The Best and Cheapest Home Insurance in New Hampshire (2024)

Vermont Mutual has the best and cheapest home insurance in NH for most people, with an average rate of $665 per year.

Compare Home Insurance Quotes in New Hampshire

Best Cheap Home Insurance in New Hampshire

To find the best and cheapest home insurance companies in New Hampshire, ValuePenguin reviewed rates, discounts, coverage options and customer service from top companies across hundreds of ZIP codes in NH. See the full methodology.

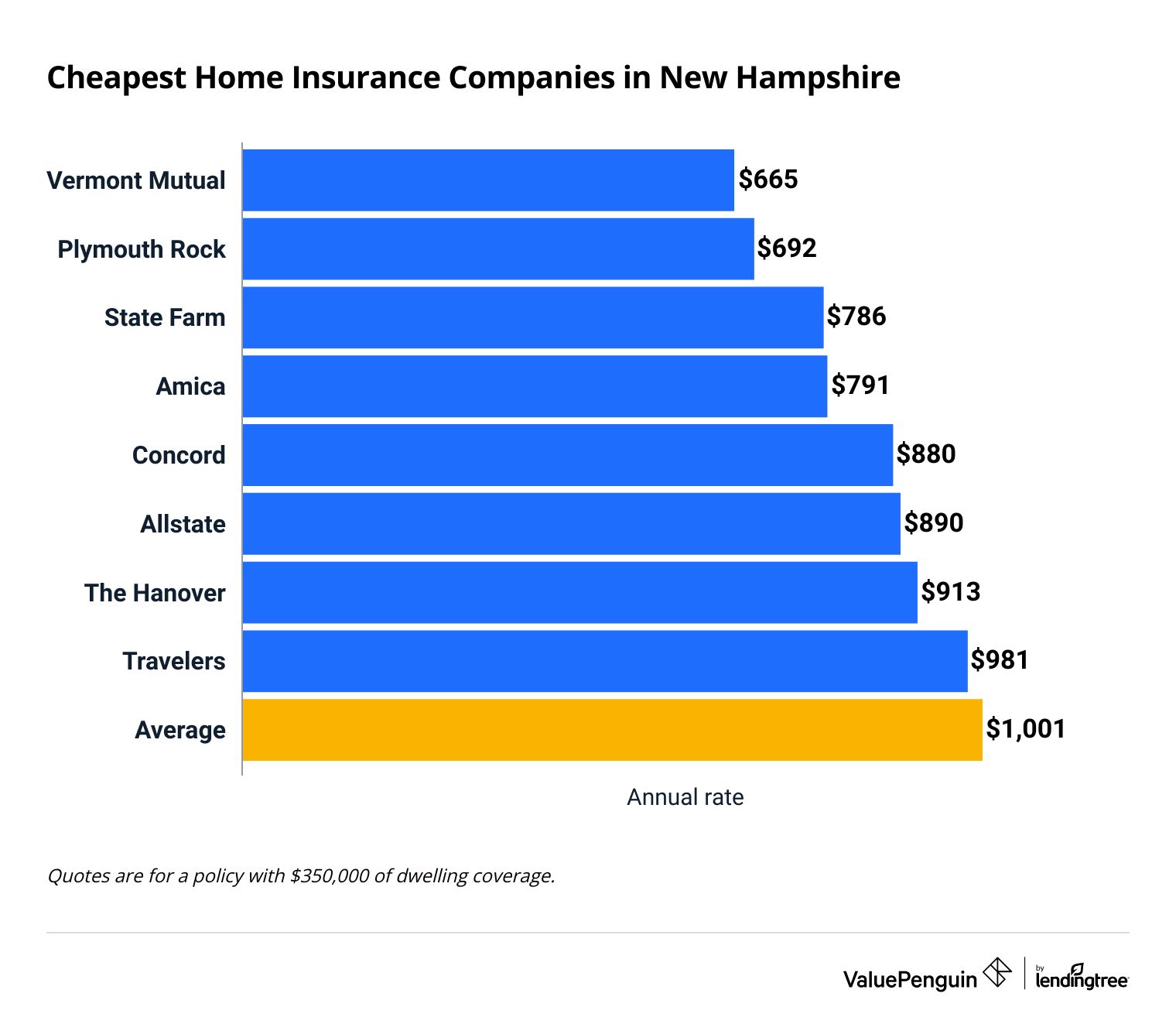

Cheapest home insurance companies in New Hampshire

Vermont Mutual has the cheapest home insurance in NH for most people.

A Vermont Mutual policy costs $665 per year for $350,000 in dwelling coverage, which is $336 cheaper per year than the state average of $1,001 per year.

Find Cheap Home Insurance Quotes in New Hampshire

If you have a home that's worth $1 million, though, State Farm has the cheapest rates, at $1,497 per year. State Farm saves you an average of $931 per year compared to the state average of $2,428.

Cheap home insurance in NH

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Vermont Mutual | $513 | |

| Amica | $533 | ||

| State Farm | $599 | ||

| Plymouth Rock | $629 | ||

| Allstate | $645 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Vermont Mutual | $513 | |

| Amica | $533 | ||

| State Farm | $599 | ||

| Plymouth Rock | $629 | ||

| Allstate | $645 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Vermont Mutual | $665 | |

| Plymouth Rock | $692 | ||

| State Farm | $786 | ||

| Amica | $791 | ||

| Concord | $880 | |

$500,000

Company | Annual rate | ||

|---|---|---|---|

| Vermont Mutual | $873 | |

| Plymouth Rock | $944 | ||

| State Farm | $966 | ||

| Amica | $1,030 | ||

| Concord | $1,076 | |

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,497 | ||

| Vermont Mutual | $1,569 | |

| Concord | $1,647 | |

| Allstate | $1,732 | ||

| Amica | $1,783 | ||

What home insurance coverage is important in New Hampshire?

