Best and Cheapest Home Insurance Companies in Indiana for 2024

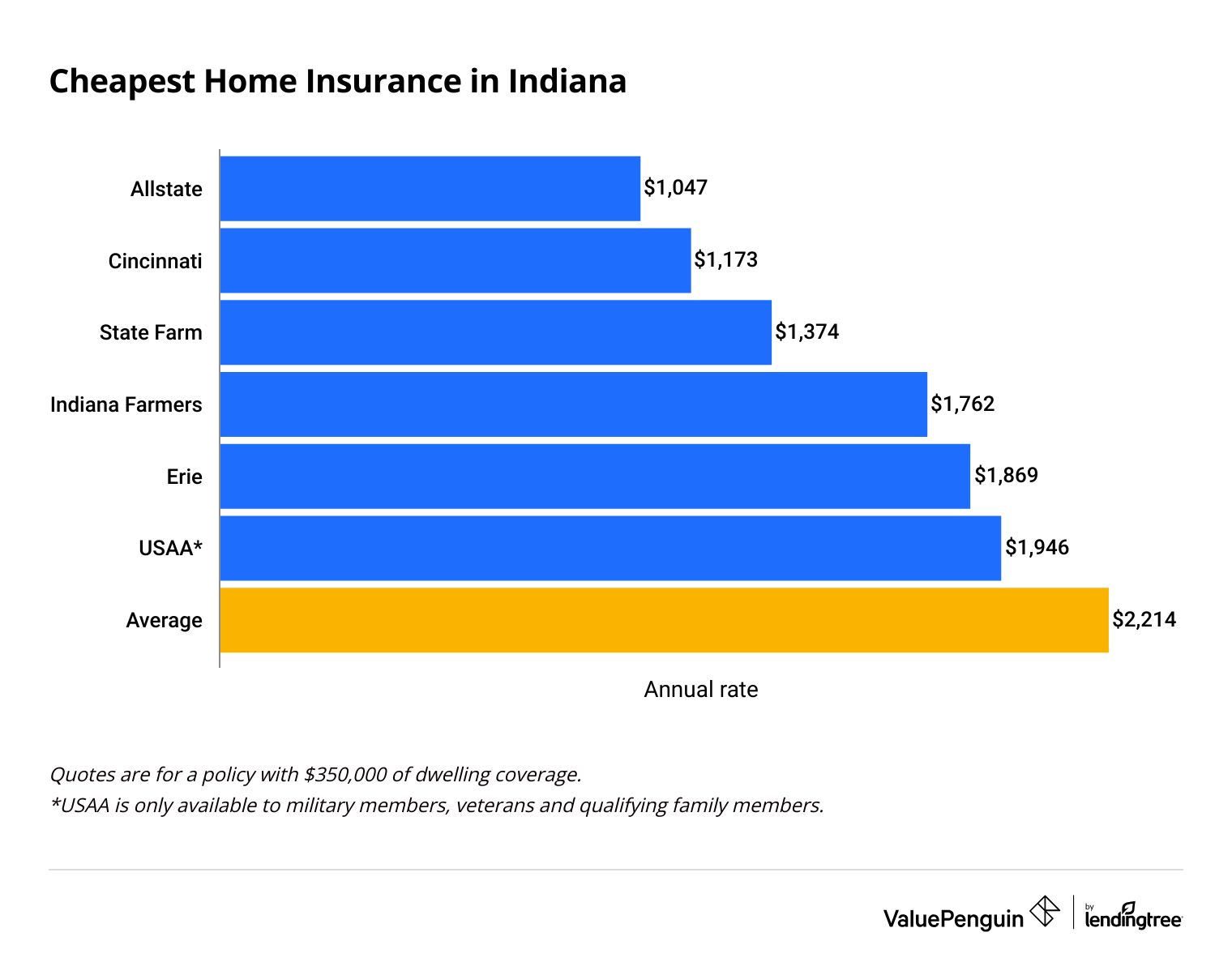

Allstate has the cheapest home insurance in Indiana. A policy costs $1,047 per year, which is almost $1,100 cheaper than the state average.

