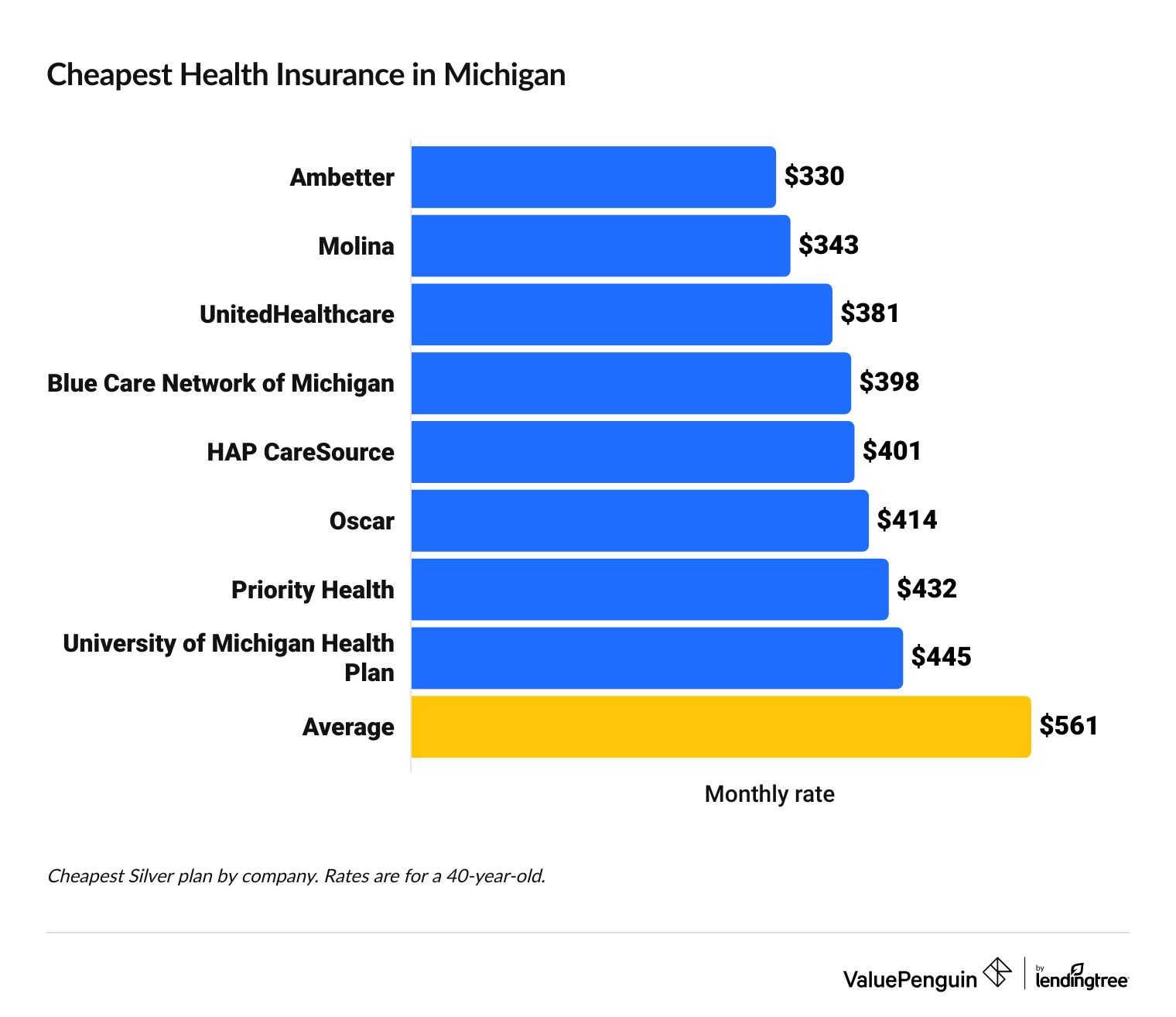

Cheapest health insurance companies in Michigan

Ambetter from Meridian has the most affordable health insurance in Michigan. Silver plans cost as little as $330 per month.

