Best Cheap Health Insurance in Pennsylvania (2026)

Highmark BCBS sells the best health insurance in Pennsylvania. A Gold plan from Highmark costs as little as $393 per month before discounts.

Find Cheap Health Insurance Quotes in Pennsylvania

Best and cheapest health insurance in Pennsylvania

Cheapest health insurance companies in Pennsylvania

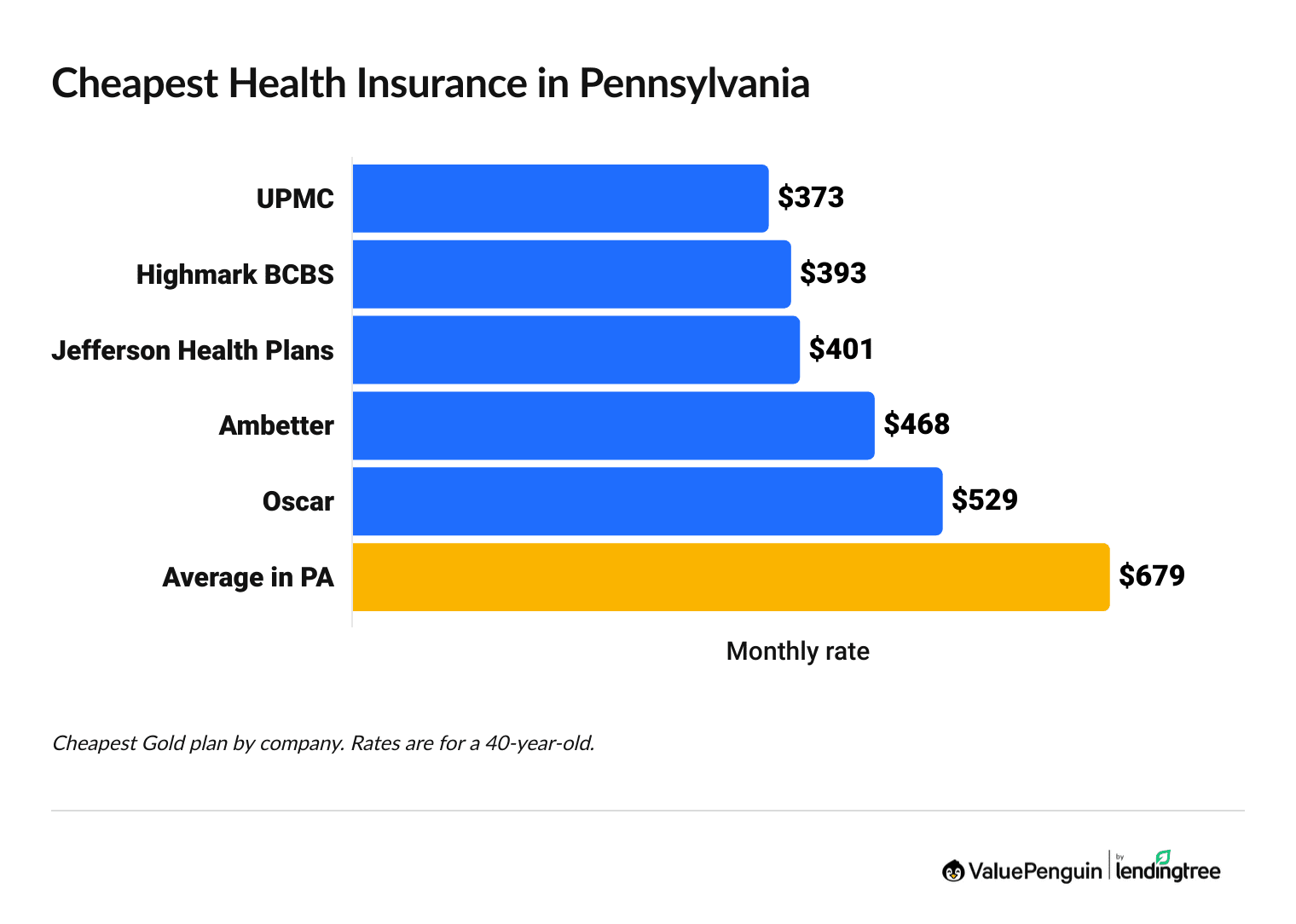

UPMC, Highmark and Jefferson Health Plans have the cheapest Gold plans in Pennsylvania, with rates as low as $373 per month before discounts.

