Best & Cheapest Car Insurance Quotes in Alaska (2024)

Geico has the most affordable full coverage car insurance in Alaska, at $112 per month.

Find Cheap Car Insurance Quotes in Alaska

Best cheap car insurance companies in Alaska

How we chose the top companies

Best and cheapest car insurance in Alaska

- Cheapest full coverage: Geico, $112/mo

- Cheapest minimum liability: State Farm, $46/mo

- Cheapest for young drivers: Allstate, $105/mo

- Cheapest after a ticket: State Farm, $123/mo

- Cheapest after an accident: Umialik, $134/mo

- Cheapest for teens after a ticket: Umialik, $121/mo

- Cheapest after a DUI: Umialik, $134/mo

- Cheapest for poor credit: Allstate, $203/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Geico, State Farm and Umialik offer the best combination of dependable customer service and cheap rates. Geico and State Farm both offer online quotes, so you can quickly compare rates to find the best option for you. However, you'll need to work with an insurance agent to get a quote from Umialik.

Cheapest car insurance in Alaska: Geico

Geico has the cheapest full coverage rates in Alaska, with an average rate of $112 per month.

That's 13% less than the state average. The average cost of car insurance in Alaska is $128 per month for full coverage.

Alaska drivers should also compare quotes from State Farm. State Farm has some of the best customer service in Alaska and costs around $115 per month for full coverage. That's only $3 more per month than Geico.

Find Cheap Car Insurance Quotes in Alaska

If you're a current or former military member or part of a military family, you can get full coverage insurance from USAA for just $84 per month.

That's $28 less per month than Geico and 34% cheaper than the state average.

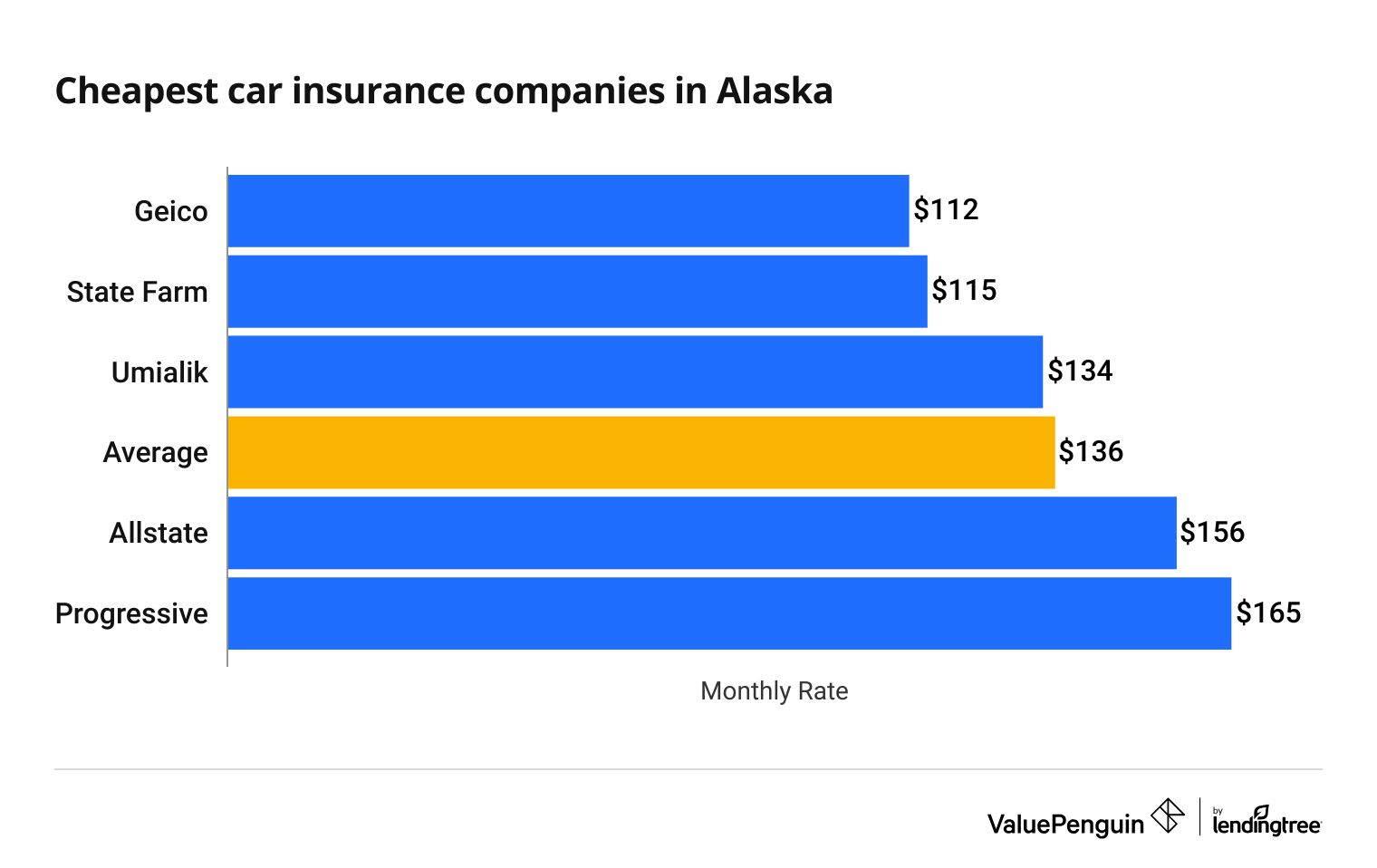

Cheapest Alaska car insurance companies

Company | Monthly rate | |

|---|---|---|

| Geico | $112 | |

| State Farm | $115 | |

| Umialik | $134 |

| Allstate | $156 | |

| Progressive | $165 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance in Alaska: State Farm

