How to Compare Renters Insurance for the Best Prices

Comparing renters insurance can help you find affordable coverage that meets your needs.

Compare Cheap Renters Insurance in Your Area

A renters insurance policy provides protection against property damage or theft, plus legal liability and additional living expenses if your home becomes uninhabitable. Renters insurance can be purchased by anyone renting a single-family house, apartment or other living space.

Comparing renters insurance quotes is an important part of shopping for a policy. The best renters insurance combines affordable rates, reliable customer service and coverages tailored to your needs.

How to compare renters insurance

Comparing renters insurance companies is an important part of shopping for a policy. Before you buy renters insurance, you should calculate how much coverage you need, compare rates and research insurance company reviews.

Step 1: Calculate how much coverage you need

To determine your coverage limits, you'll need to consider how much personal property you have and your liability exposure.

Your personal property coverage limits should be high enough to replace all of your belongings in the event of a disaster. Start by taking inventory of your belongings and the price to replace them to get an idea of the total value of everything in your home.

Once you have a general idea of what your personal property is worth, you need to decide whether you prefer a policy that pays out claims based on actual cash value or replacement cost. Actual cash value will pay you the depreciated value, which factors in the wear and age of your belongings, meaning that you'll get a check for less than they were worth when you bought them. On the other hand, a policy with replacement cost coverage ensures that you'll receive the amount you originally paid for your items.

Take note of any high-value items like jewelry, a bike, electronics, business property or artwork. Insurance companies place limits on their payout for high-value items like these.

For example, the standard limit for jewelry is $1,500. That means if your $5,000 engagement ring is stolen, you will only receive up to $1,500 to replace it.

Most insurers offer the ability to schedule personal property that is worth more than the limit included in your policy. Not only does this ensure that you'll receive the replacement value for important items, but you'll also be covered for accidental loss or damage, which is not part of a standard renters insurance policy.

Lastly, consider the amount of liability insurance you'll need. Standard renters insurance policies include $100,000 of liability insurance, but adding more liability insurance is inexpensive. Liability coverage is especially important for renters who have a pool, a dog or other potential hazards at their home.

Renters insurance policies include loss of use coverage, but the amount is often automatically calculated as a percentage of your personal property limit.

However, you should still pay attention to the level of coverage included in your quote. That limit should be able to cover reasonable accommodations if your home becomes uninhabitable.

Step 2: Compare renters insurance rates

Now that you've determined how much coverage you need, you can start comparing renters insurance quotes. We gathered quotes from across the country to help you compare the top renters insurance companies.

Our renters insurance quote comparison found that State Farm has the most affordable rates with an average premium of $156 a year. That's $50 less annually than the second-cheapest insurer, Travelers.

Find Cheap Renters Insurance Quotes in Your Area

Average national cost of renters insurance

Company | Annual premium | Monthly premium |

|---|---|---|

| State Farm | $156 | $13 |

| Travelers | $206 | $17 |

| Nationwide | $209 | $17 |

| Allstate | $222 | $18 |

| Average | $223 | $19 |

| Liberty Mutual | $232 | $19 |

| Geico | $261 | $22 |

| Farmers | $308 | $26 |

Step 3: Compare renters insurance company reviews

There are a number of factors to consider when comparing renters insurance quotes. Although rates are one of them, customer service and financial stability are equally as important.

J.D. Power ranks the level of customer satisfaction for top renters insurance companies. Of the insurers that we considered, Lemonade has the best J.D. Power score. State Farm and Travelers received top marks for financial stability from AM Best, showing that they have a high likelihood of being able to pay out claims, even in difficult economic times.

Company | Financial stability rating | J.D. Power score |

|---|---|---|

| Lemonade | A (Demotech) | 870 |

| State Farm | A++ (AM Best) | 866 |

| Nationwide | A+ (AM Best) | 834 |

| Allstate | A+ (AM Best) | 833 |

| Farmers | A (AM Best) | 831 |

| Liberty Mutual | A (AM Best) | 823 |

| Travelers | A++ (AM Best) | 815 |

Step 4: Choose your insurance company

Once, you've determined how much coverage you need, compiled quotes and researched the customer service and financial stability of the companies you're considering, it's time to choose the right rental insurance company for you.