Find Cheap Health Insurance Quotes in Pennsylvania

Affordable health insurance in Pennsylvania

Company |

Cost

| |

|---|---|---|

| UPMC | $373-$807 | |

| Highmark BCBS | $393-$923 | |

| Jefferson Health Plans | $401-$536 | |

| Ambetter | $468-$868 | |

- In Pennsylvania, Gold plans often cost less than Silver plans if you pay full price, so they're a good option for most people.

- If you make between $15,650 and $39,125 per year as a single person or between $32,150 and $80,375 per year as a family of four, consider a Silver plan. If you have a low income, Silver plans can come with extra discounts that can make the coverage even better than a Gold plan.

In 2026, Partners Insurance Co. is rebranding as part of Jefferson Health Plans. On Pennsylvania's state health insurance marketplace site, Pennie, you'll see "Partners Insurance Co." in the list of companies on the left side of the screen when you shop. However, all Partners plans show up with Jefferson Health Plans branding, logos and names.

Cheapest Silver plan: Jefferson Health Plans

Jefferson Health Plans sells the cheapest Silver plans in PA, with rates as low as $449 per month.

If your income is between $15,650 and $39,125 per year as an individual or between $32,150 and $80,375 per year as a family of four, a Silver plan is usually a better option for medical insurance in Pennsylvania. When you have a lower income and you buy a Silver plan, you can get extra discounts called cost-sharing reductions (CSRs), which lower the amount you have to pay for medical care.

On average in Pennsylvania, Silver plans usually cost more than Gold plans. But with a low income and cost-sharing reductions, Silver plans can sometimes have even better coverage than Gold plans. Plus, you might also get rate discounts that make your monthly cost cheaper.

Best health insurance companies in Pennsylvania

Highmark Blue Cross Blue Shield sells the best health insurance plans in Pennsylvania.

Highmark has an overall rating of 4.0 from HealthCare.gov because of its excellent customer service and affordable rates. That means its plans are high quality and its customers are usually satisfied with their experience.

Find Cheap Health Insurance Quotes in Pennsylvania

Best-rated health insurance companies in Pennsylvania

Company |

ACA rating

|

VP rating

|

|---|---|---|

| Highmark BCBS | ||

| UPMC | ||

| Ambetter | ||

| Independence Blue Cross | ||

| Jefferson Health Plans | N/A |

UPMC, Ambetter and Independence Blue Cross are also good options, but they aren't as widely available as Highmark. If you're not sure which company to go with, get quotes from all four, if you can get them where you live, to compare prices and coverage.

How much does health insurance cost in Pennsylvania?

Health insurance in PA costs an average of $750 per month for a Silver plan, but it could potentially cost about $235 per month if you qualify for discounts based on your income.