Find Cheap Health Insurance Quotes in Michigan

Affordable health insurance in Michigan

Company |

Cost

| |

|---|---|---|

| Ambetter from Meridian | $330 - $503 | |

| Molina Healthcare | $343 - $447 | |

| UnitedHealthcare | $381 - $481 | |

| Blue Care Network of Michigan | $398 - $765 | |

Ambetter from Meridian has the cheapest health insurance quotes for most people in Michigan residents, including those living in Detroit. However, where you live in Michigan will change the cheapest plan option for you. Molina has the most affordable health insurance in Ann Arbor, and UnitedHealthcare has the cheapest rates in Grand Rapids. University of Michigan Health Plan has the most affordable health insurance in 10% of Michigan counties, mostly in the Eastern and Central parts of the state.

Best health insurance companies in Michigan

Blue Care Network of Michigan has the best cheap health insurance in Michigan for most people.

The company offers Michigan residents affordable rates and high-quality service. Priority Health gets 42% fewer complaints than an average company its size.

Blue Care Network of Michigan is a different company than Blue Cross Blue Shield of Michigan. However, both companies are part of the Blue Cross Blue Shield network of companies.

However, Blue Care Network of Michigan only sells HMO plans, which restrict you to a network of doctors unless you need emergency medical care. If you want the freedom to choose your own doctor over getting the most affordable rate, consider Blue Cross Blue Shield of Michigan. It's the only company in Michigan to offer more flexible PPO (preferred provider organization) plans on the state health exchange.

Best-rated health insurance companies in Michigan

Company |

Editor rating

|

ACA rating

|

|---|---|---|

| Blue Care Network of Michigan | 4.0 | |

| Blue Cross Blue Shield | 4.0 | |

| Priority Health | 4.0 | |

| University of Michigan Health Plan | 4.0 | |

| Ambetter from Meridian | 3.0 |

Find Cheap Health Insurance Quotes in Michigan

Best health insurance in MI for flexible coverage: Blue Cross Blue Shield of Michigan

Blue Cross Blue Shield of Michigan is the only option PPO (preferred provider organization) plans in Michigan. These give you the flexibility to visit a specialist without getting a referral first and you can visit doctors outside your network for a higher cost. You also don't need to choose a primary care doctor. However, PPOs tend to cost more than HMOs (health maintenance organizations), which are less flexible. Consider a PPO if you want the freedom to choose your doctors more than getting the best price on your health insurance.

Blue Cross Blue Shield (BCBS) of MI is the most popular health insurance company in the state. BCBS of MI sells roughly 61% of all private health plans in Michigan. The company has a high-quality rating from HealthCare.gov. BCBS of MI also sells the only health plans in Michigan that let you go outside your network of doctors without a referral, called PPO plans.

Blue Cross Blue Shield has the largest network of doctors of any health insurance company nationwide.

However, BCBS of MI is more expensive than many of its competitors. The cheapest BCBS of Michigan Silver plan option costs $534 per month on average. That's $204 per month more than the cheapest health insurance in Michigan, the Ambetter from Meridian Clear Silver plan.

