How Age Affects Car Insurance Prices for Men and Women

Teen drivers pay three times more for car insurance than middle-aged drivers. And men pay 6% more for car insurance than women.

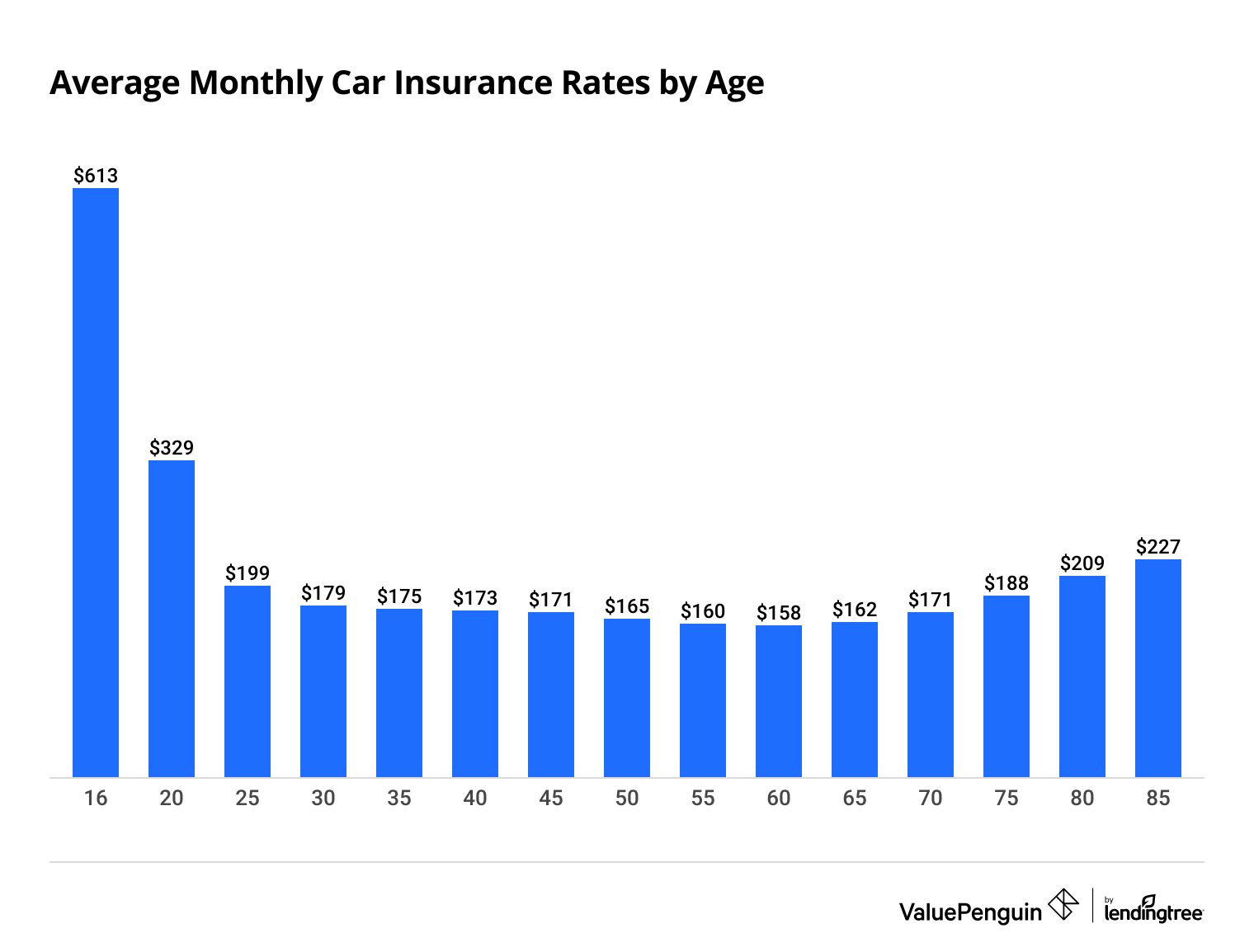

A 16-year-old driver pays $613 for full coverage insurance, on average. In comparison, 60-year-old drivers pay around $158 per month for the same coverage.

Find Cheap Car Insurance Quotes in Your Area

Highlights

- Age is one of the most important factors insurance companies consider when coming up with a car insurance quote because young people have less driving experience.

- Drivers under the age of 25 tend to pay the highest car insurance rates. Rates start to increase again after age 60.

- Travelers, State Farm, Geico and USAA have some of the cheapest rates for teens and senior drivers.

- Your gender can also impact your car insurance rates. On average, men pay 6% more for full coverage car insurance than women.

Average car insurance rates by age

The youngest and oldest drivers pay more for car insurance than middle-aged drivers.

For example, a 16-year-old driver pays around $613 per month for full coverage car insurance. That's three times more than a 25-year-old driver pays for the same coverage.

Rates are at their lowest for 60-year-old drivers, who pay $158 per month for full coverage insurance, on average. After age 60, rates begin to rise. A 75-year-old driver pays 19% more for car insurance than a 60-year-old.

