Westfield Insurance Review: Good Rates for Midwestern Drivers

Westfield has good rates and coverage options but mixed customer service ratings.

Find Cheap Auto Insurance Quotes in Your Area

Westfield Insurance has competitive auto policy rates and a modest number of extras. However, it has uneven customer service and does not offer online quotes.

Besides auto insurance, Westfield also has homeowners, renters,condo, boat, camper and farm insurance. The company offers car insurance in 10 states, almost all in the upper Midwest.

Pros and cons

Pros

Affordable minimum coverage insurance

Lots of coverage options and discounts

Cons

Mixed customer service reviews

Only available in 10 states

Westfield auto insurance coverage

Westfield's car insurance offerings are not highly robust, but they are certainly beyond the basics. The company also offers extra incentives for those who bundle home and auto coverage.

Optional coverages from Westfield include:

- Roadside assistance: Pays for towing, jump starts, tire changes, locksmithing, gas or oil delivery, among other services.

- Gap coverage: Covers the difference between an insurance payout and what is still owed on a leased or financed vehicle.

- Umbrella coverage: Raises your overall liability limits in case your regular policy is not enough to cover damages.

- Agreed value coverage/classic car coverage: Protection for a vehicle, often a valuable one, as an agreed-upon total value that does not shift with market factors.

- Customized equipment coverage: Drivers can insure added equipment on vans and pickup trucks such as custom paint jobs, snowplows and equipment to assist people with disabilities.

- Extra electronic equipment coverage: Up to $1,000 in coverage for electronic equipment you add to your vehicle.

- Original equipment manufacturer parts coverage: Added for specific vehicles, you can have coverage for the use of original equipment manufacturer (OEM) parts.

- Supplemental coverage: This adds a range of protections, including personal contents, coverage, trip interruption, air bag replacement, locksmith service and replacement cost coverage.

Westfield also offers a bundle with high-end home coverage called Wespak Estate, which includes more robust supplemental coverage. There is a stand-alone luxury home policy called Estatepak.

Westfield's offerings include the typical coverages expected from a car insurance company, including:

