Best & Cheapest Home Insurance in Rhode Island (2024)

State Farm has the best cheap homeowners insurance in Rhode Island, at around $661 per year.

Compare Home Insurance Quotes in Rhode Island

Best Cheap Home Insurance Companies in RI

To help you find the best cheap Rhode Island insurance company, ValuePenguin editors considered cost, customer service ratings, coverage availability and overall value. To find the cheapest rates, our editors gathered quotes from top insurance companies across every ZIP code in the state.

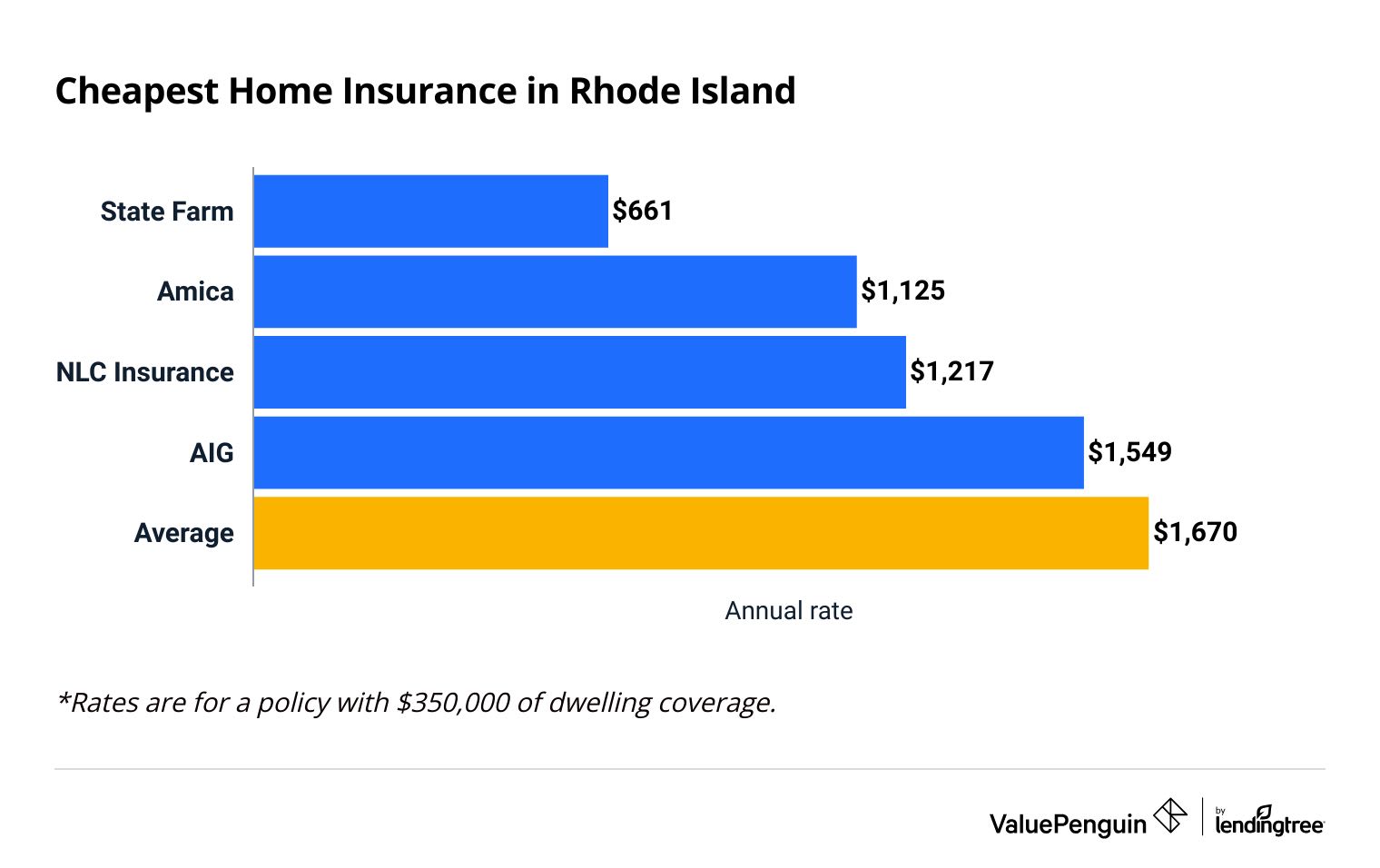

Cheapest Rhode Island home insurance

State Farm has the cheapest homeowners insurance in Rhode Island.

