Secura Insurance Review: Cost & Coverage

Secura is a good choice if you want to bundle your home and auto insurance, but you can't get a policy to insure just your home or car.

Find Cheap Auto Insurance Quotes in Your Area

Secura is a smaller insurance company that has cheap rates and good customer satisfaction. There are two packages of home and auto insurance, so you can choose your level of coverage. However, Secura is best for people who prefer a hands-on approach because you can only buy plans through a local insurance agent and there are few digital tools for managing your account.

Pros and cons

Pros

Low rates

High customer satisfaction

Personalized support from local agents

Cons

You have to bundle home and auto coverage

Only offered in 13 states

Can't get online quotes

Secura auto insurance quotes

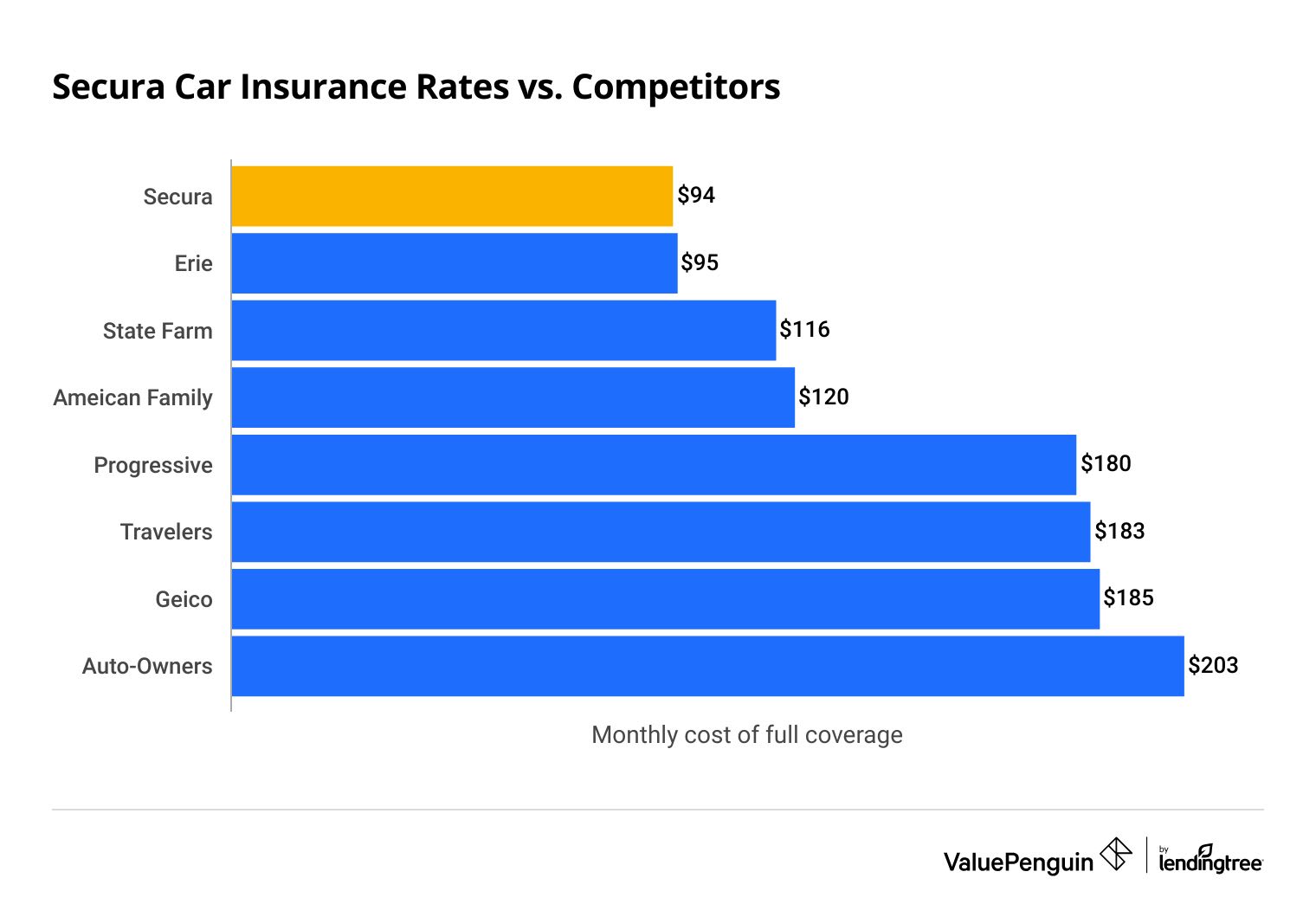

Secura is one of the cheapest companies for car insurance, with an average cost of $94 per month for full coverage.

