The Best Cheap Renters Insurance Quotes in Boston

Amica has the best renters insurance in Boston, with policies that cost around $19 per month.

Find Cheap Renters Insurance Quotes in Boston

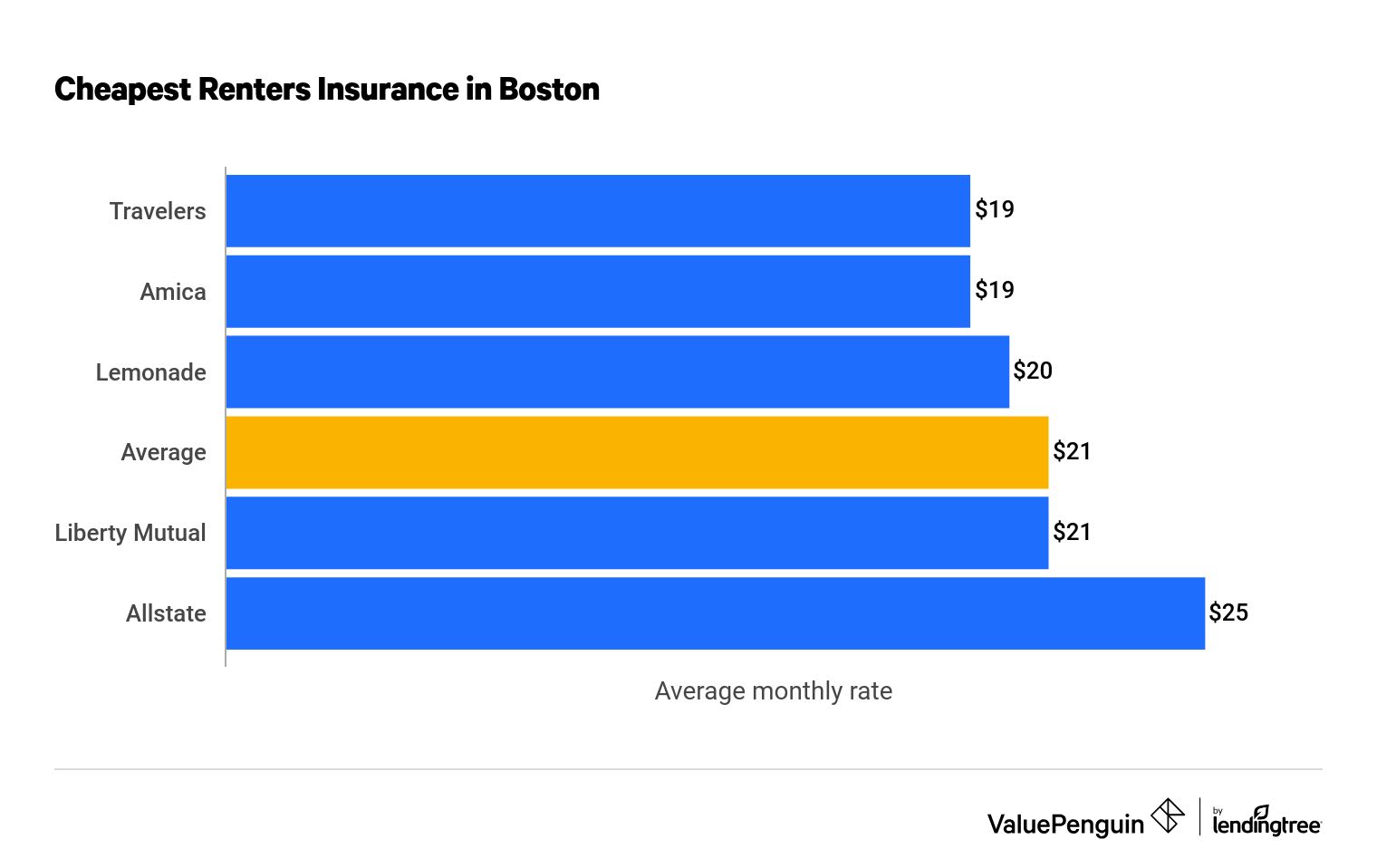

Cheapest renters insurance companies in Boston

The average cost of renters insurance in Boston is $21 per month, or $251 per year.

Travelers offers the cheapest renters insurance quotes in Boston. A typical Travelers policy costs $19 per month, or $224 per year, which is 11% cheaper than the citywide average.

Find Cheap Renters Insurance Quotes in Boston

Boston renters pay more for insurance than people in other large cities in Massachusetts. Renters insurance in Boston costs about $5 per month more than the average rate in Massachusetts, which is $16 per month.

Monthly cost of renters insurance in Boston

Company | Monthly cost | |

|---|---|---|

| Travelers | $19 | |

| Amica | $19 | |

| Lemonade | $20 | |

| Liberty Mutual | $21 | |

| Allstate | $25 |

Renters in Boston can purchase insurance from a number of smaller, regional companies. The best ones include Arbella, MAPFRE and Plymouth Rock. However, you'll need to speak to an agent directly to compare quotes.

Best rates for most renters in Boston: Amica

-

Editor rating

-

Average monthly rate

$19 ?