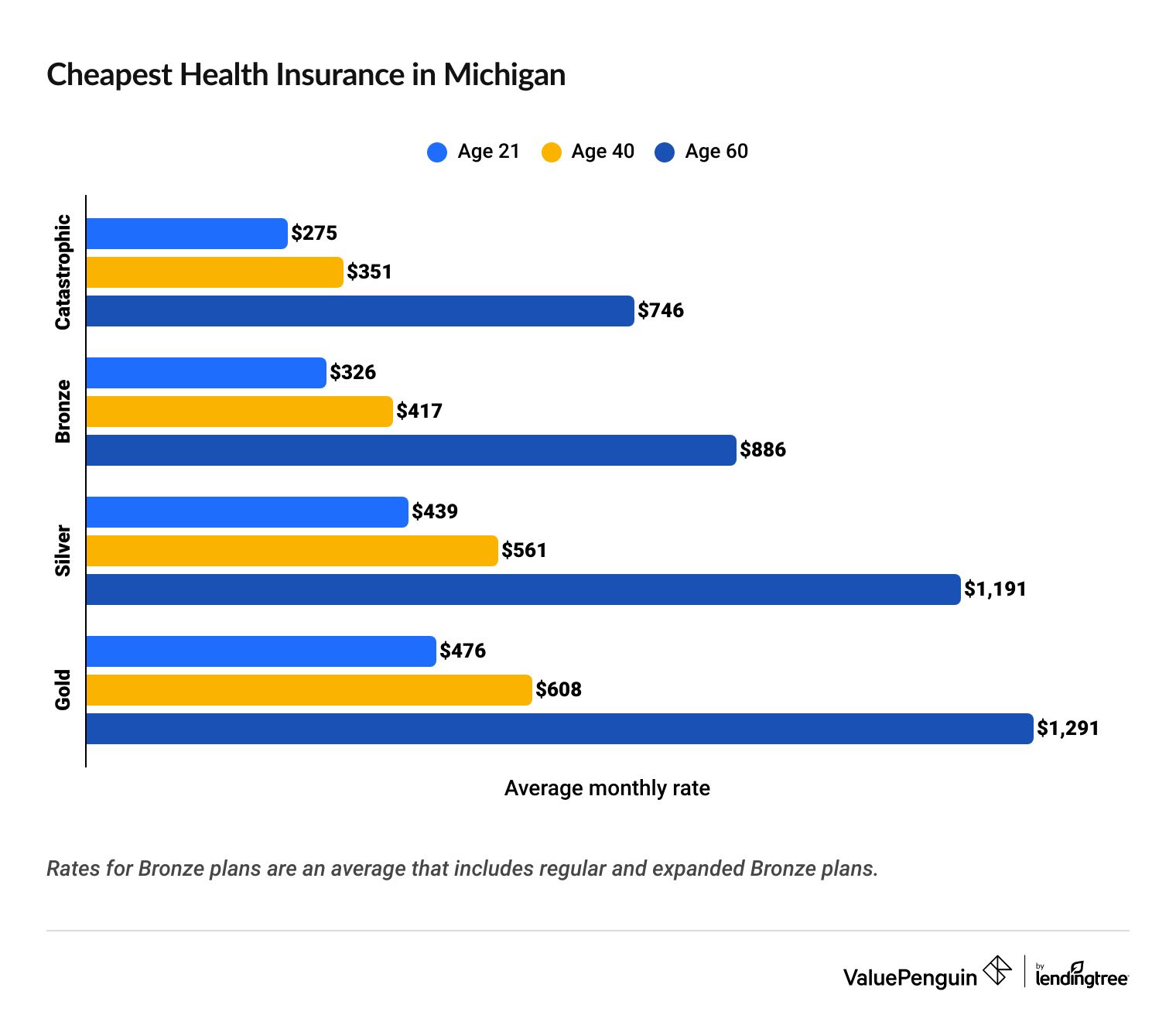

How much is health insurance in Michigan?

Health insurance in MI costs an average of $561 per month at full price or $98 per month for people who qualify for discounts based on how much money they make.

Roughly 90% of Michigan residents who buy health insurance on HealthCare.gov qualify for a discount. One-third of shoppers pay $10 per month or less for health insurance after discounts.

Those who don't qualify for government discounts pay $561 per month for a Silver health plan, on average.

Higher plan tiers have expensive monthly rates, but they cover a large portion of your doctor's bill. Lower plan tiers have cheap rates, but you pay more for medical care.

It's also important to remember your age has a big impact on how much you pay for insurance. A 40-year-old in Michigan will pay roughly a fifth more for the same Silver health as a 21-year-old on average, and a 60-year-old will pay more than double what a 40-year-old pays for the same level of coverage.

Get affordable health insurance in Michigan

Michigan residents who qualify for health insurance discounts because of their income pay $98 per month for coverage on average.

About 90% of the people in Michigan who buy health insurance online through HealthCare.gov can get health insurance discounts, called subsidies. Your household's annual income will determine the size of your discount. The less you earn, the more you save. One-third of Michigan shoppers pay under $10 per month for health insurance.

To qualify for discounts, you need to earn less than $60,240 per year as a single person or $124,800 for a family of four. You can use subsidies to help pay for any Bronze, Silver or Gold plan you find on HealthCare.gov.

