Understanding Auto Insurance Scores

Find Cheap Auto Insurance Quotes in Your Area

If you’re applying for auto insurance, some insurers will evaluate your application with an auto insurance score, also often referred to as an insurance score, insurance risk score or a credit-based insurance score. To help you find the best auto insurance, we’ve compiled a guide explaining what an auto insurance score is and how it can affect your policy and rates.

What is an auto insurance score, and how is it calculated?

Insurance companies use auto insurance scores to predict the likelihood of future claim filings and determine if an applicant should be granted an insurance policy and at what rate.

Higher scores — in other words, good scores — predict a policyholder will have fewer accidents and claim filings. If you have a good auto insurance score, an insurance company is more likely to accept you as a customer and offer you lower rates. Worse insurance scores, on the other hand, can increase the likelihood of your application being denied or having to pay higher rates.

Insurance companies will often calculate insurance scores with their own proprietary methodology or, in some cases, use a third-party vendor for the calculation. Because of the different methods used, the scale or range of possible insurance scores, as well as what's considered high or low risk, vary widely across insurers. Additionally, because insurance scores are proprietary, you won't necessarily be able to check your auto insurance score or have clear insight into how it is calculated.

Insurance scores vs. credit scores

Insurance scores are distinct from traditional credit scores. While both can influence your insurance policy and rate, insurance scores focus strictly on assessing the risk of claim filings.

In the case of auto insurance, insurance scores solely assess how likely you are to be involved in an accident and file a claim for damages. However, insurance companies often use credit-related factors to determine your auto insurance score. Credit scores, meanwhile, evaluate your overall creditworthiness and ability to pay back many different kinds of credit, from mortgages to personal loans and credit cards.

Car insurers use your auto insurance score, which is often heavily based on your credit score, to determine your rates. However, several states prohibit insurance companies from using credit scores when evaluating applications.

Additionally, many states prohibit insurers from using insurance scores as the sole criterion for policy and rate assessments. States also commonly restrict the types of personal information insurance companies can use to determine insurance scores. Contact your state's insurance department if you have further questions or concerns about what information your insurance company can use for underwriting and rate evaluations.

What is an insurance score based on?

Several factors can contribute to your auto insurance score, including previous claims, accident history and credit history.

Previous claims filed with your insurance company stay on your record for several years. Insurers interpret a high frequency of claims as higher risk of future claim filings, thereby hurting your score.

Accident history, particularly history that is on record with your insurance provider, may be used to calculate your insurance score. Like claim filings, a history of accidents will hurt your score and ability to get good rates. While public driving records are generally not included in insurance score calculations, insurance companies will still charge higher premiums for driving violations from the last 10 years.

Credit history contributes significantly to your insurance score. A stronger credit history implies a better insurance score. Relevant factors include:

- The frequency of late and on-time payments

- The average length of time between your bill’s due date and payment

- The average length of your credit history, or how long you’ve used credit cards, loans and other sources of credit

- The number of credit inquiries, which occur when you open a new liability account, such as credit cards, mortgages and more

- The number of liabilities still open and in good standing, often measured by how much credit you utilize relative to total credit available

- Previous liability defaults, such as bankruptcy filing, home foreclosures, repossessions and liens

- The diversity of your credit sources

What is a good insurance score?

The scale or range of auto insurance scores used by insurers varies depending on which company does the calculations. Insurers often use their own methodology to determine a score or request a calculation from a third-party vendor.

If your insurance company uses a third-party vendor, it may employ one of the following companies:

- Fair Isaac Corporation (FICO): 250-900, where good scores are generally higher than 700.

- LexisNexis (combined with ChoicePoint): 500-997, where good scores are generally higher than 776.

- TransUnion: 300-850, though the company does not specify a benchmark for good.

Not all insurance companies are alike, as many insurers have different standards for determining what’s considered a good auto insurance score. Given the variation across companies, it’s always a good idea to get multiple quotes when shopping around for an insurance policy.