Pros and cons

Amica is the best fit for most renters in Boston due to its low-cost coverage and industry-leading customer satisfaction record. A policy from Amica costs around $19 per month, or $233 per year. That's 7% less than average in Boston, and only $9 per year more expensive than the cheapest option, Travelers.

While pricing is the easiest way to compare insurance companies, it's important for renters to also consider customer service reviews.

Renters are generally happy with the service they receive from Amica, and it receives far fewer complaints than other insurers of a similar size, according to the National Association of Insurance Commissioners (NAIC). Our ValuePenguin editors also gave it an excellent score based on customer service reviews and the overall value it provides customers.

In addition to affordable rates, Amica offers renters lots of discounts to lower the cost of insurance, including:

- Automatic payments discount

- Bundling discount

- Claims-free discount

- Loyalty discount

- Paperless discount

Amica’s main drawback in renters insurance is it offers fewer optional coverages than other insurance companies. For example, you can't purchase water backup coverage from Amica, which protects your things from flooding due to backed-up pipes or a broken sump pump.

Cheapest renters insurance in Boston: Travelers

-

Editor rating

-

Average monthly rate

$19 ?

Pros and cons

Boston renters looking for the absolute cheapest rates should compare quotes from Travelers. Coverage from Travelers costs around $19 per month, or $224 per year, which is $27 per year cheaper than the citywide average.

However, Travelers has mixed customer service reviews. It only receives around half as many complaints as expected based on its size, according to the NAIC. But customers surveyed by J.D. Power weren't very satisfied with their experience with Travelers. It received the worst score of the 10 companies in the J.D. Power annual renters insurance survey. That means it may take longer for renters who choose Travelers to replace their stuff after an emergency.

Renters needing extra protection will find many ways of customizing their coverage with Travelers.

- Valuable items coverage

- Decreasing deductible

Best for veterans and military members: USAA

-

Editor rating

Pros and cons

USAA is the best choice for veterans, military members and their families who rent a home in Boston.

Basic renters insurance from USAA includes replacement cost coverage for your stuff.

That means you'll receive enough money to replace your belongings with brand-new items if they're damaged or stolen. By comparison, most renters insurance policies are based on the actual cash value of your items, so your payout factors in wear and tear. Most insurance companies charge extra for this benefit.

Standard renters insurance from USAA also protects you against damages from flooding and earthquakes, which are almost never included in renters coverage. This extra coverage can save Boston renters living in flood-prone areas a lot of money since you won't need to purchase a separate flood insurance policy.

Boston renters can also count on USAA to provide a stress-free, fast claims process. The company earned the highest score on J.D. Power's customer satisfaction survey. Additionally, it only receives about half as many complaints as other companies of the same size, according to the NAIC.

The best renters insurance in Boston

Amica is the best renters insurance company in Boston for customer service.

Amica only receives about 12% as many claims as other insurer companies of its size, according to the NAIC. ValuePenguin editors also gave Amica a great score based on the value it provides renters in Boston. The company offers cheaper-than-average rates, and renters can count on Amica to provide helpful service in an emergency.

Some renters can also find excellent service with USAA. However, you can only buy insurance from USAA if you're a military member, veteran or their family member.

Company |

Rating

|

|---|---|

| Amica | |

| USAA | |

| Lemonade | |

| Liberty Mutual | |

| Allstate | |

| Travelers |

Choosing a company with a reputation for great customer service is as important as finding affordable coverage. If you ever have an emergency, you'll have peace of mind knowing that your insurance company will help get your life back to normal quickly. If you choose a company with poor service reviews, you may have to pay more money to replace your things after a loss, too.

Frequently asked questions

How much is renters insurance in Boston?

Renters insurance in Boston costs $21 per month, or $251 per year, on average. Travelers has the cheapest quotes in Boston at $19 per month, but it may not be the best option for everyone due to mediocre customer service.

Who has the best renters insurance in Boston?

The best renters insurance in Boston can be found at Amica. It offers affordable rates, quality coverage and dependable customer service.

What does renters insurance in Boston cover?

A basic renters insurance policy should always include personal property coverage, personal liability coverage, medical payments and additional living expenses. Most major companies also offer useful upgrades like replacement cost coverage, which helps replace your belongings with brand-new items if they're stolen or damaged.

Methodology

To determine the best renters insurance companies in Boston, MA, we considered three main factors:

- Affordability

- Quality of coverage

- Customer service reputation

We found the average cost of renters insurance by comparing quotes from five of the top insurance companies in Boston that offer online quoting. Our sample renter is a 25-year-old single man living alone with no history of insurance claims.

Quotes are based on the following coverage limits:

Coverage | Limit |

|---|---|

| Personal property | $30,000 |

| Personal liability | $100,000 |

| Medical payments | $1,000 |

| Deductible | $500 |

To find the best customer service, we analyzed information from three sources:

- National Association of Insurance Commissioners (NAIC) Complaint Index: The complaint index assigns each insurance company a score based on the number of complaints it receives relative to its size.

- J.D. Power annual renters insurance customer satisfaction survey: J.D. Power surveys policyholders to determine their satisfaction with each insurance company based on several metrics, including its claims process and shopping experience.

- ValuePenguin editor rating: Our editor rating is based on customer service reviews, coverage availability and the overall value an insurance company provides for its customers.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.