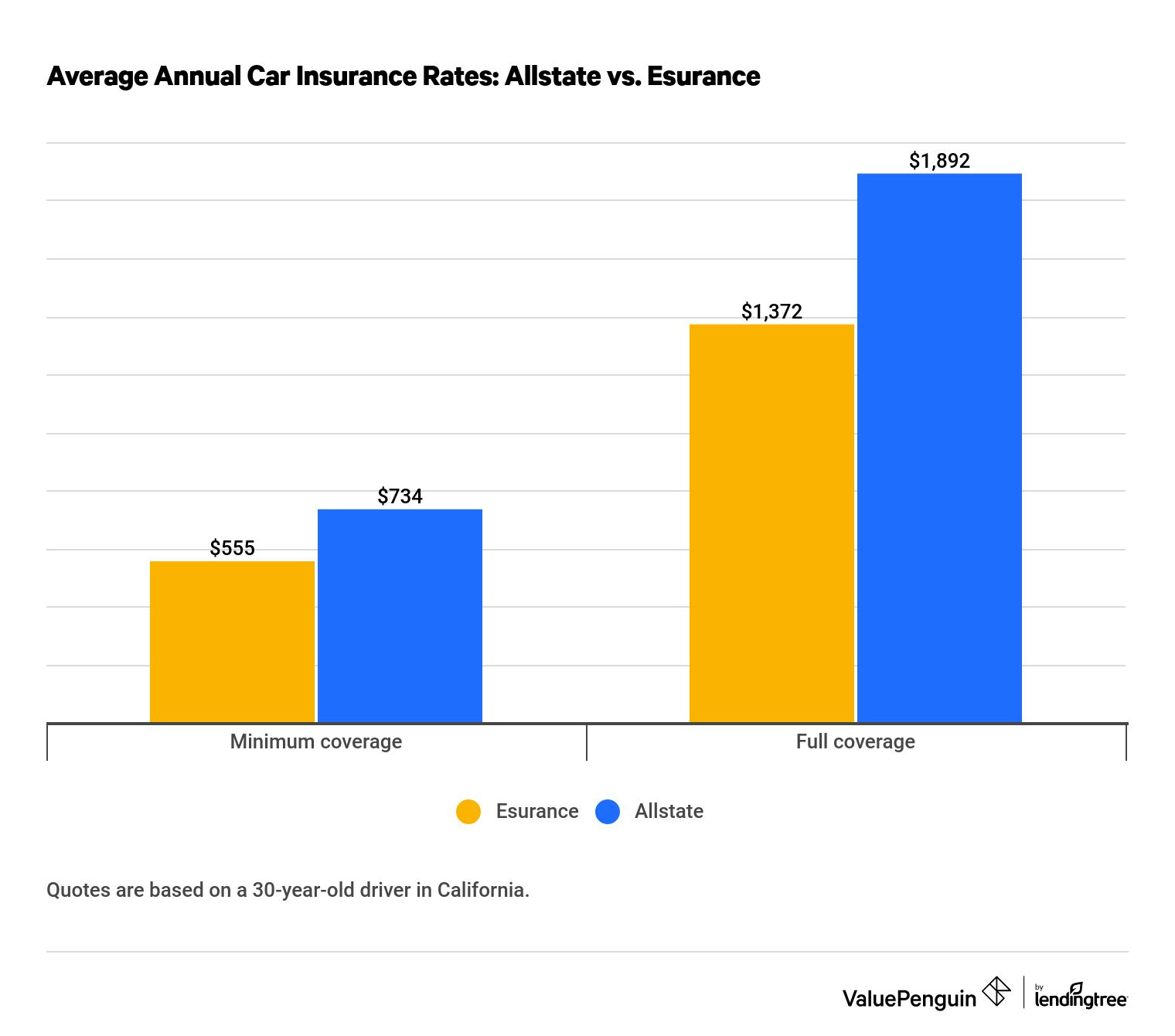

Most drivers will find better rates from Esurance than Allstate. A full-coverage policy from Esurance costs $1,372 per year, on average, which is $520 per year cheaper than Allstate and $153 per year less than the national average.

Minimum coverage is also cheaper from Esurance — a policy costs $555 per year.

However, young drivers will find cheaper rates with Allstate, and it offers more coverage options and discounts for people looking to customize their car insurance.

Best for | Allstate | Esurance |

|---|---|---|

| Price | ||

| Discounts | ||

| Coverage | ||

| Customer service | ||

| Availability | ||

| Editor's rating | ||

| Our full review | Allstate review | Esurance review |

Esurance vs. Allstate: Who’s cheaper?

Esurance offers cheaper car insurance quotes than Allstate for most drivers. However, young drivers and those who have been involved in an at-fault accident can find better rates with Allstate.

Cheapest for most drivers: Esurance

Esurance typically offers cheaper car insurance quotes than Allstate. Average auto insurance rates at Esurance are $1,372 per year, or $144 per month, for full-coverage insurance , compared to Allstate's premiums of $1,892 per year, or $158 per month.

Find Cheap Auto Insurance Quotes in Your Area

Esurance also has cheaper rates for minimum coverage . A policy from Esurance costs $555 annually, or $46 per month, while the same coverage from Allstate costs $734 per year, or $61 per month.

Esurance vs. Allstate average car insurance rates

Coverage | Allstate | Esurance |

|---|---|---|

| Full coverage | $1,892 | $1,372 |

| Minimum coverage | $734 | $555 |

Cheapest for drivers with prior incidents: Esurance

Esurance offers cheaper rates than Allstate for drivers with a recent speeding ticket or DUI. A full-coverage policy from Esurance costs 36% and 53% less, respectively.

Allstate is a better choice for drivers who have been in an accident — the company did not raise rates after a single accident. A policy from Allstate is 14% cheaper than Esurance for these drivers — a difference of $269 per year.

