Best Cheap Car Insurance for Bad Credit

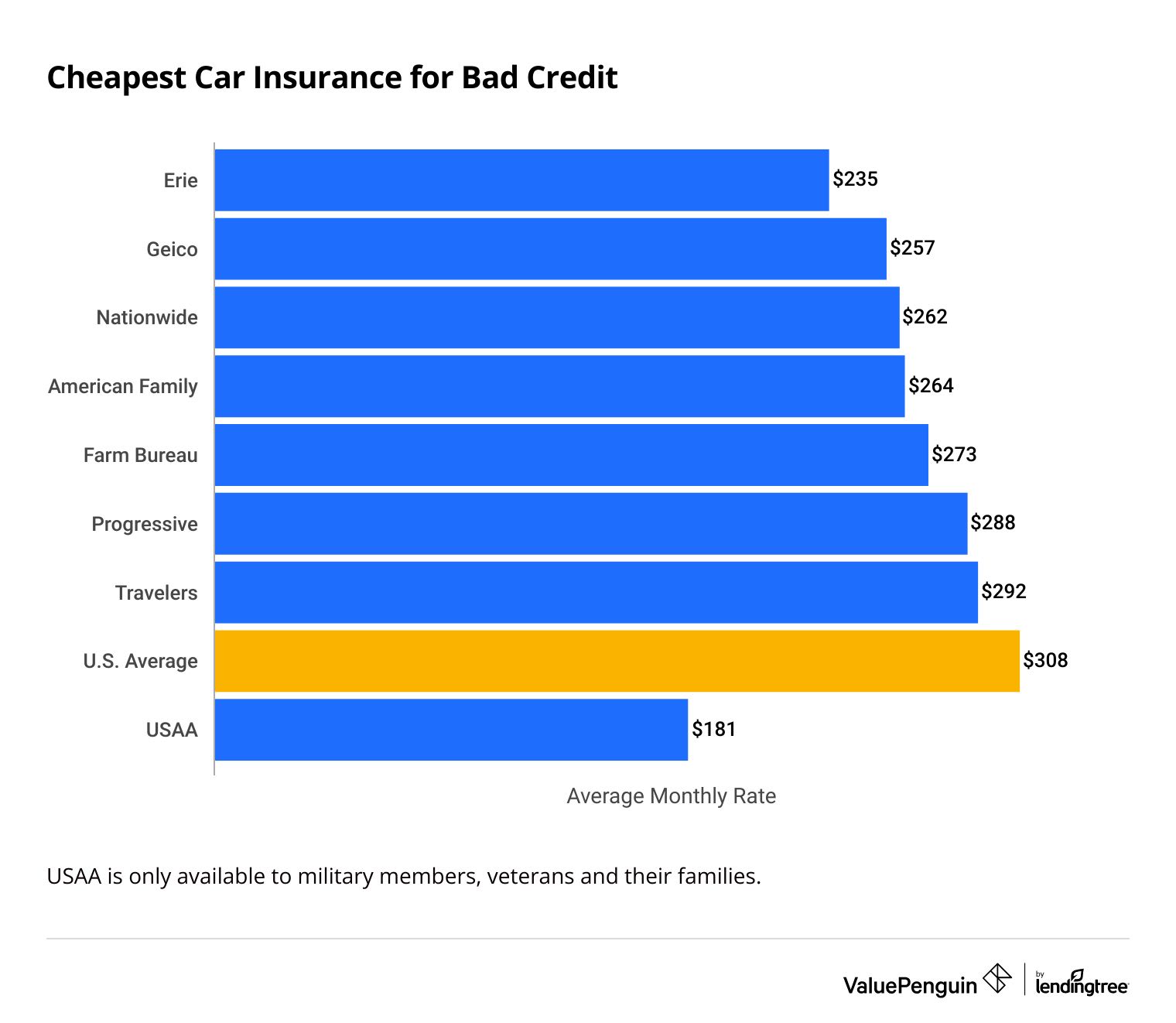

Geico has the cheapest widely-available auto insurance quotes for bad credit, with an average of $257 per month.

Find Cheap Auto Insurance Quotes

Car insurance quotes are 88% more expensive for drivers with poor credit than drivers with good credit. Insurers tend to charge higher rates for drivers with lower credit scores because they have found that people with bad credit make insurance claims more often.

Cheapest car insurance for bad credit: Geico

Geico offers the cheapest widely available auto insurance for drivers with bad credit. The average annual cost of $257 per month for full coverage is $5 per month cheaper than Farm Bureau.

USAA offers the cheapest rates overall for drivers with lower credit scores, but the company's coverage is only available to military members, veterans and some of their family members.

Find Cheap Auto Insurance Quotes

For people in the Northeast, Erie also offers great rates, but you can't get it unless you live in one of 12 states .

Across the states that allow credit rating to factor into car insurance rates, poor credit raises prices by 88% per year. By comparison, Geico only raises its rates by 59%, while State Farm more than triples its rates.

Cheapest monthly car insurance quotes

Company | Poor credit rate | Good credit rate | |

|---|---|---|---|

| Erie | $235 | $107 | |

| Geico | $257 | $162 | |

| Nationwide | $262 | $189 | |

| American Family | $264 | $160 | |

| Farm Bureau | $273 | $162 |

Best car insurance companies for poor credit

Geico is among the largest car insurance companies in the country and offers some of the best rates for drivers with poor credit. Drivers with poor credit pay an average of $257 per month with Geico. In 13 states, it has the best rates of any non-USAA insurer. The company only raises rates 59% for drivers with bad credit compared to people with good credit.

