American Modern Insurance Review for Nonstandard Homes

American Modern offers reliable service if you can't find coverage elsewhere. But it tends to be expensive.

Find Cheap Homeowners Insurance Quotes in Your Area

American Modern Insurance typically works with homeowners who can't get coverage from major insurance companies. American Modern could be a good option if you live in a high-risk location, like on a coast; if your home is very old; or if you have made lots of insurance claims.

Homeowners insurance from American Modern is more expensive than average. And the company doesn't include some standard coverage, like protection against theft, in its basic homeowners policy.

However, American Modern gives homeowners the option to add on these basic coverages and other upgrades for an extra fee.

Pros and cons

Pros

Offers coverage in coastal areas

Good for old, historic or low-value homes

Offers protection for rental or vacation properties

Dependable customer service

Cons

Expensive rates

American Modern home insurance quotes

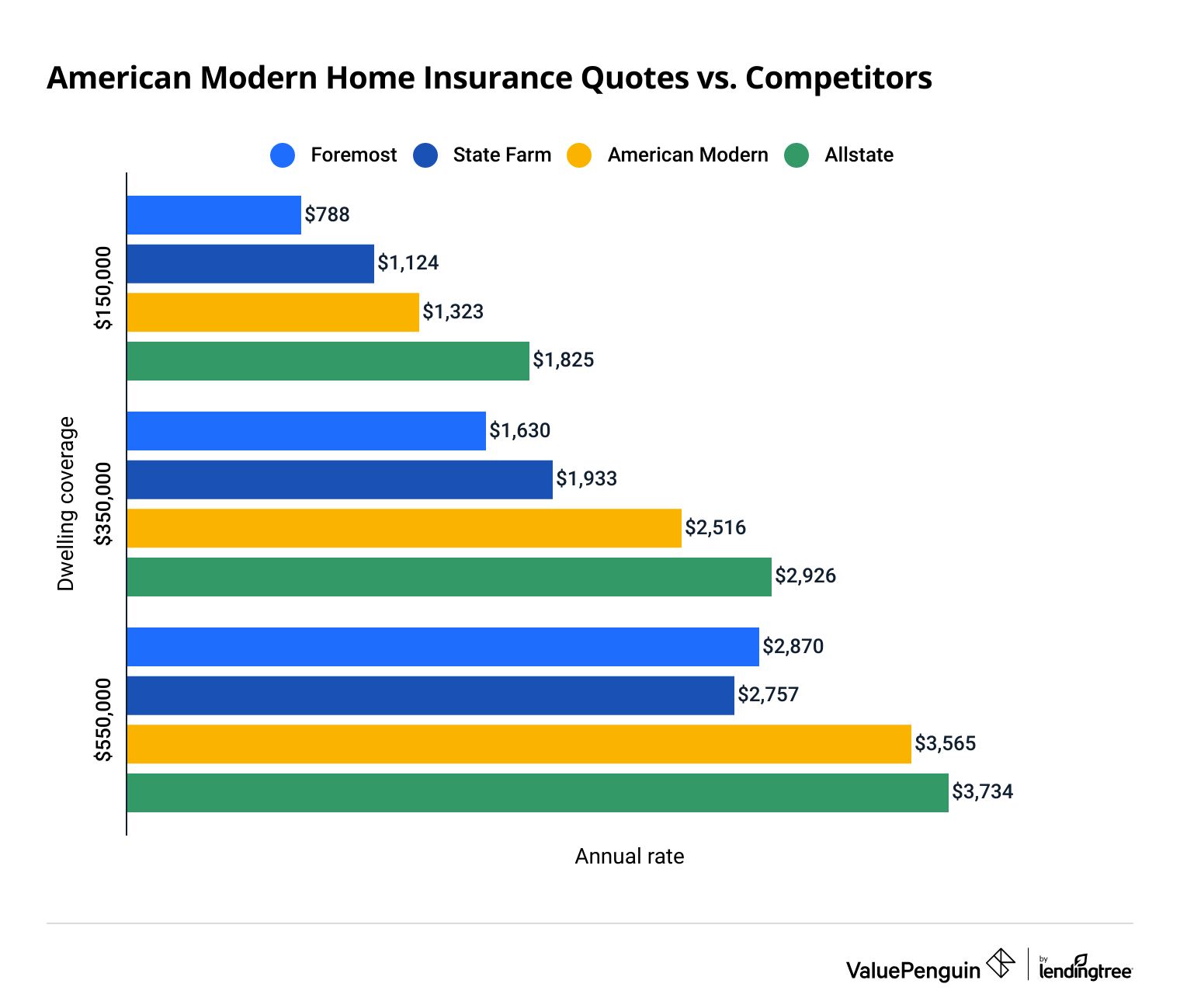

American Modern home insurance is between 4% and 8% more expensive than average.

