Average Car Insurance Costs for 20-Year-Old Drivers

Find Cheap Auto Insurance Quotes in Your Area

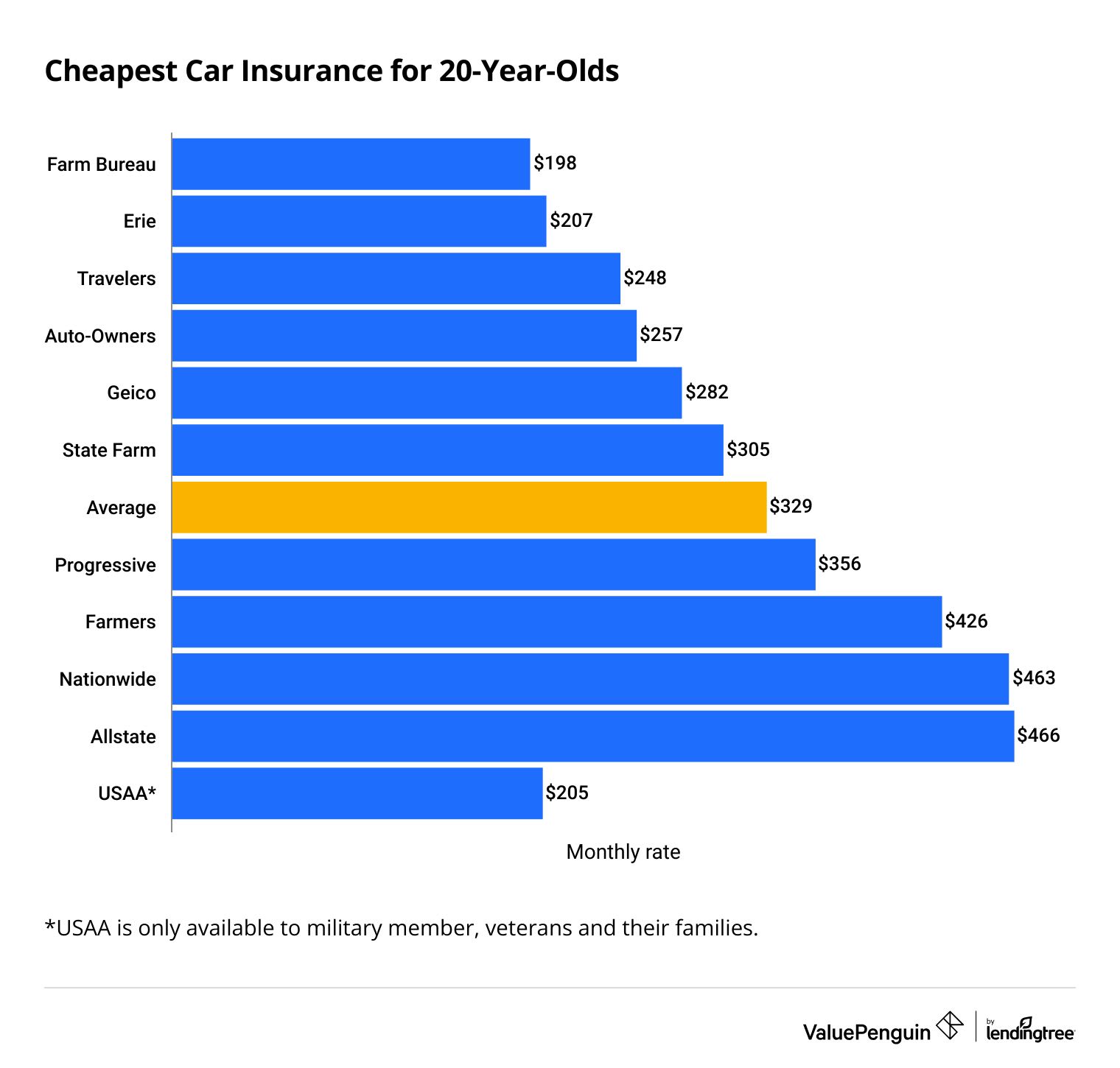

The average cost of car insurance for a 20-year-old with their own policy is $329 per month for a full coverage policy.

Farm Bureau offers the cheapest car insurance for 20-year-old drivers, at $198 per month. To find the best rates, 20-year-old drivers should shop around for quotes and consider staying on their parents' insurance policy.

How much is car insurance for a 20-year-old?

Full coverage car insurance for a 20-year-old driver costs $329 per month, on average. But average rates range by up to $268 per month from one company to the next.