Farm Bureau is an organization with availability in most states, and most offer car insurance at a discounted rate to members. A full-coverage policy for a driver with poor credit is $273 per month from Farm Bureau. You have to pay an annual membership fee, but it's usually less than $100 per year, and you don't have to be a farmer to join.

USAA is the cheapest company overall for drivers with bad credit. Full-coverage auto insurance costs $181 per month for an annual policy, on average, which is the lowest rate by far. USAA is in every state and Washington, D.C. However, policies are only available to a limited group: Military members, veterans and some of their family members.

Best bad credit car insurance companies

It's also worthwhile to get insurance quotes from companies that raise rates by a smaller amount if you have bad credit, even if their base prices are high. Nationwide raises its prices the least of any insurer for drivers with bad credit — only 39%. The average increase is 88% across every insurer.

Company |

Rating

| Monthly rate | % increase |

|---|---|---|---|

| Nationwide | $262 | 39% | |

| Farmers | $407 | 58% | |

| Geico | $257 | 59% | |

| Allstate | $349 | 61% | |

| American Family | $264 | 65% |

*USAA is only available to current and former military members and their families.

No-credit-check insurance companies

A few states, including California, Hawaii, Massachusetts and Michigan, do not allow insurance companies to use credit scores as a factor in setting car insurance rates.

Few insurance companies provide a car insurance policy without a soft credit check . Though they're rare, you might be able to find a local no-check car insurance company .

A few examples are Dillo in Texas, Cure Auto Insurance in New Jersey and Pennsylvania. But they are exceptions, as 95% of auto insurance companies factor in credit history to determine your quotes, according to FICO.

Although some insurers might not check your credit before providing you with a quote, they will almost always check your credit before you sign up for your policy.

Why is car insurance more expensive for drivers with bad credit?

A driver's credit score does not mean a driver is more risky on the road, but that they are more expensive to insure.

Insurance companies charge higher rates to drivers with low credit scores because there is a correlation between bad credit and an increased chance of filing a claim, according to a Federal Trade Commission report.

Drivers who file an insurance claim cost insurance companies money when they have to pay out a claim, even for comprehensive or collision insurance claims. And because insurers increase rates for customers they expect will have higher insurance payouts, drivers with poor credit end up with higher rates than those with excellent credit.

Drivers with no credit history are usually treated similarly to drivers with bad credit scores and generally have higher auto insurance rates.

How to get cheaper car insurance rates if you have bad credit

The best way to lower your insurance rates if you have bad credit is to work on improving your credit score, even though it's not an easy or fast process.

Make on-time payments: Making loan and credit card payments on time is one of the best ways to improve your credit, as payment history is the biggest factor in your credit history. It accounts for 35% of your FICO Score. Paying your insurance bills on time will not help your credit score, but missing payments could hurt both your score and your rate.

Don't max out your credit cards: The ratio of the credit you use compared to the credit that is available to you is known as your credit utilization ratio. Using less than 30% of the credit you have is a great way to improve your credit rating, as credit utilization accounts for 30% of your credit score. For example, if you have a credit card with $1,000 of available credit, you want to have a balance of no more than $300.

Beyond improving your credit, you can take a few more traditional steps to potentially lower your insurance rates.

- Take advantage of all discounts, such as good driver discounts, good student discounts or multiple policy discounts.

- Increase your deductibles. Increasing the deductible on your collision or comprehensive will lower your rates; just be sure you are able to cover the deductible in case of an accident or damage.

- Consider Potential Rate Increases Before Filing a Claim. A clean claims history can help keep rates reasonable. For minor issues you can afford to pay for yourself, it may be better to handle the cost yourself.

- Shop around and get quotes from multiple car insurance companies to get the best deal.

Frequently asked questions

Can I get car insurance with bad credit?

Yes, but it will likely be more expensive. Poor credit raises your insurance rates by an average of 88%.

Why does bad credit raise car insurance rates?Methodology

Data was collected from the largest insurance companies in 45 states where credit is a factor for deciding car insurance quotes. Rates are for a 30-year-old man with a 2015 Honda Civic EX and a full-coverage policy.

This analysis used insurance rate data from publicly sourced insurer filings using Quadrant Information Services. These quotes should be used for comparative purposes only, as your rates may differ.

Information on how insurers consider credit scores was sourced from the 2007 FTC report Credit-Based Insurance Score: Impacts on Consumers of Automobile Insurance.

Managing Editor

Ben Breiner is the Managing Editor of ValuePenguin/LendingTree's insurance vertical. He oversees a team of writers who focus on guiding readers through the rigors of home and auto coverage. He still loves that moment when the words fall together and he can translate an intimidating topic so a reader can make the best choice.

Ben got involved in insurance in 2021 when he joined ValuePenguin. He moved up from writer to editor and watched the team grow to expand the ways it helps consumers. Before that, he spent a decade as a sportswriter for newspapers in the Southeast and Midwest.

Ben had to put off buying his first car because of high insurance rates, so he's keenly aware how the wrong policy can get in the way of your goals. He should've shopped around and looked to the experts.

Insurance tip

Always keep an eye out for insurance you can load up on at a low price. A lot more liability coverage won't break the bank and protects your hard-earned assets.

Expertise

- Car insurance

- Home insurance

- Renters insurance

Education

- BA, Economics and Journalism, University of Wisconsin-Madison

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.