Best and Cheapest Home Insurance in Massachusetts (2024)

Norfolk & Dedham is the best overall home insurance in Massachusetts because it has satisfied customers and cheap rates of $477 per year.

Compare Home Insurance Quotes in Massachusetts

Best Cheap Home Insurance in Massachusetts

The top home insurance companies in Massachusetts are based on reliability, affordability and coverage benefits. Average rates are based on thousands of quotes across all ZIP codes in Massachusetts.

Rates can change by location. Find out local rates in the average cost of Massachusetts home insurance by city, and learn about these rates in our methodology.

Cheapest home insurance in MA

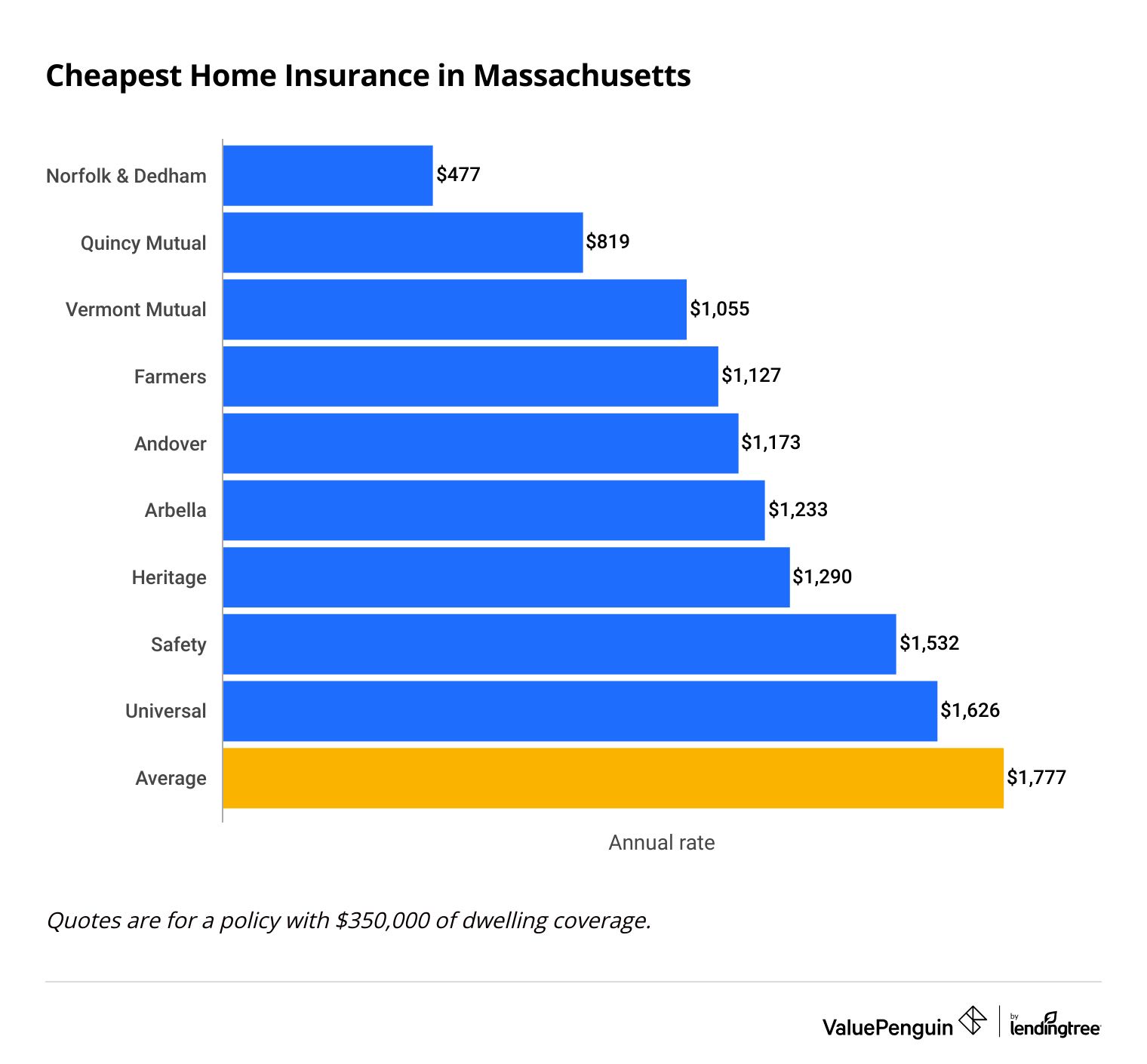

Norfolk & Dedham is the cheapest home insurance company in Massachusetts. At $477 per year, a Norfolk & Dedham policy costs about a quarter of the statewide average of $1,777 per year.

