Health Insurance

Nearly 50% of Americans Think Their Insurance Premiums Are Tax Deductible — But Most of Them Are Incorrect

Forty-nine percent of Americans believe they can write off the cost of their auto, health, home or life insurance policies as tax deductions. Most of these people, however, could face pushback from the IRS if they tried to write off every insurance expense.

In some cases, policyholders can write off their health or auto insurance policies, but this is far from the norm for most Americans. The latest coronavirus relief bill passed in March expanded tax subsidies for COBRA and marketplace health insurance policyholders. Following legislation changes, these two groups are increasingly likely to be able to write off part or all of their insurance premiums.

At the same time, there's a good chance that many of these policyholders may not understand recent changes that affect the health care and health insurance industries. For example, half of consumers believe the individual mandate for health insurance exists, although it hasn't since 2019. Others, such as those who received an insurance settlement, may also believe they owe more money to the IRS than they do.

Key findings

- About half of Americans believe their insurance premiums are tax deductible — but most of them are incorrect. Men and those with high incomes were most likely to believe they can take a deduction, while baby boomers were least likely.

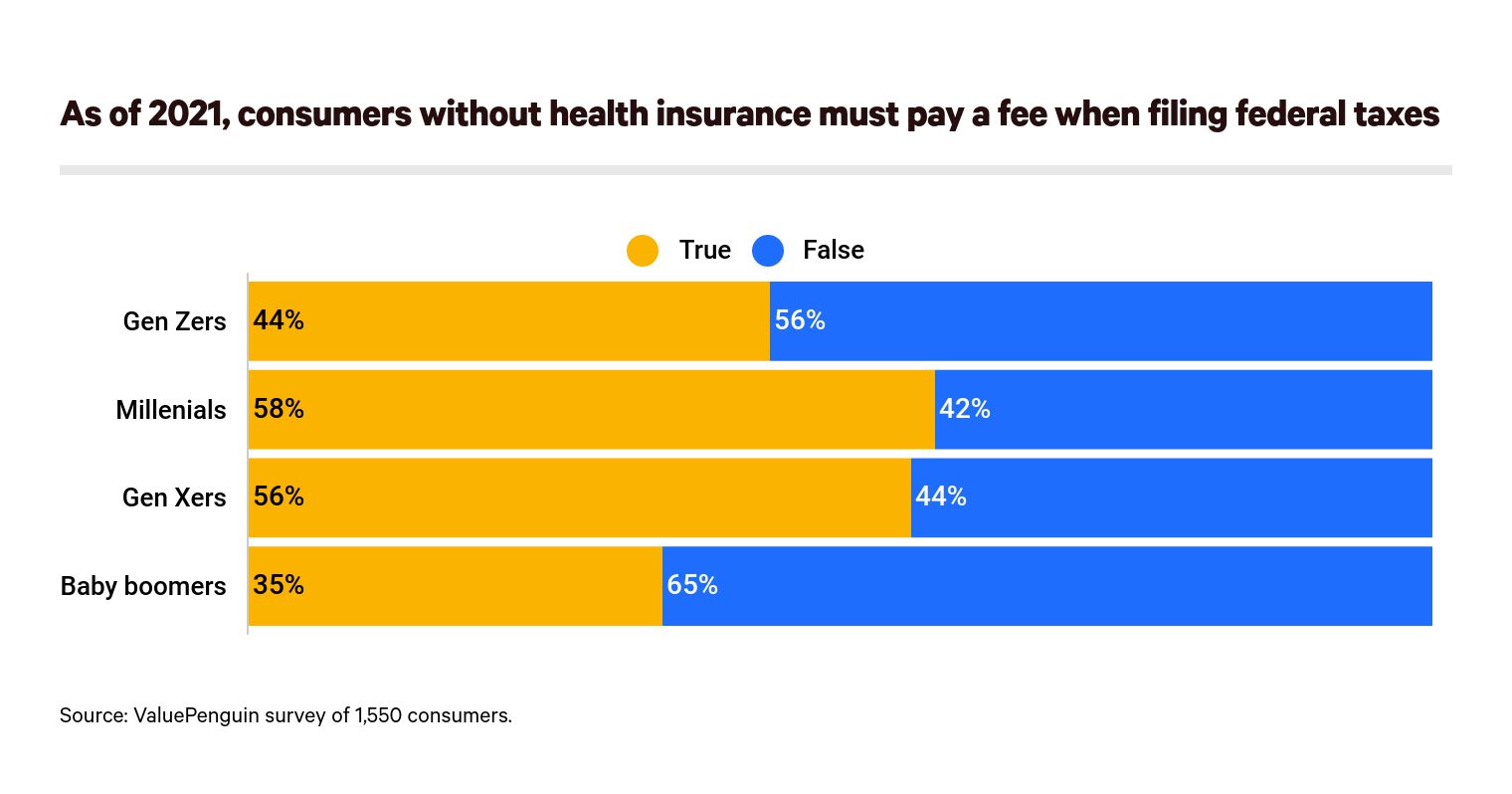

- 50% of consumers think the federal individual mandate for health care still exists, which required those without health insurance to pay a fee on their federal return. While some states still have individual mandates, this no longer exists on the federal level.

- Despite 61% of consumers thinking the opposite, if you received money from an insurance claim in 2020, it generally won’t be taxed as income.

- More than two-thirds of consumers believe life insurance policy loans count as taxable income, which is generally not the case and is one of the reasons these loans can be helpful for those struggling to make ends meet amid the pandemic.