Severe thunderstorms post the biggest threat to New Hampshire houses. These storms often bring heavy rain and strong winds. Winter storms and floods are also threats. Home insurance usually covers damage from summer and winter storms, but you'll need a separate flood insurance policy for flood damage.

Best home insurance in NH for most people: Vermont Mutual

-

Editor's rating

- Cost: $665/yr

Vermont Mutual has cheap rates and excellent customer service.

Pros:

-

Cheapest rates for most people

-

Excellent customer service

-

Local agents available

Cons:

-

No online quotes

-

Website isn't very helpful

Vermont Mutual's low rates and excellent customer service make it the best home insurance in New Hampshire for most people. If your home needs between $200,000 or $500,000 in dwelling coverage, Vermont Mutual has the cheapest average rate in NH.

Very few people file complaints about Vermont Mutual's home insurance. According to the National Association of Insurance Commissioners (NAIC), the company has 99% fewer complaints compared to an average company its size. This might be because of Vermont Mutual's local agents, who can help you get a quote, choose the right coverage, answer questions about your policy and file claims.

But Vermont Mutual doesn't have the best online tools. You can't get a quote online and the website is basic. If you're looking for a company with good digital tools, Vermont Mutual isn't the best option.

Best New Hampshire home insurance for bundling: The Hanover

-

Editor's rating

- Cost: $913/yr

The Hanover has cheap rates for home and car insurance in NH.

Pros:

-

Cheap rates on home and car insurance

-

Good customer service

-

Extra coverage options

Cons:

-

No online quotes

-

Fewer discounts than some other companies

The Hanover has cheap rates for home insurance and car insurance in New Hampshire, making it a great option for bundling your policies with one company. The Hanover also has good customer service, with fewer complaints than expected for a company its size, according to the National Association of Insurance Commissioners (NAIC).

