Arbella Insurance Review: Car and Home Insurance

Arbella's prices are affordable, but it's only available in Connecticut and Massachusetts.

Find Cheap Auto Insurance Quotes in Your Area

Arbella is a New England-based insurance company that offers auto and home insurance to people living in Connecticut and Massachusetts.

Car and home insurance quotes from Arbella are affordable, but it isn't the cheapest insurer for most people. The company does offer lots of discounts, though, which may make its rates more competitive.

Pros and cons

Pros

Full coverage car insurance comes with extra protection

Many discounts

Offers lots of discounts

Cons

Typically not the cheapest option

Few home insurance coverage options

Only available in Connecticut and Massachusetts

Arbella Insurance: Our thoughts

Auto insurance takeaway: Arbella's car insurance is a great option for drivers looking for a full-coverage policy because Arbella includes extra coverages for these drivers at no additional cost. While its rates are affordable, Arbella is not the absolute cheapest option. A long list of discounts can help make rates more competitive.

Homeowners insurance takeaway: Arbella is a good option for homeowners in New England looking for basic coverage. Some insurers are cheaper than Arbella, but it offers some sizable discounts for first-time homeowners, people who have a new house and those who bundle their home and auto insurance. There aren't a lot of extra coverage options for homeowners who want to customize their policy, though.

Arbella auto insurance stands out for its extra coverage features, which drivers can add to their standard coverage.

People who have comprehensive and collision coverage get extra perks from Arbella, like new car replacement and enhanced towing coverage, for no additional cost.

The insurer's prices are comparable to its competitors' prices, but Arbella offers up to 13 car insurance discounts and eight home insurance discounts to help lower your rate. Coupled with the company's enhancements for full-coverage car insurance, Arbella is an attractive option for budget-conscious drivers.

Homeowners insurance coverage from Arbella is fairly standard, so while it may provide enough protection, it's not a great option for people looking to customize their policy.

Arbella's customer service has mixed reviews.

Compare Arbella to other top auto insurance companies | |

|---|---|

| Read review | |

| Read review | |

| Read review | |

Although it receives fewer complaints than other insurers based on its size, it scored below average on J.D. Power's auto insurance customer satisfaction survey.

Additionally, Arbella only sells insurance in Connecticut and Massachusetts.