The next-cheapest home insurance company is Quincy Mutual which costs an average of $819 per year.

Compare Home Insurance Quotes in Massachusetts

Norfolk & Dedham has cheap rates across all home values, with an average cost of $419 per month for a home that's worth $200,000 and $1,162 per month for a home that's worth $1 million.

Cheap home insurance companies in MA by dwelling coverage amount

$200,000

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Norfolk & Dedham | $477 | |

| Quincy Mutual | $819 | |

| Vermont Mutual | $1,055 | |

| Farmers | $1,127 | ||

| Andover | $1,173 | |

$500,000

What home insurance do I need in Massachusetts?

Your home insurance will cover most of the common types of home damage in Massachusetts including wind, hail and frozen pipes.

The one exception is flooding. You'll need to get a separate flood insurance policy in Massachusetts. This can help protect you from coastal flooding, river flooding and floods from heavy rain or hurricanes.

Best Massachusetts home insurance for most people: Norfolk & Dedham

-

Editor's rating

- Cost: $477/yr

Norfolk & Dedham has satisfied customers and much lower rates than other companies.

-

Cheap quotes

-

Few customer complaints

-

Helpful local agents

-

Can't get a quote online

-

Few coverage options and discounts

Home insurance from Norfolk & Dedham is about $1,300 per year cheaper than the average rates in Massachusetts.

In addition to having low prices, it also stands out for great customer service. Helpful local agents work with you to manage your policy or filing a claim. This means it can be easiest to get your home repaired after it's damaged.

Norfolk & Dedham is not one of the major national insurance companies. So you'll have fewer options for customizing your policy. But it has strong finances, earning an A from AM Best for financial strength. This can help you feel confident that Norfolk & Dedham can pay its claims after a disaster.

Best-rated home insurance in MA: Arbella

-

Editor's rating

- Cost: $1,233/yr

Arbella has the highest quality home insurance in Massachusetts and gets very few customer complaints.

-

Great for home and auto insurance

-

Satisfied customers

-

MA is one of the few states where it's available

-

Not the absolute cheapest rates

-

Few coverage options and discounts

Massachusetts is one the two states in the country where you can get a policy from Arabella, a top-ranked insurance company.

Its low rate of complaints and satisfied customers means that you can count on Arbella if your home is damaged or if you have to file a claim.

Arabella's home insurance rates aren't the cheapest you can get in Massachusetts. But it offers an excellent set of discounts. For example, you can save 25% by bundling your home and car insurance. And Arabella's low car insurance rates in Massachusetts means that you could lower your overall insurance bills.

Best home insurance for luxury homes: Chubb

-

Editor's rating

- Cost: $3,608/yr for $500,000 in coverage

- $6,310/yr for $1 million in coverage

Chubb has great coverage for high-value homes and concierge-style customer support.

-

Coverage options for expensive homes

-

Personalized customer service

-

Satisfied customers

-

Expensive rates

-

No online quotes

If you have an expensive home or a high net worth, Chubb offers great coverage options for your home and the ability to get high liability limits of up to $100 million. Plus, policies automatically include extras such as extended replacement cost coverage and the option to get a cash payout if your home is destroyed.

Chubb is also one of the most expensive home insurance companies in Massachusetts. So you're paying more to get access to its coverage options and high-quality support.

Chubb isn't a good choice if you want a typical home insurance policy without the extras to protect luxury homes. And in many cases, Chubb won't offer policies unless you have a high-end home.

Best for historical homes: MAPFRE

-

Editor's rating

- Cost: $3,124/yr

MAPFRE has the best home insurance coverage if you care about the craftsmanship of your older home.

-

Unique coverage for home restoration

-

Few complaints

-

Can get a quote online

-

Expensive rates

-

Few discounts

MAPFRE's restorationist package can help pay for the extra costs when a historical home is damaged.

The insurance policy will help restore your home to its original condition using materials and construction that are true to its historical roots. The policy will also cover your costs if the repair means you have to meet new building codes that didn't exist when your home was built.

Rates are expensive. A MAPFRE home insurance policy costs $3,143 per year which is 77% higher than average. This extra cost may be worth it to you if you want to protect the unique character of a historical home.

Average cost of home insurance in Massachusetts

The average cost of homeowners insurance in Massachusetts is $1,777 per year for $350,000 in dwelling coverage.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,366 |

| $350,000 | $1,777 |

| $500,000 | $2,288 |

| $1,000,000 | $4,170 |

Home insurance in Massachusetts is 17% cheaper than the national average which is $2,151 per year for a $350,000 home.

However, other states in New England have even cheaper rates. Home insurance in New Hampshire, Maine and Vermont cost about $900 to $1,000 per year for a $350,000 home.

