The Best and Cheapest Homeowners Insurance Companies in Nebraska (2024)

State Farm has the best cheap home insurance quotes in Nebraska. You'll pay $2,759 per year for $350,000 of dwelling coverage, on average.

Find Cheap Home Insurance Quotes in Nebraska

Best Cheap Home Insurance in Nebraska

Our experts looked at factors like rate data, coverage, discounts and customer satisfaction scores to find the best home insurance companies in Nebraska.

Average rates were determined by using thousands of home insurance quotes from hundreds of ZIP codes in Nebraska.

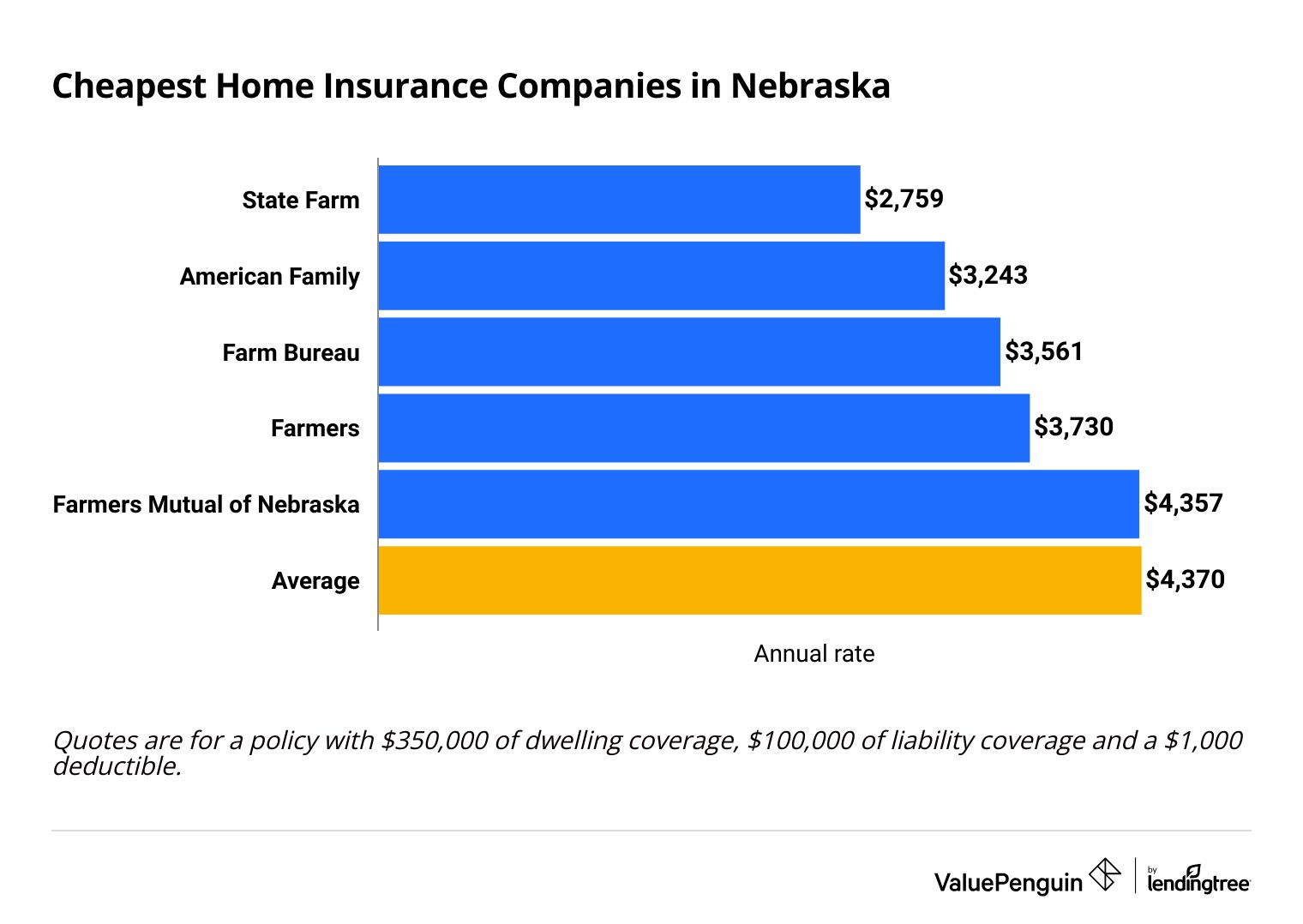

The cheapest home insurance companies in Nebraska

State Farm has the most affordable homeowners insurance in Nebraska. It charges $2,759 per year for $350,000 of coverage to repair your home, called dwelling coverage.

That's $1,611 per year or 37% cheaper than the Nebraska state average of $4,370 per year.

Find Cheap Homeowners Insurance Quotes in Your Area

Nationwide charges more than twice as much as State Farm for the same level of coverage. Comparing quotes can help you save thousands of dollars each year without sacrificing coverage or customer service.