A policy from State Farm costs an average of $661 per year for $350,000 of dwelling coverage That's $1,006 per year less than the Rhode Island average.

Compare Home Insurance Quotes in Rhode Island

State Farm is also the cheapest option for more expensive homes in Rhode Island.

A State Farm policy with $500,000 of dwelling coverage costs $881 per year, on average. And $1 million of coverage from State Farm costs around $1,527 per year.

However, it's important to consider customer service and coverage options alongside price when shopping for home insurance. For example, PURE offers coverage tailored to expensive homes that's not available at State Farm.

Homeowners insurance quotes in Rhode Island by dwelling coverage

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $478 | ||

| Amica | $769 | ||

| NLC Insurance | $850 | ||

| PURE | $1,136 | |

| AIG | $1,233 | |

$200,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $478 | ||

| Amica | $769 | ||

| NLC Insurance | $850 | ||

| PURE | $1,136 | |

| AIG | $1,233 | |

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $661 | ||

| Amica | $1,125 | ||

| NLC Insurance | $1,217 | ||

| AIG | $1,549 | |

| PURE | $1,678 | |

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $881 | ||

| Amica | $1,418 | ||

| NLC Insurance | $1,612 | ||

| AIG | $2,014 | |

| Allstate | $2,132 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,527 | ||

| Amica | $2,285 | ||

| NLC Insurance | $2,837 | ||

| AIG | $3,127 | |

| PURE | $3,925 | |

What home insurance do I need in RI?

Rhode Island's location on the Atlantic coast means homes there are at risk of damage from coastal storms, hurricanes and Nor'Easters.

Homeowners insurance covers most damage caused by storms, like wind, hail and lightning. However, it doesn't protect your home from flood damage. Homeowners near the Rhode Island coast should consider buying a separate flood insurance policy to fully protect their homes.

Best homeowners insurance in RI for most people: State Farm

-

Editor's rating

- Cost: $661/yr

State Farm has the cheapest home insurance quotes in RI, along with dependable customer service.

-

Cheapest quotes in RI

-

Reliable customer service

-

Helpful local agents

-

Few coverage options

-

May not offer coverage to coastal homes

State Farm is the cheapest home insurance company in Rhode Island for most people. Its rates are typically less than half the state average, regardless of how much coverage you need.

With State Farm, you won't have to sacrifice dependable service for affordable rates.

State Farm customers are typically happy with the service they get from the company. It earned a good score on J.D. Power's customer satisfaction study. State Farm also gets fewer complaints than an average company its size, according to the National Association of Insurance Commissioners (NAIC).

However, State Farm may not cover homes near the Rhode Island coast. Homeowners living near the coast should consider PURE, Allstate or Narragansett Bay. All three companies typically cover coastal homes, and they also offer multiple options for flood protection.

While a basic policy from State Farm has enough coverage for most homeowners it doesn't offer as many optional upgrades as some other companies. For example, it doesn't offer food spoilage coverage, which pays for groceries that go bad during a power outage.

Best RI home insurance customer service: Amica

-

Editor's rating

- Cost: $1,125/yr

Amica offers excellent customer service at an affordable rate.

-

Outstanding service

-

Cheap rates

-

Lots of discounts

-

Difficult to customize coverage

Rhode Island homeowners can count on Amica to get their lives back to normal quickly after a disaster.