Where is home insurance cheap in Massachusetts?

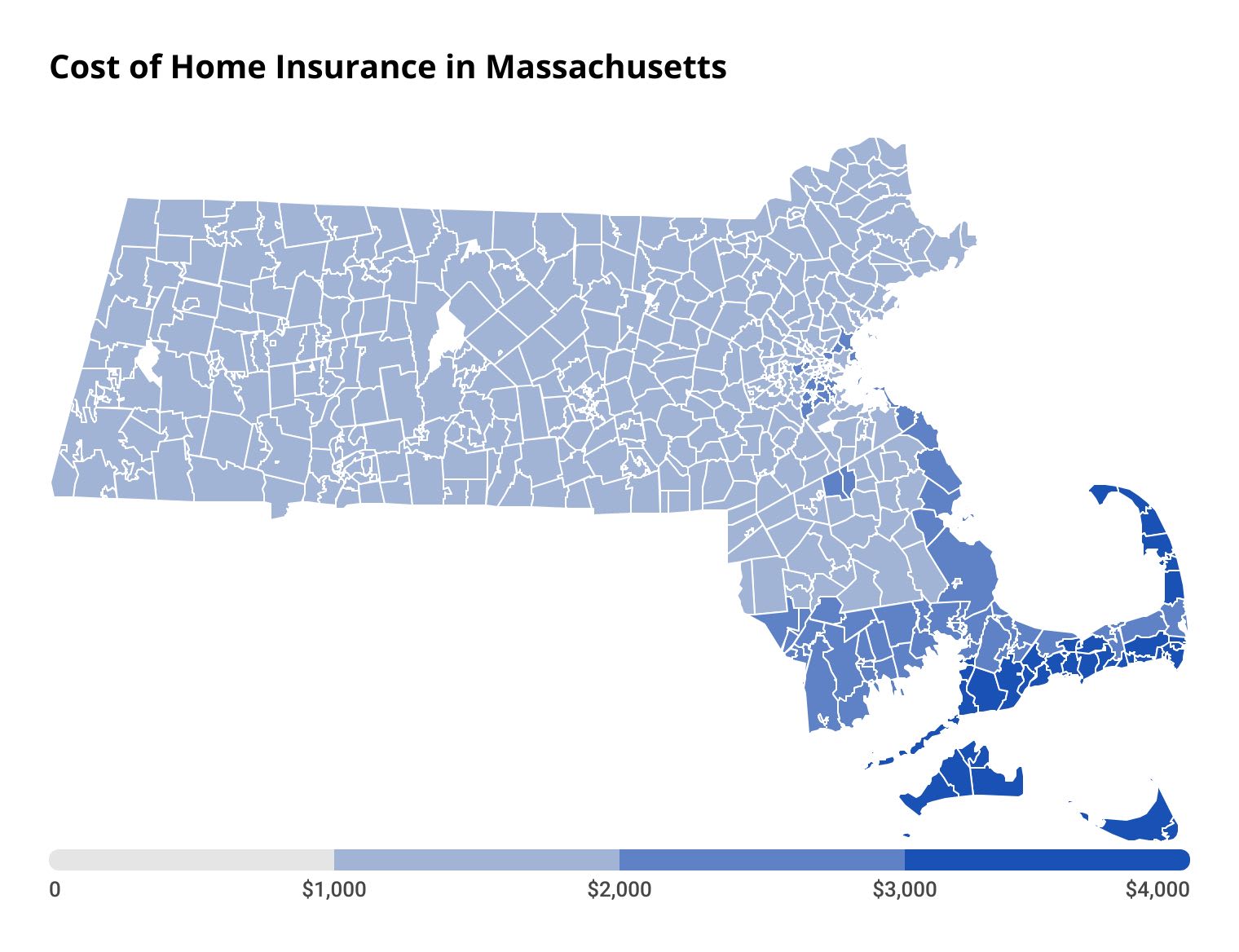

Massachusetts home insurance is cheapest in the Berkshires and most expensive in Cape Cod.

Housatonic, near Great Barrington, is the cheapest city in Massachusetts for home insurance, with average rates of $1,171 per year for $350,000 in dwelling coverage

Chilmark in Martha's Vineyard is the most expensive city in Massachusetts for home insurance. It costs an average of $4,166 per year for $350,000 in coverage. That's more than double the state average. The high rates are likely because it's an expensive area, the coastal storms coming off the Atlantic can cause weather damage, and materials need to be brought to the island by boat.

Massachusetts home insurance rates by city

City | Annual rate | % from avg |

|---|---|---|

| Abington | $1,828 | 3% |

| Accord | $1,912 | 8% |

| Acton | $1,403 | -21% |

| Acushnet | $2,226 | 25% |

| Acushnet Center | $2,193 | 23% |

Rates are for a policy with $350,000 of dwelling coverage.

