CURE Auto Insurance Review

Cure's a good insurance company if you're a safe driver in NJ, MI or PA.

Find Cheap Auto Insurance Quotes in Your Area

CURE is an auto insurance company available in New Jersey, Michigan and Pennsylvania that primarily considers driving history while placing less emphasis on other factors like your credit score. It's a good option to consider for drivers who may have a below-average credit history but who have minimal accidents and traffic violations on their records.

Pros and cons

Pros

Affordable rates for safe drivers and those with bad credit

Cons

Long claims and settlement processes

Only available in New Jersey and Pennsylvania

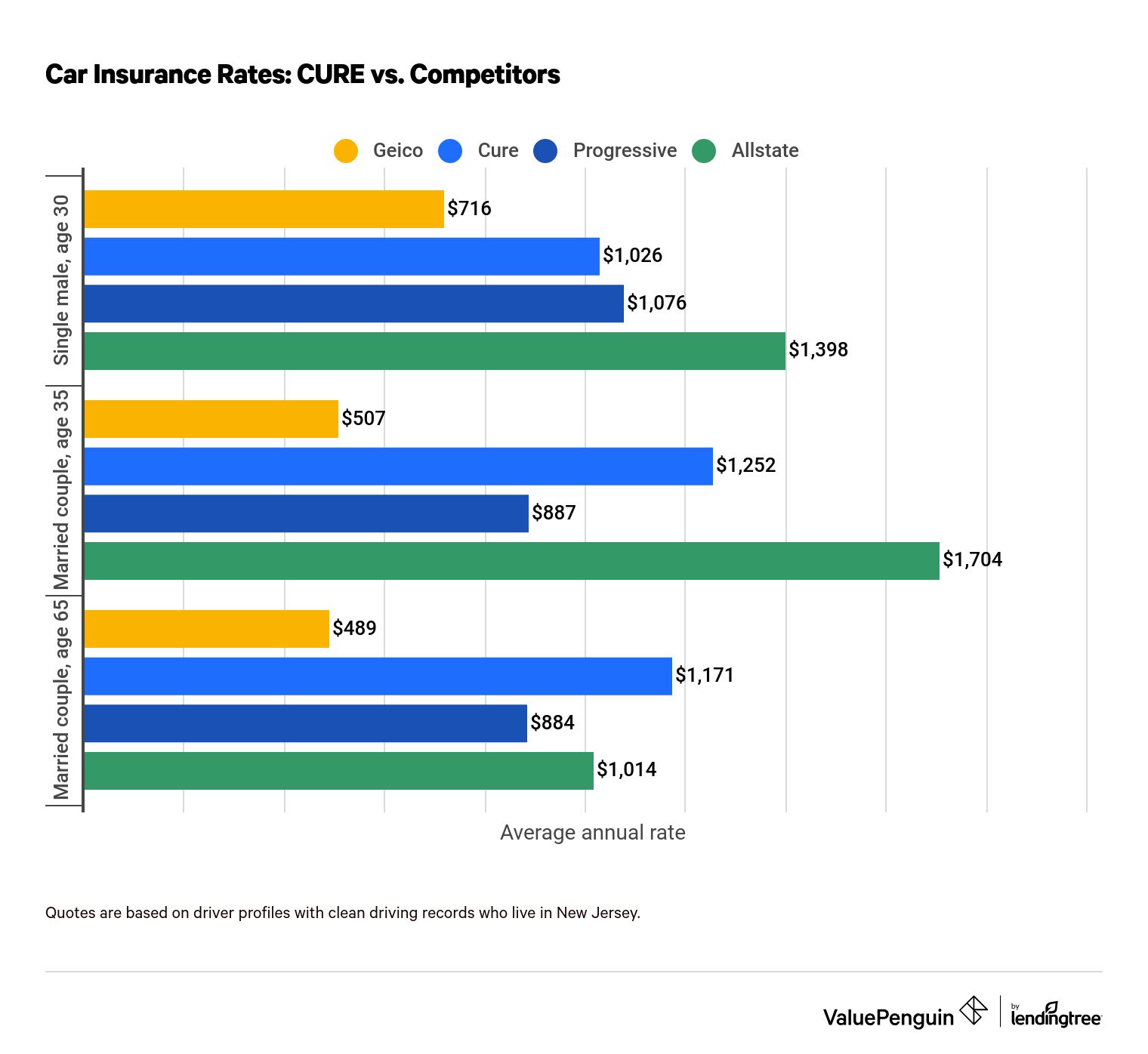

CURE Auto Insurance rate comparison

CURE Auto Insurance quotes are typically more expensive than average across our three sample demographics. Based on these quotes for drivers in New Jersey, Geico and Progressive are generally cheaper than CURE for most drivers.