Find Cheap Health Insurance Quotes in Pennsylvania

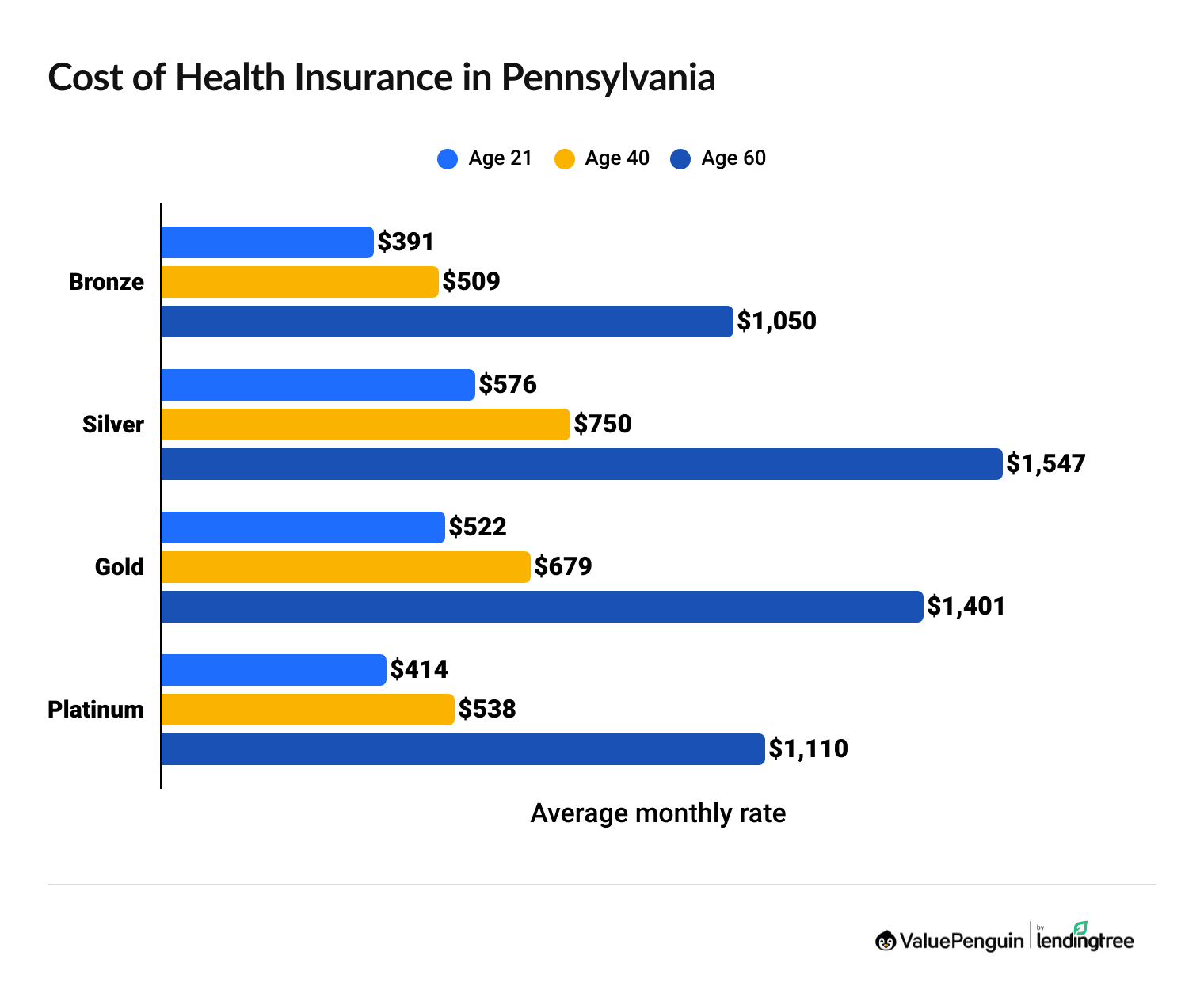

- Bronze plans have the cheapest average rates. But you'll also pay more when you visit the doctor or get a prescription filled because they pay less of the bill.

- Gold plans cost less, on average, than Silver plans in Pennsylvania. Unless you qualify for discounts called cost-sharing reductions, a Gold plan is a good option.

- Only Highmark sells Platinum plans in PA, but they're often more affordable than Silver or Gold plans. If you want a plan from Highmark, a Platinum plan is often the best choice since it has the best coverage. You can only get Platinum plans in five counties in western PA.

- Your age also has an impact on your health insurance rates. You'll usually pay more for health insurance as you get older since it's more likely you'll face medical issues.