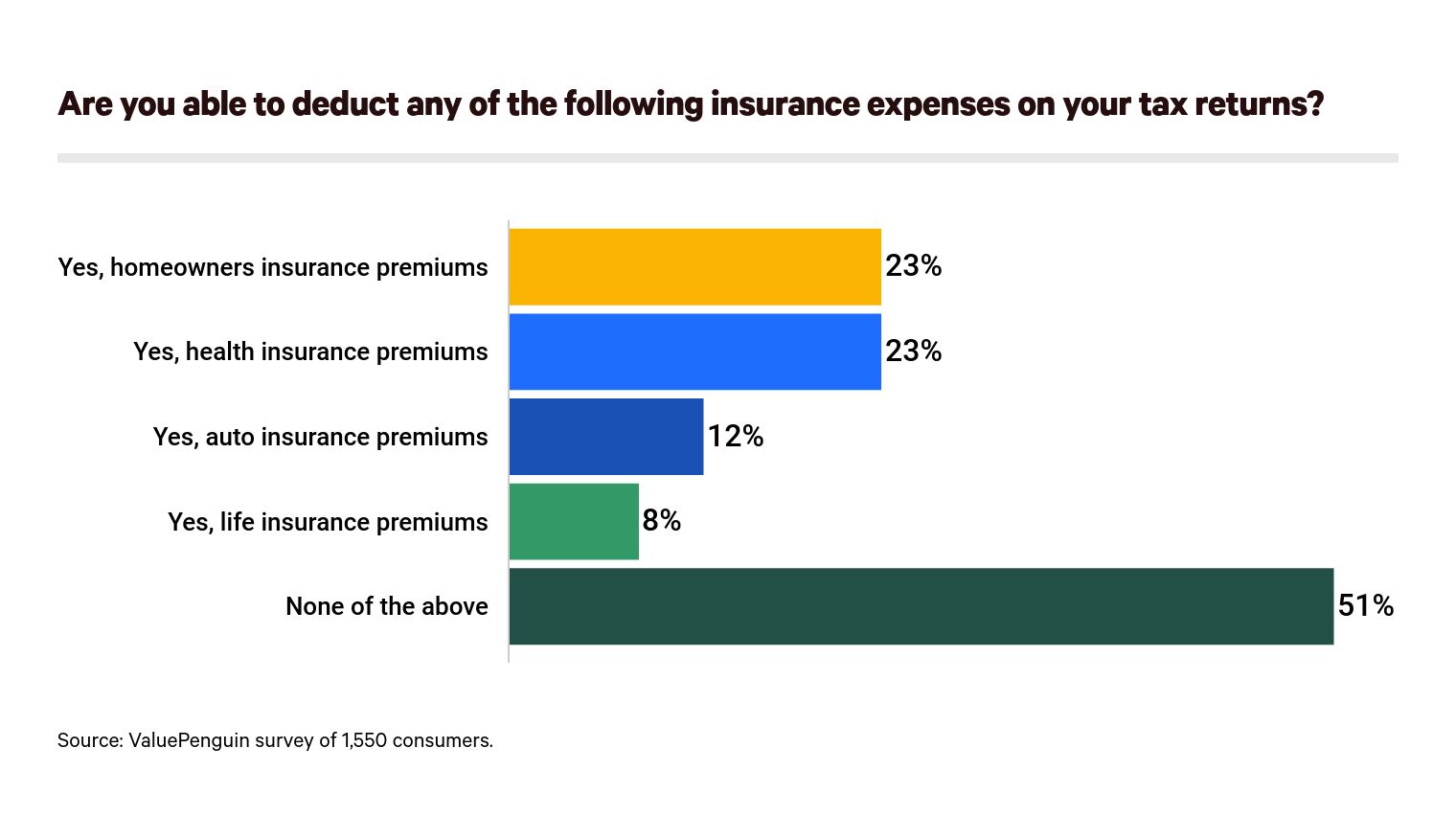

51% believe insurance costs aren't tax deductible, but the truth is complicated

Although it's incorrect that a policyholder can never deduct the cost of their insurance from their taxes, understanding when one's expenses are tax deductible is difficult. Whether one's insurance is tax deductible depends on the type of coverage, as well as a range of specific, individual characteristics that influence eligibility.

Most Americans have a clear understanding of the limits of filing a tax deduction for their life insurance premiums. Only 8% of people claimed they could deduct their life insurance premiums. Life insurance premiums for individuals are personal expenses and therefore not classified as tax deductible by the IRS.

While Americans were nearly uniformly correct about filing for tax deductions for their life insurance premiums, they were mixed on the other forms of insurance we asked about.

People were most likely to believe their homeowners insurance expenses were eligible for tax write-offs. Twenty-three percent of respondents speculated that they could write off their homeowners insurance as tax deductible, including 36% of men and 30% of Gen Xers. Conversely, women (12%) and baby boomers (13%) most often voiced skepticism. In fact, under most circumstances, policyholders can’t write off their homeowners insurance, except in some unique cases:

- Policyholders who work from home may be able to deduct the coverage for the square footage used specifically for their job.

- People who rent out their homes might be able to classify their homeowners insurance as a business expense.