Find Cheap Car Insurance Quotes in Your Area

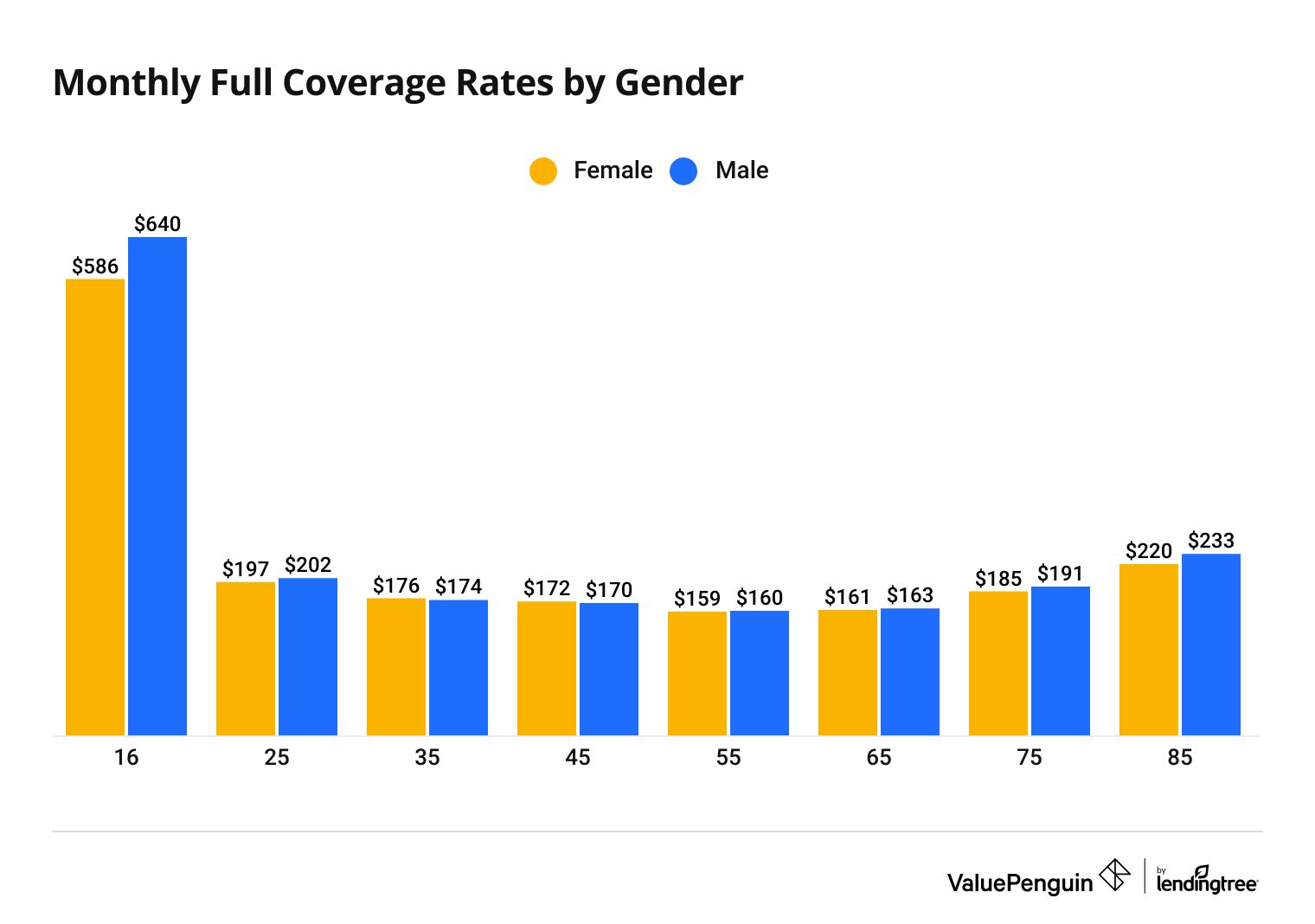

Men also tend to pay more for car insurance than women. This is especially true for young men. On average, men pay 6% more for full coverage car insurance than women. But between ages 16 and 20, rates for men are 9% to 11% more expensive than for young women.

As young drivers gain more experience, their rates gradually go down. For example, a 19-year-old driver pays 24% less for full coverage insurance than an 18-year-old driver. Rates decrease by 17% between ages 20 and 21.

Overall, young drivers can expect their car insurance rates to be much more affordable at around age 25.

Why does age affect car insurance rates?

Young drivers pay more for insurance because teens have less driving experience. That makes them more likely to cause an accident compared to other age groups.

According to the Insurance Institute for Highway Safety:

- Drivers aged 16 to 19 are four times more likely to be in a car accident compared to older drivers.

- Drivers between the ages of 15 and 20 were responsible for 7% of all fatal accidents. But this age group only represents 4% of drivers.

Since your insurance company thinks you're more likely to crash when you're young, your rates will be expensive. Experienced drivers in their mid-30s to late-50s have more practice behind the wheel and road maturity. That means middle-aged drivers typically have fewer accidents.