Arbella car insurance

Arbella car insurance quotes

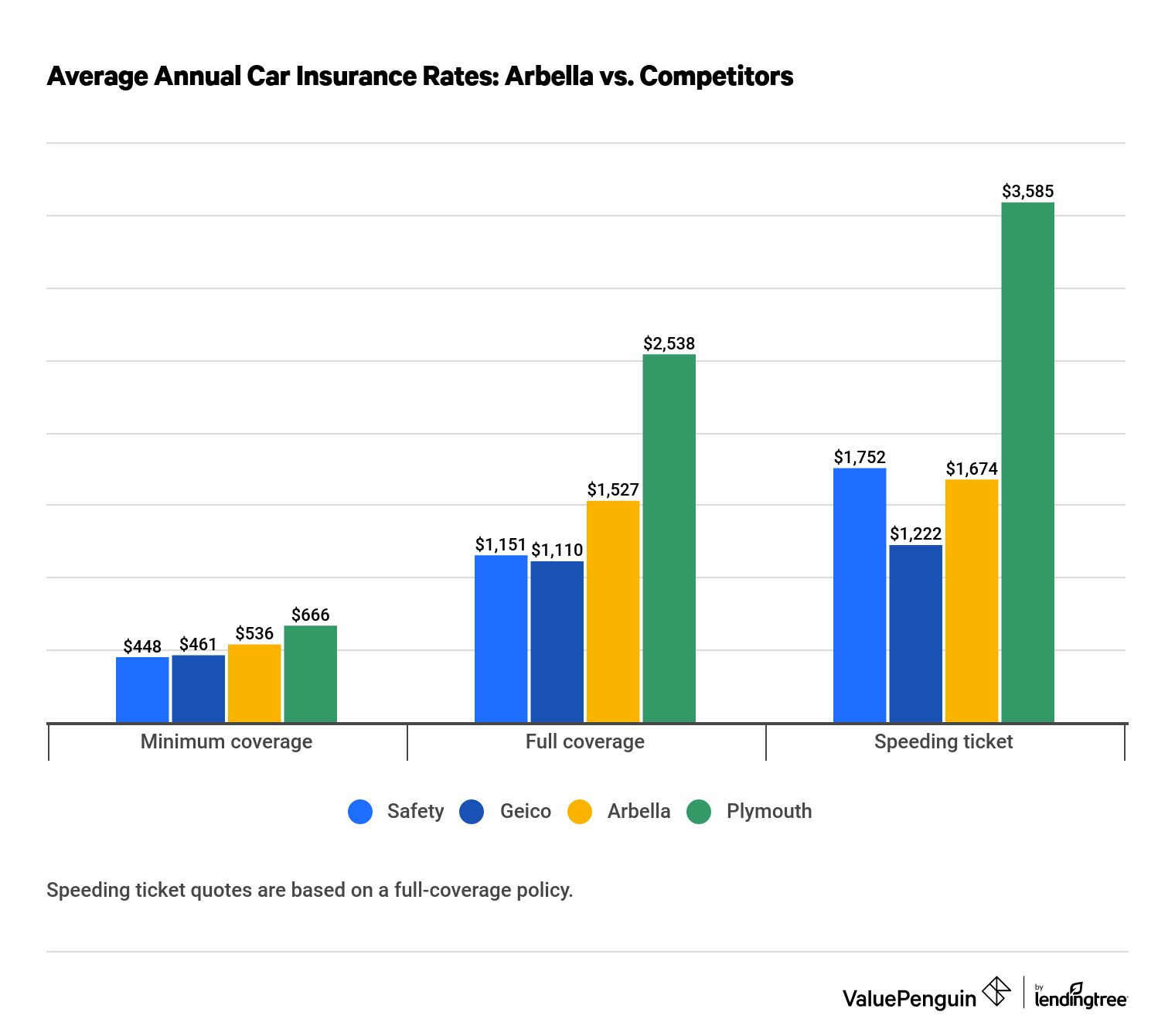

Car insurance from Arbella is affordable for both minimum- and full-coverage policies. A minimum-coverage policy is a few dollars more per year than average — the annual rate is $536.

A full-coverage policy from Arbella is $54 per year cheaper than the average including its competitors. Although Arbella isn't the cheapest option for car insurance, its full-coverage policy includes a handful of extras that you'll pay extra for from other insurance companies.

Find Cheap Auto Insurance Quotes in Your Area

While you can't get a quote online, Arbella's affordable prices could make contacting a local agent worth the time.

Average annual car insurance rates: Arbella vs. competitors

Company | Minimum coverage | Full coverage | Speeding ticket |

|---|---|---|---|

| Safety | $448 | $1,151 | $1,752 |

| Geico | $461 | $1,110 | $1,222 |

| Arbella | $536 | $1,527 | $1,674 |

| Plymouth Rock | $666 | $2,538 | $3,585 |

Arbella auto insurance discounts

Arbella offers policyholders a number of discount opportunities that could result in substantial savings for eligible drivers. Many of Arbella's discounts are easy for most drivers to qualify for. However, the discounts available and the amount you can save vary by state.

Discount | MA | CT |

|---|---|---|

| Anti-theft devices | 36% | 15% |

| Multicar discount | 2% | 25% |

| Multipolicy discount | 13% | 12%* |

| Pay-in-full discount | 6% | 6% |

| Sign-up discount | 12% | 12% |

Multipolicy discount is the percentage off of your auto insurance rate. Drivers receive an additional discount off of their home, renters or condo insurance rate when bundling policies.

Arbella car insurance coverage

Arbella's policies provide good coverage to drivers looking for minimum coverage, but the insurer stands out for the perks included with its full-coverage protection.

The company offers the basic protections required in each state. However, drivers who purchase a full-coverage policy that includes comprehensive and collision coverages get the best deal with Arbella car insurance.