In both cases, however, these exceptions are unlikely to apply to most people. In fact, insurers often specifically designate the conditions under which they're liable for covering a home according to the amount of business that takes place on the premises. Each insurer's stipulations are different, but it's common for providers to waive coverage when a homeowner exceeds a certain income level from rental fares — the extra money one takes in from renting a home could void the protections offered by an insurance policy.

As with home insurance, there are many who mistakenly believe auto insurance premiums are tax deductible. While one in eight Americans believe they can deduct the cost of their auto insurance, only those who own a car for business expenses may be able to write off the resulting insurance policy on their taxes. Most people can’t.

In all cases, ValuePenguin discovered that the richest Americans were most often incorrect about the types of insurance that are tax deductible. While 24% of Americans believed that home insurance was a deductible expense, 45% of those making at least $100,000 a year answered similarly. Additionally, 18% of people in the higher income bracket, compared with 12% overall, thought their auto insurance was deductible.

Who may write off their insurance costs on their taxes?

- Some homeowners who work from home and who rent out parts of their homes, under conditions set by their insurance provider.

- Auto owners whose cars qualify as a business expense.

ValuePenguin's survey revealed a general sense of uncertainty surrounding the relationship between auto and homeowners insurance and taxes, but the confusion about the intricacies of health insurance and taxes is much more pervasive.