The company earned the highest score on J.D. Power's property claims survey. Amica also gets 77% fewer complaints than similar-sized companies, according to the You can also save by making automatic payments or getting your bills via email.

Amica offers two levels of home insurance coverage.

- Its Standard Choice package includes special computer coverage and water backup coverage , which most companies charge extra for.

- Its Platinum Choice package comes with lots of extra protection, like coverage for valuable items, higher liability limits and business property coverage.

However, you can't pick and choose which add-ons you want, so you may end up paying for coverage you don't need.

Best insurance in Rhode Island for expensive homes: PURE

-

Editor's rating

- Cost: $2,213/yr

PURE offers extra protection for high value homes and good customer service.

-

Coverage tailored to expensive homes

-

Few customer complaints

-

Offers flood insurance

-

Can't get a quote online

-

Rates are average

PURE is a good option for expensive homes in Rhode Island. Its high-value home insurance policy includes:

- Deductible waiver

- Flexible rebuilding options

- Guaranteed home replacement cost

- Jewelry coverage

- Loss prevention

- Water backup coverage

Most major companies don't offer these coverage options, or they may be available for an extra fee.

In addition, PURE offers flood insurance with higher limits than you can get with a National Flood Insurance Program (NFIP) policy. This is especially important for Rhode Island homeowners living near the coast.

Home insurance rates fro PURE are about average. A policy from PURE costs $2,213 per year for $500,000 of dwelling coverage and $1 million of coverage costs $3,925. That's much more expensive than the cheapest company, State Farm. However, the extra coverage included in a basic policy from PURE could make the additional cost worth it.

Average cost of Rhode Island home insurance

The average cost of home insurance in Rhode Island is

That's $481 less per year than the national average, which is $2,151 per year.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,204 |

| $350,000 | $1,670 |

| $500,000 | $2,200 |

| $1,000,000 | $4,058 |

Home insurance rates in Rhode Island are similar to its neighboring states. Homeowners insurance in Massachusetts costs around $1,777 per year, while Connecticut homeowners pay an average of $2,119 per year.

Rhode Island homeowners insurance rates by city

Cumberland Hill, a neighborhood within Cumberland, has the cheapest home insurance quotes in the state.

The average cost of home insurance in Cumberland Hill is $1,525 per year. That's $145 per year less than the state average.

Block Island is the most expensive city for home insurance in Rhode Island. At an average rate of $1,931 per year, Block Island home insurance costs $261 per year more than the state average.

Block Island is south of Rhode Island off the eastern tip of Long Island, NY. As an island, it's more prone to damage from tropical storms, hurricanes and Nor'easters. That's why insurance on Block Island is more expensive than the rest of the state.

Homeowners insurance quotes by Rhode Island city

City | Annual rate | % from avg |

|---|---|---|

| Adamsville | $1,767 | 6% |

| Albion | $1,619 | -3% |

| Ashaway | $1,645 | -2% |

| Barrington | $1,561 | -7% |

| Block Island | $1,931 | 16% |

Rates are for a policy with $350,000 of dwelling coverage.

Best homeowners insurance in RI

Amica is the best-rated home insurance company in Rhode Island.

Amica offers the best combination of excellent customer service, affordable rates and useful coverage options.

Top home insurance in RI

Company |

Rating

|

Complaints

|

|---|---|---|

| Amica | Low | |

| PURE | Low | |

| State Farm | Average | |

| NLC Insurance | Low | |

| AIG | Low |

It's important to choose an insurance company you can count on to get your life back to normal quickly after an emergency.

Companies with great service achieve this by having a smooth, fair claims process. But companies with poor service could take longer to pay for damage, and you may end up spending more on repairs.

What homeowners insurance do I need in Rhode Island?

As a coastal New England state, Rhode Island homes are at risk of damage from Atlantic hurricanes, tropical storms and Nor'easters.

Does Rhode Island home insurance cover hurricanes?

Homeowners insurance covers some, but not all, types of hurricane damage. It typically pays for wind, hail and lightning damage, but not flood damage.