Compare Home Insurance Quotes in Indiana

Best Cheap Home Insurance in Indiana

ValuePenguin gathered thousands of quotes for Indiana home insurance to find the best and cheapest options for Hoosier homeowners. Our experts reviewed each company's average rates, customer satisfaction, third-party ratings, coverage options, discounts and more. Full methodology.

Cheapest homeowners insurance companies in Indiana

Allstate has the cheapest rates for policies with $350,000 or more in dwelling coverage.

But for less expensive homes, Cincinnati Insurance is a less expensive choice.

Compare Home Insurance Quotes from Companies in Indiana

But you should consider more than cost when you're buying home insurance. It's sometimes worth paying more if it means getting better coverage or customer service.

Cheap home insurance in Indiana

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Cincinnati | $792 | ||

| Allstate | $821 | ||

| State Farm | $1,037 | ||

| Indiana Farmers Insurance | $1,129 | ||

| Erie | $1,188 | ||

Average annual rates for $200,000 in dwelling coverage.

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Cincinnati | $792 | ||

| Allstate | $821 | ||

| State Farm | $1,037 | ||

| Indiana Farmers Insurance | $1,129 | ||

| Erie | $1,188 | ||

Average annual rates for $200,000 in dwelling coverage.

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $1,047 | ||

| Cincinnati | $1,173 | ||

| State Farm | $1,374 | ||

| Indiana Farmers Insurance | $1,762 | ||

| Erie | $1,869 | ||

Average annual rates for $350,000 in dwelling coverage.

$500,000

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $1,306 | ||

| Cincinnati | $1,671 | ||

| State Farm | $1,750 | ||

| Indiana Farmers Insurance | $2,442 | ||

| USAA | $2,453 | ||

Average annual rates for $500,000 in dwelling coverage.

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $2,267 | ||

| State Farm | $2,762 | ||

| Cincinnati | $3,077 | ||

| Progressive | $3,329 | ||

| USAA | $3,905 | ||

Average annual rates for $1,000,000 in dwelling coverage.

Severe weather in Indiana

Indiana is no stranger to high winds, tornadoes, heavy rain and freezing temperatures. Most home insurance policies cover damage caused by weather. But it's a good idea to make sure your home insurance covers the common types of damage in Indiana.

Best home insurance in Indiana for most people: State Farm

-

Editor's rating

- Cost: $1,374/yr

State Farm's rates and service make it the best for most IN homeowners.

Pros:

-

Cheap rates

-

Local agents

-

Cheap auto coverage for bundling

Cons:

-

Fewer discounts than some competitors

-

Not as many add-on coverage options

State Farm has agents in 169 cities in Indiana. It's a great choice if you want to have a local agent to help you with your home insurance. While State Farm's rates aren't the cheapest in the state, they are lower than average, no matter how much coverage you need.

But State Farm doesn't have as many discounts or add-on coverage options as some other companies. If you want to personalize your coverage, it might not be the best choice.

State Farm is also great if you want to bundle your auto and home insurance together. The company has cheap car insurance rates in Indiana. Plus, bundling can also lower your home insurance rates.

Best home insurance in Indiana for customer service: Erie

-

Editor's rating

- Cost: $1,869/yr

Erie is a good choice if customer service is your biggest priority.

Pros:

-

Excellent customer satisfaction

-

Cheap rates

-

Policies include some extra protections

Cons:

-

No online quoting available

-

Mobile app isn't well rated

Erie has some of the best customer satisfaction in Indiana. The company only has half the number of complaints about its home insurance when compared with the average for a company its size, according to the National Association of Insurance Commissioners (NAIC).

Erie's local agents aren't quite as widespread as State Farm's. But it has offices in 129 cities, so there's a good chance there's an agent near you. However, Erie's digital tools aren't as good as those at some larger home insurance companies.

Best home insurance in Indiana for cheap rates: Allstate

-

Editor's rating

- Cost: $1,047/yr

Allstate has the cheapest home insurance in Indiana for most homes.

Pros:

-

Cheap rates for most homes

-

Numerous discounts

-

Lots of add-on coverage options

Cons:

-

Poor customer service

-

Bad for bundling, expensive auto rates

Allstate has cheap home insurance rates along with plenty of discounts to lower your costs even more. You might be able to save even more when you switch to Allstate from another company, if you sign up at least seven days before your coverage starts and if you're a new homebuyer.

