Best and Cheapest Home Insurance Companies in Arizona (2024)

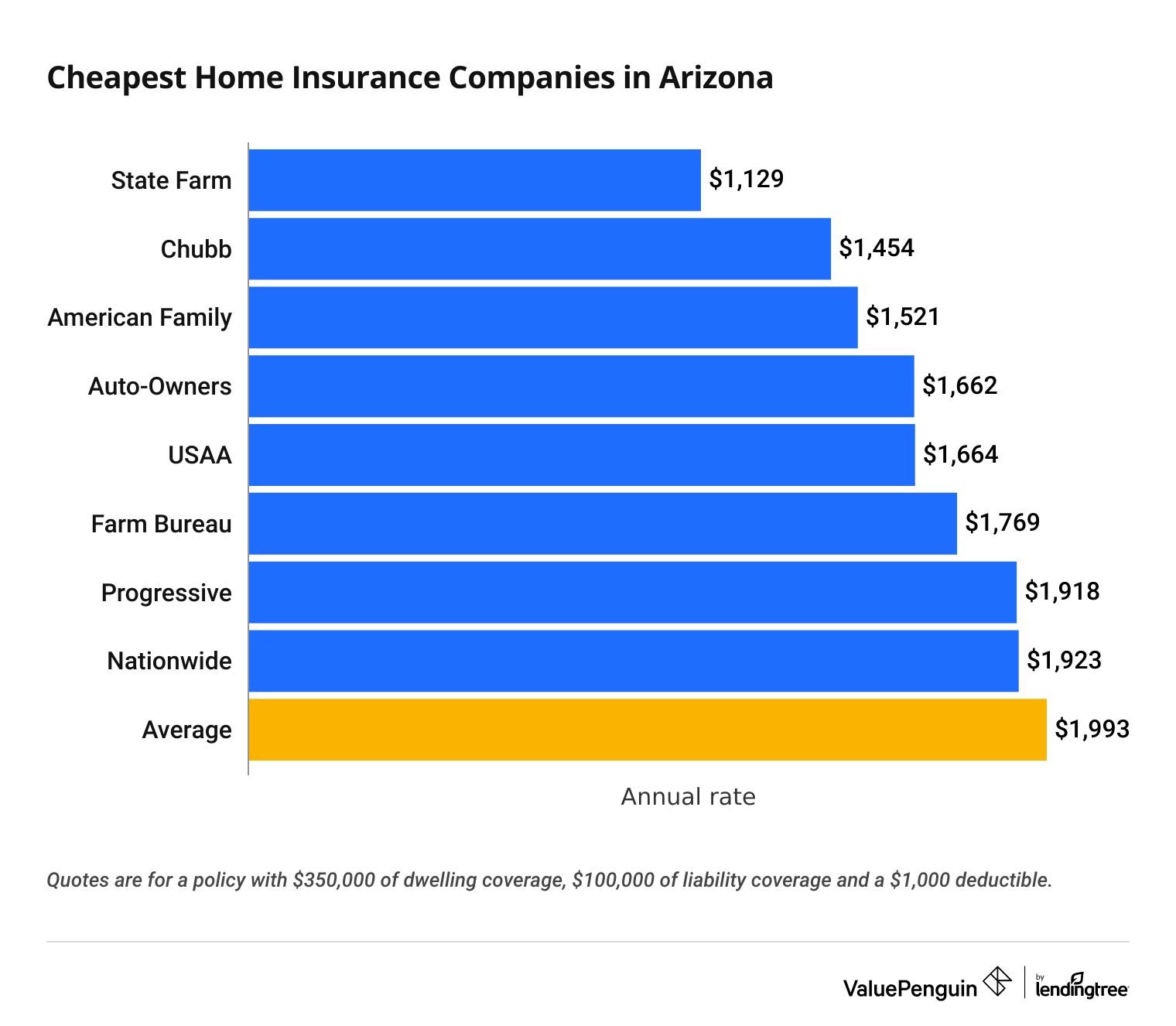

State Farm has the cheapest home insurance in Arizona, at $1,129 per year on average.

Compare Home Insurance Quotes in Arizona

Best Cheap Home Insurance in AZ

ValuePenguin collected thousands of quotes across hundreds of ZIP codes from Arizona's top home insurance companies.

Our experts compared cost, customer service, reliability and coverage benefits to find the best insurance companies in AZ.

Cheapest home insurance quotes in AZ

State Farm has the cheapest home insurance rates in Arizona.