The cheapest rates for 20-year-olds come from Farm Bureau.

A full coverage policy from Farm Bureau costs $198 per month, which is 40% cheaper than average. In comparison, the most expensive company, Allstate, charges $466 per month for the same coverage.

Smaller insurance companies like Farm Bureau, Erie and Auto-Owners tend to have the cheapest rates for 20-year-olds.

Travelers is the most affordable major insurance company, with an average full coverage rate of $248 per month for 20-year-olds.

Cheap full coverage car insurance for 20-year-olds

Company | Monthly rate | ||

|---|---|---|---|

| Farm Bureau | $198 | ||

| Erie | $207 | ||

| Travelers | $248 | ||

| Auto-Owners | $257 | ||

| Geico | $282 | ||

*USAA is only available to military members, veterans and their families.

Young drivers looking for cheap car insurance should always shop around to find the best price.

Cheapest insurance for 20-year-olds by state

Average car insurance rates vary by up to $305 per month depending on where you live.

State Farm has the best rates for 20-year-old drivers in Florida, with an average of $276 per month. That's almost three times as much as the cheapest rate in North Carolina. Travelers offers full coverage car insurance to 20-year-olds in North Carolina for just $95 per month.

Monthly car insurance rates by state

State | State average | Cheapest rate | |

|---|---|---|---|

| California | $270 | Geico | $192 |

| Florida | $506 | State Farm | $276 |

| Georgia | $358 | Country Financial | $244 |

| Illinois | $300 | Country Financial | $153 |

| Michigan | $356 | Geico | $176 |

| New York | $351 | Progressive | $254 |

| North Carolina | $156 | Travelers | $95 |

| Ohio | $261 | Erie | $157 |

| Pennsylvania | $294 | Travelers | $160 |

| Texas | $436 | Farm Bureau | $169 |

Find the Cheapest Insurers for Young Drivers in Your State

Best cheap car insurance for 20-year-olds: Farm Bureau

-

Editor rating

- Monthly rate: $198/mo

Pros and cons

Farm Bureau has the best cheap car insurance for 20-year-olds. Its full coverage policy costs $198 per month, which is 40% cheaper than average.

In addition, Farm Bureau has discounts tailored to young drivers. For example, 20-year-old drivers can complete a driver safety program to earn a discount. You can also save money if you get a "B" or higher GPA in school. If you live on campus or have a short commute, you might be able to save money with Farm Bureau's low mileage discount, too.

A Farm Bureau policy includes all of the basic coverage you need to drive legally. You can also upgrade your coverage with roadside assistance, which can be helpful if your car breaks down on the side of the road.

But it doesn't have gap insurance, which helps pay the difference between the value of your car and the balance on your car loan if you're in a bad wreck. So it may not be the best option for young drivers who have a loan or lease on their car.

In some states, Farm Bureau policies are managed by partner companies like Nationwide or Country Financial. In that case, you won't deal with Farm Bureau directly if you're in an accident and need to make a claim. That means you won't benefit from the great customer service at Farm Bureau.

Best major insurance company for 20-year-olds: Travelers

-

Editor rating

- Monthly rate: $248/mo

Pros and cons

Travelers is the most affordable major insurance company for 20-year-old drivers. A full coverage policy from Travelers costs $248 per month, which is 25% cheaper than average.

Travelers has lots of discounts that can help you lower your car insurance costs, including:

- Automatic payment discount : Up to 4% off

- Continuous insurance discount: Up to 15% off

- Driver training discount: Up to 8% off

- Early quote discount: Up to 10% off

- Good student discount: Up to 8% off

- Pay on time discount: Up to 15% off

- Safe driver discount: Up to 23% off

- Student away at school discount: Up to 7% off

Travelers also offers accident forgiveness, rental car coverage, roadside assistance and rental car reimbursement for 20-year-old drivers who need extra coverage.

However, customers weren't typically happy with their experience with Travelers after an accident. It earned one of the lowest scores on J.D. Power's claims satisfaction survey, which ranks major insurance companies based on customer feedback.

The best way for 20-year-olds to find cheap car insurance

The most effective ways for 20-year-old drivers to get cheaper car insurance quotes are:

- Share a policy with your parents

- Compare quotes from multiple companies

- Take advantage of discounts

- Lower your coverage limits

Stay on your parents' car insurance policy

The best way to get cheap car insurance as a 20-year-old is to stay on your parents' policy. Young drivers can typically save around 62% by sharing a policy with their parents.

Your parents' insurance rates will typically be more expensive with you on their policy. But the overall cost will be much less than the price of two separate policies.