Cheap annual home insurance quotes in NE

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| American Family | $1,990 | ||

| State Farm | $2,021 | ||

| Farmers | $2,408 | ||

| Farmers Mutual of Nebraska | $2,533 | |

| Farm Bureau | $2,676 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| American Family | $1,990 | ||

| State Farm | $2,021 | ||

| Farmers | $2,408 | ||

| Farmers Mutual of Nebraska | $2,533 | |

| Farm Bureau | $2,676 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $2,759 | ||

| American Family | $3,243 | ||

| Farm Bureau | $3,561 | ||

| Farmers | $3,730 | ||

| Farmers Mutual of Nebraska | $4,357 | |

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $3,462 | ||

| American Family | $4,431 | ||

| Farmers | $4,607 | ||

| Farm Bureau | $4,638 | ||

| Allstate | $5,003 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $5,143 | ||

| Allstate | $6,912 | ||

| Farmers | $7,459 | ||

| American Family | $7,924 | ||

| Farm Bureau | $8,049 | ||

Natural disasters to watch out for in Nebraska

Nebraska has some of the most expensive home insurance rates in America in part because it's vulnerable to tornados, flooding and storms. Fortunately, your home insurance policy will usually cover wind damage, hail and snow damage.

However, you may need a separate flood insurance policy, depending on where you live.

Best NE home insurance for most people: State Farm

-

Editor's rating

- Cost: $2,759/yr

State Farm has the cheapest homeowners insurance rates in Nebraska.

Pros:

-

Cheap rates

-

Strong customer service

-

Good bundling discount

Cons:

-

Few extra coverage options and discounts

State Farm offers the cheapest homeowners insurance quotes for Nebraska residents.

A State Farm homeowners policy in Nebraska costs $2,759 per year on average for $350,000 of dwelling coverage. That's $1,611 per year cheaper than the Nebraska state average. State Farm also has the best rates for high-value homes.

State Farm has a strong reputation for customer satisfaction. It gets fewer complaints compared to an average company its size, according to the National Association of Insurance Commissioners (NAIC), an industry group. It also scored above average on customer satisfaction according to a recent J.D. Power survey.

State Farm has a good home auto bundling discount. However, it offers relatively few discounts and coverage add-ons compared to its competitors. Consider American Family if you need a more customizable policy.

Best NE homeowners insurance for customer service: Farm Bureau

-

Editor's rating

- Cost: $3,561/yr

Farm Bureau gets significantly fewer complaints compared to its top competitors in Nebraska.

Pros:

-

Excellent customer service

-

Cheap quotes

-

Good home auto bundling discounts

-

Strong network of local agents

Cons:

-

No online quotes

-

Few coverage extras

-

You need to buy a Farm Bureau membership

Farm Bureau gets 94% fewer complaints than an average company its size. That's the best number for any major home insurance company in Nebraska.

Farm Bureau also offers affordable home insurance quotes. The company charges $3,561 per year for $350,000 of dwelling coverage, on average. That's $809 per year cheaper than the statewide average.

You can't get an online quote through Farm Bureau. Instead, you have to speak to a Farm Bureau agent. That makes comparison shopping more difficult. However, this may work to your advantage if you prefer a personalized buying experience.

You need to buy a Farm Bureau membership before you can get Farm Bureau home insurance. Membership costs are typically between $50 and $55 per year in Nebraska. Memberships come with several benefits, such as discounts for travel, entertainment and farm equipment.

Best NE homeowners insurance for extra coverage and discounts: American Family

-

Editor's rating

- Cost: $3,243/yr

American Family lets you customize your homeowners insurance policy with many extra coverage options.

Pros:

-

Many discounts and extra coverage options

-

Cheap rates

-

Strong customer service

Cons:

-

Expensive for high-value homes

American Family lets you customize your home insurance policy with many coverage extras. These range from standard add-ons like identity theft protection and extra protection for your valuable items to less common coverage options like senior living protection , vacation home protection and matching undamaged siding .

In addition to its many coverage extras, American Family has cheap home insurance quotes. You'll pay $3,243 per month on average for $350,000 of dwelling coverage . That's 26% per year cheaper than the Nebraska state average.

American Family is an expensive choice for high-value homes in Nebraska. While it offers affordable rates for $200,000, $350,000 and $500,000 of dwelling coverage, American Family ranks fourth behind State Farm, Allstate and Farmers for $1 million of coverage.

American Family has a good customer service reputation. It gets significantly fewer complaints than an average company its size, according to the NAIC. American Family also scored above average on a recent J.D. Power survey that measured customer satisfaction among major home insurance companies.

Average cost of home insurance in Nebraska

Nebraska has the second most expensive home insurance rates in the country.

