What Are the Best Medicare Supplement Plans in Connecticut?

Compare Medicare Plans in Your Area

AARP/UnitedHealthcare (UHC) has the best Medigap plans in CT, including the cheapest Plan G. AARP/UnitedHealthcare is known for its good service, and the AARP membership gives you access to unique perks.

If you want a cheaper Medigap plan, Anthem sells the cheapest Plan N. But the company's service isn't good.

If you're a current or former military member or part of a military family, USAA is a good option. The company has cheap rates for Plans G and N and gives its members extra perks and discounts. USAA also has high customer satisfaction.

What's the best Medicare Supplement company in Connecticut?

AARP/UnitedHealthcare has the best Medicare Supplement plans in CT because of its low rates and good service.

Anthem has cheap rates for Plan N, but members tend to struggle with slow service and claims being denied. USAA is also a good choice for Plan G or N. But USAA is only available to those affiliated with the military.

Top Medicare Supplement companies in Connecticut

Compare Medicare Plans in Your Area

About 20% of Connecticut residents are eligible for a Medicare Supplement plan. Medigap Plan F is the most popular plan in the state, making up 37% of all Medicare Supplement plans. But you can only buy Plan F if you were eligible for Medicare before 2020. If you became eligible during or after 2020, Plan G is the most comprehensive plan available to you.

Best overall: AARP/UnitedHealthcare

-

Editor rating

- Plan K: $67

- Plan L: $124

- Plan N: $171

- Plan A: $186

- Plan G: $210

- Plan F: $283

- Plan B: $329

- Plan C: $395

AARP/UnitedHealthcare's combination of low rates, several plan options and good customer satisfaction makes it the best Medicare Supplement company in Connecticut. You need an AARP membership to buy a plan. But the annual membership cost is just $16, and it gives you access to AARP perks like travel and restaurant discounts.

Plan G from AARP/UnitedHealthcare costs 36% less than the state average and is the cheapest in the state.

In fact, all of AARP/UnitedHealthcare's Medigap plans in CT cost less than the state average, making it a great choice for budget shoppers who still want high-quality customer service.

AARP/UnitedHealthcare gets 61% fewer complaints than an average company its size, according to the National Association of Insurance Commissioners (NAIC). This means that most people are likely happy with the service they get from AARP/UnitedHealthcare. Only 14 complaints were filed against the company in Connecticut in 2022, and only one was related to its Medicare Supplement plans.

Best for military members: USAA

-

Editor rating

- Plan N: $172

- Plan G: $258

- Plan F: $284

- Plan A: $414

USAA serves the military population and stands out for its customer service. It has 30% fewer complaints than average, according to the NAIC. And none of those complaints came from Connecticut residents in 2022.

Buying a Medigap plan from a company with good service means you're less likely to have to deal with claim denials, slow payments or frustrating service interactions.

USAA only sells four Medigap plans in Connecticut: Plans A, F, G and N. You'll have fewer plan options than you would with other companies. But Plans F, G and N are the three most popular Medicare Supplement plans in CT, accounting for 80% of all Medigap plans.

USAA is only available to current and former military members and qualifying family members. If you qualify for coverage, you'll also have access to USAA perks, including a wide range of discounts. USAA offers other types of insurance, too, as well as banking, retirement and investment accounts.

Cheapest Plan N: Anthem

-

Editor rating

- Plan N: $169

- Plan G: $212

- Plan F: $298

- Plan A: $1,008

Anthem's Plan N costs an average of $169, about 26% less than the state average. Plan N is a good choice if you want cheap rates but still need comprehensive coverage. It doesn't cover quite as much as Plan G, but the savings might make up for it.

Anthem has more than three times as many complaints about its Connecticut Medigap plans than an average company its size, according to the NAIC.