But Allstate doesn't have good customer service. The NAIC reports that Allstate has 30% more complaints about its home insurance than an average company its size. If you value good service, Allstate isn't the best choice.

Best home insurance in Indiana for high-value homes: Cincinnati

-

Editor's rating

- Cost: $1,671/yr

Cincinnati has policies specifically for homes that cost $1 million or more.

Pros:

-

Special policies for high-value homes

-

Cheap rates

-

Good customer satisfaction

Cons:

-

No online quotes

-

Fewer discounts than some companies

Cincinnati's Executive Capstone policy is designed specifically for houses that need $1 million or more in dwelling coverage. If your home is damaged or destroyed, you'll get the full cost to rebuild it. That includes any unique or custom features your home might have.

And Cincinnati's rates for high-value homes are cheap. A policy with $1 million in dwelling coverage costs $3,077 per year in Indiana. That's 40% less than the state average. Cincinnati also has excellent customer service, which can give you peace of mind during a claim.

Average home insurance cost in Indiana

Homeowners insurance in Indiana costs $2,144 per year for $350,000 in dwelling coverage.

That's the part of your policy that covers the structure of your house, like the roof, siding, walls and flooring. The more coverage you need, the more you'll pay.

Average cost of home insurance in Indiana by dwelling amount

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,474 |

| $350,000 | $2,144 |

| $500,000 | $2,852 |

| $1,000,000 | $5,101 |

It costs more to insure a home in Indiana than in Illinois, Ohio and Michigan. But the average cost of home insurance is cheaper in Indiana than Kentucky, where a $350,000 house costs almost $300 more each year to insure.

Indiana homeowners insurance rates by city

Goshen, in the northern part of the state, has the cheapest home insurance rates in Indiana, at $1,830 per year on average.

Gary, which is in northwestern Indiana near Chicago, has the most expensive home insurance in Indiana. It costs $2,616 per year, on average, to insure a $350,000 home in Gary. That could be because of the city's proximity to Lake Michigan, which raises the chances of storm damage.

And in Indianapolis, home insurance costs an average of $2,421 per year. That's 13% more than the state average.

Indiana home insurance rates by city

City | Annual rate | % from avg. |

|---|---|---|

| Aberdeen | $1,986 | -7% |

| Advance | $2,159 | 1% |

| Akron | $2,031 | -5% |

| Alamo | $2,224 | 4% |

| Albany | $2,123 | -1% |

Rates are for a policy with $350,000 of dwelling coverage.

The best-rated homeowners insurance companies in Indiana

Erie, USAA and Cincinnati are the top-rated home insurance companies in Indiana.

All three companies have a low number of complaints compared to their size, according to the National Association of Insurance Commissioners (NAIC).

Erie and USAA earned high scores in J.D. Power's customer satisfaction survey. However, Cincinnati wasn't included in the study. And keep in mind that USAA is only available to military members, veterans and their families.

Company |

Rating

|

Complaints

|

|---|---|---|

| Erie | Low | |

| USAA | Low | |

| Cincinnati | Low | |

| Farm Bureau | Low | |

| State Farm | Average |

ValuePenguin's insurance experts also reviewed each company's average rates, coverage options and discounts. All three companies got a high rating.

Customer service is an important part of your experience with home insurance. Fast and efficient service during claims especially can make an already stressful situation easier to deal with.

What kind of home insurance do I need in Indiana?

Strong winds, heavy rains and cold temperatures are all common causes of damage in Indiana.

Knowing what is likely to damage your home can help you build your insurance policy with the coverage you'll need.

Does home insurance in Indiana cover wind?

Home insurance policies almost always cover damage caused by wind. Indiana can get windy, especially in the spring, when strong thunderstorms and tornadoes form.

Even though wind damage is covered, it's always best to avoid damage if you can. To lessen the risk of wind damage, you can:

- Remove branches hanging over your house.

- Secure loose items, like patio furniture, before a storm.

- Get your roof inspected regularly.

If you lose power because of high winds, your policy might cover the cost of spoiled food in your fridge and freezer. Some policies include this coverage automatically, and sometimes you have to buy it as an add-on. Check your policy or talk with your agent to see if you have coverage.

