The Best Cheap Home Insurance Companies in Utah (2024)

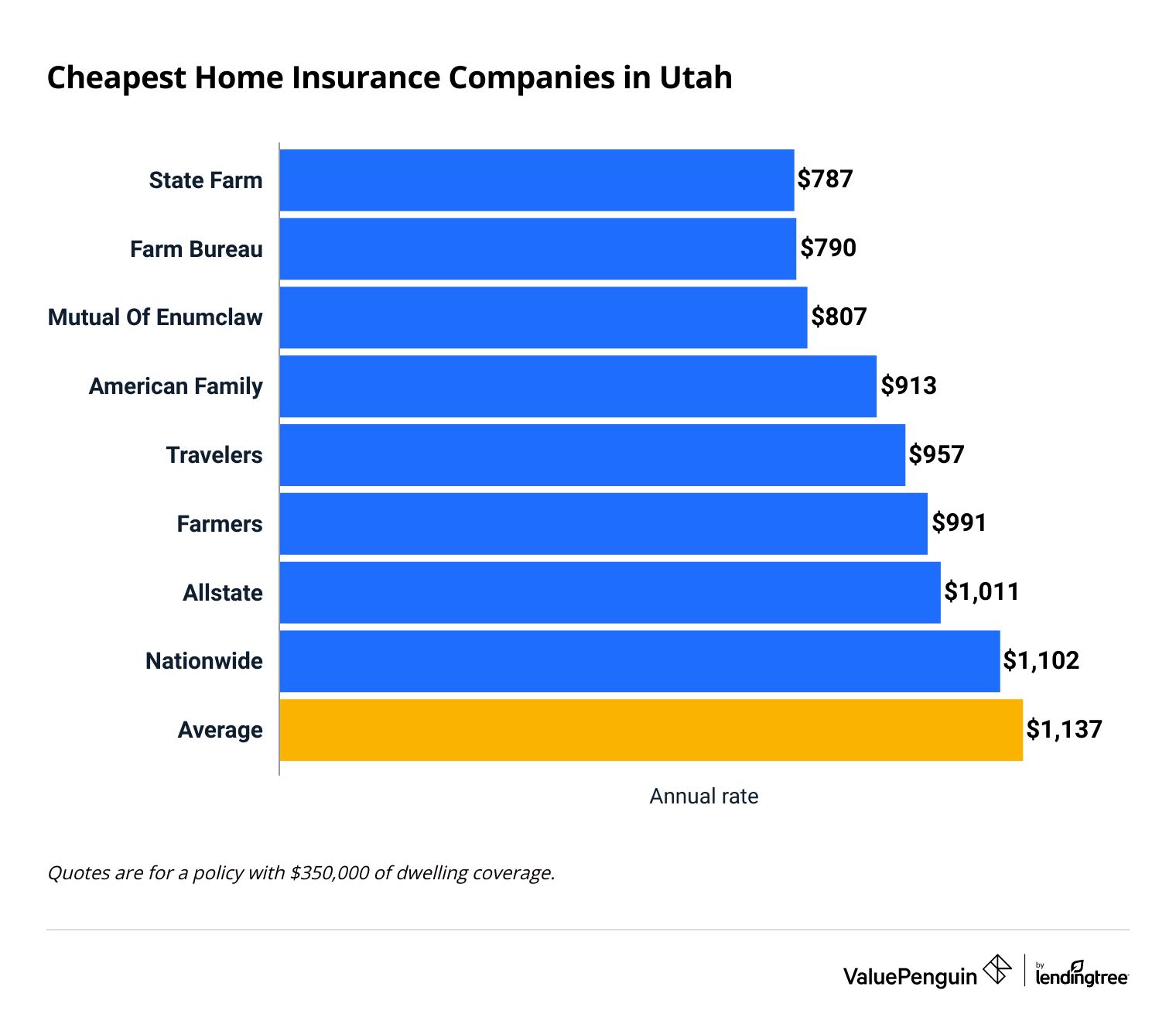

State Farm has the cheapest home insurance in Utah. It charges $787 per year on average for $350,000 of dwelling coverage.

Find Cheap Home Insurance Quotes in Utah

Best cheap home insurance in Utah

Our experts compared cost, coverage and customer service to find the best companies in Utah.

ValuePenguin collected thousands of quotes for top home insurance companies across hundreds of Utah ZIP codes.

Cheapest home insurance quotes in UT

State Farm has the cheapest homeowners insurance quotes in Utah at $787 per year for $350,000 of coverage to repair or rebuild your home, called dwelling coverage. That's 31% less than the Utah state average.

Find Cheap Homeowners Insurance Quotes in Your Area

Mutual of Enumclaw is a good choice if you own a more affordable home. At $545 per year, it has the cheapest rates in Utah for $200,000 of dwelling coverage.