A full coverage car insurance policy from The Hanover costs $57 per month. That's $39 cheaper per month than to the state average of $96 per month. Its home insurance rates aren't the cheapest in the state, but they are still lower than average.

But The Hanover doesn't have as many discounts as other companies. In addition to the bundling discount, the company only advertises savings for new homes, home buyers, security devices, and being part of a qualifying club or organization. This might not be much of a concern considering it has cheaper-than-average rates to begin with. But if you're looking for a company with a long list of discounts, The Hanover won't be a good fit.

Best home insurance customer service in NH: Amica

-

Editor's rating

- Cost: $791/yr

Amica has great service, cheap rates and lots of discounts.

Pros:

-

Cheap rates

-

Excellent customer satisfaction

-

Numerous discounts

Cons:

-

Not as many coverage add-ons as some companies

-

Can't buy a policy online

Amica is the best option in New Hampshire if you want top-tier customer service. The company has about one-third the amount of complaints than an average company its size, according to the National Association of Insurance Commissioners. Amica also ranked second for overall customer satisfaction in J.D. Power's annual home insurance survey for 2023.

While Vermont Mutual gets fewer complaints than Amica, Amica has more ways to get service. You can contact a local agent, call the 800 number or report a claim online. The ease of getting service is important, considering that home insurance questions and damage can happen any time.

Amica has several discounts to help you get a lower price on home insurance, including savings for getting your bills and statements electronically, having an alarm system, and having a new or remodeled home. But Amica doesn't offer as many optional coverages as some companies, making it harder to customize your policy. And while you can get a quote online, you have to call an agent to buy a policy.

What's the average cost of home insurance in NH?

Home insurance in New Hampshire costs $1,001 per year, on average, for $350,000 in dwelling coverage.

New Hampshire is one of the cheapest states for home insurance. Only Maine, Vermont and Hawaii have cheaper rates. Rates are likely low because homes in New Hampshire are less likely to be damaged than homes in other parts of the country, like Oklahoma, Florida and California.

Average cost of home insurance in NH by dwelling amount

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $716 |

| $350,000 | $1,001 |

| $500,000 | $1,336 |

| $1,000,000 | $2,428 |

The more coverage you need, the more you'll pay. That's because more expensive homes cost more to repair or rebuild after a claim.

Cost of New Hampshire home insurance by city

Nashua, in southeastern NH, has the cheapest home insurance rates in the state at $928 per year.

Hampton Beach, along New Hampshire's 18-mile coastline, has the most expensive home insurance rates in the state. A policy with $350,000 in dwelling coverage costs $1,424 per year. The high rates are likely because of Hampton Beach's coastal location. Homes along the coast may be more likely to be damaged by strong coastal storms and wind.

City | Annual rate | % from avg |

|---|---|---|

| Alton Bay | $1,001 | 0% |

| Antrim | $939 | -6% |

| Ashland | $997 | 0% |

| Ashuelot | $961 | -4% |

| Barnstead | $993 | -1% |

Rates are for a policy with $350,000 of dwelling coverage.

Best-rated homeowners insurance companies in New Hampshire

USAA is the best-rated home insurance company in New Hampshire.

But you can only buy a policy from USAA if you're a member of the military, a veteran or a family member. If you don't qualify, Amica and Concord also have excellent customer satisfaction.

Company |

Rating

|

Complaints

|

|---|---|---|

| USAA | Low | |

| Amica | Low | |

| Concord | Low | |

| State Farm | Average | |

| The Hanover | Low |

What kind of home insurance coverage do you need in NH?

Strong summer storms, like thunderstorms and coastal storms, pose the biggest threat to New Hampshire homes. But winter storm damage and flooding are also risks. Understanding how home insurance covers these types of events can help you make sure your policy has the right coverage.

Does home insurance in NH cover wind damage?

Home insurance usually covers wind damage, whether it's from a thunderstorm, coastal storm or snowstorm. But you should make sure you maintain your home, especially your roof and siding. If your house is in poor condition, it makes it more likely that wind can cause damage. And your home insurance company might not cover wind damage if your house isn't well maintained.