Does Indiana home insurance cover snow and ice?

Snow and ice can cause damage to your home in several ways. Some of them are covered, while others usually aren't.

- Frozen and burst pipes: Home insurance typically covers the water damage caused by frozen and burst pipes. Cold temperatures can cause pipes in your home's outside walls to freeze and expand, which cracks the pipe. When the pipes thaw, the water can leak out of the crack and cause damage.

- Breaking and falling trees: If ice and snow build up on a tree or branch near your home, it could fall and damage your house. Almost all home insurance policies would also cover trees or branches that fell on your home.

- Roof damage caused by weight: Ice and snow are heavy, and as they pile up on your roof, the weight can cause damage. Luckily, almost all types of home insurance cover this damage.

- Ice dams: These happen when the heat of your home melts the bottom layer of snow on your roof. Since the ice and snow near your gutters are still frozen, the melted water gets trapped and can't run off your roof. Instead, it can seep back into your home and cause water damage. Home insurance usually covers the damage to your roof and walls from ice dams.

Snow is common in most parts of the Hoosier state. Because of its location near Lake Michigan, northern Indiana often gets lake-effect snow, which is particularly heavy and wet. This type of snow can cause damage to your roof as it piles up.

However, your insurance company might not pay a claim if the damage is caused by a lack of maintenance. For example, if you had a pipe freeze and burst last year but didn't fix it correctly, it could burst again. Home insurance probably wouldn't pay if the same pipe caused more damage.

Does Indiana home insurance cover flooding?

Home insurance does not cover flood damage. To have insurance coverage for flood damage, you have to buy a flood insurance policy.

Many parts of Indiana can sometimes flood, especially near the state's many lakes and rivers. In fact, nearly every county has been affected by a federally declared flood disaster at some point since 1953.

You can buy flood insurance policies either through the National Flood Insurance Program (NFIP) or through a private insurance company. To get the best flood insurance, compare quotes from the NFIP to a few different private insurance companies.

How to save on home insurance in Indiana

The best way to get cheap home insurance in Indiana is to shop around and compare quotes.

That way, you can see what company has the cheapest rates for your specific home and coverage needs. You can also take some other steps to get a cheap policy.

- Update your roof: Your roof is your home's first line of defense against wind, rain, snow and more. Not only will an updated roof lessen the chance of damage, but it'll get you a discount with most insurance companies.

- Install water sensors: These sensors alert you if water is overflowing or leaking into an area where it shouldn't be. Some insurance companies will give you a discount for water sensors, especially in basements. Water damage in basements is common in Indiana. Preventing or minimizing it can save you and the insurance company money.

- Take care of your home: A home that is well taken care of is less likely to be damaged. That means you're less likely to file a claim, which helps keep your rates down over time. Indiana's weather can be hard on homes, so inspecting your home often and keeping up with maintenance is important.

Frequently asked questions

How much is homeowners insurance in Indiana?

Home insurance in Indiana costs $2,144 per year for a house with $350,000 in dwelling coverage. Your cost will depend on where you live, how much coverage you need and what company you choose.

How much is home insurance in Indianapolis?

A $350,000 home in Indianapolis costs an average of $2,421 per year to insure. But that's just for the Indianapolis city limits. If you live in Carmel, for example, you'll pay an average of $2,064 per year. And in Fishers, the same house costs $2,079 per year, on average.

Who has the cheapest home insurance in Indiana?

Allstate has the cheapest home insurance in Indiana. A $350,000 house costs $1,047 per year, on average, with Allstate. That's less than half of the state average. Homes that need $500,000 or $1 million in dwelling coverage are also cheapest to insure with Allstate. But if you need less than $350,000 in coverage, consider getting a quote from Cincinnati.

Methodology

ValuePenguin collected home insurance quotes for a 45-year-old married man from 13 home insurance companies in all ZIP codes in Indiana. Our experts used the following coverage limits to get average rates for a variety of home values:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only — your own quotes may be different.

ValuePenguin's home insurance ratings combine complaint numbers from the NAIC, scores from J.D. Power's home insurance customer satisfaction survey and ValuePenguin's own editorial ratings.

Other sources include insurance company websites and the Federal Emergency Management Agency (FEMA).

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.