Health insurance discount changes in Pennsylvania for 2026

Health insurance in Pennsylvania is expected to cost around $235 per month in 2026 if you qualify for discounts because of your income.

That's up 83% from the cost after discounts in 2025, which was about $129 per month. Discounts probably aren't going to be as big in 2026. Congress could still extend the bigger discounts that are expiring at the end of 2025, but if they don't, discounts will go back to the way they were before 2021.

Health insurance rates in Pennsylvania after subsidies (2025 vs. 2026)

Income | 2025 rate | 2026 rate | Difference |

|---|---|---|---|

| $30,000 | $49 | $155 | 216% |

| $40,000 | $154 | $287 | 86% |

| $50,000 | $283 | $415 | 47% |

| $60,000 | $423 | $498 | 18% |

| $70,000+ | $461 | $572 | 24% |

Average cost after subsidies for a single 40-year-old with a Benchmark Silver plan.

It's also possible that the subsidy program could be entirely different in 2026.

Congress could make massive changes to the program or restructure it altogether.

As it stands now, you can use rate subsidies on any Bronze, Silver, Gold or Platinum plan. You can't use subsidies on Catastrophic plans.

To qualify, your income has to be between $15,650 and $62,600 if you're single or between $32,150 and $128,600 for a family of four. You can't get subsidies if you can get Medicaid based on your income.

The other type of discount you might qualify for is called a cost-sharing reduction. This lowers your medical bills instead of your monthly rate.

Cheap Pennsylvania health insurance plans by city

Jefferson Health Plans sells the most affordable health insurance in Philadelphia, with Gold plans starting at $401 per month.

But the cheapest company for you changes depending on where you live in PA. In Pittsburgh, UPMC has the cheapest Gold plan, while in Reading, the cheapest plan comes from Ambetter.

The best way to find affordable health insurance in PA is to get quotes from several companies. That lets you compare rates and coverage so that you find an affordable plan that also works for your medical needs.

Cheapest health insurance plans by PA county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Adams | Highmark my Direct Blue EPO Gold 1700 HSA | $673 |

| Allegheny | UPMC Advantage Gold HSA $2,900/10% - Partner Network | $373 |

| Armstrong | UPMC Advantage Gold HSA $2,900/10% - Premium Network | $523 |

| Beaver | UPMC Advantage Gold HSA $2,900/10% - Select Network | $395 |

| Bedford | UPMC Advantage Gold HSA $2,900/10% - Partner Network | $403 |

Cheapest Gold plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Pennsylvania

Best health insurance in PA by level of coverage

The best health insurance plan for you will depend on your health and budget.

In Pennsylvania, many people will be better off with Gold plans because they often cost less than Silver plans and let you pay less when you visit the doctor. If you like Highmark, a Platinum plan may even be better since it could be cheaper than a Gold plan, but Platinum plans aren't widely available. If you don't need much medical care, a Bronze plan might be a better option.

Platinum plans: Best if you need frequent medical care

| Platinum plans pay for about 90% of your medical care. |

In Pennsylvania, Platinum plans cost $538 per month, on average.

Platinum plans are best if you go to the doctor often or need expensive medical care. These plans pay the highest portion of your medical bills. In Pennsylvania, coverage on a Platinum plan starts right away. That's because the plans have no deductible.

Highmark is the only company in PA that sells Platinum plans. You can only get Platinum plans in Allegheny, Butler, Erie, Washington and Westmoreland counties in western Pennsylvania. If your doctor doesn't take Highmark insurance or if you would prefer another company, a Gold plan is a better option.

Gold plans: Best for most people

| Gold plans pay for about 80% of your medical care. |

Gold plans cost an average of $679 per month in Pennsylvania.

Gold plans are the best option for most people, especially people who need medical care often. With a Gold plan, you'll pay less when you go to the doctor compared to a Silver or Bronze plan. That's because Gold plans have low deductibles, copays and coinsurance.