How auto insurance scores affect quotes

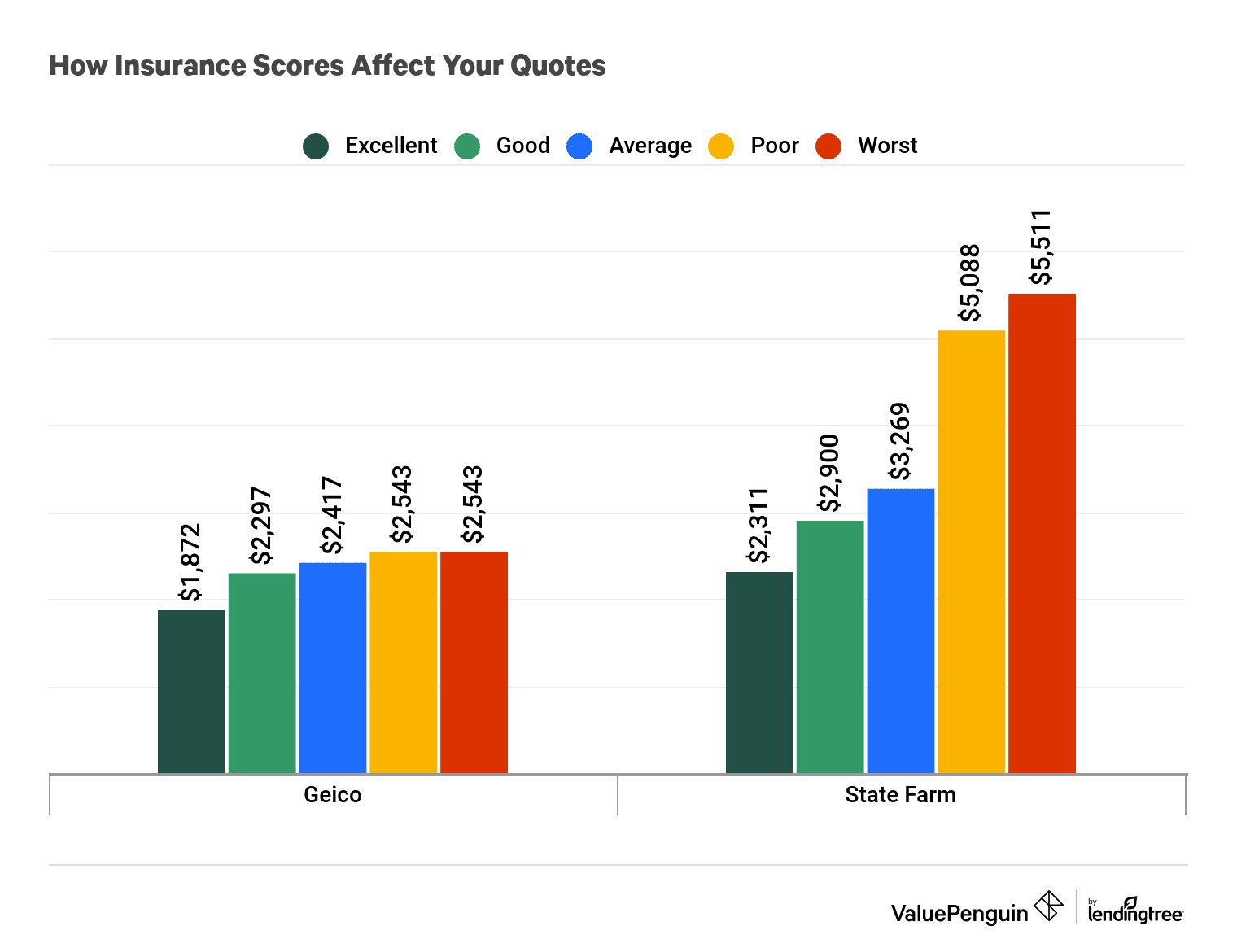

Having a poorer car insurance score will definitely increase your rates. However, quotes based on insurance scores vary substantially across different insurers due to proprietary insurance score levels or scales. For example, a rate at State Farm based on a good insurance score was higher than all of the rates at Geico, including the rates for a poor and worst insurance score tier.

There are also often significant disparities in rates from one insurance score tier to the next. At State Farm, for instance, the difference in annual premiums between an average and poor insurance score is nearly $2,000.

To determine how car insurance scores impact quotes, we collected sample annual premiums for five insurance score profiles for a 30-year-old single man in Texas.

How to improve your insurance score

Given that credit history contributes to a substantial portion of your insurance score, and that only time will mitigate the effects of prior accidents and claim filings, you should focus on improving credit-related factors.

Recommendations include:

- Pay off your liabilities on or before the due date. On-time payments avoid letting interest compound month after month and signal to insurance companies that you are reliable with your finances.

- Decrease your credit utilization. In other words, try to use less credit than the total amount available across all your liabilities.

- Diversify your available credit. Paying off different types of credit sources signals to insurers you are adept at managing different liabilities. You should still proceed with caution, because paying your bills on time and in full is much more important than credit diversification, and taking out a loan or opening too many accounts at once for the sake of diversifying credit may negatively impact your score by resulting in several credit inquiries.

Insurance scores ultimately help determine your rates, so investigating quotes across different companies can help you find a policy best car insurance for you.

Some insurers do not disclose your insurance car to customers. However, some insurers, such as Say Car Insurance, do disclose insurance scores.

Methodology

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used only for comparative purposes — your quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.