These drivers receive Arbella's customer care package at no additional cost, which includes:

- New vehicle replacement on cars less than a year old

- Enhanced substitute transportation coverage

- Expanded towing and labor coverage

Other extras that are offered by Arbella include:

Coverage | Description | Availability |

|---|---|---|

| Gap coverage | Pays the balance of your car loan or lease in the event your car is totaled in an accident, regardless of its current value. | CT, MA |

| Original equipment manufacturer (OEM) parts | Guarantees that repairs will be made with original manufacturer parts, when available. | CT |

| Disappearing deductible | Reduces your deductible by $100 each year you remain accident-free. The maximum reduction is $500. | MA |

| Accident forgiveness | Protects you from a rate increase after an at-fault accident. | MA |

| Pet protection | Pays up to $500 in vet fees if your pet is in your car during an accident. | MA |

Arbella home insurance

Arbella home insurance quotes

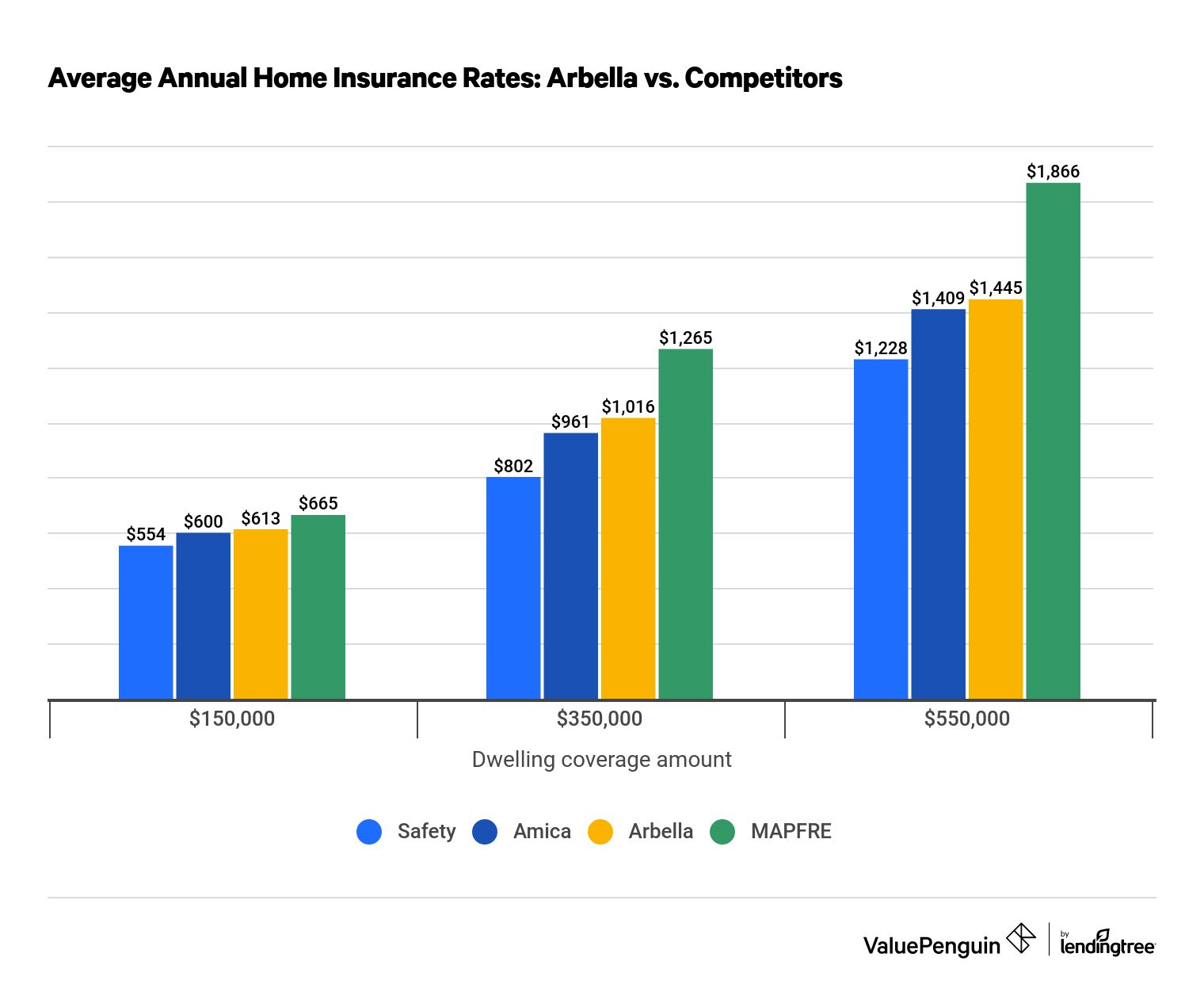

Homeowners insurance rates from Arbella are fairly average. A policy with $150,000 of dwelling coverage from Arbella costs $613 per year, which is $5 more per year than the average including its competitors.

