Alfa Insurance Review

Alfa has exceptional customer service for Southern drivers, but coverage and prices are merely average.

Find Cheap Auto Insurance Quotes in Your Area

Editor's Rating

Alfa Insurance, a regional insurer that operates in 11 states mostly in the southeastern United States, has great customer service, but we found its coverage options and prices to be about average. For eligible drivers who want the peace of mind of a very dependable car insurance company, Alfa is a great choice. And although base prices are average, Alfa also has some discounts that may allow people in certain professions (such as farmers or religious ministers) to save on their insurance bills.

But for people looking for the absolute lowest prices or the biggest range of coverage options, it's worth looking at other options.

Pros and cons

Pros

Great customer service

Discounts for military members, first responders, educators, government employees, ministers and farmers

Cons

Limited coverage options

Only available in 11 states

Alfa auto insurance

Alfa car insurance quotes

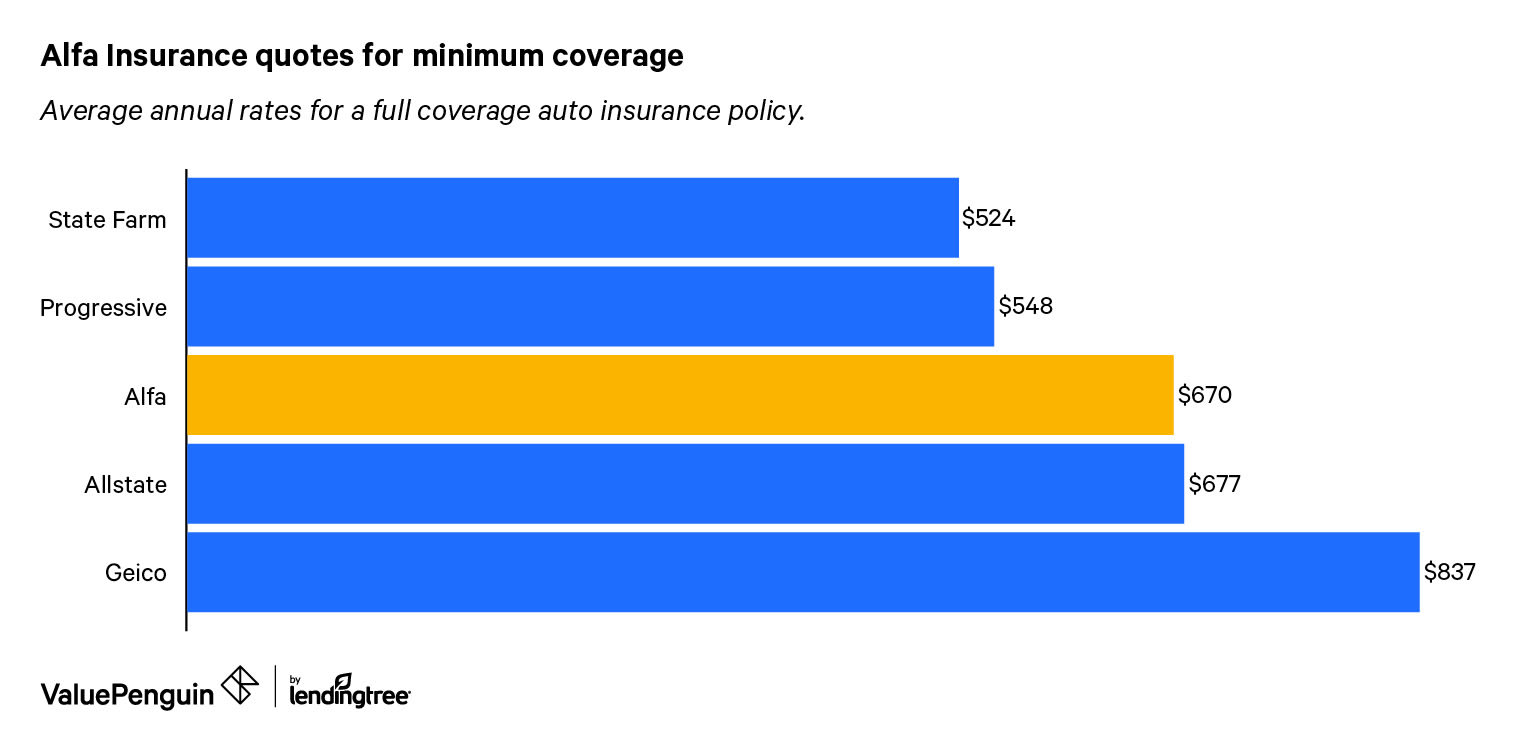

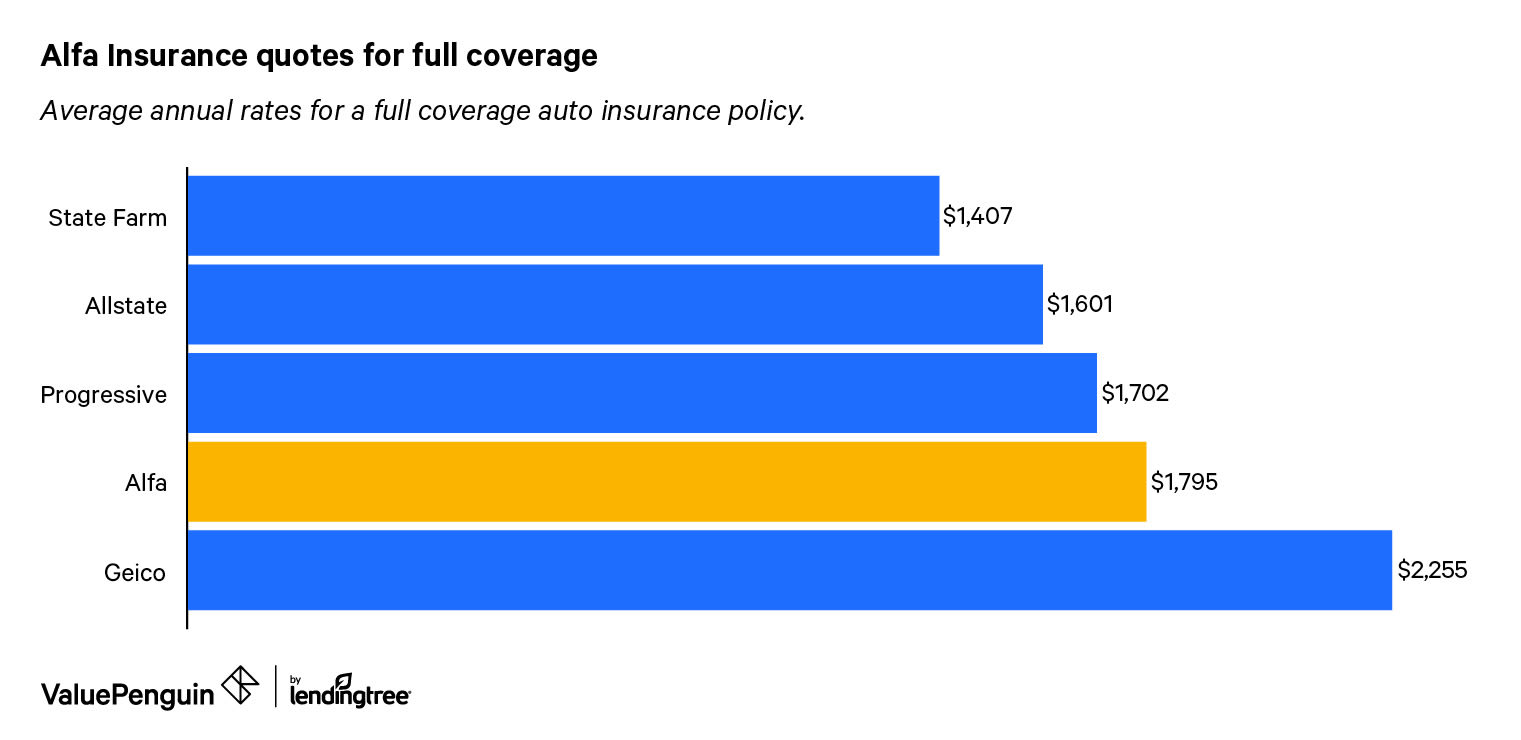

We found insurance rates from Alfa to be about average overall. For both full coverage and state minimum coverage levels, Alfa's typical price was just under 3% higher than the average price we found among its top competitors.