You should consider Anthem's customer service carefully before buying a policy. The NAIC received 85 complaints in Connecticut in 2022. Most of the issues stem from claim denials and slow response times. Although Anthem has the cheapest Plan N in Connecticut, you might want to pay a bit more for better service. AARP/UnitedHealthcare's Plan N is only $2 more per month compared to Anthem, and AARP/UHC has much better customer service.

How much does a Medigap plan cost in Connecticut?

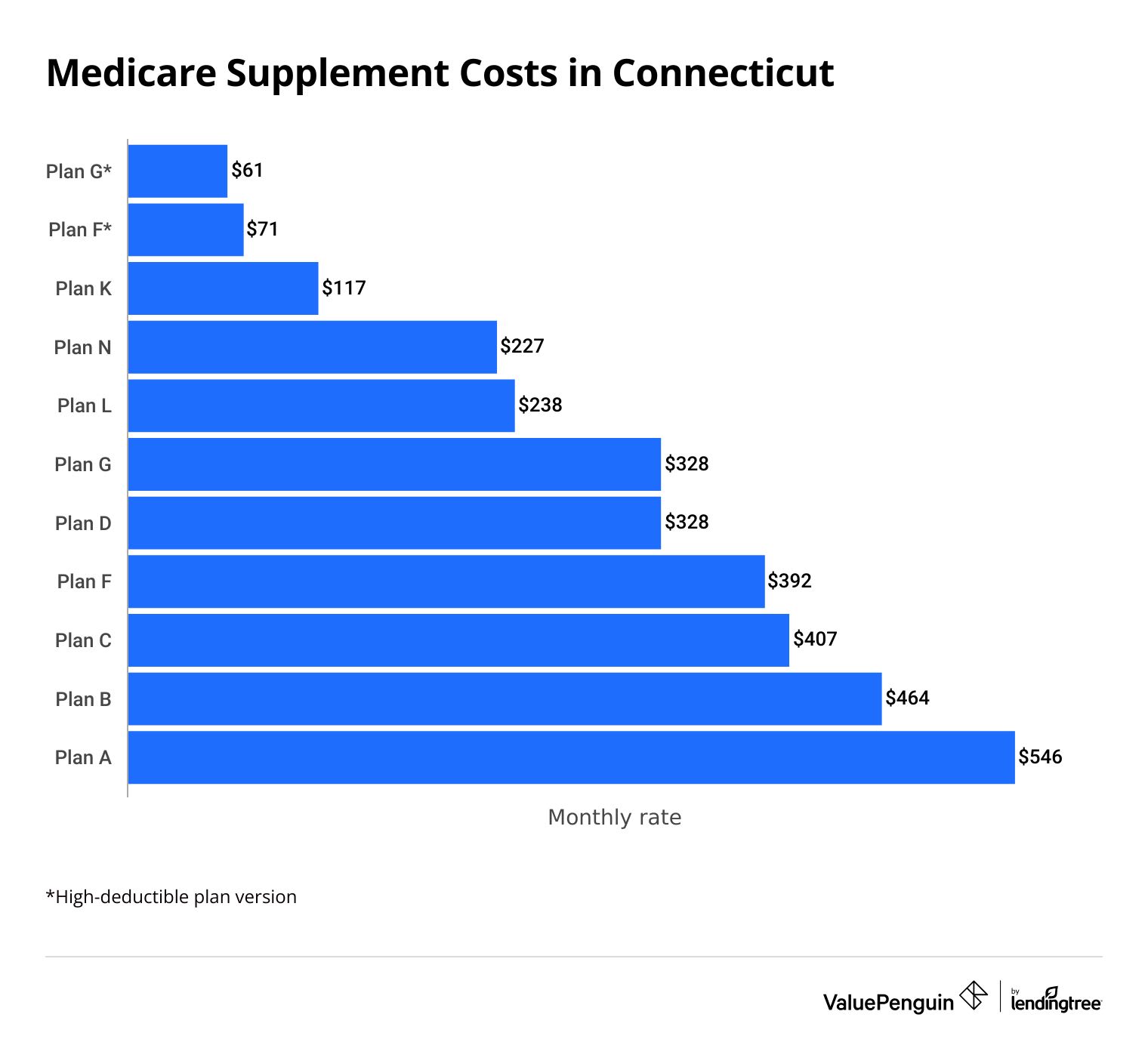

Medigap plans in CT cost between $61 and $546 per month.

