How Age Affects Health Insurance Costs

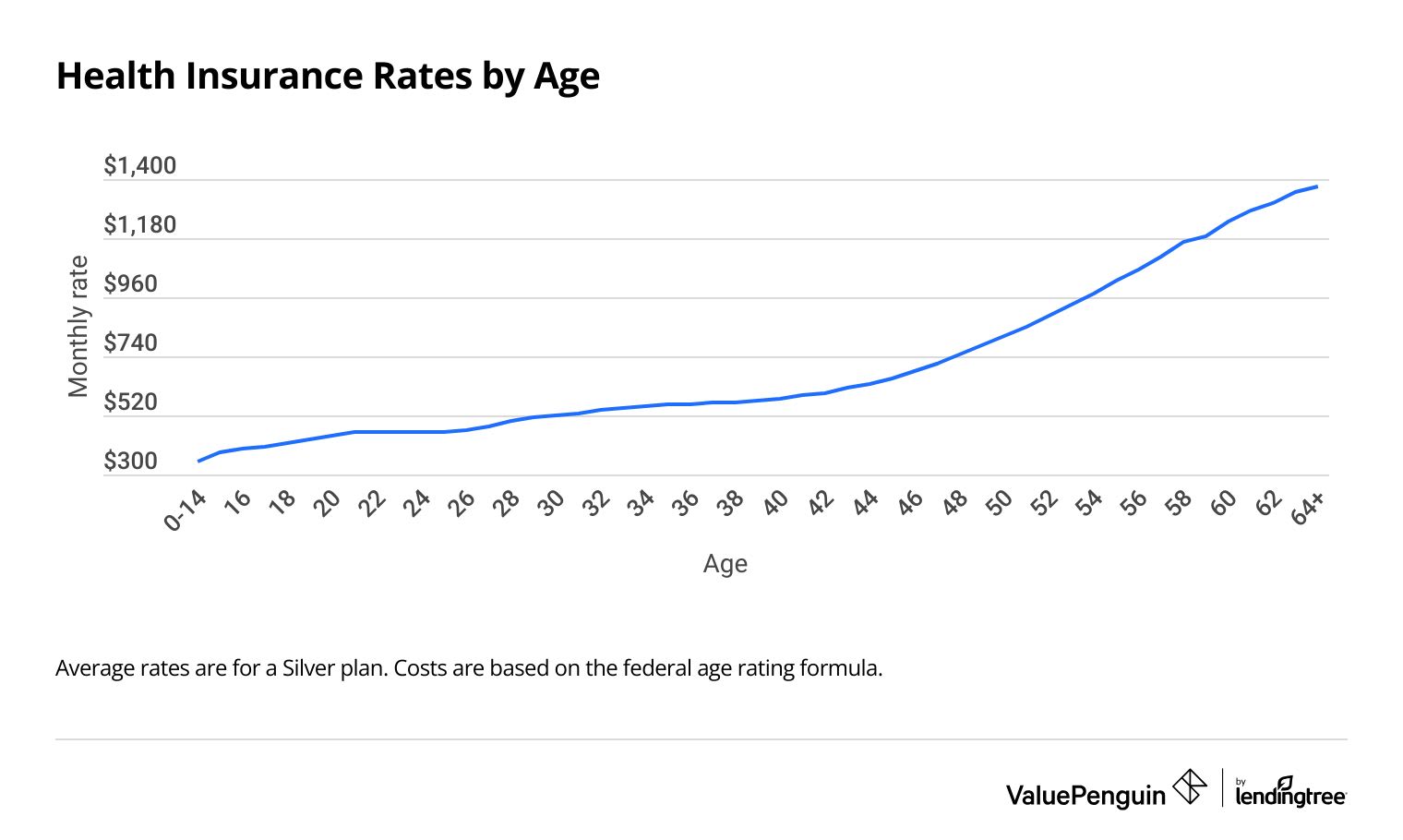

Health insurance rates get higher with age because older people are more likely to need medical care.

Find Cheap Health Insurance Quotes in Your Area

By the time you reach your early 50s, you will generally pay twice as much as you did in your early 20s.

But federal rules limit how much individuals pay for Affordable Care Act (ACA) plans based on age. Some states use their own rating system, and a few don't include age in health insurance rates at all.

Average cost of health insurance plans by age

By law, health insurance companies can only use a few features to set the cost of your health insurance. Age has the biggest impact on your rate, along with the level of coverage you choose.

Insurance companies use age to figure out how likely you are to need medical care. Older people are more likely to have health problems, which means the insurance company has to pay more for their medical bills. This increases the cost for the insurance company, so it charges a higher rate for health insurance to compensate.

Although your age does affect your health insurance rates, there are federal rules about how much of an impact it has. For example, people aged 64 and older can't be charged more than three times as much as someone in their early 20s. Generally, though, you will pay more the older you are.