To make your decision, consider the pros and cons of each company. Then, you'll need to determine how they line up with the things that are most important to you in a policy. Is staying within a budget crucial, or are you more concerned about being able to buy brand new belongings if yours are damaged? Do you value talking to an agent if you have to file a claim, or would you rather manage your policy online?

If you're having a hard time deciding, we put together a list of top renters insurance companies across different categories to help you make the right choice.

What does renters insurance cover

Renters insurance typically includes four main coverages:

- Personal property insurance covers the cost of replacing or repairing your personal property if it is stolen or damaged by a peril covered by your policy.

- Personal liability insurance protects you if someone is injured or their property is damaged and you are at fault. Liability insurance pays any settlement and legal costs that you are responsible for.

- Loss of use or additional living expense coverage reimburses you for expenses related to having to live away from home — like hotels, food and additional transportation costs — if your rental becomes uninhabitable.

- Medical payments coverage reimburses guests for minor medical expenses if they're hurt in your home.

However, coverage options vary by company. Some companies include expanded coverage in their standard policy, while others offer a number of options that you can add onto a base policy to customize it to fit your needs.

Compare quotes with these top renters insurance companies

The best renters insurance company is affordable and has reliable customer service along with policy coverages that meet your needs. We compared top renters insurance companies across different categories to make it easy to find the right policy for you.

Cheapest renters insurance: State Farm

-

Editor rating

Why it's great

Renters who choose State Farm get both affordable policy premiums and a large discount for bundling auto and renters insurance.

Renters looking for the lowest rates can start by getting a quote from State Farm. With an average rate of $156 a year or $13 a month, it's almost 30% cheaper than the nationwide average.

Affordable premiums don't equate to cut-rate service at State Farm — the company received high marks for customer satisfaction from J.D. Power and the highest financial stability rating from AM Best. That means that renters can rely on State Farm to provide a smooth claims process and pay out claims even in difficult economic times.

State Farm policies provide all of the standard coverages you would expect from a renters insurance policy. State Farm also gives renters extended coverage options in the form of an umbrella policy, identity theft protection, earthquake coverage, and business property and liability coverage.

The company already offers some of the cheapest rates available, but State Farm has a handful of discounts available, including the best discount we found for bundling car and renters insurance — 4.7%.

Top customer service scores: Lemonade

-

Editor rating

Why it's great

Lemonade pairs low rates with excellent customer service and a high-tech insurance experience.

By utilizing technology, Lemonade has made getting renters insurance and making claims easy, which has led to top marks on J.D. Power's customer satisfaction study.

The company has developed an artificial intelligence bot named Maya, which replaces the traditional insurance agent process. Renters can download the Lemonade app, get a quote and pay for their policy in just a few minutes for instant renters insurance coverage. Maya also helps process claims. Lemonade shared that 30% of claims are paid instantly via bank wire, with its fastest claim completed in only three seconds.

Lemonade also offers some of the most affordable insurance rates. Paired with its basic coverage and excellent online experience, this makes it the best renters insurance for college students and young adults. For those who need more coverage than the standard policy provides, Lemonade offers extended coverage for:

- Jewelry and engagement rings

- Bikes

- Cameras

- Artwork

- Musical instruments

Renters insurance for apartments: Assurant

-

Editor rating

Why it's great

Assurant offers coverage tailored to apartment renters, especially those who have a roommate.

Renters living in apartments have different needs, and Assurant has a number of policy features that cater to apartment living.

With Assurant, your personal property is covered regardless of where it's located. Whether you're storing items at a facility or in your parents' basement, your property is protected from damage and theft. Replacement cost coverage comes standard on Assurant renters policies and ensures you receive enough money to purchase brand new items after a loss. This coverage costs extra with most insurers.

Adding a roommate to your policy is easy with Assurant — just include their name on your application and their belongings are covered, too. Even though Assurant doesn't offer the cheapest coverage, the fact that multiple people can be included on a single policy helps make premiums more affordable for roommates.