State Farm offers Alaska drivers the best rates for minimum liability insurance, with an average of $46 per month.

That makes State Farm's rates 9% cheaper than the Alaska average. The average cost of minimum coverage car insurance in Alaska is $50 per month.

Military members, veterans and their families can find the cheapest rates with USAA. A minimum coverage policy from USAA costs only $26 per month.

Cheapest minimum coverage quotes in AK

Company | Monthly rate |

|---|---|

| State Farm | $46 |

| Allstate | $47 |

| Geico | $47 |

| Umialik | $50 |

| Progressive | $87 |

*USAA is only available to current and former military members and their families.

Find Cheap Car Insurance Quotes in Alaska

Cheapest car insurance for teen drivers in Alaska: Allstate

Allstate has the cheapest minimum coverage rate for an 18-year-old driver, at $105 per month.

That's 33% cheaper than average. But full coverage from Allstate is costly, at $409 per month.

The cheapest full coverage insurance for Alaska teens comes from Umialik. A full coverage policy from Umialik costs $297 per month, which is 19% cheaper than average.

Cheapest car insurance for young drivers in Alaska

Company | Liability only | Full coverage |

|---|---|---|

| Allstate | $105 | $409 |

| Umialik | $121 | $297 |

| Geico | $138 | $299 |

| State Farm | $159 | $368 |

| Progressive | $351 | $647 |

Young drivers in Alaska pay $106 more per month for minimum coverage car insurance than adult drivers. And full coverage for 18-year-old drivers costs nearly three times more than the same coverage for a 30-year-old driver.

Teen drivers in Alaska can save money on their car insurance by:

It's also important to compare quotes from multiple companies. For example, a teen driver with minimum coverage from Progressive could save $246 per month by switching to Allstate.

Best car insurance after a speeding ticket: State Farm

State Farm has the cheapest quotes for drivers with a speeding ticket, charging $123 per month for full coverage. That's 18% cheaper than the average cost for Alaskans with a speeding ticket, which is $150 per month.

Company | Monthly rate |

|---|---|

| State Farm | $123 |

| Geico | $133 |

| Umialik | $134 |

| Allstate | $187 |

| Progressive | $213 |

A single speeding ticket will raise your rates by 17% in Alaska. Insurance companies believe that drivers with a speeding ticket are more likely to cause an accident in the future. So they charge these drivers more to help cover the cost of a potential accident.

Cheapest quotes after an accident: State Farm and Umialik

State Farm and Umialik offer affordable quotes for Alaska drivers with an at-fault accident on their record. Both companies charge an average of $134 per month for full coverage insurance after an accident, which is 22% cheaper than the state average.

Cheapest car insurance in Alaska after an accident

Company | Monthly rate |

|---|---|

| State Farm | $134 |

| Umialik | $134 |

| Geico | $177 |

| Progressive | $231 |

| Allstate | $234 |

State Farm offers a lot more discounts than Umialik. It could be cheaper for drivers who can qualify for extra savings.

State Farm also has a usage-based program that rewards safe driving with a discount. These programs also give you feedback on your driving habits. That may help you make safer choices and avoid accidents in the future.

Alaska drivers with a recent accident on their record pay an average of $172 per month for full coverage. That's an increase of 34% after a single at-fault accident.

Insurance companies increase rates because drivers who have been in one accident are more likely to get into another accident in the future. But your rates may go down if you keep a clean driving record until the accident drops off your driving record. This typically happens after three to five years.

Cheapest for young drivers after a ticket or accident: Umialik

Umialik has the cheapest rates for young drivers after a speeding ticket or accident.

Umialik doesn't raise rates for some young drivers after a single ticket or accident. So an 18-year-old pays around $121 per month for minimum coverage after one driving incident.

That's because Umialik offers a penalty-free promise as a part of its Signature Auto program. The penalty-free promise guarantees your rates won't increase because of accidents or tickets.

But only drivers with a clean record can get an Umialik Signature Auto policy. If you already have a ticket or accident on your record, you won't be able to take advantage of this perk.

Best car insurance for teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Umialik | $121 | $121 |

| Allstate | $131 | $171 |

| Geico | $154 | $202 |

| State Farm | $171 | $188 |

| Progressive | $364 | $385 |

Insurance companies raise rates by about 8% after young Alaska drivers get a speeding ticket. Teen drivers in Alaska can expect their rates to increase by around 22% after an accident.