After drivers enter their 60s, rates begin to slowly increase as age and slower reflexes begin to impact driving. An 80-year-old driver pays around $209 per month for full coverage. That's $10 more per month than a 25-year-old.

How gender affects car insurance rates as you age

Gender also plays a big role in car insurance costs. Men will pay around 6% more than women over their lifetime, though the price difference varies by age.

Until the age of 21, men pay an average of 10% more than women for full coverage insurance. The gap shrinks after age 30, when men begin to pay 1% less than women until age 50.

How to save money on car insurance at any age

The best ways for both young and elderly drivers to save money on car insurance are to shop around and to ask about discounts.

Teen drivers can also save by sharing a car insurance policy with family members.

Shop around. Shopping around is the most effective way to save money on car insurance. You should compare quotes from at least three companies. Most large insurance companies let you start a quote online so you can quickly compare rates.

Look for discounts. Discounts are an easy way for teens and senior drivers to save money on their auto insurance.

Maintaining good grades and taking defensive driving courses can save young drivers up to 10% on car insurance costs.

Senior drivers can find discounts, too. Allstate offers a "55 and Retired" discount where safe, retired drivers over the age of 55 will automatically save 10%. Some companies also allow drivers over the age of 55 to take defensive driving courses to qualify for discounts.

Join your parents' policy. It costs an 18-year-old driver about 62% less to join their parents' policy than to buy their own coverage.

Your parents' rate will increase significantly. However, the overall cost should still be quite a bit lower than the cost of having two separate policies. If they're willing to add you, sharing a policy is often a surefire way to get a lower rate.

Cheapest insurance companies for young drivers

Travelers has the cheapest rates for drivers under 25, with an average of $273 per month for full coverage.

That's 6% cheaper than Geico and 9% cheaper than State Farm.

If you're a young driver, picking the right insurance company can mean major savings. The difference between companies can be more than $300 per month for full coverage insurance.

Company | Monthly rate | |

|---|---|---|

| Travelers | $273 | |

| Geico | $290 | |

| State Farm | $299 |

*USAA is only available to military members, veterans and their families.

Find Cheap Car Insurance Quotes in Your Area

Young drivers might be able to find cheaper rates from smaller regional companies like Erie, Farm Bureau and Auto-Owners.

For example, full coverage from Erie costs $191 per month. But it's only available in 12 states and Washington, D.C.

The best option can change each year, so you should compare quotes from a few companies whenever your policy comes up for renewal.

Cheapest car insurance for senior drivers

State Farm, Travelers and USAA offer the cheapest rates for senior drivers. Those three companies have below-average rates for drivers 65 and older.

Company | Monthly rate | |

|---|---|---|

| State Farm | $162 | |

| Travelers | $172 | |

| Geico | $183 |

*USAA is only available to members of the military, veterans and their families.

If you're a senior, you should also compare quotes from smaller regional companies like Farm Bureau, Erie, Auto-Owners and Country Financial if they're available in your area.

With an average rate of $118 per month, Farm Bureau has the cheapest full coverage quotes for seniors. But Farm Bureau's options can change depending on where you live. You'll also have to pay a membership fee to get a policy.

Frequently asked questions

What age group pays the most for car insurance?

Young drivers under the age of 25 tend to pay the most for car insurance because they don't have much driving experience. That means they're more likely to make a mistake behind the wheel and cause a crash.

What age group pays the cheapest car insurance rates?

Car insurance rates are the cheapest for 60-year-old drivers. That's because these drivers have lots of experience behind the wheel. Rates are pretty affordable for drivers from age 30 to age 65. After 60, rates begin to increase because seniors start to have slower reflexes that can impact their driving.

Is car insurance more expensive for men or women based on their age?

Men generally pay 6% more for full coverage car insurance than women over their lifetime. The difference is greatest for drivers under the age of 21, when men pay 10% more than women, on average.

Why is car insurance so expensive for young drivers?

Car insurance is more expensive for young drivers because they have less driving experience and are also less risk-averse. Insurance companies see this as a sign that young drivers are more likely to cause an accident. That makes them more expensive to insure.

Your age can also be related to other factors that make car insurance more expensive. For example, young drivers are more likely to rent an apartment, park on the street or have a bad credit score than older drivers.

Methodology and sources

To compare car insurance quotes by age and gender, we gathered rates from ZIP codes across the 10 most populated states in the U.S. Rates are based on a male or female driver with a good credit score and clean driving record who owns a 2015 Honda Civic EX.

Quotes are for a full coverage policy, which includes higher liability limits than required in each state, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist coverage: $50,000 per person and $100,000 per accident

- Personal injury protection or medical payments coverage: $5,000 or state requirement

- Comprehensive and collision deductibles: $500

Rate data was collected using Quadrant Information Services. Your quotes will differ, as rates should be used for comparative purposes only. Rates are publicly sourced from insurer filings.

Statistics on teenage accidents came from the Insurance Institute for Highway Safety.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.