Find Cheap Auto Insurance Quotes in Your Area

Secura's rates for full coverage are usually a better deal than its minimum coverage rates.

Secura costs an average of $94 per month for full coverage car insurance. That's cheaper than Erie, which is one of the cheapest major car insurance companies in the U.S.

For minimum coverage, Secura is affordable but not as cheap as Erie and American Family.

Monthly cost of Secura car insurance vs. competitors

Company | Min. coverage | Full coverage |

|---|---|---|

| Secura | $34 | $94 |

| Erie | $28 | $95 |

| State Farm | $35 | $116 |

| American Family | $32 | $120 |

| Progressive | $43 | $180 |

Discounts on Secura car insurance

Secura's discounts could help you lower your insurance costs. The company has a few unique ways to save, such as a discount for having a hybrid car.

- Hybrid car

- Safe driver

- Good student

- Loyalty

- Good credit

- Shopping early

- Pay in full or through a funds transfer

Which discounts are available can vary based on where you live.

Secura home insurance quotes

Secura has affordable rates on home insurance, averaging $646 per year, which is 28% cheaper than average.

Find Cheap Auto Insurance Quotes in Your Area

Secura's home insurance rates are much cheaper than major insurance companies such as State Farm or Allstate, saving you $175 per year or more compared to these larger companies.

Cost of Secura home insurance vs. competitors

Company | Annual | Monthly |

|---|---|---|

| Erie | $590 | $49 |

| Secura | $646 | $54 |

| State Farm | $821 | $68 |

| Travelers | $830 | $69 |

| American Family | $895 | $75 |

Discounts on Secura home insurance

Secura only offers a few ways to lower your home insurance rates.

- Newly built home

- Safety features

- Umbrella coverage

Most insurance companies offer a better set of home insurance discounts. So if you're relying on discounts to lower your rates, consider another company such as State Farm.

Secura Insurance coverage

Secura has two home and auto insurance packages called MILE-STONE Basic and MILE-STONE Gold.

The Gold package has more types of coverage included and has higher limits, meaning it will cover more of your repair costs. The Basic package is similar to a typical insurance policy where you can add on the coverage extras that you choose.

Auto insurance coverage comparison

Basic | Gold | |

|---|---|---|

| Accident forgiveness | ||

| Auto glass coverage | ||

| Roadside assistance | Can be added |

The Gold package automatically includes many coverage extras. For example, it will pay for a rental car if your car is in the shop after an accident. It also provides roadside assistance through a program it calls Roadside Rescuer.

Home insurance coverage comparison

Basic | Gold | |

|---|---|---|

| Increased coverage for theft and missing items | $2,000 | $10,000 |

| Sewer and drain backup | $1,000 | $5,000 |

| Extra personal property coverage |

Secura's MILE-STONE Gold package will give you higher amounts of protection in situations such as if you have damage from a drain line backup or if jewelry is stolen. If you want these extras, you'll have to get the Gold package because you can't add them to the Basic package.

Other types of coverage included in Secura's packages

Basic | Gold | |

|---|---|---|

| Pet coverage after an accident | ||

| Identity theft coverage | Can be added | |

| Travel assistance |

Pet protector

Secura will help pay for vet bills up to $500 per pet or $1,500 per incident if your dog or cat is injured at home, in your car or in your boat. Coverage only applies in certain circumstances such as if your pet is hit by a car, is riding in a car that has a car accident or is in a house fire. There's no deductible, and you can go to any vet you choose.

Identity theft

Secura provides up to $25,000 in coverage for costs if your identity is stolen. Plus, Secura has partnered with a company called ID Resolution, which gives you step-by-step support, including working with credit bureaus, banks and law enforcement.