It tends to have better rates for high- and low-value homes. Its quotes for midpriced homes are less competitive.

Find Cheap Homeowners Insurance Quotes in Your Area

Another company that focuses on specialty home insurance, Foremost Insurance, has much cheaper rates than American Modern. A Foremost policy with $150,000 of dwelling coverage costs just $788 per year. That's 40% cheaper than a policy from American Modern.

American Modern home insurance rates by dwelling coverage limit

$150,000

$350,000

$550,000

Company | Annual rate | ||

|---|---|---|---|

| Foremost | Not rated | $788 |

| State Farm | $1,124 | ||

| Nationwide | $1,200 | ||

| American Modern | $1,323 | ||

| Farmers | $1,353 | ||

| Allstate | $1,825 | ||

$150,000

Company | Annual rate | ||

|---|---|---|---|

| Foremost | Not rated | $788 |

| State Farm | $1,124 | ||

| Nationwide | $1,200 | ||

| American Modern | $1,323 | ||

| Farmers | $1,353 | ||

| Allstate | $1,825 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Foremost | Not rated | $1,630 |

| State Farm | $1,933 | ||

| Nationwide | $2,422 | ||

| American Modern | $2,516 | ||

| Farmers | $2,563 | ||

| Allstate | $2,926 | ||

$550,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $2,757 | ||

| Foremost | Not rated | $2,870 |

| American Modern | $3,565 | ||

| Allstate | $3,734 | ||

| Farmers | $3,766 | ||

| Nationwide | $3,882 | ||

Unfortunately, you can't get American Modern home insurance quotes online.

You'll have to speak to a local independent insurance agent to get a quote. You can find an agent near you on the American Modern website.

American Modern home insurance discounts

American Modern offers all of the common discounts you would find with a major insurance company.

Even though American Modern doesn't sell standard car insurance, it still offers a bundle discount if you buy car insurance through the same agent that sold you an American Modern home policy, regardless of which auto insurance company you choose.

As a homeowner, you can save on an American Modern policy if:

- You get multiple insurance policies from American Modern, like a home policy plus a boat, motorsport or collector car policy

- You don't have any home insurance claims over the past three years

- You have safety devices installed in your home, like a fire or smoke alarm, a burglar alarm and dead bolts

- You belong to an approved association, like an alumni association

- You're over the age of 50

- You sign up to get statements and bills via email

- You pay your annual home insurance bill in full

- You're insured with American Modern for five years or longer

American Modern homeowners insurance coverage options

American Modern offers three main home insurance policies.

- Homeowners insurance: This is similar to a standard home insurance policy. However, it includes less coverage than most major companies provide with their basic policies.

- Homeowners FLEX: This includes more coverage than American Modern's basic home insurance policy. And it gives homeowners more options to customize their coverage.

- Dwelling Basic: This is the most bare-bones option from American Modern. It's only a good choice if you're not able to buy a regular policy.

American Modern homeowners insurance

American Modern's homeowners insurance policy comes with less coverage than what's considered a standard home insurance policy. It only pays for damage caused by hazards listed on your policy, called "named perils."

Homeowners insurance from American Modern won't pay for damage due to:

- Falling objects, like trees

- Glass breakage

- Power surges

- The weight of ice or snow

- Theft

- Water damage

American Modern gives homeowners the option to add protection against these hazards for an extra fee. However, most home insurance companies include these in a base policy.

An American Modern policy covers your home's structure based on its actual cash value (ACV). If your home is damaged, American Modern will pay you based on the current wear and tear on any materials that need to be replaced. That means you may not get enough money from insurance to fully cover the cost of repairs.

However, American Modern customers can upgrade their policy to include replacement cost value (RCV). That means American Modern will pay the full cost to repair your home with new materials.

Other American Modern homeowners insurance upgrades

- Coverage for valuables

- Hobby farming coverage

- Home equipment breakdown coverage

- Identity theft protection

- Ordinance or law coverage

- Service line coverage

- Water backup coverage

Lastly, you can only add a maximum of $500,000 of liability insurance to an American Modern homeowners policy. While this is enough coverage for most people, those who want higher limits will need to upgrade to a FLEX policy or buy an umbrella policy from another company.