If anyone on your lease is responsible for covered damage, you'll be able to file a claim, even if they're not listed on your policy. In some locations, Assurant even includes flood insurance and bed bug coverage.

In addition to its included coverages, Assurant also offers a number of helpful add-ons:

- Rent protection if you lose your job

- Pet damage coverage

- Earthquake coverage

- Water sewer backup coverage

- Identity fraud protection

Home renters insurance: Nationwide

-

Editor rating

Why it's great

Nationwide's optional coverages and affordable rates make it the best insurance for home renters.

Nationwide is an excellent choice for home renters who may need expanded insurance coverage. Its basic policy includes the standard coverages that you would expect, along with building additions and alterations coverage. This extra protection pays for covered damage to alterations, fixtures, additions and improvements that you make to your rental home.

Nationwide offers extended coverage options that make it the best home renters insurance provider. Home renters usually have more belongings than those living in apartments, so having the ability to increase personal property coverage may be important. Additional property coverages include:

- Brand new belongings coverage — provides replacement cost coverage, ensuring that you'll be able to replace your belongings with new ones after a loss.

- Valuables plus — provides extended coverage for high-value items like artwork, jewelry and antiques.

- Theft extension — protects any personal property stored in your car, a trailer or watercraft.

Aside from offering extensive coverage options, Nationwide has cheap renters insurance rates. Its average rate is $209 a year — $14 below average.

