MetLife Car & Home Insurance Review: Now From Farmers

MetLife auto and home insurance is now part of Farmers Insurance, though you can still get a quote or file a claim directly through MetLife for now.

Find Cheap Auto Insurance Quotes in Your Area

Is MetLife going out of business?

No. MetLife sold its home and auto business to Farmers as of April 7, 2021. The acquisition doesn't affect MetLife's other insurance options, including life, health and pet insurance, which will still be available through MetLife.

MetLife has promised that if you have a current MetLife auto or home policy, your current coverage and rates will stay the same during the transition. The only difference is your policy will be issued through Farmers or a subsidiary like Foremost, and you'll need to work with Farmers to manage your policy.

However, your rate, coverage or discounts could change when your policy is up for renewal. You should be notified in writing of any changes when you renew. Your rates can also change if you update your policy before renewal, like changing your address or adding or removing a driver or car.

Should I stay with MetLife/Farmers?

MetLife is now sending customers through Farmers' website or agent for support, payments, account management and claims. Current customers should have received updates on the acquisition and new policy documents in the mail.

There's one exception: MetLife's MyDirect program has been discontinued and won't be moved to Farmers, so MyDirect members will have to contact MetLife directly for next steps.

Like MetLife, Farmers is known for offering solid coverage at reasonable rates. However, you may get better support as a Farmers customer, since MetLife scores slightly worse on customer service ratings. Our experts waited on hold for over an hour to speak to MetLife support and get few helpful details about the acquisition.

Find Cheap Auto Insurance Quotes in Your Area

Pros and cons

Pros

Bundling home and auto insurance

Home insurance coverage options

Cons

Rates aren't the cheapest

MetLife auto and home insurance review

For any coverage level, MetLife has rates that are slightly more expensive than average.

MetLife did offer reasonable rates for drivers who have been in a crash.

Despite MetLife's few discounts, car and home customers who qualify for an employer or affinity discount could reduce their rates a lot.

The customer service MetLife provides is mixed: Its car insurance service is below average, while its home insurance service is somewhat more highly regarded.

In both cases, shoppers who prioritize high-quality customer service when looking for coverage will likely be more satisfied with other providers.