A policy with $350,000 of dwelling coverage from State Farm costs $1,129 per year. That's $864 per year cheaper than the state average of $1,993 per year.

Compare Home Insurance Quotes in Arizona

State Farm is also the cheapest company for people who need more coverage. A State Farm policy with $500,000 of dwelling coverage costs $1,499 per year. That's 43% less than the Arizona average.

Best cheap homeowners insurance in AZ by dwelling coverage amount

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $794 | ||

| Chubb | $979 | ||

| Auto-Owners | $1,114 | ||

| American Family | $1,217 | ||

| USAA | $1,221 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $794 | ||

| Chubb | $979 | ||

| Auto-Owners | $1,114 | ||

| American Family | $1,217 | ||

| USAA | $1,221 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,129 | ||

| Chubb | $1,454 | ||

| American Family | $1,521 | ||

| Auto-Owners | $1,662 | ||

| USAA | $1,664 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,499 | ||

| American Family | $1,876 | ||

| Chubb | $1,960 | ||

| USAA | $2,043 | ||

| Farm Bureau | $2,153 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $2,603 | ||

| American Family | $2,920 | ||

| USAA | $3,087 | ||

| Chubb | $3,396 | ||

| Farm Bureau | $3,831 | ||

What home insurance do I need in AZ?

Wildfires are common in the Arizona desert, so look for a policy that includes wildfire coverage.

Most basic home insurance policies cover wildfire damage in Arizona. However, your insurance company may exclude wildfire coverage if your home is in a high-risk area.

If your insurance doesn't cover wildfire damage, you should consider buying a separate fire insurance policy.

Best home insurance in Arizona for most people: State Farm

-

Editor's rating

- Cost: $1,129/yr

State Farm has reliable customer service and the cheapest rates for many people.

Pros:

-

Cheapest quotes in AZ

-

Dependable service

-

Cheap auto rates if you bundle

-

Lots of local agents

Cons:

-

Few coverage options and discounts

-

May need an agent to buy a policy

Home insurance from State Farm costs 43% to 45% less than the overall state average in Arizona.

You can depend on State Farm to help fix your home quickly after an accident. It earned above-average scores on J.D. Power's customer satisfaction and claims satisfaction surveys. State Farm also gets fewer complaints than other major insurance companies, according to the National Association of Insurance Commissioners (NAIC). That makes State Farm a safe choice for most homeowners.

In addition, State Farm is an excellent choice for Arizona homeowners who want to bundle their home and auto insurance. It typically has some of the cheapest car insurance rates in AZ, and you'll get an extra discount for having two policies with State Farm.

Although State Farm doesn't offer many coverage upgrades, a policy comes with enough protection for most people.

Best Arizona homeowners insurance for extra coverage: Auto-Owners

-

Editor's rating

- Cost: $1,662/yr

Auto-Owners is the best home insurance company for Arizona homeowners who need extra protection.

Pros:

-

Low-cost home insurance

-

Lots of coverage add-ons and discounts

-

Numerous discounts

-

Reliable customer service

Cons:

-

No online quotes

Homeowners insurance from Auto-Owners costs 2% to 21% less than the Arizona average.

Although Auto-Owners isn't the cheapest option in AZ, it offers many discounts to lower your rates.

For example, you can save by getting a quote before your current policy ends, choosing online statements and paying your yearly bill up front.

In addition to basic protection for your home, Auto-Owners offers lots of upgrades that you can pay extra to add to your policy. For example, Arizona homeowners may be able to get inland flood coverage from Auto-Owners. That could be helpful if you live near a river basin or wash.

Arizona homeowners can also add:

- Equipment breakdown coverage

- Guaranteed replacement cost

- Identity theft coverage

- Ordinance or law coverage

- Special personal property

- Water backup coverage

Auto-Owners is one of the best insurance companies in Arizona for customer service. If you need to file a claim, you'll contact your local agent directly. This makes the claims process faster and easier. It's one reason Auto-Owners gets 67% fewer complaints than similar companies, according to the NAIC.

Best AZ homeowners insurance for luxury homes: Chubb

-

Editor's rating

- Cost: $1,960/yr

The extra coverage included in Chubb's standard policy makes it a great choice for homeowners with a high net worth.

Pros:

-

Basic policy includes extra coverage

-

Very few customer complaints

-

Extra protection against wildfires

Cons:

-

No online quotes

-

Not the cheapest option

-

May not cover less expensive homes

Chubb is the best Arizona home insurance company for expensive homes. That's because Chubb tailors its coverage to homeowners with a high net worth.