Find Cheap Auto Insurance Quotes in Your Area

CURE car insurance cost vs. competitors

Company | Single male, age 30 | Married couple, age 35 | Married couple, age 65 |

|---|---|---|---|

| Geico | $716 | $507 | $489 |

| CURE | $1,026 | $1,252 | $1,171 |

| Progressive | $1,076 | $887 | $884 |

| Allstate | $1,398 | $1,704 | $1,014 |

CURE Auto Insurance discounts

CURE has a short list of discounts for drivers. Note that these are the discounts available to New Jersey drivers, and availability may vary by state. Most CURE discounts only apply to certain coverages: for example, keeping your car in a secure garage will reduce what you pay for comprehensive (other-than-collision) coverage but won't impact your liability coverage.

CURE car insurance discounts and savings

Discount | Coverage | Savings |

|---|---|---|

| Anti-theft device | Comprehensive | 5%-25% |

| Defensive driving course | Liability, personal injury protection (PIP), collision | 5% |

| Loss-free | Comprehensive, collision | 5% (2 years), up to 20% (5 years) |

| Bundle | Collision (does not stack with loss-free) | 15% |

| Safe parking | Comprehensive | 10% (off-street), 25% (secure garage) |

Loss-free discount

CURE policyholders are eligible for a loss-free discount that increases the longer they go without a claim on their policy.

If you have two claim-free years while insured with CURE, you'll receive a 5% discount. After three years, the discount increases to 10%, and at five or more years, the discount jumps to 20%.

Parking discount

CURE Auto Insurance policyholders are eligible for discounts on their comprehensive coverage if they park their car in certain locations:

- Off-street parking discount: A 10% discount on comprehensive coverage is afforded on vehicles that are customarily parked off-street. The discount applies to vehicles that are parked in a driveway or nonsecure parking facility.

- Secure parking discount: A 25% discount is afforded on comprehensive coverage to vehicles that are customarily kept in a garage or secure parking facility that provides 24/7 guard service and/or requires a security code key for entry and exit. Proof is required.

Auto insurance policy coverage

CURE offers both a basic and standard car insurance policy in New Jersey. The basic policy is a lower-cost alternative to the standard car insurance policy for drivers who may find the features and coverage unnecessary.

Rates based on driving history

CURE Auto Insurance stands apart because it bases insurance premiums primarily on your driving history. Most insurers factor in credit score, the highest level of education attained, homeownership and other factors to determine the risk of a driver getting into accidents. CURE, however, views this as income discrimination and secondary to accident risks.

If you live in New Jersey, Michigan or Pennsylvania and have a great driving record but below-average credit history or educational attainment, consider CURE. However, this means that you'll see a proportionally bigger jump in rates after a crash than you would at another insurer.

Rates at CURE for married couples, however, are more expensive versus the state average and more expensive than at some competitors like Geico or Progressive. For a married couple, age 35, Geico is 60% cheaper than CURE, and Progressive is 29% cheaper.

The basic package

Generally speaking, in the state of New Jersey, CURE offers the following coverage in its basic car insurance package:

- $5,000 property damage coverage limit

- $15,000 PIP medical expense coverage limit

- $10,000 extended medical expense benefits coverage limit

- The limitation on lawsuit threshold

- Drivers also have the option of choosing bodily injury liability coverage (up to $10,000) and personal injury protection coverage (with various deductibles and discounts on PIP premiums)

CURE also allows its customers to create their own policy, just like at other insurers, where you can choose your liability limits. These plans also offer optional coverages like collision, comprehensive (other-than-collision) and towing coverages.

Poor to average claims experience

Customers report that the claims process with CURE involves several rounds of back and forth communication. Company representatives can be unresponsive, or uncoordinated in terms of having necessary paperwork and information in order. Several policyholders report prolonged investigation with delayed payouts, while some insureds say they're satisfied with claims being paid in full and efficiently.

CURE insurer ratings

Metric | Value |

|---|---|

| AM Best financial rating (2022) | Not rated |

| Better Business Bureau rating (2022) | A+ |

| NAIC complaint index (2022) | 0.97 (slightly better than average) |

How to file a claim with CURE

After dialing the claims phone number, you'll automatically be connected with a claims representative without having to key in any prompts. CURE claims representatives are available 24/7.

Phone number: 800-229-9151

Customer service

To speak to a person for general CURE customer service questions, dial 800-535-2873:

- Press 1 if you're a current or prospective Michigan customer

- Press 2 if you're a current or prospective New Jersey customer

- Press 3 if you're a current or prospective Pennsylvania customer

About CURE Auto Insurance

CURE Auto Insurance is licensed to offer auto insurance in the states of New Jersey, Michigan and Pennsylvania. CURE stands for Citizens United Reciprocal Exchange. It was founded in 1990 by former New Jersey Insurance Commissioner James J. Sheeran and Lena Chang and is based out of Princeton, N.J. CURE is not set up as a traditional insurance company and instead exists as a not-for-profit reciprocal exchange.

Methodology

We evaluated CURE on its price, coverage options and service to see how it stacks up against its competitors.

All insurance quotes are for a driver (or drivers) living in Edison, N.J., who drives a 2015 Toyota Corolla with no recent claims or driving infractions.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.