The typical rate for a full coverage policy was $1,795 per year, while the typical price for minimum coverage was $670.

Find Cheap Auto Insurance Quotes in Your Area

Annual car insurance premiums: Alfa vs. competitors

Company | Minimum coverage | Full coverage |

|---|---|---|

| State Farm | $524 | $1,407 |

| Progressive | $548 | $1,702 |

| Alfa | $670 | $1,795 |

| Allstate | $677 | $1,601 |

| Geico | $837 | $2,255 |

Rates are based on statewide averages in Alabama for a 30-year-old driver with no recent accidents.

Discounts available at Alfa Insurance

Alfa has a good selection of discounts, though not as many as you may find at a national insurance company like Geico or Progressive. For example, Alfa offers some of the discounts you'll find with most insurers, such as bundling, but it doesn't offer discounts that have become increasingly common, such as driving tracking technology savings.

One unique benefit of Alfa is the range of jobs that are eligible for occupational discounts. In addition to military members and first responders, who often get discounted rates, educators, government employees, ministers and farmers are all eligible, too.

Other common discounts Alfa offers include:

- Discounts on car insurance for taking defensive driver training

- Discounts for people under 24 with a 3.0 GPA or higher

- Bundle discounts for buying multiple insurance policies

However, we always recommend caution when evaluating an insurer based on discounts. Insurance rates are different for every driver, and you may find that your rates are lowest at a company that doesn't offer many explicit discounts.

Alfa auto insurance coverage

Coverage options at Alfa don't lack any major coverages, but don't stand out compared to other companies. For drivers looking for a wider range of coverages like new car replacement or collision deductible waivers, you should consider looking at other companies.

Alfa has all the typical coverages you'd expect from a car insurance company, including:

- Liability coverage for personal injury and property damage

- Uninsured/underinsured motorist protection

- Collision and comprehensive coverage

- Medical payments coverage

Alfa also offers optional coverages including:

- Roadside assistance: Pays for a tow or other roadside assistance, such as extra fuel.

- Accident waiver: Eliminates the cost increase associated with one at-fault accident.

- Loss of use/rental car: Pays for a rental car or other alternative transportation while your car is being repaired after a covered incident.

Customer service reviews and ratings

Alfa Insurance has excellent service reviews from its customers. It has a 0.19 complaint index from the National Association of Insurance Commissioners (NAIC), meaning it's received just 19% as many complaints as a typical insurance company of its size. And it did better than average in J.D. Power's car insurance customer satisfaction survey, too. Overall, Alfa customers appear to be pleased with the service they receive from the insurer.

Alfa also received an "A" financial strength rating from AM Best. This means that the company is in strong financial standing and has an "excellent" ability to pay out claims, even during times of high claim demand or a negative economic climate.

Alfa customer service ratings

| Industry Reviewer | Rating |

| NAIC complaint index | 0.19 (Much better than average) |

| J.D. Power car insurance satisfaction | 858 (Better than average) |

| AM Best | A ("Excellent") |

Where is Alfa Insurance available?

Alfa Insurance primarily operates in the southern United States. Its main states of operation are Alabama, Georgia and Mississippi, and it has some products available in Arkansas, Indiana, Kentucky, Missouri, Ohio, Tennessee, Texas and Virginia.

Methodology

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Our quotes are based on statewide average rates in Alabama for a single 30-year-old male. He drives a 2015 Honda Civic EX and has no recent car insurance claims or traffic citations.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.