Gold plans are also a good option if you earn more than $39,125 per year as a single person or $80,375 per year as a family of four. Unlike in most states, Gold plans in PA are usually cheaper than Silver plans if you pay full price. If you make less than that, a Silver plan is probably better because you might qualify for a few discounts.

Silver plans: Best if you have a low income

| Silver plans pay for about 70% of your medical care. |

Silver plans cost an average of $750 per month in Pennsylvania.

Silver plans give you a middle-ground level of coverage. They can be a good option if you go to the doctor a handful of times each year or have manageable health conditions.

Silver plans are best if you have a low income and average health needs. That's because you could qualify for discounts that let you pay less when you visit the doctor. To qualify, you have to make between $15,650 and $39,125 per year as a single person or between $32,150 and $80,375 as a family of four.

You might also qualify for savings on your monthly rate. If you get both these discounts, a Silver plan might be cheaper and pay for more of your health care bills than a higher-tier plan.

Bronze plans: Best if you're healthy and have emergency savings

| Bronze plans pay for about 60% of your medical care. |

Bronze plans cost $509 per month, on average, in Pennsylvania.

Bronze plans typically have the lowest monthly rates. You may save money with a Bronze plan if you don't have to go to the doctor often.

But even a single accident or unexpected illness can be expensive to treat, and with a Bronze plan, you have to pay a higher share of your medical bills compared to other plan tiers. You should only consider a Bronze plan if you have enough money saved up to meet your policy's high deductible.

Catastrophic plans: Best as a last resort

Catastrophic plans cost an average of $313 per month for a 21-year-old in Pennsylvania.

A Catastrophic plan is only a good idea if you can't afford anything else but you can't get Medicaid. Catastrophic plans require you to pay up to $10,600 of your medical bills yourself each year, so make sure you have savings in the bank.

You can only get a Catastrophic plan if you're under 30 or qualify for an exemption. And you can't use premium tax credits to lower your monthly rate.

Cheap or free health insurance in Pennsylvania if you have a low income

If you have a low income in Pennsylvania, you might qualify for cheap or even free health insurance through Medicaid. If you make too much to qualify for Medicaid, you might still get discounts that lower what you have to pay at the doctor.

Medicaid in Pennsylvania

Medicaid is a type of free health insurance that the government offers to people with low incomes. In Pennsylvania, you can qualify for Medicaid if you earn about $22,000 or less per year as a single person or roughly $44,000 per year for a family of four.

Seniors who earn a low income might qualify for both Medicare and Medicaid, which could help lower their medical bills even more.

Use cost-sharing reductions for cheaper medical care

If you earn between $15,650 and $39,125 per year as a single person or between $32,150 and $80,375 per year as a family of four, consider buying a Silver health insurance plan.

In this income range, you qualify for discounts that lower what you pay when you go to the doctor, called cost-sharing reductions (CSRs). These discounts are only available for Silver plans, but they could make your coverage the same as or even better than a Gold or Platinum plan.

And if you also qualify for rate subsidies, your monthly cost for insurance could be cheap too.

Are health insurance rates going up in PA in 2026?

Average health insurance costs in Pennsylvania rose by 17% across all plan levels from 2025 to 2026.

Silver plans had the biggest increase, going up by 23% year-over-year. Gold plans, the most popular plan tier in the state, cost 16% more in 2026 compared to 2025. Over the last five years, Gold plans have gone up by 43%.

Bronze

Silver

Gold

Platinum

Year | Cost | Change |

|---|---|---|

| 2022 | $413 | – |

| 2023 | $380 | -8% |

| 2024 | $409 | 8% |

| 2025 | $431 | 5% |

| 2026 | $509 | 18% |

Monthly costs are for a 40-year-old. Expanded Bronze plans are included in 2024, 2025 and 2026 averages, when they're offered.

Why is health insurance expensive in PA in 2026?

Insurance rates are more expensive in 2026 largely because of higher health care costs.

