Cheap Car Insurance Quotes in Kansas City, Missouri

State Farm has the best cheap car insurance in Kansas City, at $46 per month for minimum coverage and $98 per month for full coverage.

Find Cheap Auto Insurance Quotes in Kansas City

Best cheap car insurance in Kansas City

To help drivers find the best cheap insurance companies in Kansas City, MO, ValuePenguin collected quotes from top insurance companies across every ZIP code in the city. Quotes for minimum coverage meet the Missouri state minimum requirements of $25,000 in bodily injury liability coverage per person and $50,000 per accident, matching uninsured/underinsured motorist bodily injury liability coverage, and $10,000 in property damage protection. Full coverage quotes include comprehensive and collision coverage, along with higher liability limits than state minimums.

We also ranked the best car insurance companies in Kansas City based on affordability for different drivers, customer service ratings, convenience and coverage availability.

Cheapest car insurance in Kansas City: State Farm

State Farm has the cheapest rates for full coverage in Kansas City, with an average of $98 per month.

That's 43% less than the Kansas City average, and $39 less per month than the second-cheapest option, American Family.

Drivers with military ties should also consider USAA, which has an average full coverage policy cost of $65 per month.

Find Cheap Auto Insurance Quotes in Kansas City

Cheap full coverage car insurance rates in Kansas City

Company | Monthly rate | |

|---|---|---|

| State Farm | $98 | |

| American Family | $137 | |

| Travelers | $165 | |

| Progressive | $181 | |

| Allstate | $191 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance in Kansas City: State Farm