Best cheap home insurance in Utah

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Mutual Of Enumclaw | $545 | ||

| Farm Bureau | $564 | ||

| State Farm | $613 | ||

| Travelers | $633 | ||

| Farmers | $662 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Mutual Of Enumclaw | $545 | ||

| Farm Bureau | $564 | ||

| State Farm | $613 | ||

| Travelers | $633 | ||

| Farmers | $662 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $787 | ||

| Farm Bureau | $790 | ||

| Mutual Of Enumclaw | $807 | ||

| American Family | $913 | ||

| Travelers | $957 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $984 | ||

| Farm Bureau | $998 | ||

| Mutual Of Enumclaw | $1,094 | ||

| American Family | $1,135 | ||

| Allstate | $1,266 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,582 | ||

| Farm Bureau | $1,634 | ||

| Allstate | $1,791 | ||

| American Family | $1,889 | ||

| Mutual Of Enumclaw | $1,994 | ||

Natural disasters in Utah

Utah homeowners should protect themselves against common natural disasters like floods, earthquakes and wildfires.

Fortunately, most standard home insurance policies cover wildfires. However, it's always a good idea to double-check your policy because some companies don't offer coverage in high-risk areas.

You need to buy separate coverage for earthquakes and floods.

Best home insurance in Utah for most people: State Farm

-

Editor's rating

- Cost: $787/yr

State Farm offers the best combination of cheap rates and good customer service for Utah homeowners.

Pros:

-

Affordable rates

-

Strong customer service

-

Good home-auto bundling discount

Cons:

-

Few extra coverage options and discounts

State Farm has the cheapest rates in Utah for most homes. On average, it charges roughly a third less than the state average for average homes dwelling coverage. It also has the most affordable rates for high-value homes.

State Farm has a strong reputation for customer service. It scored above average for customer satisfaction among major home insurance companies according to a recent J.D. Power survey. State Farm also gets fewer complaints than an average company its size.

State Farm lets you personalize your policy with several coverage extras.

State Farm coverage add-ons

- Home systems protection

- Identity theft protection

- Service line protection

- Water backup coverage

State Farm offers fewer discounts than many of its competitors. However, the company stands out for its good home-auto bundling discount. Consider State Farm for your home insurance if you already have an auto policy with the company.

Best home insurance in Utah for wildfire protection: Mutual of Enumclaw

-

Editor's rating

- Cost: $807/yr

Mutual of Enumclaw homeowners insurance policies come with access to a private firefighting service.

Pros:

-

Cheap rates

-

Good customer service

-

Large network of local agents

-

Extra protection against wildfires

Cons:

-

No online quotes

-

Bare bones website

Mutual of Enumclaw customers are protected by a private firefighting service.

This benefit comes standard with all Mutual of Enumclaw home insurance policies. Utah is one of the most wildfire-prone states in the U.S. The Beehive State gets between 800 and 1,000 fires each year and that number has only grown in recent years.

Mutual of Enumclaw also has some of the most affordable home insurance rates in Utah. The company offers the best quotes for cheap and mid-priced homes. That makes Mutual of Enumclaw a good choice for people who own affordable and mid-priced homes.

Mutual of Enumclaw doesn't offer online quotes. Instead, you'll have to work with a local agent. Some people prefer the personalized service and local expertise you get by working with an agent. However, you may find it less convenient when .

Best home insurance company for customer service in Utah: Farm Bureau

-

Editor's rating

- Cost: $790/yr

Farm Bureau has a strong reputation for customer satisfaction.

Pros:

-

High levels of customer satisfaction

-

Strong network of local agents

-

Affordable quotes

-

Many discounts available

Cons:

-

No online quotes available

-

Few extra coverage options

Farm Bureau gets far fewer complaints than an average insurance company its size. That suggests most Farm Bureau customers are happy with their coverage. It's a good idea to choose an insurance company that gets few complaints because you're more likely to have a smooth claims process.

Farm Bureau has the second cheapest home insurance rates in Utah, whether your home is cheaper or more expensive to rebuild. The company charges $790 per year for $350,000 of dwelling coverage. That's 30% cheaper than the Utah state average.

You have to buy a Farm Bureau membership before you can get a Farm Bureau home insurance policy. Memberships cost $72 per year and give you access to a range of benefits, such as discounts to zoos, movie theaters and restaurants.

You can only buy Farm Bureau insurance through a local agent. The company doesn't offer online quotes, and the Farm Bureau website doesn't have much detailed information. That makes Farm Bureau less convenient for people who prefer to buy and manage their insurance policies online. However, Farm Bureau may be a good choice if you want personalized service and a human touch.