Chubb's standard homeowners insurance policy comes with unique benefits.

This includes a home appraisal and risk consulting to help prevent theft and fires. A basic policy from Chubb also pays to repair or rebuild your home, even if the costs exceed your policy limit.

Homeowners in Arizona who worry about wildfires can take advantage of Chubb's Wildfire Defense Services (WDS) program. WDS includes a professional assessment of your home to help prevent wildfire damage. You'll also have access to private fire professionals if a wildfire threatens your property. This is free for Chubb home insurance customers.

Chubb also has excellent customer service reviews in Arizona. It has 89% fewer complaints than similar insurance companies, according to the NAIC. That means you can trust Chubb to take good care of you in an emergency.

However, all of these extras come at a cost. A Chubb home insurance policy with $500,000 of coverage costs around $1,960 per year and $1 million of coverage costs $3,396 per year. While that's between 26% and 28% cheaper than the state average, it's quite a bit more expensive than State Farm.

Best AZ home insurance for military families: USAA

-

Editor's rating

- Cost: $1,664/yr

USAA offers affordable rates and extra protection to Arizona homeowners with military ties.

Pros:

-

Exceptional customer service

-

Basic policy includes coverage perks

-

Military-specific benefits

Cons:

-

Only available to military members and family

-

Few discounts

-

Not the cheapest choice

Arizona homeowners with ties to the military can get excellent coverage through USAA.

Standard home insurance from USAA includes replacement cost coverage for your home and belongings. So, if a fire ruins your 6-year-old couch, USAA will pay for a brand-new replacement. Most companies charge extra for this coverage.

Home insurance from USAA also comes with unique military benefits. This includes a deductible waiver for your uniform while on active duty and personal property protection that extends to war zones.

USAA is known for having some of the best customer service in the insurance industry.

In Arizona, USAA gets 64% fewer complaints than other major insurance companies, according to the NAIC. It also earned the highest score on J.D. Power's customer satisfaction survey. That means you can count on USAA to fix your home or replace your stuff quickly after an accident.

However, one of the main drawbacks of USAA is that it is only available to military members, veterans or their families. So, most civilians can't get USAA homeowners insurance.

Average home insurance cost in Arizona

The average cost of homeowners insurance in Arizona is $1,993 per year.

That's 7% cheaper than the national average of $2,151 per year.

Average cost of home insurance in AZ by dwelling coverage amount

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,403 |

| $350,000 | $1,993 |

| $500,000 | $2,634 |

| $1,000,000 | $4,748 |

Homeowners insurance in Arizona is more expensive than in some of its neighboring states. This includes California, where a policy costs around $1,575 per year, and Nevada, where coverage costs $1,350 per year.

Homeowners insurance quotes in Arizona by city

The cheapest town in Arizona for home insurance is San Luis, a small town in Yuma County along the Mexico border.

A policy with $350,000 of dwelling coverage costs $1,646 per year in San Luis, on average.

The most expensive town for home insurance is Forest Lakes, a small community near the Mogollon Rim, where coverage costs $2,689 per year. This could be because of the high risk of wildfires and property crime in Forest Lakes.

Cost of AZ home insurance by city

City | Annual rate | % from avg. |

|---|---|---|

| Aguila | $1,802 | -10% |

| Ajo | $1,795 | -10% |

| Ak-Chin Village | $1,972 | -1% |

| Alpine | $2,113 | 6% |

| Amado | $1,824 | -8% |

Rates are for a policy with $350,000 of dwelling coverage.

In the largest city in Arizona, Phoenix, home insurance costs an average of $2,276. That's 14% above the state average. Home insurance in Tucson, the second-largest city, is 9% cheaper than the state average.

Best-rated Arizona home insurance companies

USAA has the best customer service for home insurance in Arizona.

USAA earned top marks from our editors for combining cheap quotes, good coverage options and highly rated customer support. However, USAA is only available to military members, veterans and their families.

Auto-Owners, Farm Bureau and State Farm are the best insurance companies in Arizona for homeowners who don't qualify for USAA.

Arizona home insurance company reviews

Company |

Rating

|

Complaints

|

|---|---|---|

| USAA | Low | |

| Auto-Owners | Low | |

| Farm Bureau | Low | |

| State Farm | Average | |

| Chubb | Low |

When shopping for the best homeowners insurance in Arizona, it's important to consider customer service reviews along with price.

