Largest Business Insurance Companies in the U.S.

Travelers is the largest business insurance company for covering injuries and property damage.

Progressive is the biggest business auto insurance company. Liberty Mutual, State Farm and Auto-Owners are also some of the top business insurance companies.

Top 10 commercial insurance companies

There are three main segments of the commercial insurance industry: liability, nonliability and auto insurance.

- Business liability insurance protects a business from lawsuits if it is facing accusations for injuries or property damage that occurred at the business location or as a result of business operations or products.

- Business nonliability insurance includes all other types of business insurance, such as commercial property insurance and business income insurance.

- Business auto insurance protects business owners and employees against property damage and bodily injury claims when driving company-owned vehicles.

Largest commercial liability insurance companies

Travelers is the largest commercial liability insurance company, with $2.02 billion in premiums in 2023. Tokio Marine is the next largest company, with about $1.27 billion in premiums.

The top 10 commercial liability insurance companies account for 47% of the business liability insurance market in 2023.

Top business insurance companies for liability coverage

Company | Market share | Direct premiums |

|---|---|---|

| Travelers | 9.9% | $2,024M |

| Tokio Marine | 6.2% | $1,272M |

| Liberty Mutual | 5.6% | $1,143M |

| The Hartford | 4.4% | $892M |

| Auto-Owners | 3.9% | $792M |

Direct premiums are in millions.

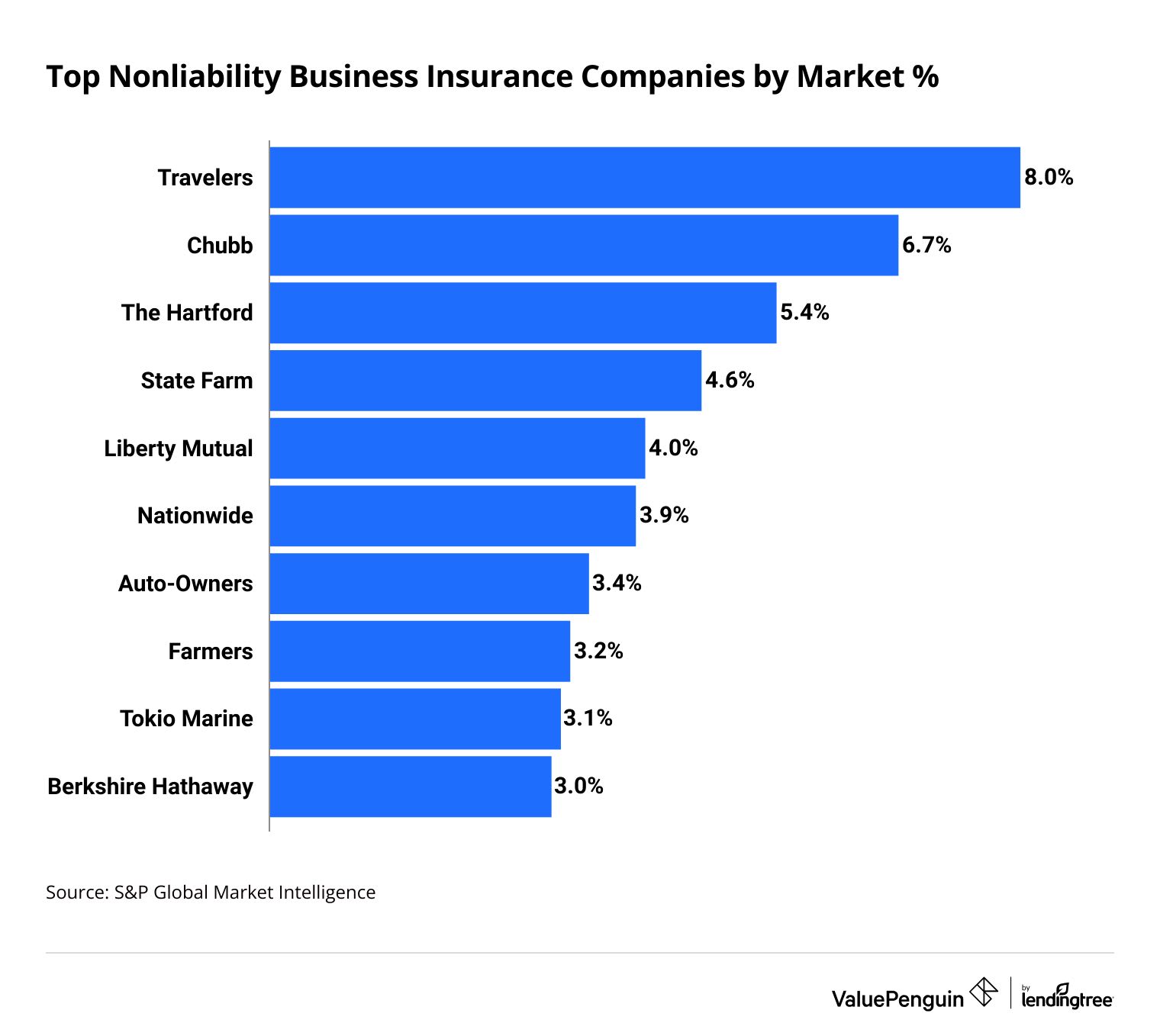

Largest commercial nonliability insurance companies

Travelers is also the largest nonliability business insurance company, with $3.25 billion in premiums for 2023. Travelers sold almost $528 million in policies more than Chubb, the second-largest company.

The 10 largest nonliability companies make up about 45% of all the nonliability business insurance in the country. Nonliability coverage includes things like business property damage coverage and income insurance.