Cheapest Alaska car insurance after a DUI: Umialik

Umialik has the most affordable car insurance quotes in Alaska after a DUI. At $134 per month, the full coverage rate from Umialik is 42% cheaper than average.

Company | Monthly rate |

|---|---|

| Umialik | $134 |

| Progressive | $197 |

| Geico | $206 |

| Allstate | $223 |

| State Farm | $455 |

Alaska drivers who have been caught driving under the influence pay an average of $228 per month for full coverage. That's 78% more than drivers with clean records.

In addition, drivers with a DUI may have to get SR-22 coverage in Alaska. This can make car insurance even more expensive.

Best rates for drivers with poor credit in Alaska: Allstate

Allstate offers the best rates for Alaska drivers with poor credit, with an average rate of $156 per month for full coverage. That's 34% cheaper than average.

In Alaska, car insurance costs 87% more for drivers with poor credit than those with good credit.

Cheapest car insurance in Alaska with poor credit

Company | Monthly rate |

|---|---|

| Allstate | $156 |

| Umialik | $112 |

| Geico | $165 |

| Progressive | $115 |

| State Farm | $134 |

Insurance companies believe drivers with poor credit are more likely to make claims in the future. That's why people with bad credit pay more for car insurance in most states.

Best car insurance companies in Alaska

USAA is the best car insurance company in Alaska based on its excellent customer service, affordable rates and helpful coverage.

But only military members, veterans and their family members can buy car insurance from USAA.

State Farm is the best option for Alaska drivers not eligible for USAA membership. Geico also offers good customer service and some of the cheapest quotes for Alaska drivers.

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 881 | A++ | |

| State Farm | 842 | A++ | |

| Geico | 835 | A++ | |

| Umialik | 876 | A+ | |

| Allstate | 824 | A+ |

It's important for Alaska drivers to consider a company's customer service reputation along with its prices when shopping for car insurance.

Excellent customer service can make the claims process easy and get you back on the road quickly after an accident. But poor service can make a stressful accident even more frustrating. And you could end up paying more money to get your car fixed.

Average cost of car insurance quotes in Alaska by city

Anchorage, the largest city in Alaska, has the most expensive full coverage car insurance rates, with an average of $146 per month.

The towns of Coffman Cove, Douglas, Ketchikan, Saxman and Ward Cove have the lowest rates, with an average of $101 per month.

Full coverage quotes in Alaska by city

City | Monthly rate | % from avg. |

|---|---|---|

| Adak | $121 | -5% |

| Akiachak | $121 | -5% |

| Akiak | $121 | -5% |

| Akutan | $121 | -5% |

| Alakanuk | $121 | -5% |

Where you live can impact your rates as much as other factors, like your age or driving history.

Car insurance tends to be more expensive in big cities like Anchorage. That's because big cities typically have higher crime rates and more traffic, which can lead to more accidents and insurance claims. The cheapest places in Alaska tend to be the islands around Juneau in the southernmost part of the state.

In Alaska, quotes vary by as much as $45 each month, depending on your city.

Alaska state minimum car insurance requirements

Alaska auto insurance policies must include a minimum amount of liability coverage. The coverage limits for a minimum policy in Alaska are commonly written as 50/100/25.

- Bodily injury liability (BI): $50,000 per person and $100,000 per accident

- Property damage liability (PD): $25,000 per accident

Bodily injury liability coverage pays for injuries to the other driver. On the other hand, property damage liability coverage pays to fix a damaged car or property after an accident you cause.

What's the best car insurance coverage for Alaska drivers?

Minimum coverage insurance is very affordable, but it only pays for a limited amount of damage you cause to other drivers and their cars. That could leave you with a hefty bill if you cause a major accident.

Full coverage car insurance in Alaska costs $78 more per month than a minimum coverage policy.

However, full coverage car insurance pays for repairs to your car. It includes collision and comprehensive coverage, which pay for damage after a wreck with another car, vandalism or hitting an animal, among other things.

If your car is worth more than a few thousand dollars, it's typically worth having full coverage insurance. In addition, lenders usually require drivers with a car loan or lease to get full coverage.

Frequently asked questions about Alaska car insurance

How much is car insurance in Alaska?

The average price of full coverage auto insurance in Alaska is $128 per month. Minimum coverage costs around $50 per month.

Who has the cheapest car insurance in Alaska?

Geico offers the cheapest full coverage insurance in Alaska, at $112 per month. State Farm has the cheapest minimum coverage, with an average rate of $46 per month.

How much auto insurance do I need in Alaska?

Alaska drivers must have $50,000 in bodily injury coverage per person and $100,000 per accident. You also need to have $25,000 in property damage coverage per accident.

Methodology

ValuePenguin collected thousands of rates from ZIP codes across Alaska from the state's largest insurance companies. Rates are for a 30-year-old man with good credit who has a clean driving record and owns a 2015 Honda Civic EX.

Full coverage rates include liability coverage, uninsured and underinsured motorist coverage and comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used only for comparative purposes — your quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.