Shop around for the best rates

A 20-year-old driver could see a difference of hundreds of dollars per month from one insurance company to the next.

For example, a 20-year-old driver in Texas can get full coverage insurance from Farm Bureau for around $169 per month. The most expensive company, Allstate, charges $930 for the same coverage.

The best way to compare rates quickly is to shop for cheap quotes online. You should compare quotes from major insurance companies as well as smaller, regional companies in your area.

Find Cheap Auto Insurance Quotes in Your Area

Qualify for discounts

When you compare quotes, make sure you're getting all the discounts you qualify for. You should check for:

- Good student discounts

- Defensive driving course discounts

- Student away from home discounts

- Safe driver discounts

- Automatic payment discounts

Young drivers who live on campus or have a short commute should also consider pay-per-mile insurance. This type of insurance uses your monthly mileage to help calculate your rates. That makes it a great choice for people who don't drive much.

Lower your coverage limits

It's important to have enough insurance to protect you and your car if you're in a serious accident. That's why we recommend a full coverage policy. It covers the cost of damage or injury to others and also pays for repairs to your own car.

However, you could save money by lowering your limits. For example, if your car is worth less than a few thousand dollars, it may not be worth it to have comprehensive and collision coverage. These coverages protect your own car against damage. But they can be expensive, so if your car isn't worth much, you may be better off putting the money in savings to pay for potential repairs yourself.

You could also consider raising your deductible. Having a higher deductible means lower car insurance rates. That's because your car insurance company won't pay you as much money for repairs. But it's important to choose a deductible that you're comfortable paying after an accident.

Car insurance for 20-year-old men vs. women

On average, 20-year-old men pay $33 more per month for full coverage insurance than women.

Full coverage car insurance costs $345 per month for 20-year-old men, on average. In comparison, 20-year-old women pay $312 per month. That's because young male drivers are more likely to cause an accident than young female drivers.

Company | Male | Female |

|---|---|---|

| Farm Bureau | $177 | $219 |

| Erie | $184 | $230 |

| Travelers | $237 | $259 |

| Auto-Owners | $239 | $275 |

| Geico | $270 | $294 |

*USAA is only available to military members, veterans and their families.

Some states have banned insurance companies from using gender to determine car insurance rates. So men and women of the same age pay the same amount for car insurance in these states:

- California

- Hawaii

- Massachusetts

- Michigan (in certain areas)

- Montana

- North Carolina

- Pennsylvania

Car insurance for 20-year-olds vs. other ages

As a 20-year-old driver, you can expect your rates to go down by nearly 17% when you turn 21. You'll pay around 40% less for full coverage insurance at age 25, when car insurance rates become much more affordable.

Young drivers aged 25 and under tend to have high car insurance rates. That's because they have less experience behind the wheel, making them more likely to cause an accident.

Full coverage car insurance rates by age

Compare ratesFrequently asked questions

How much is car insurance for a 20-year-old per month?

The average cost of full coverage car insurance for a 20-year-old is $329 per month. But rates vary significantly depending on where you live and the company you choose. So it's important to compare quotes from multiple companies to find the best rate for you.

Why is my car insurance so high at age 20?

Young drivers tend to pay a lot for car insurance because they have less experience behind the wheel. That means they're more likely to make a mistake and cause an accident than older drivers.

Rates tend to get much more affordable as you get older. For example, 25-year-old drivers pay 40% less for car insurance than 20-year-olds.

How much is car insurance for a 20-year-old in California?

A full coverage policy for a 20-year-old driver in California costs $270 per month, on average. Californians can find the cheapest rates with Geico, which costs around $192 per month for 20-year-olds.

What is the cheapest car insurance company for 20-year-olds?

Farm Bureau has the cheapest car insurance rates for 20-year-old drivers, with an average of $198 per month for full coverage. However, it's not available in every state.

How much is car insurance for a 20-year-old male driver?

On average, a 20-year-old man pays $345 per month for full coverage car insurance. Farm Bureau has the most affordable rates for 20-year-old men, with an average of $219 per month.

Methodology

To find the average cost of car insurance for 20-year-old drivers, we collected quotes across thousands of ZIP codes in 10 of the most populous states in the country. Rates are for a 20-year-old man or woman with a clean driving record who owns a 2015 Honda Civic EX.

Full coverage quotes include higher liability limits than required in each state, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: Minimum when required by state

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

We included 13 insurance companies in this analysis. Rates were only included in our list of average prices and recommendations if their policies were available in at least four of the 10 states.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.