Excellent customer service will make your life much easier if you need to fix or replace your home or belongings after damage. On the other hand, poor service could make it take longer to fix your home and replace your stuff. Or you could end up spending more money on repairs.

What home insurance do I need in Arizona?

Wildfires pose the greatest natural risk for Arizona homeowners, so it's important to have a policy that covers wildfire damage.

Flash floods, hailstorms and lightning are also common in parts of Arizona.

Does AZ home insurance cover wildfires?

Most basic homeowners insurance policies pay to fix fire and smoke damage.

However, if your home is in an area with a big risk of wildfire damage, your insurance company may exclude wildfire coverage from your policy. In that case, you should buy a separate fire insurance policy.

The five Arizona counties with the most homes in high-risk wildfire areas are:

- Gila

- Navajo

- Greenlee

- Apache

- Coconino

While Arizona doesn't have as many wildfires as California, they're still a major threat, especially for homes in dry areas near brush and undeveloped deserts.

Over the past five years, wildfires caused $92 million of property damage across the state.

Five percent of buildings in Arizona are considered high risk for wildfire damage, according to Verisk Wildfire Risk Analytics. And 26% are at a low to moderate risk of damage.

Does home insurance in AZ cover flooding?

Standard home insurance does not cover flood damage. Parts of Arizona are at risk for flash flooding with heavy rainfall, especially places near a river or wash.

From 2014 to 2018, 4 in 10 flood claims filed came from homeowners outside of high-risk areas according to the Federal Emergency Management Agency (FEMA). And just one inch of floodwater in your home can cause up to $25,000 of damage.

If you live in an area where a flood would cause major damage to your property, you should consider buying a separate flood insurance policy.

How to get cheaper home insurance in Arizona

There are three main ways to get cheaper home insurance in Arizona: compare quotes, qualify for discounts and change your coverage.

Comparing rates from multiple companies is the easiest way to lower your home insurance payments.

There's a difference of $2,802 per year between Arizona's cheapest and most expensive home insurance companies. That's why it's important to shop around for quotes every year or two.

Most home insurance companies offer at least a few discounts to help you save on home insurance.

You'll typically get the largest discount for bundling your home insurance with a cheap auto insurance policy in Arizona. Some companies also offer discounts for military members, government employees or retirees.

You can usually lower your home insurance rates by raising your deductible or lowering your coverage limits.

A higher deductible means the insurance company will pay you less money to fix your damaged home. It's important to choose a deductible you can easily pay in an emergency.

You can also lower your coverage limits and get rid of any coverage extras you may not need. However, make sure your limits are high enough to cover the cost of rebuilding your home and replacing your belongings if you have a major accident.

Frequently asked questions

How much is homeowners insurance in Arizona?

The average cost of homeowners insurance in Arizona is $1,993 per year. That makes the average monthly rate around $166 per month. This rate is slightly cheaper than the national average cost of home insurance, $2,151.

What is the cheapest home insurance in Arizona?

State Farm offers the most affordable rate for Arizona homeowners, at around $94 per month. That's $72 per month cheaper than the state average of $166.

Is homeowners insurance required in AZ?

The state of Arizona doesn't require homeowners insurance. However, you'll typically need a policy to get a mortgage. That's because your mortgage company wants to ensure you can afford to fix your home if there's ever serious damage.

What is the best home and auto insurance bundle in AZ?

State Farm has the best home and auto insurance bundle in Arizona. It has the cheapest home insurance rates in the state along with the most affordable full coverage car insurance quotes. State Farm has a reputation for dependable customer service. So you can count on a quick and easy claims process if you ever have an accident or damage to your home.

How much is home insurance in Scottsdale, AZ?

Homeowners insurance in Scottsdale costs an average of $2,155 per year for a policy with $350,000 of dwelling coverage. That's 8% more than the Arizona state average but 5% less than neighboring Phoenix.

Methodology

To find the best homeowners insurance in Arizona, ValuePenguin collected quotes from the top companies across every residential ZIP code in the state. Rates are for a 45-year-old married man with no prior insurance claims.

Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. Quadrant's rates were publicly sourced from insurer filings and should only be used for comparative purposes.

Home insurance ratings are based on complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey, and ValuePenguin's ratings.

Wildfire statistics are from the Arizona Verisk Wildfire State Risk Report.

Flood damage statistics are from the Federal Emergency Management Agency (FEMA).

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.