Cheap Michigan health insurance plans by city

Ambetter from Meridian has the cheapest health insurance in Detroit, at $354 per month.

UnitedHealthcare has the most affordable Silver health plan in Grand Rapids at $397 per year.

Cheapest health insurance by MI county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Alcona | Blue Care Network of Michigan Preferred Silver Saver | $519 |

| Alger | Blue Care Network of Michigan Preferred Silver Saver | $641 |

| Allegan | Ambetter from Meridian Clear Silver | $397 |

| Alpena | Blue Care Network of Michigan Preferred Silver Saver | $519 |

| Antrim | Blue Care Network of Michigan Preferred Silver Saver | $476 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Michigan

Ambetter from Meridian has the cheapest rates for more than half of the population of Michigan. Ambetter has the most affordable health insurance for three of the largest counties in Michigan: Wayne, Macomb and Oakland.

Blue Care Network of Michigan has the cheapest health insurance in Michigan for about one-tenth of the state's population and about half of Michigan's counties, mostly in the Northern and Western parts of the state. That makes Blue Care the most affordable option for many rural Michigan residents.

Best health insurance by level of coverage

Silver health plans offer the best combination of cheap rates and affordable costs when you visit the doctor.

It's important to remember that the best plan tier for you will depend on your medical needs and whether you qualify for discounts because of your income.

Gold plans: Best if you have ongoing or expensive medical needs

| Gold plans pay for about 80% of your medical care. |

A Gold plan makes sense if you think you'll have to spend a lot of money on medical care in the coming year. That's because you'll have a lower deductible, copays and coinsurance.

Gold plans cost $608 per month in Michigan, on average. That's $47 per month more than an average Silver plan.

Silver plans: Best for most people

| Silver plans pay for about 70% of your medical care. |

Silver plans offer a middle ground with moderate monthly rates and affordable costs that you're responsible for paying when you visit the doctor.

In Michigan, Silver health plans cost $561 per year on average with no discounts.

Average deductible by plan tier in Michigan

- Catastrophic: $9,200

- Bronze: $7,521

- Silver: $4,609

- Gold: $1,279

With a Silver health plan, you'll typically pay higher costs for most types of medical care. On average, you'll pay thousands of dollars more before your coverage starts with a Silver plan than you would with a Gold plan in Michigan.

Bronze plans: Best if you're young, healthy and comfortable with risk

| Bronze plans pay for about 60% of your medical care. |

A Bronze plan may be a good option if you're in good health and rarely visit the doctor. Michigan residents pay $417 per year for Bronze plans on average. That is a savings of $144 per year compared to an average Silver health plan.

However, you'll pay more when you visit the doctor with a Bronze plan. In Michigan, Bronze health plans have deductibles that are $2,912 higher than Silver plans on average.

Catastrophic plans: Best to prevent financial disaster

You can only buy a Catastrophic health plan if you're under 30 years old or you qualify for a special hardship exemption.

Consider a catastrophic plan if you only need protection for expensive emergencies and you have a large amount of money in your savings account.

Catastrophic plans have lower rates than Bronze plans. However, you'll have to pay $9,200 before your coverage begins for most medical care. It's important to remember that you can't qualify for subsidies with a Catastrophic plan.

Catastrophic plans are rarely worth it if you earn a low income and qualify for discounts.

Best health insurance for Michigan residents who earn low incomes

Michigan residents who struggle to afford health insurance should consider Medicaid or a Silver health plan with discounts and cost-sharing reductions (CSRs).

Depending on your income, you may qualify for heavily discounted or free health insurance from the government.

Silver plans: Best if you earn a low income but can't get Medicaid

| Silver plans will pay 73% to 94% of your medical costs if you have a low income. |

You can qualify for extra financial assistance from the government called cost-sharing reductions with a Silver health plan. Other plan tiers don't have this option.

To get cost-sharing reductions in Michigan, you need to earn less than roughly $38,000 per year as an individual or $78,000 per year as a family of four.