In most states, monthly health insurance rates get gradually more expensive until around your mid-40s. After that, prices start to get more expensive quickly.

Find Cheap Health Insurance in Your Area

In most states, people between the ages of 21 and 24 pay what's called a base rate. The rate varies between companies. But by law, it's the price that is used as a base to set the rate for other ages. This rate is then adjusted according to your age. If you're between 0 and 14, you pay a flat rate that doesn't change with age. After age 14, your rate starts going up each year, but you still pay less than the base rate until age 20.

By age 64, your monthly rate will be as high as it will go. Federal law requires that people aged 64 and up pay no more than three times the base rate. And when you turn 65, you will likely stop buying private health insurance and be covered by Medicare.

Average Silver health plan cost by age

Age | Monthly cost |

|---|---|

| 0-14 | $350 |

| 15 | $381 |

| 16 | $393 |

| 17 | $404 |

| 18 | $417 |

Rates are calculated using the federal age rating ratios, starting with the national average rate for age 40.

States with different methods for age-based health insurance rates

A few states set their own guidelines when it comes to health insurance rates. If you live in one of these states, or in Washington, D.C., your age will have a different impact on your health insurance rate:

- Alabama

- Massachusetts

- Minnesota

- Mississippi

- New York

- Oregon

- Utah

- Vermont

States that don't use age for health insurance rates

New York and Vermont don't allow health insurance companies to use your age when setting your rate. This usually means that younger people pay higher rates compared to other states, while older people pay lower rates. And although your age doesn't change your rate, other factors can, including the plan tier you buy and what company you choose.

States that give young people lower rates

In Alabama, Minnesota, Mississippi and Oregon, health insurance rates don't start increasing with age until you reach 21. At that point, rates follow the federal guidelines. But for people under 21, the rates are consistent and different from the federal rules.

In Alabama, Mississippi and Oregon, companies charge everyone between birth and age 20 a rate that is 63.5% of the base rate. In Minnesota, people under age 21 pay 89% of the base rate.

Other state rating systems for age

Massachusetts, Utah and Washington, D.C., have their own unique ways of using age to set health insurance costs. In these areas, some ages are charged more than the federal guidelines, while some are charged less.

- Massachusetts: People under 21 pay about 75% of the base rate. Between ages 21 and 24, you pay about 18% more than the base rate. Then, until you turn 49, your rates gradually increase each year, but you'll still pay more than the federal guideline rate. At age 49, though, you'll start paying less than you would in other states.

- Utah: You'll pay about 79% of the base rate until you turn 21, but then your rate starts increasing faster than it would in other states. By the time you reach 59, you'll be paying three times as much as a 21-year-old. In other states, you don't hit that point until you turn 64.

- Washington, D.C.: Age impacts your rate less than it does in other states. Your rate still increases with age, but it's a smaller and more gradual change.

Health insurance options if you are under 26 years old

If you are under 26 years old and don't have coverage through your job, you have a few different options for health insurance.

- Stay on your parents' policy: In most states, you can stay on your parents' or guardians' health insurance plan until you are 26. Some states, including Georgia, New York and South Carolina, let you stay on your family's plan longer if you meet certain requirements.

- Buy a marketplace policy: You can also choose to buy a policy from HealthCare.gov or your state's marketplace website. These plans usually cost more than staying on a parent's policy or getting Medicaid. But they are a good option if you need coverage for yourself and you don't have a plan through your job.

- See if you qualify for Medicaid: Depending on your income, you may qualify for Medicaid. In most states, you have to make less than around $20,000 as a single person or $27,000 as a couple.

Health insurance options if you are 65 or older

If you're 65 or older, Medicare is usually your best option for health insurance coverage.

If you get Social Security benefits and are 65 or older, you are generally enrolled in Original Medicare, which is Parts A and B, automatically. Most people pay nothing for Medicare Part A and pay $174.70 per month for Part B in 2024.

Once you're on Medicare, you might choose to enroll in a Medigap or Medicare Advantage plan to help with costs not fully paid by Medicare. While some Medigap rates are based on age, Medicare Advantage plans do not count age as a rating factor.

Frequently asked questions

Does age affect my health insurance rates?

Yes, age affects your health insurance rates in most states. The average cost of health insurance is higher for older people since they typically need more medical services. But insurance companies have to follow state and federal laws about age-based rates. Someone who is 64 or older can't be charged more than three times what a 21-year-old pays, for example.

Does my state use age to set health insurance rates?

Do employers determine health plan rates by age?

It depends on the size of your employer. Large employers don't usually use age to rate your policy, although they are allowed to in some circumstances. Small employers, those with 50 or fewer employees, are allowed to use your age to rate your policy. But they do have to follow federal guidelines on how much they charge.

Methodology

ValuePenguin used Centers for Medicare & Medicaid Services (CMS) public use files (PUFs) and age rating information to calculate average rates for various ages. All rates are for Silver plans.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.