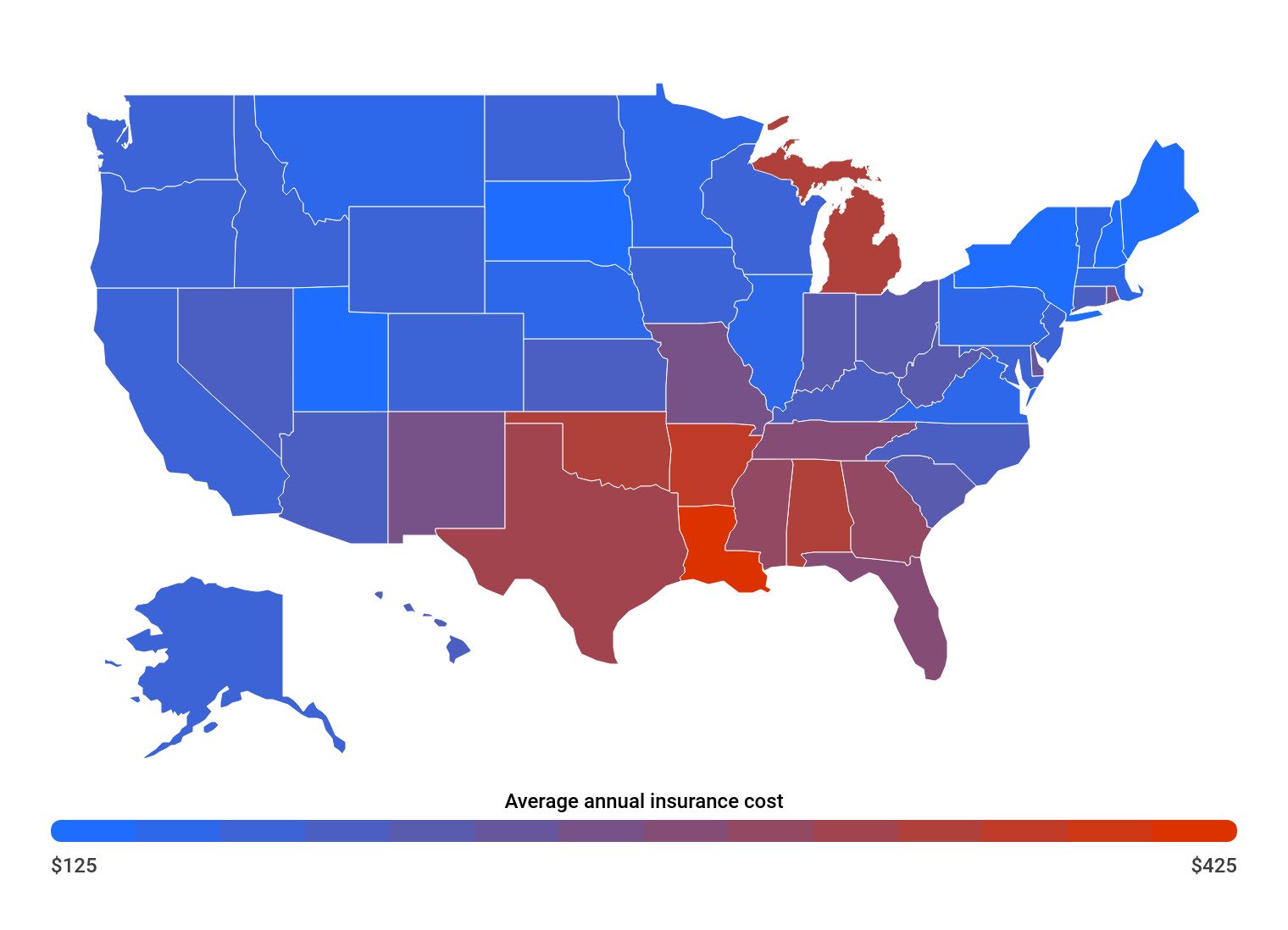

Renters insurance quotes by state

The price you pay for renters insurance varies based on where you live. Utah has the cheapest rates in the country on average — $138 a year or $11 a month. On the other hand, Louisiana renters pay the highest rates at $442 a year or $37 a month.

Renters insurance rates by state

State | Annual premium | Monthly premium |

|---|---|---|

| Alabama | $345 | $29 |

| Alaska | $187 | $16 |

| Arizona | $206 | $17 |

| Arkansas | $366 | $30 |

| California | $194 | $16 |

Renters insurance quotes by city

Premiums across the country can vary greatly, and the same is true for major metropolitan cities. We analyzed 10 of the most populated cities, and San Diego has the cheapest renters insurance we found at $178 a year, while rates in Houston are close to 240% more expensive at $426 a year.

Renters insurance rates by city

Frequently asked questions

Do I need renters insurance?

Some landlords and property management companies require tenants to purchase renters insurance. Even if you're not required to have coverage, we recommend that all renters consider purchasing renters insurance to protect themselves from the costs associated with property damage, theft and lawsuits.

How do I get renters insurance?

Getting a renters insurance policy is easy — most major companies allow you to get a quote and purchase your policy online. To compare renters insurance quotes, you'll need to provide your personal information (name, address and Social Security number) and the amount of coverage you need. Some companies will also ask questions about the building you're renting, including the number of units and external building materials.

Who has the cheapest renters insurance?

State Farm has the cheapest renters insurance with an average rate of $13 a month or $156 a year. That's $50 a year less than the next-cheapest option, Travelers. State Farm also has the lowest renters insurance rates in 36 of the 50 states, so it's likely that the company's prices will be competitive near you.

How often should you shop around for renters insurance?

You should compare renters insurance quotes every year at the end of your policy term. Getting multiple quotes isn't time-consuming since you can compare rates from most major insurers online. Don't forget to review your home inventory to make sure that you still have the right amount of personal property coverage before renewing or starting a new policy.

How is renters insurance different from homeowners insurance?

Renters insurance is different than homeowners insurance in that it does not cover the structure of the building that you live in. For example, if the roof of your rental home starts to leak from hail damage, homeowners insurance would help replace the roof, while renters insurance will not. However, if the leak damages your furniture, or is your fault, it will be covered by a renters insurance policy. Your landlord should have their own insurance policy to cover structural damage that is not caused by you.

Methodology

To calculate average renters insurance rates, we compiled quotes from the five largest insurance companies in each state, where the data was available. Our sample renter is an unmarried 30-year-old male, with no pets or roommates, living in a multiunit building with the following limits:

Coverage | Amount |

|---|---|

| Personal property | $30,000 |

| Personal liability | $100,000 |

| Medical | $1,000 |

| Deductible | $500 |

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.