Travel Rescuer

Travel Rescuer is a nice perk for frequent travelers because it provides help if there's an emergency when you're more than 100 miles from home. Secura can help you replace lost or stolen documents, refer you to doctors, dentists or lawyers, and help with evacuation or transportation if there's a medical emergency. The program even works when you're traveling internationally.

Drivers who purchase car insurance from Secura can get comprehensive and collision coverage. These types of coverage pay to repair or replace your car if you cause an accident or if your car is damaged by something out of your control, such as a falling tree.

Comprehensive and collision coverage are parts of a full coverage policy, and they are required if you have a car loan or lease.

Secura Insurance reviews and ratings

Secura is a good insurance company that has high customer satisfaction and few complaints.

-

Complaints: 61% fewer than avg.

- Financial strength: A (Excellent)

-

Google reviews:

Secura has a low rate of complaints, according to the National Association of Insurance Commissioners (NAIC), with the company receiving 61% fewer complaints than a typical insurance company of its size. While both home and car insurance performed better than average, Secura's homeowners insurance policies stood out with 85% fewer complaints than average.

Secura customers are satisfied with their policies, according to Google reviews. The company has 4.4 out of 5 stars, across 396 reviews. Many recent reviewers commented about how the claims process was quick and easy. However, not all commenters were positive. Some users gave the company 1 star after a difficult claims process and not getting their desired outcome.

Secura has excellent financial strength, according to AM Best. Secura's A rating is not as high as the maximum rating of A++. However, the excellent rating shows that Secura has a strong ability to pay its claims.

A key downside of Secura is its lack of digital tools. You can't log in to check your policy or track a claim. There also isn't a mobile app. So if you would rather not have to call customer service, you'll be happier with a larger insurance company that has more digital tools.