Misinformation about health insurance and taxes exceeds uncertainty about writing off premiums — but rules are changing

Twenty-three percent of Americans believe that they can write off health insurance premiums on their taxes. While this is partially true for many Americans, it's not a universal truth. Generally, consumers with employee-sponsored medical coverage can't write off their health insurance premiums. For those who purchase their own health insurance through the Affordable Care Act (ACA) marketplace, those with Medicare and individuals with COBRA plans are eligible for an increasingly longer list of tax deductions.

The passage of the coronavirus relief package in March expanded tax benefits for many people. Nonetheless, the 23% of Americans still wouldn't be able to write off their health insurance with approval from the IRS, based on projections from the Congressional Budget Office.

In previous years, individuals who carried COBRA plans would have been responsible for payments equaling up to 102% of their premiums for 18 months. However, the federal government now only requires policyholders to pay 15% of their premiums per month through the end of September. The government pays the rest with tax subsidies. COBRA enrollees who lost their jobs or saw a reduction in their hours involuntarily could also see their premiums paid for.

Depending on their incomes, those whose health care comes from the ACA marketplace may be able to write off a portion — or the entirety — of their premiums.

Before the passage of the relief bill, eligibility for tax credits for those who purchased their own health insurance from the federal marketplace was constrained to those making between 100% and 400% of the federal poverty level, and it was tied to local insurer prices and age. Now, however, far more people may be able to write off their health insurance premiums when they file their taxes.

Those making more than 400% of the federal poverty level can qualify for tax benefits. Those with the lowest incomes could write off the entirety of their premiums, but even those making greater than $51,520 (400% of the federal poverty level) could write off a portion of their health insurance premiums. Additionally, those who received unemployment benefits could qualify for a tax credit as if their income was equal to 133% of the federal poverty level, which would entitle them to a $0 net premium after tax credits.

Target | Old laws | Law change |

|---|---|---|

| COBRA-eligible consumers | Policyholders must pay up to 102% of their premiums for 18 months | Must pay 15% of their premiums through the end of September — though some could pay less |

| Marketplace policyholders with incomes between 100% to 400% of the federal poverty level | Receive tax credit proportional to income, other factors | Expanded tax credits for eligible policyholders |

| Earners with incomes greater than 400% of the federal poverty level | Not eligible for tax credit | Eligible for ACA tax credit |

| Workers who received unemployment benefits in 2021 | Tax benefits tied to income | Eligible for tax credit as if their income level was 133% of the federal poverty level |

Based on a misunderstanding of income and tax penalties, some consumers may be worried they aren't paying enough in taxes

In addition to feelings of uncertainty about what types of insurance generally qualify for tax credits, respondents to ValuePenguin's survey expressed a lack of understanding regarding income and taxes, as well as the potential for penalties that could impact a household's ability to plan accurately for a budget.

Sixty-six percent of Americans believe that a loan they take out from their life insurance policy counts toward taxable income. But this isn't necessarily the case. Rather, the funds one gets from a loan often wouldn't be taxed like normal income unless a policyholder's life insurance lapses, or unless the amount owed on the loan — coupled with interest — exceeds the policy's value.

Similarly, 61% of people think they would have to pay taxes on insurance settlement money that they receive after making a claim. However, there are only a few exceptions where this money would be taxed. Any life insurance payouts that replace conventional income may be taxable. Punitive damages awarded in a lawsuit and lost wages, both of which a policyholder may use their insurance to acquire, may be taxed, as well.

Finally, data shows that a portion of the population may be expecting tax penalties that aren’t forthcoming. Half of Americans think that consumers without health insurance must pay a fee when they file federal taxes. In reality, the individual mandate — originally part of the ACA's legislation — hasn’t been in effect since 2019. This is good news for those who lost coverage in 2020. Still, 61% of men thought this tax penalty exists, while more than half of millennials (58%) and Gen Xers (56%) thought the same.

Methodology

ValuePenguin commissioned Qualtrics to field an online survey of 1,550 Americans, conducted Feb. 19-22, 2021. The survey was administered using a non-probability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

- Generation Z: 18 to 24

- Millennial: 25 to 40

- Generation X: 41 to 55

- Baby boomer: 56 to 75

While the survey also included consumers from the silent generation (defined as those 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.