QBE Homeowners Insurance Review

QBE offers standard homeowners insurance coverage at above-average prices, and you can only purchase a policy through an insurance agent.

Find Cheap Homeowners Insurance Quotes in Your Area

QBE makes very little information about its homeowners insurance policies public. However, the limited information we were able to find proved QBE to be a poor choice for most homeowners due to high rates and subpar customer satisfaction scores.

Alternatives to QBE

QBE's high cost and lack of transparency may mean that it is not the best insurer for you. We recommend the following alternatives, all of which earned four stars or better from our editors.

Pros and cons

Pros

Offers extended replacement cost coverage

Cons

Expensive rates

Can't compare quotes online

Poor customer service

QBE home insurance rates

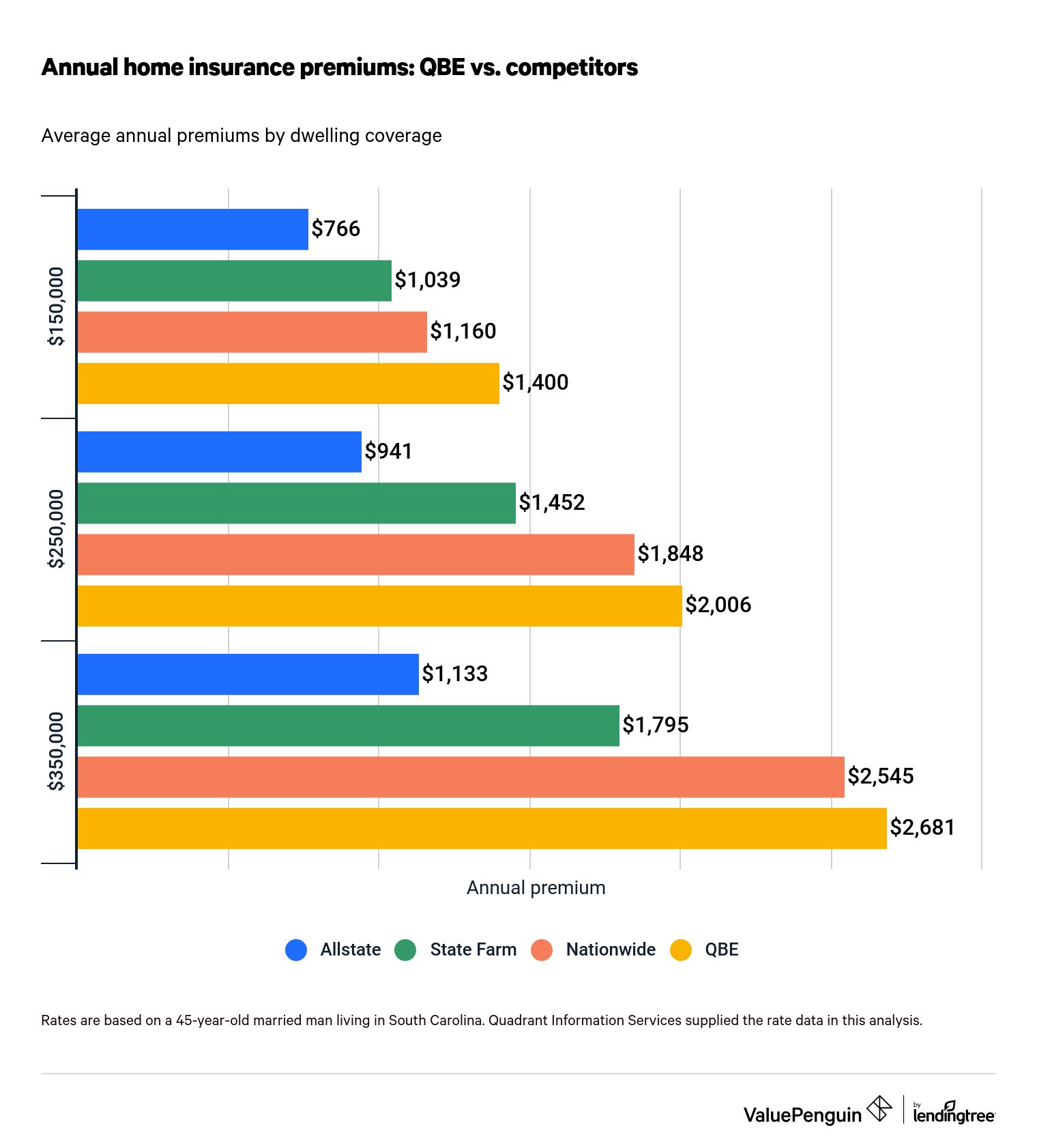

We collected quotes to compare homeowners insurance rates at QBE to those of top competitors. QBE homeowners insurance rates are the most expensive at all three levels of coverage we researched. On average, its quotes were twice as expensive as the cheapest company we analyzed, Allstate.

Find Cheap Homeowners Insurance Quotes in Your Area

QBE home insurance rates vs. competitors

Dwelling coverage | $150,000 | $250,000 | $350,000 |

|---|---|---|---|

| Allstate | $766 | $941 | $1,133 |

| State Farm | $1,039 | $1,452 | $1,795 |

| Nationwide | $1,160 | $1,848 | $2,545 |

| QBE | $1,400 | $2,006 | $2,681 |

QBE home insurance coverage

QBE offers fairly standard home insurance coverage, which is sufficient for most homeowners.

Homeowners with QBE insurance can benefit from their extended replacement cost coverage, which is an optional policy addition. The building replacement cost endorsement promises to pay to rebuild your home after a loss.

While your homeowners policy usually pays up to 100% of the coverage limit to rebuild your home, this endorsement raises that figure by 20% to 25%, depending on where you live.

This can help ensure your home will be rebuilt to your standards, even if building material and labor costs rise.

QBE home insurance only offers HO-3 policies. An HO-3 policy is fairly standard and protects the structure of your home against all perils except those named in your policy. Examples of commonly excluded perils are:

- Earth movements, such as earthquakes, landslides and sinkholes

- Government seizure, demolition or requirement to rebuild the structure to meet current building codes

- War and nuclear hazards

- Homeowner neglect