Wind damage is common in New Hampshire. Summer thunderstorms, hurricanes and nor'easters, and winter storms can all bring strong winds. Since 2014, the Federal Emergency Management Agency (FEMA) has declared nine disasters in New Hampshire from severe storms, which often brought high winds to the area.

Does NH home insurance cover snow damage?

New Hampshire home insurance usually covers snow damage. The weight of ice and snow can damage or even collapse your roof. And sometimes, snow melting and refreezing on your roof can cause ice dams, which lead to water leaking into your house. Making sure your house is in good condition before winter can help minimize damage.

Most of New Hampshire gets between four and eight feet of snow each year. Northern and western New Hampshire tend to have more severe winters compared to the rest of the state, with many areas getting up to 12 feet of snow. In parts of White Mountain National Forest, some areas regularly see over 16 feet of snow.

Does home insurance in New Hampshire cover flood damage?

Home insurance doesn't cover damage from floods. You need a separate flood insurance policy for that. Many home insurance companies can help you get a policy through the National Flood Insurance Program (NFIP), and some companies even sell their own flood insurance.

Flooding is a risk in every part of New Hampshire. Floods can happen even if you don't live near the coast or a body of water. Even a minor flood can cause tens of thousands of dollars in damage, so it's a good idea to at least consider a flood insurance policy.

How to save on New Hampshire home insurance

New Hampshire home insurance is already inexpensive compared to most other states, but there are still ways to lower your cost.

Shop around and compare quotes: Every home insurance company has different rates, so getting more quotes helps you find the cheapest option. If you want to save time while you shop, work with an independent agent who can get you quotes from several companies at once.

Ask about discounts: Common home insurance discounts include having a new roof, having an alarm system and not having any claims on your record. Bundling, which means buying your auto and home insurance from the same company, is one of the biggest discounts. Plus, it can make managing your policies easier.

Maintain your home: Homes that are in good condition are less likely to be damaged during storms, which in turn makes it less likely that you'll have to file a claim. Because rates usually go up after a claim, having a well-maintained home and avoiding claims when you can keeps your rates steadier over time.

Frequently asked questions

How much is home insurance in New Hampshire?

The average cost of home insurance in New Hampshire is $1,001 per year for a policy with $350,000 in dwelling coverage. Your rate will change based on where you live, how much coverage you need, if you've filed any home insurance claims in the past and more.

Who has the cheapest home insurance in New Hampshire?

Vermont Mutual has the cheapest home insurance in New Hampshire for most people. A policy with $350,000 in dwelling coverage costs $665 per year, which is $336 cheaper than the state average. But if you have a high-value home, State Farm is a cheaper option.

Is home insurance required in New Hampshire?

The state of New Hampshire doesn't require you to have a home insurance policy. But if you have a mortgage or any other type of home loan, your bank will require you to have a policy. It's a good idea to have home insurance even if your house is paid off. Home insurance protects you from having to pay for some expensive repairs on your own.

Methodology

ValuePenguin gathered home insurance quotes in every ZIP code in New Hampshire from the largest home insurance companies in the state. The quotes were for a 45-year-old married man with average credit, no home claims and the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin uses Quadrant Information Services for home insurance rates. The rates are from publicly sourced from insurer filings and should be used for comparative purposes only. Your quotes will likely be different.

To choose the best home insurance companies in New Hampshire, our experts reviewed average rates, coverages and discounts. Customer complaint data from the National Association of Insurance Commissioners (NAIC) and scores from J.D. Power's home insurance customer satisfaction survey were also taken into consideration.

Other sources include the Federal Emergency Management Agency (FEMA), the National Oceanic and Atmospheric Administration (NOAA), the New Hampshire Department of Environmental Services and the New Hampshire Department of Health and Human Services.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.