Average home insurance cost in Utah

Homeowners insurance costs $1,137 per year in Utah for $350,000 of coverage. That's roughly half the national average of $2,151 per year.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $803 |

| $350,000 | $1,137 |

| $500,000 | $1,497 |

| $1,000,000 | $2,607 |

Utah residents pay less for home insurance than in neighboring states. Home insurance in Utah is cheaper than in nearby Nevada and Idaho. You'll pay significantly more for homeowners insurance in Colorado, New Mexico and Arizona .

Utah insurance rates by city

Vernon, a small town West of Salt Lake City, has the most expensive homeowners insurance rates in Utah, at $1,431 per year on average.

Washington, a city in Southwestern Utah near Zion National Park, has the cheapest rates in Utah, at $1,045 per year on average.

Where you live will influence how much you pay for home insurance. Factors like crime, labor and materials costs and how often they experience natural disasters like powerful storms and wildfires can all influence homeowners insurance rates.

City | Annual rate | % from avg |

|---|---|---|

| Alpine | $1,213 | 7% |

| Altamont | $1,155 | 2% |

| Alton | $1,136 | 0% |

| Altonah | $1,165 | 2% |

| American Fork | $1,105 | -3% |

Rates are for a policy with $350,000 of dwelling coverage.

The best homeowners insurance companies in UT

State Farm, Mutual of Enumclaw, Farm Bureau and Auto-Owners have the best-rated homeowners insurance in Utah.

All four companies offer quality coverage and get few complaints.

State Farm, Mutual of Enumclaw and Farm Bureau also have cheap rates, but Auto-Owners has some of the most expensive home insurance quotes in Utah. However, the company balances its high rates with strong customer service.

Company |

Rating

|

Complaints

|

|---|---|---|

| State Farm | Average | |

| Farm Bureau | Low | |

| Mutual Of Enumclaw | Low | |

| Auto-Owners | Low | |

| American Family | Low |

Common natural disasters in UT

You may need coverage for earthquakes, wildfires and flooding if you live in Utah.

A standard home insurance policy will cover fire damage. However, insurance companies may drop coverage if your home is in an area with frequent wildfires.

If you can't buy wildfire coverage through a private company, you can get coverage through the government, called a FAIR plan policy. Keep in mind that these plans tend to be expensive.

Flood insurance in Utah

Floods are the most common and destructive natural disaster in Utah.

Mortgage lenders often require that you buy flood insurance if you live in a high-risk area. Even if you own your home outright, you should still consider flood coverage. A single inch of floodwater in your home can cause $25,000 of damage.

The type of floods you should prepare for will depend on where you live in Utah. For example, Southern Utah is at a greater risk of flash floods. Areas closer to the mountains may experience seasonal flooding related to mountain snowmelt.

Earthquake risks in Utah

Utah has had 17 large earthquakes since settlers arrived in 1847.

In addition to earthquakes caused by regular movements of the earth, the eastern and central parts of the state get frequent earthquakes because of coal mining. You can get standalone earthquake coverage if you live in an earthquake-prone part of the state.

Tips for saving money on home insurance in Utah

Comparing quotes can save you more than a thousand dollars per year on your home insurance.

The difference between the most and least expensive home insurance companies in Utah is $1,037 per year for $350,000 of coverage to repair or rebuild your house.

It's important to remember that paying more for home insurance won't necessarily get you better customer service or coverage. For example, State Farm has the cheapest home insurance in Utah and a strong customer service reputation.

Take advantage of home insurance discounts

Most home insurance companies offer multiple discounts. You can lower your monthly rate by taking advantage of common discounts like home-auto bundling and having a burglar and fire alarm.

It's a good idea to check for discounts when comparing home insurance quotes. The cheapest home insurance for you will depend on which discounts you qualify for.

Raise your home insurance deductible

You can lower your home insurance rate by increasing the amount of money you pay for home repairs before your home insurance starts working, called a deductible. You should never raise your deductible beyond what you can easily cover from your savings.

Frequently asked questions

What's the best cheap home insurance in Utah?

State Farm has the best cheap home insurance in Utah because of its cheap rates and strong customer service. Mutual of Enumclaw is a good choice if you'd like to take advantage of its private firefighting service.

What is the average cost of home insurance in Utah?

Home insurance in Utah costs $1,137 for $350,000 on average for coverage to repair or rebuild your home, called dwelling coverage. That's around half the national average for homeowners insurance.

Does Utah require homeowners insurance?

No, Utah does not require homeowners to buy insurance. But, lenders often require you to buy home insurance to get a mortgage.

Methodology

To find the best homeowners insurance in Utah, ValuePenguin collected quotes from the top home insurance companies across all of Utah's residential ZIP codes. Rates are for a 45-year-old married man who has never had an insurance claim.

Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

Insurance rate data came from Quadrant Information Services. Quadrant's rates are from public insurance company filings and should only be used for comparative purposes. Your rates will likely be different.

Complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey and ValuePenguin's ratings were used to create home insurance ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.