Although this is fairly standard, the downside is that your personal property is only covered for the perils mentioned in your homeowners policy documents. Some commonly excluded perils are construction theft, power failure and mysterious disappearance — meaning that a lost item would not be covered unless you can prove it was stolen. Additionally, high-value belongings — like jewelry, artwork, sports equipment and electronics — may only be covered up to set limits.

A list of QBE discounts is not publicly available.

QBE Insurance ratings and reviews

QBE Insurance received a 1.26 National Association of Insurance Commissioners (NAIC) complaint index score, which indicates that it has more complaints than average.

Customers cite delays in claim handling, unsatisfactory settlement offers, policy non-renewal and claim denials as the top reasons for their dissatisfaction.

The NAIC index measures the number of customer complaints a company receives in relation to its size.

QBE received an A rating from AM Best, showing it has an excellent ability to pay out customer claims, even in difficult economic times.

Contact QBE

QBE's website is not customer-focused — it doesn't offer online quotes, policy information, virtual chat or even a contact form. The company has a handful of phone numbers listed on its website for general inquiries, billing and policy changes or questions about coverage.

General inquiries: 800-362-5448

Billing: 800-560-2745

Coverage-related questions or changes: 866-318-2016

To file a claim, homeowners are directed to call their agent or a 24/7 hotline — 844-723-2524.

About QBE

QBE Insurance, an Australia-based company, offers insurance products in the U.S. and has a limited number of personal insurance options available. The company offers homeowners, renters and builders insurance for new construction homes. It also has specialty and commercial insurance lines available.

To buy its homeowners insurance, you'll have to work with an agent licensed to sell QBE products. Homeowners insurance policies are available in 47 states.

Methodology

To calculate average homeowners insurance rates, we collected three sets of quotes from every ZIP code in South Carolina. Our sample homeowner is a 45-year-old married man with an average credit score, living in a home built in 1977.

We compared rates for dwelling coverage limits of $150,000, $250,000 and $350,000 with the following limits:

Coverage | Amount |

|---|---|

| Liability coverage | $100,000 |

| Medical payments | $5,000 |

| Deductible | $1,000 |

Quadrant Information Services supplied the rate data in this analysis. Rates were publicly sourced from insurer filings and are intended for comparative purposes only. Your own quotes will likely differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.