Top business insurance companies for nonliability coverage

Company | Market share | Direct premiums |

|---|---|---|

| Travelers | 8.0% | $3.3B |

| Chubb | 6.7% | $2.7B |

| The Hartford | 5.4% | $2.2B |

| State Farm | 4.6% | $1.9B |

| Liberty Mutual | 4.0% | $1.6B |

Direct premiums are in billions.

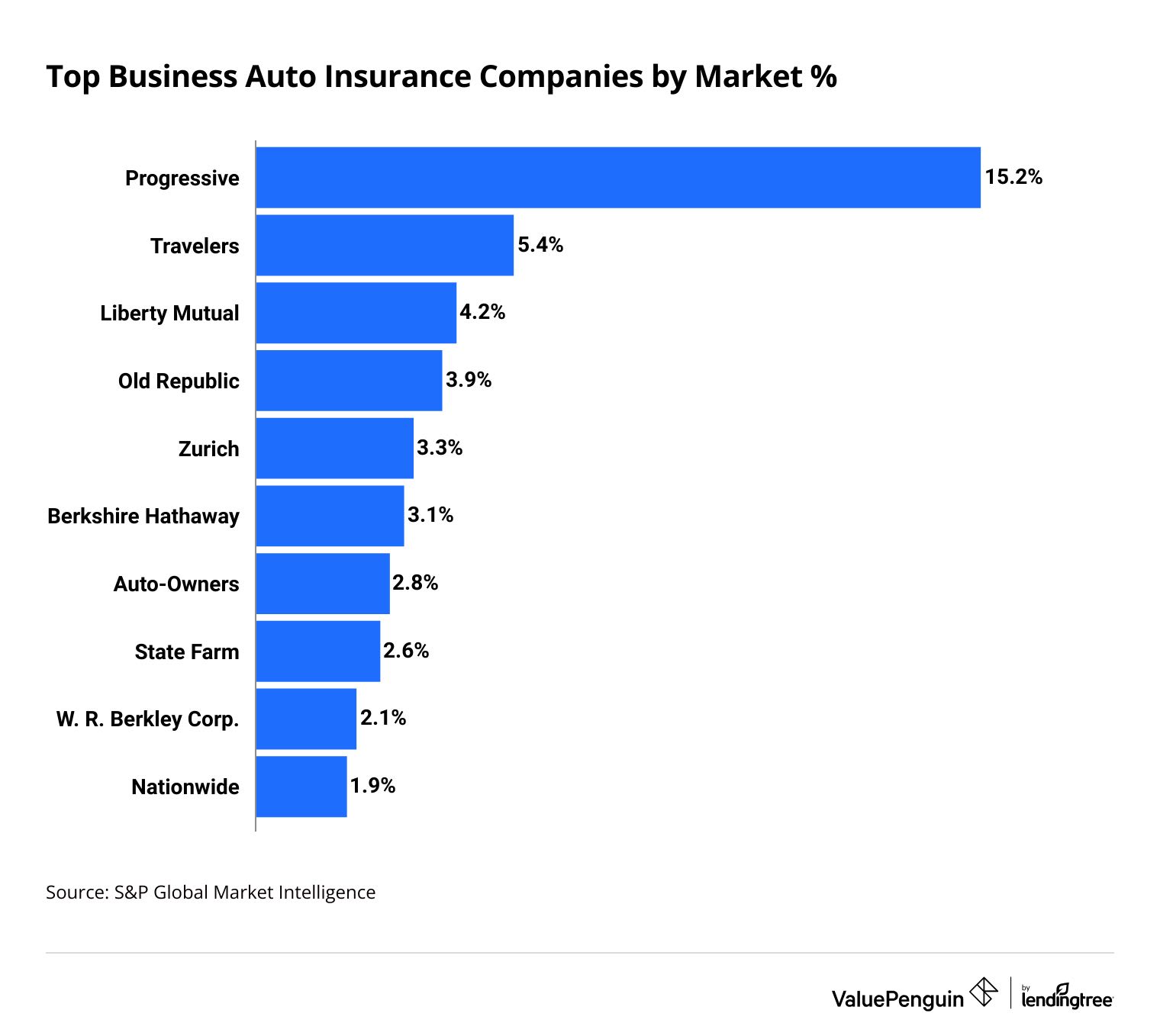

Largest commercial auto insurance companies

Progressive is the largest business auto insurance company by far, with over 15% of the market. The company sold $9.7 billion worth of business auto insurance in 2023.

The 10 biggest commercial auto insurance companies make up 45% of the market, with more than $28 billion in direct premiums written.

Top business auto insurance companies

Company | Market share | Direct premiums |

|---|---|---|

| Progressive | 15.2% | 9.7B |

| Travelers | 5.4% | 3.4B |

| Liberty Mutual | 4.2% | 2.7B |

| Old Republic | 3.9% | 2.5B |

| Zurich | 3.3% | 2.1B |

Direct premiums are in billions.

Business insurance customer service reviews

J.D. Power ranks the level of customer satisfaction of small commercial insurance companies based on feedback from businesses. Choosing a company with good customer satisfaction can make your life easier if you need to file a claim or make changes to your policy.

Company |

J.D. Power score

|

|---|---|

| Nationwide | 883 |

| State Farm | 877 |

| Cincinnati | 870 |

| Farmers | 864 |

| Allstate | 860 |

Source: J.D. Power 2023 U.S. Small Commercial Insurance Study

Methodology

ValuePenguin gathered market share and direct written premium data from S&P Global Market Intelligence, a financial data resource for the insurance industry.

J.D. Power is a market research firm that analyzes customer feedback across many industries, including insurance. It conducts annual customer satisfaction surveys across the industry, with a rating out of 1,000 points. The average score among small business insurers in 2023 is 847.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.