Compare MetLife to other top auto insurance companies | |

|---|---|

| |

| Read review |

| Read review |

| Read review |

| Read review |

Metlife car insurance quote comparison

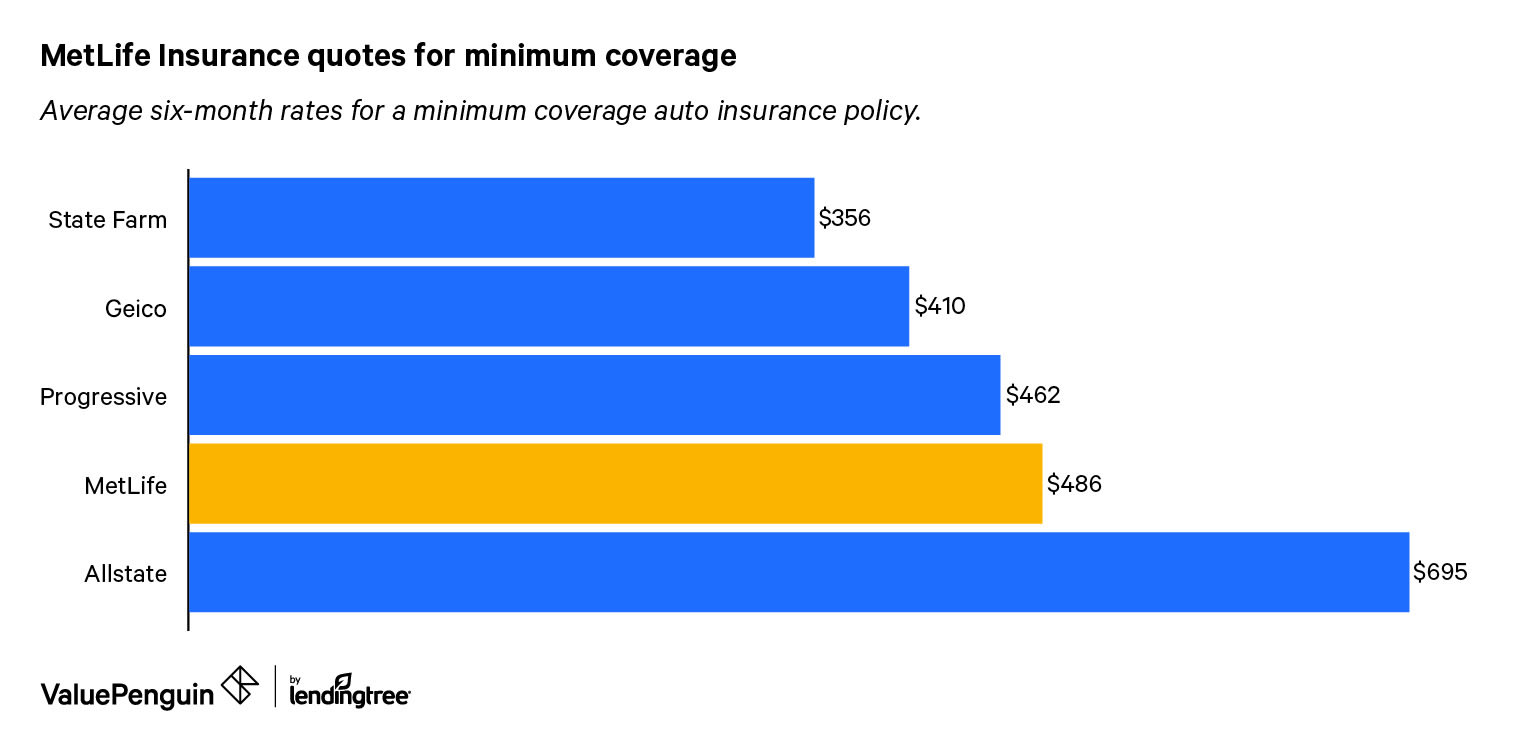

We compared rates offered by MetLife and a few of its competitors for minimum and full coverage car insurance. Most drivers looking for any level of coverage could find competitive auto insurance quotes with MetLife, though we found they're usually slightly more expensive than average.

Find Cheap Auto Insurance Quotes in Your Area

MetLife car insurance rates vs. competitors

Insurance provider | Minimum coverage | Full coverage | Full coverage with one accident |

|---|---|---|---|

| State Farm | $356 | $869 | $1,038 |

| Geico | $410 | $1,079 | $1,570 |

| Progressive | $462 | $1,197 | $1,907 |

| MetLife | $486 | $1,224 | $1,980 |

| Allstate | $695 | $1,773 | $2,680 |

MetLife was more expensive than many of its competitors for drivers with one accident. In spite of this, the insurer's high quotes didn't make it an unrealistic option for most drivers. Rather, even for those who don't qualify for discounts, MetLife's rates are close enough to its competitors’ that certain drivers — like those looking to add specific coverage to their policies — may favor it.

MetLife vs. Geico

MetLife is more expensive than Geico for both full and minimum coverage car insurance. Moreover, Geico's rate increase after an accident was far more forgiving than MetLife's, which charged a six-month rate that was hundreds of dollars more expensive than Geico following one claim for bodily injury liability.

The coverage options and discounts available from MetLife are mostly comparable to those offered by Geico. Drivers looking specifically for MetLife's custom sound equipment coverage won't find a similar coverage at Geico. Those who can reduce their rates with MetLife's affiliate discount will likely be drawn to the insurer. Otherwise, price will likely be the deciding factor for most drivers.

MetLife car insurance features and coverages

Aside from offering bodily injury and property damage liability, uninsured motorist and other forms of coverage that are required by nearly every state, MetLife has a few special features that are hard to find elsewhere — as well as a few common upgrades that are nonetheless useful ways for most drivers to maximize coverage.

Drivers can add the following protections their MetLife Insurance policies for an extra cost:

Replacement cost coverage for major parts

Replaces damages to the insured vehicle's tires, brakes and batteries without factoring in the car's depreciation.

New car replacement

Pays the entire replacement cost of the insured vehicle without factoring in depreciation, provided the car is younger than one year old or has driven fewer than 15,000 miles.

Custom sound equipment coverage

Protects any aftermarket sound systems that have been added to the insured car.

Glass repairs without deductible

Waives the deductible for replacing a damaged window or windshield.

Gap coverage

Pays the difference between what's owed on the insured car's lease or loan and its current value after it's totaled.

Rental car insurance

Provides supplemental protection against damages that are incurred while driving a rental car.

Rental car reimbursement coverage

Pays for the cost of a rental car while the insured car is being repaired after an accident, up to the selected limit.

Auto insurance discounts from MetLife

You could get substantial discounts by being part of MetLife's network of affiliated organizations and workplaces.