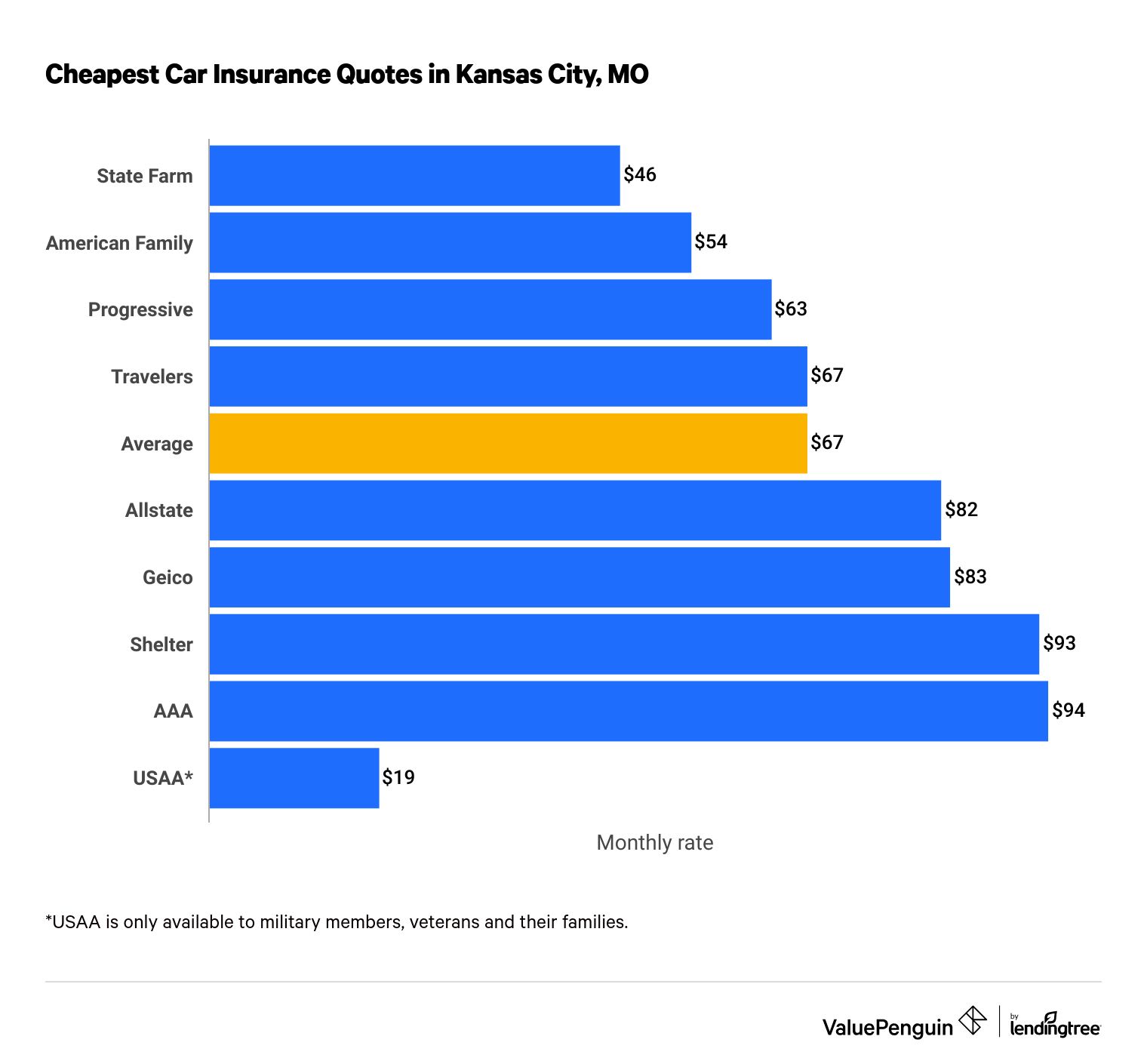

State Farm has the cheapest car insurance quotes in Kansas City.

A minimum coverage policy from State Farm costs $46 per month, which is 31% cheaper than the city average. The average cost of minimum coverage auto insurance in Kansas City, Missouri, is $67 per month. That's 20% more expensive than the Missouri state average of $56 per month.

Find Cheap Auto Insurance Quotes in Kansas City

Drivers who qualify for USAA can take advantage of even cheaper quotes, with an average of $19 per month for minimum coverage. However, USAA only sells car insurance to current and former military members, as well as some family members.

Cheap minimum coverage auto insurance in Kansas City

Company | Monthly rate | |

|---|---|---|

| State Farm | $46 | |

| American Family | $54 | |

| Progressive | $63 | |

| Travelers | $67 | |

| Allstate | $82 |

*USAA is only available to current and former military members and their families.

Cheap quotes for teen drivers in Kansas City: State Farm

State Farm is the most affordable insurance company for teen drivers in Kansas City.

A minimum coverage policy from State Farm costs $148 per month for an 18-year-old driver, which is 28% cheaper than average. The company also has the best full coverage rate in Kansas City, at $285 per month — 41% cheaper than the city average.

Young drivers who are enlisted in the military or have a family member who has served can find cheaper rates at USAA. Minimum coverage from USAA costs $41 per month, on average, while a full coverage policy from USAA costs $130 per month.

Monthly car insurance quotes for Kansas City teens

Company | Liability only | Full coverage |

|---|---|---|

| State Farm | $148 | $285 |

| Travelers | $185 | $425 |

| Allstate | $242 | $443 |

| American Family | $217 | $484 |

| Geico | $213 | $525 |

Young and inexperienced drivers pay around three times more for car insurance than older drivers in Kansas City. That's because they have less experience behind the wheel, so they're more likely to make a mistake and cause an accident. That makes them riskier, and more expensive, to insure.

Teen drivers can find cheaper car insurance quotes by:

Cheapest car insurance after a speeding ticket: State Farm

State Farm has the best rates for Kansas City drivers with a single speeding ticket on their record, with an average of $107 per month for a full coverage policy. That's 48% cheaper than the citywide average.

Cheapest car insurance after a speeding ticket in Kansas City

Company | Monthly rate |

|---|---|

| State Farm | $107 |

| American Family | $163 |

| Travelers | $199 |

| Progressive | $214 |

| Allstate | $223 |

The average cost of full coverage insurance in Kansas City goes up by 19% after a single speeding ticket. That's an increase of $32 per month compared to drivers with a clean record.