Cost-sharing reductions help you pay for the costs you're responsible for when you visit the doctor, such as medical costs before you reach your deductible, copay and coinsurance.

Medicaid: Free health insurance for Michigan residents

Medicaid is free government health for people who earn a low income.

Medicaid is the best health insurance option if you qualify. In Michigan, you can go on Medicaid if you make about $21,000 per year or less as a single person or $44,000 per year or less for a family of four. Pregnant women can qualify for Medicaid with an income of about $30,000 or less and children younger than 18 are eligible if they earn less than $32,000 per year.

Are health insurance rates going up in Michigan?

Health insurance rates rose by 9% on average in Michigan from 2024 to 2025. However, some plan tiers saw much larger increases than others. For example, Silver health plans got 13% more expensive, on average, while Catastrophic and Gold plans only increased by 7%.

Tier | 2024 | 2025 | Change |

|---|---|---|---|

| Catastrophic | $328 | $351 | 7% |

| Bronze | $382 | $417 | 9% |

| Silver | $497 | $561 | 13% |

| Gold | $571 | $608 | 7% |

Monthly costs are for a 40-year-old.

It's important to compare health insurance quotes every year. The cheapest health insurance in Michigan this year won't necessarily be the best choice next year.

In Michigan, Obamacare plans bought through HealthCare.gov are required by law to cover 10 essential benefits regardless of the plan tier you choose.

- Outpatient care

- Emergency services

- Hospital care

- Care for pregnant women and newborns

- Services for mental health and substance use disorders

- Prescription drugs

- Rehabilitation services and devices

- Laboratory services

- Preventive, wellness and ongoing disease services

- Coverage for babies (pediatrics)

In addition, companies can't deny you coverage or charge you higher rates based on your health. All plans also have maximum annual limits on how much you'll spend for medical care, called out-of-pocket maximums.

Cost of Michigan health insurance by family size

How much you pay for health insurance will depend on the size of your family.

You'll pay an average of $336 per month for every child under the age of 18 that you add to your plan on average. In Michigan, a family of four with two 40-year-old adults and two children under 14 will pay $1,793 per month before discounts for a Silver health plan.

Family size | Average monthly cost |

|---|---|

| Individual | $561 |

| Individual + Child | $896 |

| Couple, age 40 | $1,122 |

| Family of three | $1,457 |

| Family of four | $1,793 |

Averages based on a Silver plan for 40-year-old adults and children who are under age 15.

Short-term health insurance in Michigan

You can buy short-term health coverage for up to four months at a time in Michigan.

You can buy short-term health insurance at any time of the year. In addition, these plans tend to cost less than regular health insurance.

Pros of short-term health insurance in MI

Cons of short-term health insurance in MI

Frequently asked questions

What is the most affordable health insurance in Michigan?

Ambetter from Meridian has the cheapest health insurance for most Michigan residents, including those in the Detroit area. However, Molina offers the most affordable rates in Grand Rapids and Ann Arbor.

What is the average monthly cost of health insurance in Michigan?

You'll pay $561 per month before discounts for health insurance in Michigan on average. Keep in mind that 90% of Michigan residents who buy health insurance on HealthCare.gov qualify for discounts. Those who qualify for discounts pay $98 on average and roughly one-third of shoppers eligible for discounts pay under $10 per month.

How do I get free health insurance in Michigan?

In Michigan, you may qualify for free government health insurance, called Medicaid, if you make around $21,000 per year ($44,000 for a family of four) or less. If you earn a low income but don't qualify for Medicaid, you may qualify for financial assistance from the government, called subsidies and cost-sharing reductions (CSRs).

Methodology

Michigan health insurance rate data for 2025 is from the Centers for Medicare & Medicaid Services (CMS) website. ValuePenguin used the CMS public use files (PUFs) in calculations to average rates across a variety of factors such as plan tier, county and family size. Plans and insurance companies for which county-level data was included in the CMS Crosswalk file were used in our reporting. Those excluded from these files were not included in our analysis.

Rates are based on a 40-year-old with a Silver plan, unless otherwise noted. Other sources include S&P Global Capital IQ, NAIC (National Association of Insurance Commissioners) and the Michigan Department of Insurance.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.