Arbella's rates are more competitive for high-value homes — $550,000 of dwelling coverage costs $1,445 per year, which is $42 cheaper than average.

Find Cheap Homeowners Insurance Quotes in Your Area

Although Arbella isn't the cheapest company we analyzed, home insurance rates can vary widely depending on where you live, so quotes may be more competitive in your area.

Arbella home insurance discounts

Arbella offers a number of homeowners insurance discounts that can help make your rates more affordable. People who bundle their home and auto policies, purchase a new home or are first-time homebuyers can save a substantial amount of money with Arbella.

Discount | MA | CT |

|---|---|---|

| Multipolicy discount | 25% | 22%* |

| New home discount | 20% | 20% |

| Sign-up discount | 7% | 10% |

| Affordable housing workshop discount | 10% | - |

| Energy assessment discount | 5% | - |

Multipolicy discount is the percentage off of your home insurance rate. Homeowners receive an additional discount off of their car insurance rate when bundling policies.

Arbella home insurance coverages

Arbella offers all of the standard home insurance coverages you would expect, including dwelling coverage, personal property coverage, personal liability coverage and loss of use coverage.

In addition, homeowners can purchase:

- Home systems protection coverage, which pays to repair major appliances like a furnace or air conditioning unit if you experience a mechanical breakdown.

- Service line coverage, which pays to repair damage to service lines on your property, like your water main.

- Home cyber protection, which covers you in the event of online fraud, cyber extortion and other cybercrimes.

Arbella Insurance reviews

Arbella Insurance receives mixed reviews for its service.

The insurer gets significantly fewer complaints than expected from its policyholders, according to the National Association of Insurance Commissioners (NAIC). That means Arbella customers are generally satisfied with the service they receive. The company also received an "A" financial stability rating from AM Best, meaning it has an excellent ability to pay claim settlements, even in difficult economic situations.

However, J.D. Power rated the service provided by Arbella lower than average in the New England region, the only place where Arbella sells insurance. Out of 13 companies that J.D. Power surveyed there, Arbella placed 11th.

Contact Arbella

To contact Arbella customer service by phone, policyholders should call

800-272-3552.

Arbella also gives you the option to start the claims process online via its website or the myArbella mobile app. Customers can also use the app to make a payment, view their policy details or contact an agent.

Frequently asked questions

Is Arbella a good insurance company?

Yes, Arbella offers good home and auto insurance. Although its rates are just average, there are a lot of discounts that can help you save money. Arbella also receives fewer customer complaints than other insurers based on its size, which means that people are generally happy with their experience.

Does Arbella allow you to make online payments?

Yes. Even though you have to contact a representative to buy a policy, you can pay your bills online or via the myArbella mobile app.

What is the number for Arbella Mutual Insurance claims service?

Policyholders can start a claim by calling the customer service line at 800-272-3552. You can also begin the process on the company's website or mobile app.

Methodology

To compare car insurance rates, we gathered hundreds of quotes from ZIP codes across the state of Massachusetts. Our sample driver was a 30-year-old single man with a clean driving record and average credit score who drives a 2015 Honda Civic EX. Quotes are based on the following policy coverage limits:

Coverage | Minimum-coverage limit | Full-coverage limit |

|---|---|---|

| Bodily injury liability | $20,000/$40,000 | $50,000/$100,000 |

| Property damage liability | $5,000 | $25,000 |

| Uninsured motorist bodily injury | $20,000/$40,000 | $50,000/$100,000 |

| Underinsured motorist bodily injury | waived | $50,000/$100,000 |

| Personal injury protection | $8,000 | $8,000 |

| Comprehensive and collision deductible | waived | $500 |

Speeding ticket rates were calculated using full-coverage limits.

To compare homeowners insurance rates, we compared quotes from ZIP codes across Massachusetts based on a 45-year-old married man with average credit living in a home built in 1977. We compared quotes with dwelling coverage limits of $150,000, $350,000 and $550,000. Sample policies also included coverages with the following limits:

Coverage | Limit |

|---|---|

| Personal property | 50% of dwelling limit |

| Liability coverage | $100,000 |

| Medical payments coverage | $5,000 |

| Loss of use coverage | 20% of dwelling limit |

| Other structures coverage | 10% of dwelling limit |

| Deductible | $1,000 |

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.