Esurance vs. Allstate car insurance cost after accident

Incident | Allstate | Esurance |

|---|---|---|

| Speeding ticket | $2,749 | $1,752 |

| Accident | $1,892 | $2,161 |

| DUI | $7,390 | $3,448 |

Cheapest for young drivers: Allstate

Young drivers will pay less for car insurance from Allstate than Esurance. Quotes from Allstate are 7% cheaper, on average.

While there isn't a significant difference in the cost of a minimum-coverage policy for young drivers with a clean record or a recent speeding ticket, Allstate is much cheaper for full-coverage insurance and after an accident. In fact, drivers involved in a single accident pay the same rates with Allstate as those with a clean record.

Esurance vs. Allstate car insurance for teens

Allstate | Esurance | |

|---|---|---|

| Minimum coverage | $1,948 | $1,963 |

| Speeding ticket | $2,309 | $2,329 |

| Accident | $1,948 | $2,194 |

| Full coverage | $4,409 | $4,967 |

Esurance vs. Allstate auto insurance discounts

Allstate offers many of the standard discounts drivers expect from a major insurer. Esurance does not provide an overall list of available discounts, and those that they do offer vary by state.

Discount | Allstate | Esurance |

|---|---|---|

| Anti-lock brakes | ||

| Anti-theft device | ||

| Automatic payments | ||

| Early signing | ||

| Good student |

Discounts available vary depending on your location and driver profile. Insurance companies may also limit the total potential reduction in annual premium costs. Furthermore, certain discounts may be applicable to only specific coverages, such as just the PIP section of your premium, rather than the entire policy.

Allstate vs. Esurance: Usage-based insurance

Both Allstate and Esurance have usage-based programs that provide drivers with the opportunity to save money on car insurance based on their driving behaviors.

The programs are very similar. Both companies use a mobile app to track driving behaviors and offer drivers a sign-up discount for participating in their program.

In addition, Allstate offers a pay-per-mile program, Milewise, that calculates your car insurance rate based on the number of miles you drive per month. Milewise logs your miles using a plug-in telematics device and is currently available in 21 states .

People who do not drive often, including students, retirees and those who work from home, can save money by choosing a per-mile insurance program.

Esurance vs. Allstate: Compare coverage options

As two large insurers, both Esurance and Allstate offer the standard coverages you would expect from a car insurance policy. However, Allstate offers a handful of coverage add-ons that Esurance does not.

Allstate car insurance coverage options

Allstate offers a number of coverage options that you can use to customize your policy.

Custom equipment coverage helps cover the cost of damaged or stolen aftermarket parts and electronics.

Classic car insurance protects your antique, vintage or classic car for an agreed-upon value and gives you the flexibility to decide who to trust with repairs if you make a claim.

Mexico car insurance helps pay for medical bills, car repairs, legal assistance and more if you travel to Mexico.

Ride for Hire, ride-share insurance coverage that protects drivers while their ride-share app is on and they're waiting to be assigned a passenger .

Esurance car insurance coverage options

Esurance offers fewer coverage add-ons than Allstate. Drivers can pay extra for roadside assistance, rental car reimbursement and gap insurance.

Esurance also offers ride-share insurance, called ShareSmart, in California, Illinois and New Jersey.

Allstate vs. Esurance: Company structure and policy availability

Allstate, which is available in all 50 states, underwrites policies under several subsidiary names, including Allstate Assurance, Allstate Fire & Casualty and Allstate Indemnity, among others.

Esurance is owned and backed by parent company Allstate but operates with a high degree of independence. Esurance is available to drivers in 43 states .

Esurance vs. Allstate: Customer service, reviews and satisfaction

While Allstate owns Esurance, the companies have different approaches to customer service. The major difference between the two is that Esurance focuses more on direct-to-consumer relationships, whereas Allstate relies on a large network of insurance agents.

Industry reviewer | Allstate | Esurance |

|---|---|---|

| Editor's rating | ||

| NAIC Complaint Index | 0.63 | 1.76 |

| AM Best financial strength rating | A+ | A+ |

Allstate receives better customer service ratings than Esurance, based on complaint data from the National Association of Insurance Commissioners (NAIC).

Esurance's score is higher than both Allstate and the national median, which indicates the insurer received more complaints than expected based on the company's market share.

Allstate also received a higher rating from our editors. Our rating considers the overall value a company provides, including its rates, coverage options and customer satisfaction.

Frequently asked questions

Does Allstate cover rental cars?

Your Allstate car insurance policy does cover you while driving a rental car. However, if you don't have comprehensive and collision coverage on your policy, also known as full coverage, you won't be protected for damage to the rental car that's your fault.

Who owns Esurance?

Esurance is owned by Allstate, but the companies operate independently from one another. Each offers different rates, coverage options and discounts, and your customer service experience will be different.

What states does Esurance cover?

Auto insurance from Esurance is available in 43 states. Coverage is not available in Alaska, Delaware, Hawaii, Montana, New Hampshire, Vermont and Wyoming.

Methodology

We analyzed Esurance and Allstate car insurance quotes from thousands of ZIP codes across California. The sample driver is a single 30-year-old man with a clean driving record driving a 2015 Honda Civic EX, unless otherwise noted. Young driver quotes were based on an 18-year-old man.

The following coverage levels were used to gather quotes:

Coverage type | Minimum coverage | Full coverage |

|---|---|---|

| Bodily injury liability | $15,000/$30,000 | $50,000/$100,000 |

| Property damage liability | $5,000 per accident | $25,000 |

| Uninsured/underinsured motorist bodily injury | Waived | $50,000/$100,000 |

| Comprehensive and collision | Waived | $500 deductible |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.