The cost for GLP-1 weight loss drugs, like Ozempic and Wegovy, is also driving up rates. Increased health care costs mean insurance companies have to pay more money when people get medical care. To make up for it, the companies charge higher rates.

A change to the way marketplace discounts work is also likely to increase rates in 2026. For the last five years, people with low incomes have gotten bigger discounts, called "enhanced subsidies." Those extra discounts are set to expire at the end of 2025. It's possible that they'll be renewed, but if they aren't, you'll pay higher rates for your plan even if you get discounts.

What to do if your plan is too expensive in 2026

- Get other quotes. If the price of your plan goes up for 2026, shop around and get quotes from other insurance companies. You might find a cheaper plan that still gives you good coverage.

- Consider a lower-tier plan. If you don't go to the doctor often, consider dropping down to a Bronze plan. The monthly rate is cheaper, but you'll have to pay more when you go to the doctor. However, you can get an HSA with a Bronze plan, and that can help you save for medical costs.

- Check for discounts. Even though discounts might be smaller in 2026, it's still a good idea to check to see if you can get them, especially if you've recently had a change in your income.

- See if you can get Medicaid. If you make less than about $22,000 per year as a single person or about $44,000 per year as a family of four, you can get Medicaid in Pennsylvania. With Medicaid, your health care costs are free or very low.

In Pennsylvania, you can buy Affordable Care Act (ACA) plans, also called "Obamacare" plans, from the state's health insurance marketplace, Pennie.

No matter what plan level you buy, you'll have coverage for at least 10 medical situations.

- Doctor visits

- Preventive and wellness care

- Emergency care

- Hospital stays

- Prescription medications

- Lab services

- Pregnancy and baby care

- Pediatric care

- Mental health care

- Rehab services

The plan you buy affects how much you have to pay for medical care. For example, if you need blood work, you'll probably have to pay more if you have a Bronze plan than you would with a Gold plan. But with both plan levels, you'll have coverage.

COBRA insurance in Pennsylvania

In PA, COBRA insurance costs an average of $781 per month for a single person or $2,417 per month for a family.

COBRA lets you keep the health insurance you had with your job when you leave, get fired or retire, but you have to pay the full cost each month. You can usually have COBRA insurance for a year and a half from the time you leave your job, but it can last up to three years in some cases.

Because COBRA is so expensive, it's almost always cheaper to get a marketplace plan from Pennie. But COBRA might be a good idea if you rely on a specific coverage that your employer plan had.

Short-term health insurance in Pennsylvania

At the start of 2025, the Trump administration reversed a rule that would have limited short-term health plans to no more than three months. The administration hasn't said when this change will happen. But short-term health insurance that lasts up to 364 days could be available in Pennsylvania sometime soon.

You can buy a short-term plan at any time of the year. That makes it a good option if you're not in open enrollment (Nov. 1 to Jan. 15) and if you don't have what's called a qualifying life event that lets you get marketplace coverage outside of open enrollment.

But these plans usually have worse coverage than marketplace plans, which makes them a poor choice if you need health insurance for more than a few months.

Pros of short-term health insurance in PA

Cons of short-term health insurance in PA

Health insurance enrollment by income level in Pennsylvania

More than half of people with a plan from Pennie make $37,650 per year or less.

People with lower incomes are more likely to drop their health insurance coverage if rates go up. In fact, Pennie reported that for every one new enrollment so far in 2026, two existing customers have canceled their plans.

People who make between about $23,000 and $31,000 per year as a single person or between about $48,000 and $64,000 per year as a family of four have had the highest level of cancellation.

Enrollment by income

Income | % of total enrollment |

|---|---|

| Less than $15,060 | 3% |

| $15,060 to $20,783 | 9% |

| $20,784 to $22,590 | 12% |

| $22,591 to $30,120 | 22% |

| $30,121 to $37,650 | 14% |

Enrollment in 2025 marketplace plans made during the 2024-2025 open enrollment period. Total may not be 100% due to rounding.