- Collision coverage

- Comprehensive coverage

- Personal injury protection

Westfield car insurance quotes

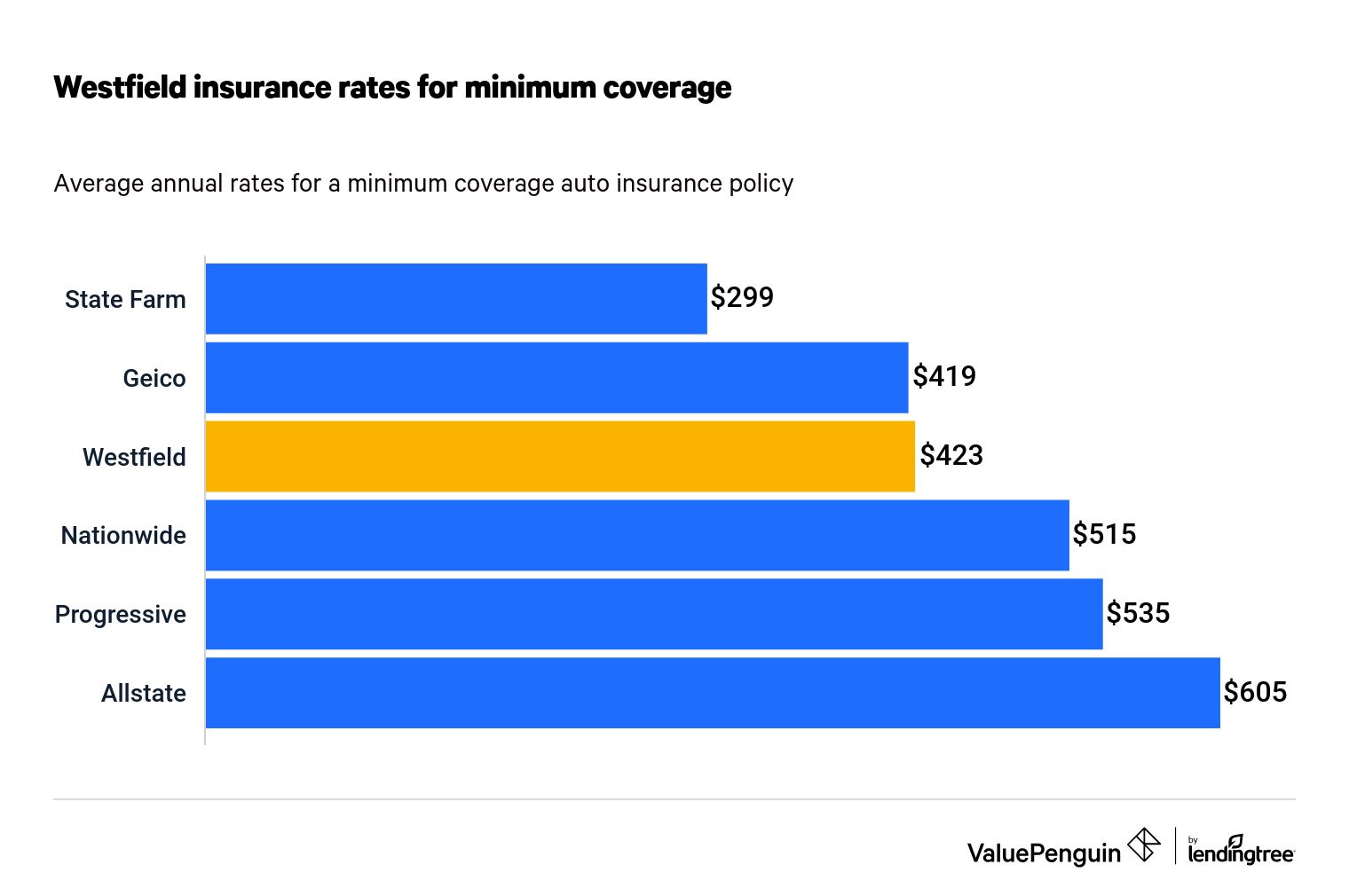

Westfield's rates for minimum coverage car insurance are 9% cheaper than average. However, full coverage costs 8% more than average with Westfield, but that still beats out several national insurers like Progressive and Allstate.

The average price for minimum coverage from Westfield is $423 per year, while full coverage costs $1,420 per year.

Annual car insurance rates: Westfield vs. competitors

Insurer | Full coverage | Minimum coverage |

|---|---|---|

| Allstate | $1,849 | $605 |

| Geico | $948 | $419 |

| Nationwide | $1,345 | $515 |

| Progressive | $1,545 | $535 |

| State Farm | $786 | $299 |

| Westfield | $1,420 | $423 |

Discounts available at Westfield Insurance

Discounts offered by an insurer should be considered with a full context of the driver in question. Rates will vary with different insurers, and your rates might be cheaper with a company that offers you fewer discounts.

Westfield offers a modest selection of discounts, though none are particularly unusual. The company does not advertise a telematics program, and many of its discounts can be found at larger companies.

Availability varies by state, but the discounts Westfield offers include:

- Anti-theft device discount: You can get a discount if your vehicle has an anti-theft device installed.

- Safety equipment discount: Vehicles with anti-lock brakes and passive restraint systems get drivers a discount.

- Companion car/multipolicy discount: You can get a break on rates for having multiple policies with Westfield.

- Defensive driving course discount: Taking a defensive driving course can lower your rates with Westfield.

- Good student discount: Students with a 3.0 GPA or higher can get a discount on their rates.

- Loyalty discount: If your Westfield policy has been in place for more than three years, you can get a discount.

- Next generation discount: This discount is available for drivers age 22-29 who were previously on a parent's Westfield policy.

- Preferred payment discount: You can pay less if you pay for six months of a full year up front.

- Resident student discount: Students who live more than 100 miles from where the insured vehicle primarily is kept can get a price break.

- Senior driver discount: This applies when drivers are 65 and older and drive less than 3,000 miles a year.

Customer service reviews and ratings

Westfield's customer service reviews are decidedly mixed. Among insurers in its region, it was above average in J.D. Power's car insurance customer satisfaction survey, ahead of the likes of Farmers, Allstate and State Farm.

However, Westfield Insurance has a higher number of complaints than expected, according to the National Association of Insurance Commissioners (NAIC). Westfield has a complaint index rating of 2.51, meaning it gets more than twice as many complaints as typical for a company of its size.

Westfield also has an "A" rating for financial strength from AM Best. This means it has an "excellent" ability to pay out claims. The company has an "A+" rating from the Better Business Bureau, which rates how companies reply to customer complaints.

Westfield customer service ratings

Agency | Rating |

|---|---|

| NAIC complaint index | 2.51 (much worse than average) |

| J.D. Power car insurance satisfaction survey | 836 (better than average) |

| AM Best | A ("excellent") |

| Better Business Bureau | A+ |

Frequently asked questions

Who owns Westfield Insurance?

Westfield Insurance Company is a subsidiary of Ohio Farmers Insurance Company. The parent company owns a range of smaller organizations, primarily in insurance and real estate.

Where is Westfield Insurance available?

Westfield offers auto insurance in 10 states, mostly in the Midwest: Minnesota, Wisconsin, Ohio, Iowa, Illinois, Indiana, Pennsylvania, West Virginia, Kentucky and Tennessee. It underwrites or offers other types of insurance in all 50 states.

Is Westfield Insurance a good company?

Westfield is a good insurance company, especially for drivers looking for minimum coverage policies. It does most of its auto insurance business in Ohio and the Midwest and has a modest set of coverage options.

What does Westfield Insurance cover?

Westfield offers a range of insurance products, including auto insurance, home insurance, umbrella coverage, farm insurance and surety bonds.

Methodology

Rates were gathered using Quadrant Information Services and publicly sourced from insurer filings. Rates should be used only for comparative purposes. Your quotes will likely be different.

Quotes were from the state of Ohio for a single 30-year-old man. He has a Honda Civic, average credit and a clean driving record.

Discounts and some coverages were collected from a rate filing by the company in the state of Michigan.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.