About the Secura insurance company

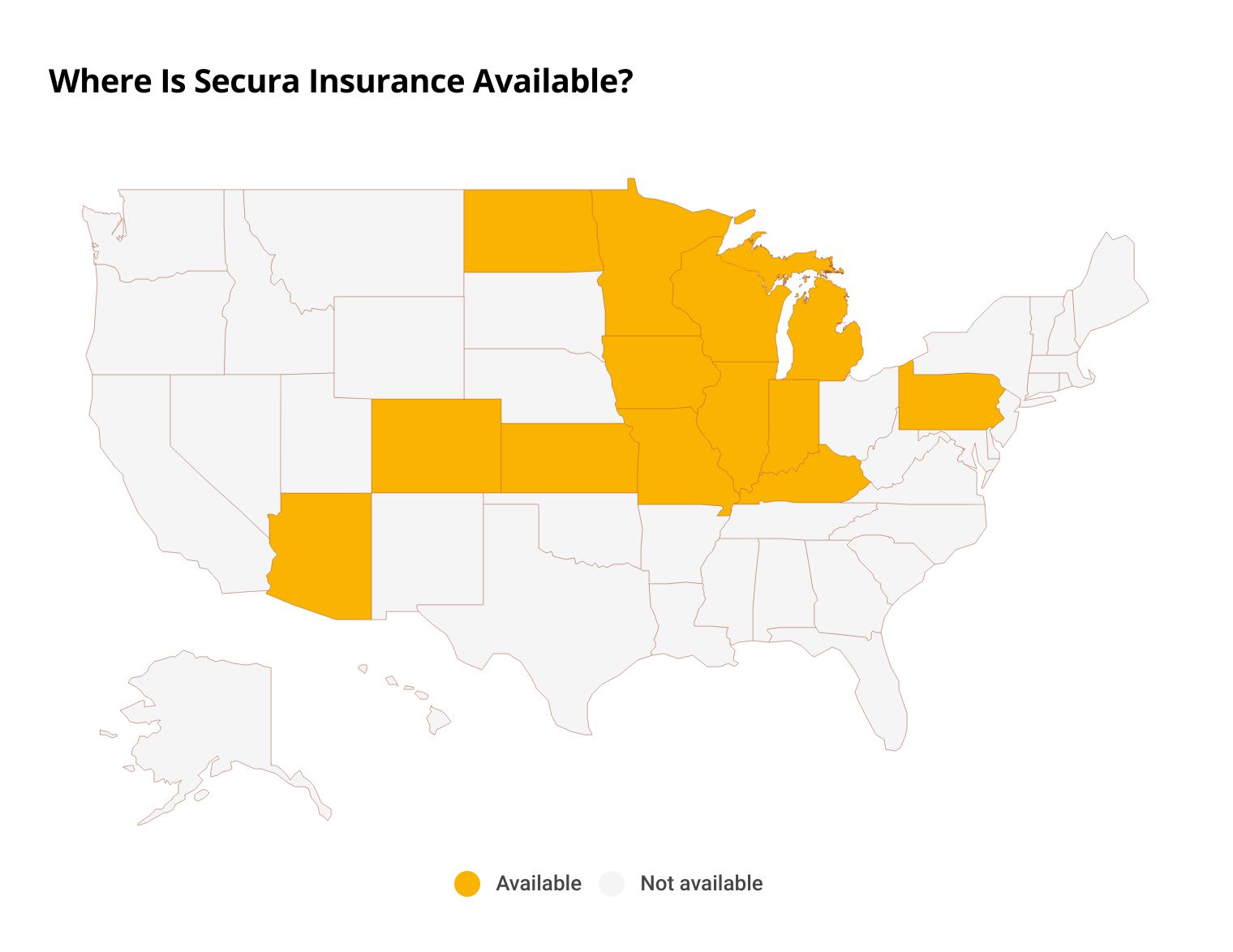

Secura insurance is only available in 13 states: Arizona, Colorado, Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, North Dakota, Pennsylvania and Wisconsin.

However, if you live in Pennsylvania or Kansas, you can't get Secura's home and auto insurance. You will only have access to specialty policies such as a business insurance policy.

Secura is based in Appleton, WI, and Wisconsin is the only state where it's a major provider of both home and car insurance. So while Secura policies are available in other states, the company is less popular in those areas.

Secura only sells policies through local agents

You cannot buy insurance directly from Secura. You'll have to work with a local agent.

An agent will typically be someone who can help you compare rates from multiple insurance companies. Secura frequently has agents in major cities, but those in rural areas may not have as many options.

Working with an agent is a perk for some people because the agent can give you personalized service and help you choose the right coverage for your situation. However, others find it more convenient to shop directly with the insurance company.

Other insurance policies sold by Secura

In addition to homeowners and auto insurance, Secura offers other types of insurance, including:

- Renters

- Umbrella

- Business

- Workers' compensation

- Nonprofit

- Farm and agriculture

- Specialty businesses such as day care and health cubs

Secura phone numbers

You can use the following numbers for general questions about your Secura insurance policy.

| Secura general phone number | 800-558-3405 |

| Secura general phone number in Arizona and Colorado | 866-356-7870 |

Use the following numbers if you have a specific question or need to reach a certain department.

| Secura claims | 800-318-2136 |

| Secura billing and payments | 800-830-9150 |

| Secura nurse hotline for work injuries | 888-333-3334 |

| Secura roadside assistance | 800-828-7047 |

| Secura Travel Rescuer for medical, prescription or passport assistance | 800-527-0218 |

| Secura identity theft report line | 800-558-3405 |

Methodology

The average cost of Secura insurance is based on thousands of quotes from ZIP codes across Wisconsin, where Secura has a large share of customers. Comparisons are made to the top home and car insurance companies in the state.

Car insurance rates are for a 30-year-old man who drives a 2015 Honda Civic EX and has good credit. Minimum coverage quotes have the legally required coverage in Wisconsin. The full coverage policy has the following limits:

-

Bodily injury liability: $50,000 per person and $100,000 per accident

- Medical payments coverage: $10,000

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

Home insurance rates are for a 2,100-square-foot house built in 1973 and insured for $180,600 — these figures align with Wisconsin's median household income and median value of an owner-occupied home.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Additional data sources include AM Best, Google reviews of Secura Insurance Co. and the National Association of Insurance Commissioners (NAIC). The rate of complaints is based on a weighted average across the company's underwriting subsidiaries.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.