MetLife offers affinity discounts to hundreds of different organizations nationwide. Shoppers could get discounts of more than 30% for being associated with private and public employers of all sizes, labor unions, credit unions and more.

Even drivers who don't qualify for the insurer's affinity discounts could save money with Metlife Insurance. Shoppers may qualify for reduced rates by:

- Electing to make automatic payments each month

- Completing a defensive driving course

- Bundling MetLife's car insurance with a home or life policy

- Having a high grade point average

- Continuing to be claim-free for five years

- Owning a vehicle with anti-theft or safety devices

- Signing up for MetLife's MyJourney® and receiving a high driving score

- Being an older driver

MetLife also allows drivers who don't make a claim for consecutive years to get a $50 credit toward a future deductible payment. This perk can lower the cost of a deductible by as much as $250.

MetLife MyDirect

For drivers who prefer to take care of their car insurance needs entirely online, MetLife MyDirect may be an attractive option. In exchange for agreeing to do everything online, including paying your bills and making claims, MyDirect customers will pay a lower rate than drivers covered by a standard MetLife auto insurance policy.

However, user reviews suggest consumers have difficulty using MyDirect. Customers showed frustration regarding the stability and ease of use of the MyDirect site and difficulty getting support from a MyDirect representative when they needed it. The service has low marks on both Apple and Android devices.

Platform | Number of stars out of five |

|---|---|

| Google Play | 1.5 |

| App Store | 1.5 |

MetLife home and auto reviews and ratings

While its service isn't poor, few drivers would consider MetLife's customer service as a particular strength of the company.

MetLife Insurance customers have different assessments of the insurer's customer service, depending on whether they're auto or homeowners insurance customers. According to the National Association of Insurance Commissioners (NAIC), MetLife auto insurance gets more complaints than a median insurer, while its home insurance gets fewer. In any case, customers cited the surprise fees that they were charged by MetLife as the main reason for their dissatisfaction.

J.D. Power also rated MetLife's products differently. While MetLife's auto insurance service is about average compared to its competitors at the national level, the insurer's home product line ranked far below average. However, at the regional level, MetLife's auto insurance was rated consistently below many of its competitors.

MetLife's financial standing, meanwhile, is solid. The company earned an "Excellent" rating from A.M. Best, meaning MetLife is very likely to be able to pay out claims made by its customers.