Cheapest car insurance after an accident in Kansas City: State Farm

State Farm has the most affordable car insurance quotes in Kansas City after an at-fault accident. A full coverage policy from State Farm costs $113 per month after a single accident, which is 55% cheaper than the Kansas City average.

Cheapest car insurance after an accident

Company | Monthly rate |

|---|---|

| State Farm | $113 |

| Travelers | $215 |

| American Family | $225 |

| Progressive | $265 |

| Allstate | $288 |

In Kansas City, the average rate increase for an at-fault accident is 46% for full coverage, which is a difference of $79 per month.

Cheapest quotes in Kansas City, MO after a DUI: State Farm

State Farm has the cheapest full coverage rates in Kansas City after a DUI, with an average of $107 per month. That's 58% less than the city average, and $88 less per month than the second-cheapest company, Progressive.

Cheapest car insurance after a DUI

Company | Monthly rate |

|---|---|

| State Farm | $107 |

| Progressive | $195 |

| Travelers | $227 |

| American Family | $236 |

| Allstate | $262 |

A DUI increases full coverage insurance for a Kansas City driver by 49% on average, or $84 per month.

However, each company raises rates differently after a DUI. For example, full coverage rates from Progressive only go up by 8% after a DUI, while American Family increases rates by 72%. That's why it's especially important for Kansas City drivers to shop around for the best car insurance rates after a DUI.

Cheapest car insurance for drivers with poor credit: State Farm

State Farm has the cheapest insurance rates for drivers with poor credit in Kansas City. A full coverage policy from State Farm costs $186 per month, making it 43% cheaper than the citywide average.

Cheapest car insurance for Kansas City drivers with poor credit

Company | Monthly rate |

|---|---|

| State Farm | $186 |

| American Family | $226 |

| Travelers | $283 |

| Progressive | $305 |

| Allstate | $321 |

Poor credit increases rates by 89%, on average, in Kansas City. That's an increase of $153 per month for full coverage — more than a DUI, an accident or a speeding ticket.

While your credit score doesn't reflect your driving skills, insurance companies believe that drivers with bad credit are more likely to make a claim in the future. That makes these drivers more expensive to insure, so most companies in Kansas City charge them more for coverage.

Cheapest quotes for teens with traffic violations: State Farm

State Farm has the most affordable car insurance for young drivers in Kansas City with incidents on their records.

A minimum coverage policy from State Farm costs $164 per month for an 18-year-old driver after a single speeding ticket, which is 32% cheaper than the city average. State Farm is 38% cheaper than average for teen drivers after an at-fault accident, at $180 per month for minimum coverage.

Monthly minimum coverage quotes for teen drivers in Kansas City

Company | Speeding | Accident |

|---|---|---|

| State Farm | $164 | $180 |

| Shelter | $216 | $291 |

| Travelers | $229 | $261 |

| American Family | $242 | $330 |

| Geico | $252 | $318 |

Young drivers in Kansas City can expect to pay 18% more for car insurance after a speeding ticket, and 20% more for coverage after an accident.

Cheapest car insurance for married drivers: State Farm

State Farm has the cheapest quotes for a married driver in Kansas City. A full coverage policy from State Farm costs $99 per month for one car, which is 36% less than the Kansas City average.

Full coverage quotes for married drivers in Kansas City

Company | Monthly rate |

|---|---|

| State Farm | $99 |

| American Family | $137 |

| Progressive | $140 |

| Travelers | $165 |

| Shelter | $179 |

On average, married drivers in Kansas City pay 10% less for car insurance than unmarried drivers. That's because married drivers are less likely to be involved in a car accident, which makes them cheaper to insure.

Best car insurance in Kansas City, MO

Shelter has the best-rated car insurance for most drivers in Kansas City.

Shelter earned a high score on J.D. Power's claims satisfaction survey, which means that most people are happy with the service they receive after an accident. ValuePenguin's editors also gave it a high rating based on customer service reviews, coverage availability and the overall value it provides to customers.