Older people (between 55 and 64) are canceling plans at the highest rate. You're more likely to face health issues as you age, and you generally don't get Medicare until you're 65, which means this age group could be left with staggering medical bills if they develop health problems.

Younger people (between 26 and 34) are also canceling their plans at a high rate. This could cause a problem for future financial security. If you have a major health issue come up at a younger age and you don't have health insurance to help pay for the costs, that medical debt could hinder your financial growth for years.

Frequently asked questions

How much is health insurance in PA per month?

Health insurance in Pennsylvania costs $679 per month for a 40-year-old with a Gold plan. Your costs will depend on your age and the plan tier you choose. You might be able to get a cheaper plan if you have a low income and get discounts.

Is health insurance free in Pennsylvania?

You can qualify for Medicaid, a type of free government health insurance, if you earn about $22,000 per year or less (roughly $44,000 for a family of four). If you're on Medicaid, most of your health care will be free or very cheap.

What's the best health insurance in Pennsylvania?

Highmark is the best health insurance company in PA. It has cheap rates, excellent customer service and good coverage quality.

Is $500 a month normal for health insurance?

$500 per month for health insurance in Pennsylvania is a little cheaper than average. Bronze plans cost an average of $509 per month, Silver plans cost an average of $750 per month and Gold plans cost an average of $679 per month. You might be able to get cheaper health insurance by shopping around or getting discounts based on your income.

How do I get health insurance in PA?

If you don't get health insurance from your job, you can shop on the state's marketplace website, Pennie. You can also shop directly with an insurance company, but you won't be able to get rate discounts that way.

Are subsidies going away in 2026?

Currently, it's not known what will happen to subsidies in 2026. Congress could still renew the "enhanced subsidies" by the end of the year, although that doesn't seem likely to happen. Lawmakers could also let the enhanced subsidies expire and let the discounts roll back to their previous format. Or Congress could restructure the program entirely.

Methodology

Pennsylvania health insurance rate data for 2026 is from Pennie, Pennsylvania's state health insurance marketplace site. ValuePenguin used the state marketplace data to find average rates for different plan tiers, geographic locations and family sizes.

Rates

Rates are based on a 40-year-old with a Gold plan, unless otherwise noted. Rates for Bronze plans include regular and Expanded Bronze plans for 2024, 2025 and 2026, when the plans are available. Your costs and plan options will vary; plans aren't always available in all parts of a state or county.

Subsidies

Rates after subsidies are estimates for a 40-year-old with a Benchmark Silver plan and are based on how subsidies were structured before 2021. Prices are calculated using KFF's rates for full-price Benchmark plans, federal poverty levels (FPLs), IRS rules about premium tax credits and Congressional reports about expanded tax credits. The total cost in the state uses rates calculated by income, which are weighted using Centers for Medicare & Medicaid Services (CMS) data on the incomes of those who purchased plans during 2024-2025 open enrollment. The median was used for each income range. Unknown incomes were excluded from the calculations. Incomes of 100% of the federal poverty line and 500% of the federal poverty line were assumed for enrollees who earn less than 100% FPL and more than 500% FPL, respectively. Information about state subsidies, when available, was sourced from state marketplaces.

Ratings

ValuePenguin's experts rank companies based on cost, coverage options, customer satisfaction and unique value. Ratings are out of 100 possible points. ACA ratings show how the company performs in Pennsylvania for medical care, member experience and plan administration. The 2026 plan quality data from CMS is based on data from the previous year. Ratings are not available for new plans or plans with low enrollment.

More sources

Enrollment trends, including plan selections by tier and enrollment by income, are from CMS data for the 2024-2025 open enrollment period.

Info about why Pennsylvania health insurance companies are raising rates is from the Peterson-KFF Health System Tracker. Other sources include KFF, the National Association of Insurance Commissioners (NAIC) and S&P Global Capital IQ.

About the Author

Insurance Writer

Cate Deventer is a ValuePenguin writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.