Product | Number of complaints | J.D. Power score |

|---|---|---|

| MetLife auto insurance | More than expected | Average |

| MetLife home insurance | Fewer than expected | Below average |

MetLife home insurance reviews

Metlife home insurance quote comparison

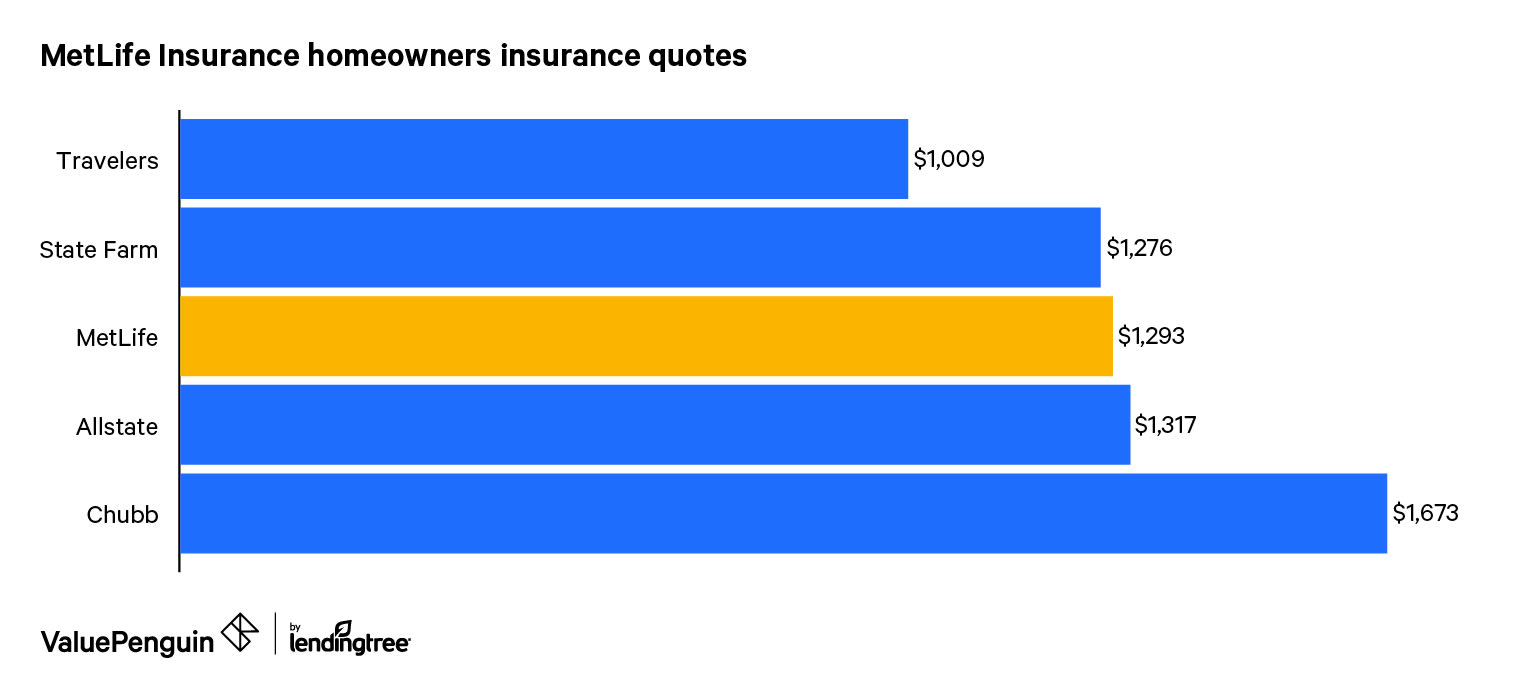

The cost of Metlife home insurance is in alignment with its largest competitors. However, given the few features that come with a standard MetLife home insurance policy, many customers may have to factor in the extra cost it takes to get the benefits that come with the insurer's Platinum or GrandProtect packages.

Find Cheap Homeowners Insurance Quotes in Your Area

MetLife home insurance rates vs. competitors

Insurance provider | Annual rate |

|---|---|

| Travelers | $1,009 |

| State Farm | $1,276 |

| MetLife | $1,293 |

| Allstate | $1,317 |

| Chubb | $1,673 |

MetLife home insurance coverage

MetLife’s home insurance coverages are split into three different plans. Each level of protection combines a few endorsements and other perks. This means that homeowners can't get endorsements separately, as they would with MetLife auto insurance.

Homeowners can choose between the Standard, Platinum and GrandProtect plans. MetLife's standard plan includes coverage for one's dwelling, personal property, along with liability protection and reimbursement for loss of use expenses.

Comprehensive coverage from MetLife includes the following perks:

Replacement cost coverage

Covers damage to the insured structure and its contents after a loss, without consideration to monetary depreciation.

Water backup protection

Pays for the damage caused by a backed-up sump pump or drain, up to $10,000.

Valuables plus

Increases the protection afforded to high-value items, such as jewelry, precious metals and firearms.

Personal identity protection

Enrolls you in identity fraud monitoring services and provides professional support in the event of a breach.

Excess liability

Provides up to $1 million of liability protection to homeowners who face lawsuits.

MetLife home insurance discounts

There are fewer discounts offered to MetLife home insurance customers than to its auto customers. Applicants could reduce their rates by:

- Bundling an auto or life insurance policy with their home coverage

- Remaining claim-free for five consecutive years

- Equipping a home with safety and security features, like a sprinkler system or burglar alarm

- Owning a home that's less than 20 years old

Frequently asked questions

Does MetLife still sell insurance?

MetLife doesn't sell car or home insurance anymore because it sold this part of its business to Farmers. All existing MetLife car and home insurance customers will have their policies transferred in the next few months. MetLife still sells other kinds of insurance.

What company owns MetLife auto insurance?

MetLife recently sold its auto and home insurance businesses to Farmers Insurance. Everyone who has a homeowners or car insurance policy from MetLife will eventually be transferred to Farmers. MetLife still retains its other businesses, including life and dental insurance.

Methodology

We gathered quotes for MetLife auto insurance for minimum and full coverage. We also checked how experiencing one accident would change the cost of coverage. We used the sample profile of a 30-year-old man who drove a 2015 Honda Civic EX to get the rates for this review.

Likewise, we got the information for our home insurance rate comparison from New York. We got rates for the cost to insure a house built in 1961 that's worth $314,500 — the median value of a home in the Empire State. This sample home was 2,100 square feet in area.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.