The average cost of a Medicare Supplement plan in Connecticut is $351 per month. Your rate will vary depending on the company and plan you choose.

Compare Medicare Plans in Your Area

Plans F, G and N are the three most popular plans. They make up 80% of all Medicare Supplement plans in CT. Plans F and G both have high-deductible versions that you could consider if you want to save money. With these plans, you have to pay for your health care until you reach your deductible. After that, your plan will pay.

Connecticut Medicare Supplement plan costs

Medigap plan | Monthly cost | Percentage of CT enrollment |

|---|---|---|

| F | $392 | 37% |

| N | $227 | 23% |

| G | $328 | 20% |

| J | N/A | 7.7% |

| C | $407 | 2.3% |

How Connecticut Medigap plans work

Medigap plans in Connecticut are "community rated." This means that insurance companies charge the same rate for everyone who buys the same plan. So everyone who buys Plan G from AARP/UnitedHealthcare will pay the same rate, for example. Your age, gender, health and other factors can't be used to set your premium. Prices can still change with inflation and vary between companies and plans. Connecticut health insurance companies also can't decline to sell you a Medigap plan because of your health. All Medicare Supplement plans in CT are "guaranteed-issue."

These two features mean you can change Medicare Supplement plans in Connecticut at any time. You won't have to answer medical questions, and you won't be charged a higher rate because of your age.

Frequently asked questions

What are the best Medicare Supplement plans in CT?

AARP/UnitedHealthcare has the best Medicare Supplement plans overall, but USAA is also a good choice if you qualify. Medigap Plans F, G and N are the most popular options in Connecticut. To find the right plan and company for you, compare Medigap rates, extra perks and company satisfaction.

How much do Medigap plans in CT cost?

Connecticut Medicare Supplement plans cost between $61 and $546 per month. The cheapest plan is the high-deductible version of Plan G and the most expensive is Plan A. Connecticut uses a community-rating system for Medigap plans. This means that everyone within a company pays the same price per plan. Rates still vary between insurance companies and by plan.

Can I buy a Medigap plan in CT if I'm under 65?

Yes. If you're under 65 and eligible for Medicare because of a disability, you can buy a Medicare Supplement plan in Connecticut. You can only buy Plan A, B or D. You can also buy Plan C if you were eligible for Medicare before 2020.

Methodology and sources

All Medicare Supplement rates are averages for a person who does not smoke. The rates represent the costs when consumers are first eligible for a plan, have preferred rates and do not have to undergo medical underwriting. Rates are based on actuarial data for private health insurance companies in CT. Only companies with 450 or more policies were analyzed.

We chose the best plans and companies by analyzing rates, customer satisfaction and financial strength ratings from AM Best. America's Health Insurance Plans (AHIP) was used for the information on plan popularity. Information about Connecticut's Medicare-eligible population comes from Kaiser Family Foundation.

The customer satisfaction score for each company is based on average complaint data from the National Association of Insurance Commissioners (NAIC). The scores use a five-point scale. Higher scores mean lower levels of complaints, which mean better customer service.

Satisfaction score | Customer complaints adjusted for company size |

|---|---|

| 5.0 (top rating) | Over 75% fewer complaints than typical |

| 4.5 | 50% to 75% fewer complaints than typical |

| 4.0 | 25% to 50% fewer complaints than typical |

| 3.5 | 0% to 25% fewer complaints than typical |

| 3.0 | An average rate of complaints |

| 2.5 | 0% to 50% more complaints than typical |

| 2.0 | 50% to 100% more complaints than typical |

| 1.5 | 100% to 250% more complaints than typical |

| 1.0 | Over 250% more complaints than typical |

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.