Best-rated Massachusetts home insurance companies

Arbella is the best-rated home insurance company in Massachusetts.

Arabella's great customer satisfaction and bundling options set it apart from other companies.

Amica is another top-rated home insurance company in MA. Unlike Arabella which is a local company in New England, Amica stands out across the country as one of the best companies for customer service. Its agents are easy to deal with and a claims process that helps you make repairs quickly.

Company |

Rating

|

Complaints

|

|---|---|---|

| Arbella | Low | |

| Amica | Low | |

| Norfolk & Dedham | Low | |

| Quincy Mutual | Average | |

| Vermont Mutual | Low |

USAA is another great home insurance company, but it's only available if you have a connection to the military.

Worst home insurance companies in Massachusetts

Universal has the worst home insurance in Massachusetts because it receives twice as many customer complaints than average.

This means that you're likely to face frustrations if you file a claim or if you call customer service about your policy. Universal also doesn't have cheap rates so it won't help you save money.

When comparing home insurance quotes, remember that it's sometimes worth it to pay more to get home insurance from one of the best companies. That's because good customer support and an easy claims process are very useful when filing a claim after your home is damaged.

What home insurance coverage is important in Massachusetts?

Cold weather damage such as frozen pipes and ice dams can cause widespread and expensive home repairs in Massachusetts.

Home insurance protects you from the cost of cold weather home damage, including frozen pipes and ice damage to your roof.

Older homes are usually more at risk for cold weather damage because poor insulation can cause water pipes to freeze or melting snow can cause ice damage to your roof.

But all homes in MA could have claims related to cold weather. For example, a power outage can mean pipes can freeze even in new homes. Or someone could be injured on icy steps.

Flash flooding and hurricanes can cause some of the worst home damage in Massachusetts.

Water damage can be expensive costing about $25,000 in repairs if you get an inch of water in your home. And Massachusetts homes can be affected by heavy rains and overflowing rivers. Coastal storm surges can also happen when hurricanes travel up the Atlantic coast.

Getting a separate flood insurance policy can help protect you from water damage. Policies are available through the government's National Flood Insurance Program (NFIP) or through private flood insurance plans

If you live in a part of Massachusetts with high crime, you're more likely to have your home vandalized or something stolen.

Your home insurance policy will cover your costs for property crimes and theft. If something is stolen, the claim would be under the personal property part of your home insurance policy. This is especially useful in cities with high rates of property crime including Holyoke and North Adams.

Home insurance coverage also includes vandalism. So if someone breaks your mailbox or spray paints your fence, your insurance will pay for the repairs,

How to save money on Massachusetts home insurance

The best way to save on home insurance is to compare home insurance quotes from multiple companies. By shopping around, you'll find out which company offers you the best deal for your home.

Even cheap home insurance companies are not cheap for everyone. That's because each company uses their own calculations in how they determine rates. Factors like your credit rating, the age of your home, and where you live are all used in the calculations.

Frequently asked questions

What's the best auto and home insurance bundle in Massachusetts?

Arbella has the best bundle of auto and home insurance in Massachusetts. It has great customer service, good discounts and affordable rates for both home and auto insurance.

What's the best home insurance company in Boston?

Norfolk/Dedham and Arbella are the best home insurance companies in Boston. Norfolk and Dedham has cheap rates at $648 per year. Arbella has top-notch customer service. Quincy Mutual and Vermont Mutual are other good options in Boston because they have affordable rates in the city and good ratings.

What's the best home insurance company in Cape Cod?

The best home insurance companies in Cape Cod are Norfolk/Dedham and Arbella. Similarly to the rest of Massachusetts, Arbella has great customer service, and Norfolk and Dedham is cheap, averaging $804 per month for a $350,000 home in Barnstable County. You should also consider Quincy Mutual if you want a local independent agent and Andover if you want options such as boat coverage.

What is the average home insurance cost in Boston?

The average cost of home insurance in Boston is $1,960 per year for $350,000 in coverage. East Boston pays higher rates at an average of $2,153 per year, and South Boston is also high at $2,092 per year. Home insurance is cheap in Cambridge, at an average of $1,477 per year.

Methodology

The average cost of home insurance in Massachusetts is based on quotes from the top companies across every residential ZIP code in the state. Rates are for a 45-year-old married man with no prior insurance claims. Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin used insurance rate data from Quadrant Information Services. Quadrant's rates were publicly sourced from insurer filings and should only be used for comparative purposes.

Home insurance ratings are based on complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey and ValuePenguin's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.