Kansas City drivers can also find excellent service at USAA and State Farm, which are generally less expensive than Shelter. However, USAA is only available to members of the military and certain family members.

Best insurance companies in Kansas City

Company |

Editor's rating

|

|---|---|

| USAA | |

| Shelter | |

| State Farm | |

| AAA | |

| Geico |

It's important to consider customer service reviews along with prices when you're shopping for car insurance in Kansas City.

An insurance company with great reviews can help you get back on the road quickly after an accident while minimizing the amount you have to pay for repairs. On the other hand, companies with bad service can take longer to pay your claim or require you to pay more out of pocket.

Average cost of car insurance in Kansas City, by ZIP code

Kansas City's least expensive ZIP code for car insurance is 64167, a small area north of the city.

The most expensive Kansas City ZIP code is 64127, which is near the city center.

The average cost of full coverage insurance can change by up to $51 per month, depending on where you live within Kansas City. Car insurance costs can vary within a city due to population density, traffic congestion, crime rates and the frequency of accidents.

Full coverage quotes by Kansas City ZIP code

ZIP code | Monthly cost | % from average |

|---|---|---|

| 64012 | $151 | -12% |

| 64101 | $186 | 8% |

| 64102 | $186 | 8% |

| 64105 | $183 | 6% |

| 64106 | $192 | 12% |

Minimum car insurance requirements in Missouri

Missouri drivers must have liability insurance to legally drive on public roads. They have to get a minimum amount of car insurance for bodily injury liability and property damage liability, sometimes written as 25/50/10. In addition, Missouri drivers need matching uninsured/underinsured motorist bodily injury coverage.

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $10,000 per accident

- Uninsured/underinsured motorist bodily injury coverage: $25,000 per person and $50,000 per accident

What's the best car insurance coverage in Kansas City, MO?

The low cost of minimum coverage insurance may make it seem like a good way for Kansas City drivers to save money. However, minimum coverage won't protect your own car if you cause an accident, which means you'll have to pay for any repairs yourself. In addition, minimum coverage insurance may not have high enough liability limits to cover the cost of a major accident.

Drivers should still consider optional coverages such as collision and comprehensive insurance, as well as higher liability limits. Minimum coverage is often not enough to cover medical bills or property damage.

We recommend full coverage insurance for most drivers, especially those with a car that's newer than 10 years old or worth more than $5,000.

A full coverage policy in Kansas City cost $105 more per month than minimum coverage. Full coverage includes higher liability limits than the state minimums, as well as comprehensive and collision coverage, which protect your car against damage, regardless of whose fault it is.

Frequently asked questions

How much is car insurance per month in Kansas City, MO?

A minimum coverage policy costs $67 per month in Kansas City, on average. Full coverage car insurance in Kansas City costs around $172 per month. That's between 12% and 20% more expensive than the average cost across Missouri.

What car insurance company is usually the cheapest in Kansas City, MO?

State Farm has the cheapest car insurance quotes for most drivers in Kansas City. A minimum coverage policy from State Farm costs $46 per month, while full coverage from State Farm costs $98 per month, on average. Some drivers can find even cheaper rates with USAA, but you have to be a military member, a veteran or their family member to buy a policy.

What is the best car insurance in Kansas City, MO?

Shelter has the best-rated car insurance in Kansas City, based on its high claims satisfaction, customer service reviews, coverage availability and the overall value it provides policyholders. Kansas City drivers can also find great service at State Farm and USAA, which are usually less expensive than Shelter.

Methodology

To find the best cheap car insurance in Kansas City, MO, insurance quotes were collected from nine of the top companies in Missouri. Rates are for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX.

Full coverage car insurance quotes include higher liability limits than the state minimum requirements, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision deductible: $500

Rate data is from Quadrant Information Services, which uses publicly sourced insurer filings. Rates should be used for comparative purposes only, as your rates will likely be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.