However, coastal homes may have a separate wind or hurricane deductible. This is typically higher than your regular deductible. So be prepared to pay extra if a hurricane damages your home.

Rhode Island homeowners can get flood insurance through the National Flood Insurance Program (NFIP) or a private insurance company.

You can buy a National Flood Insurance Program (NFIP) policy from many home insurance companies, including State Farm and Amica. The government backs NFIP policies, and they cost the same no matter where you buy them from. The average cost of an NFIP policy in Rhode Island is $1,271 per year for $283,954 of coverage.

You may want to consider private flood insurance if your home is worth more than $250,000, you have valuable belongings or you want a policy with loss of use coverage.

PURE and Narragansett Bay both offer private flood insurance options.

- PURE offers up to $1 million of flood insurance coverage and up to $50,000 of loss of use coverage.

- Narragansett Bay offers flood insurance as an add-on to your home insurance policy. This add-on matches your home insurance policy limits.

Does Rhode Island home insurance cover winter storms?

Rhode Island has winters that bring potentially damaging levels of snowfall and ice. Homeowners insurance usually covers any damage from the weight of falling snow.

However, most insurance companies won’t cover damage caused by negligence. It’s important to shovel heavy snow off your roof and chip away the ice to help prevent damage to your home.

How to find the best homeowners insurance in Rhode Island

Before you begin shopping for home insurance in Rhode Island, you should decide how much coverage you need. Then, you can compare quotes from multiple companies and read customer service reviews.

Decide how much coverage you need. Most standard home insurance policies include similar coverage. However, some homeowners may need more protection.

For example, PURE and Narragansett Bay offer flood protection. This is an important add-on for Rhode Islanders living near the coast.

Shop for quotes from multiple companies. The most expensive company in Rhode Island costs four times more than the cheapest option. That's a difference of nearly $2,000 per year for a policy with $350,000 of dwelling coverage.

In addition, each insurance company calculates rates differently. Companies consider your insurance history and credit score, your home's location and building materials and other factors. So the best company for you may differ from your neighbors, family and friends.

Consider customer service ratings. It's important to choose a company you can rely on in an emergency. Companies with excellent service reviews typically get your life back on track quickly after your home is damaged. On the other hand, companies with poor service might take longer to send you a check.

ValuePenguin editor's ratings consider customer service reviews from multiple sources, along with coverage availability and overall value. If you want to do more research, look up J.D. Power customer service scores and the National Association of Insurance Commissioners (NAIC) complaint index.

Frequently asked questions

What is the average cost of homeowners insurance in Rhode Island?

The average cost of homeowners insurance in Rhode Island is $1,670 per year, or $139 per month. That’s 22% cheaper than the national annual average of $2,151.

Who has the cheapest home insurance in Rhode Island?

State Farm has the cheapest home insurance in Rhode Island, at $661 per year for $350,000 in dwelling coverage. It also has the cheapest rates for expensive homes, at $881 per year for $500,000 of dwelling coverage.

How much is home insurance in Warwick, RI?

Home insurance in Warwick costs an average of $1,689 per year. That's $19 per year more than the Rhode Island average.

What is Narragansett Bay Insurance's A.M. Best rating?

Narragansett Bay isn't rated by A.M. Best. This could be because it's a smaller company that does most of its business in five states: New York, New Jersey, Massachusetts, Connecticut and Rhode Island.

However, it has an "A" or exceptional financial strength rating from Demotech. This means Narragansett Bay likely won't have a problem paying customer claims, even in difficult economic markets.

Methodology

To find the best cheap RI insurance company, ValuePenguin collected home insurance quotes for every ZIP code across Rhode Island from the state’s largest home insurance companies. Rates are for a 45-year-old married man with a good credit score and no history of insurance claims.

Rates include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Our experts ranked each company's customer service scores by comparing the National Association of Insurance Commissioners (NAIC) complaint index, J.D. Power's home insurance customer satisfaction rankings and our ValuePenguin editor's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.