American Modern often deals with customers who can't get homeowners insurance elsewhere. So the company has specific minimum requirements for homes it will insure.

Its standard homeowners policy requires that your home be a single- or two-family building, in average or better condition and regularly maintained. However, there is no home age limit, so owners of older homes will likely be able to get coverage.

American Modern Homeowners FLEX coverage

The Homeowners FLEX program from American Modern is a great choice for people who want more protection.

It includes more coverage than American Modern's basic homeowners policy. It will protect your home from common damage that's excluded from the basic policy, like falling tree limbs and theft. It also includes replacement cost coverage for your home's structure, so you'll have to pay less money to repair covered damage.

FLEX coverage offers the same coverage upgrades available for the basic homeowners policy. But FLEX customers can also add protection against earthquake damage. And a FLEX policy can cover you if you occasionally rent out your home.

In addition, the FLEX policy offers up to $1 million in liability coverage.

American Modern Dwelling Basic coverage

Dwelling Basic coverage from American Modern is meant for people who are struggling to find home insurance elsewhere. For example, it can cover rental homes, vacant homes and homes in fair condition.

This policy only covers the structure of your home.

It doesn't include other coverage typical for a home insurance policy, like personal property or liability coverage. However, you can add these protections for an additional fee.

In addition, a Dwelling Basic policy covers fewer hazards than American Modern's homeowners policy. For example, it doesn't cover vandalism or burglary.

Homeowners should only choose Dwelling Basic coverage as a last resort. If you qualify for another policy type, this isn't the best option for you.

Other specialty home coverages from American Modern

American Modern offers several different types of specialty home coverage for properties that aren't usually covered under typical homeowners insurance.

For example, a vacation home that is unoccupied for much of the year is less likely to have a cooking fire but may have more damage in a storm because no one was there to board up the windows.

American Modern offers the following special types of property insurance coverage:

- Vacation home insurance protects properties that are used as part-time residences. This policy offers high dwelling coverage limits, so it's a good option for high-end vacation homes as well as rustic cabins and cottages.

- Mobile and manufactured home insurance protects manufactured homes, which are not eligible for coverage under most standard homeowners insurance policies.

-

Landlord insurance is for people who own a house and rent it out to others.

- Vacant property insurance protects a home you own that is unoccupied for a long period of time. For example, this could include a house undergoing renovations or a house that is vacant while it is for sale.

American Modern also offers a range of other insurance products, including collector car insurance, motorsport insurance, and yacht and boat insurance, among others.

American Modern customer service ratings and reviews

Homeowners can count on American Modern to help get their lives back to normal quickly after an emergency.

The company gets 27% fewer customer complaints than the average for a company of its size, according to the National Association of Insurance Commissioners (NAIC). That means American Modern customers are generally happy with the service it provides.

It also has excellent financial ratings. American Modern's AM Best rating is an A+, or "Superior." That means its customers should not be concerned about the company's ability to pay out future claims.

Contact American Modern Insurance

The best way to contact American Modern Insurance is to contact an insurance agent. An agent can help you buy a policy, file a claim or make changes to your policy. Agents typically provide better service than a call center because they will get to know you and have a better understanding of your needs.

If you do need to speak to American Modern customer service, you can call 800-543-2644. Its customer service center is open Monday through Friday from 8 a.m. to 8 p.m. American Modern also has a live chat feature available on its website, which operates during the same hours as the service center.

Frequently asked questions

Who owns American Modern Insurance?

American Modern is owned by Munich RE. Munich RE is a Fortune Global 500 company, which means it's one of the largest companies in the world. That means you can trust American Modern to pay customer claims.

Is American Modern a good insurance company?

American Modern is a good insurance company for homeowners who can't get coverage from a major company. It has reliable customer service and more coverage than you may be able to find at other specialty insurance companies. But it's typically not the cheapest option, so you should compare quotes from multiple companies before buying a policy from American Modern.

What is the AM Best rating for American Modern Insurance?

American Modern has an A+ rating from AM Best. That means it has a superior ability to pay out customer claims, even if there are a lot at the same time.

Methodology

To compare home insurance quotes for American Modern and competitors, we gathered rates from ZIP codes across Montana.

Quotes include three levels of dwelling coverage: $150,000, $350,000 and $550,000.

Each policy included the following coverage:

- Liability coverage: $100,000

- Medical payments: $5,000

- Personal property coverage: 50% of dwelling coverage

- Additional living expenses: 20% of dwelling coverage

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.