Home insurance in Nebraska costs $4,370 per year on average for $350,000 of dwelling coverage. That's more than twice the $2,151 per year national average. Only Oklahoma has more expensive home insurance rates than Nebraska.

Average cost of home insurance in NE

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $2,961 |

| $350,000 | $4,370 |

| $500,000 | $5,657 |

| $1,000,000 | $8,993 |

Cost of Nebraska home insurance by city

Imperial, a town in West Nebraska, has the most expensive home insurance rates of any city or town in Nebraska, at $5,393 per year on average.

Home insurance in Omaha costs $4,135 per year on average. That's 5% less than the state average. Quotes in Lincoln, the state capital, average $3,856 per year or 12% cheaper than the Nebraska statewide average.

City | Annual rate | % from avg |

|---|---|---|

| Abie | $4,185 | -4% |

| Albion | $4,398 | 1% |

| Alda | $4,584 | 5% |

| Alexandria | $4,364 | 0% |

| Allen | $4,044 | -7% |

Rates are for a policy with $350,000 of dwelling coverage.

The best home insurance companies in Nebraska

State Farm and Farm Bureau offer the best combination of customer service, low costs and quality coverage in Nebraska.

USAA is also a great option if you qualify for coverage. You can only buy a USAA policy if you or a family member are current or former military.

Company |

Rating

|

Complaints

|

|---|---|---|

| State Farm | Average | |

| Farm Bureau | Low | |

| American Family | Low | |

| Farmers Mutual of Nebraska | Average | |

| Allstate | Average |

It's important to choose a home insurance company that has a strong reputation for customer satisfaction. Companies that get more complaints than average tend to have a difficult or slow claims process. You don't want to navigate another headache when your home is under repair.

Natural disasters in Nebraska

Nebraska has some of the highest home insurance rates in the country because it's vulnerable to powerful storms, tornados, hail and blizzards. Fortunately, a standard home insurance policy will cover most damage caused by these natural disasters. However, some companies may have special restrictions for certain hazards.

Because tornados are so common in Nebraska, some companies require a separate deductible for wind damage. So, even if you've met your annual homeowners insurance deductible because of a fire, you'd still have to pay several thousand dollars out of your own pocket before your insurance pays for wind or tornado damage. Similarly, insurance companies may have a separate deductible for hail damage depending on where you live.

Nebraska regularly sees heavy snowfalls during the winter months. Your standard home insurance policy will cover snow-related damages. However, it's important to take standard precautions, such as shutting off your water and insulating your pipes if you plan on being away from home during freezing weather. Otherwise, your company may deny your claim.

Nebraska flood insurance

Nebraska homeowners who live close to a large body of water, such as the Missouri or Platte Rivers may need to buy a separate flood insurance policy. Your mortgage company will require that you get flood coverage if you live in a high-risk area .

Even if you own your home outright, you should consider getting flood insurance if you live in a flood-prone area. A single inch of water can cause $25,000 of damages according to FEMA.

Tips to save money on your Nebraska home insurance policy

You can save on your Nebraska homeowners insurance by taking advantage of discounts, comparing quotes and raising your deductible.

Most Nebraska homeowners insurance companies offer several discounts. For example, you may qualify for a discount if you have a fire or burglar alarm installed in your home. Other common discounts include going a certain number of years without filing a claim, switching to a different company and bundling your home and auto policies.

Shopping around can save you hundreds or even thousands of dollars per month without sacrificing coverage or service. For example, Nationwide has the most expensive home insurance rates in Nebraska and significantly more complaints compared to an average company of the same size.

In contrast, State Farm offers the cheapest rates and some of the best customer service in the state.

It's possible to lower your monthly rate by raising your deductible. Keep in mind that you have to pay your entire deductible before your home insurance coverage starts. That means you should never raise your deductible beyond what you can easily afford to pay for from your savings.

Frequently asked questions

What's the best cheap company for home insurance in Nebraska?

State Farm has the best cheap home insurance coverage in Nebraska. It has the most affordable rates for most coverage levels, and State Farm gets fewer complaints compared to an average insurance company of the same size.

What's the average cost of homeowners insurance in Nebraska?

Homeowners insurance in Nebraska costs $4,370 per year for $350,000 of coverage to repair your home, called dwelling coverage. That's roughly twice the national average of $2,151 per year.

Why is Nebraska home insurance so expensive?

Nebraska has the second most expensive home insurance rates nationwide because of natural disasters and the rising cost of labor and materials. Sharp increases in the cost of Nebraska home insurance in recent years may be linked to climate change.

Methodology

ValuePenguin collected quotes from the largest home insurance companies in Nebraska across hundreds of ZIP codes. Rates are for a 45-year-old married man with no history of insurance claims.

Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

Rate data for Nebraska homeowners insurance came from Quadrant Information Services. Quadrant's rates were taken from public filings and should only be used for comparative purposes.

Home insurance ratings were created using complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey and ValuePenguin's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.