Best Cheap Car Insurance With a Bad Driving Record

State Farm and Progressive have the cheapest car insurance rates for most people with a bad driving record.

Find Cheap Auto Insurance Quotes in Your Area

Cheap car insurance for bad drivers

Bad drivers pay more for car insurance. But you can save by using a company with cheap rates for bad drivers, such as State Farm or Progressive. You can also get insurance from a company that specializes in high-risk drivers, such as The General.

To help you find the best auto insurance for a bad driving record, ValuePenguin collected rates from ZIP codes across the U.S. Our experts also considered how insurance companies raise rates after a ticket, accident or DUI.

Cheapest car insurance companies for bad drivers

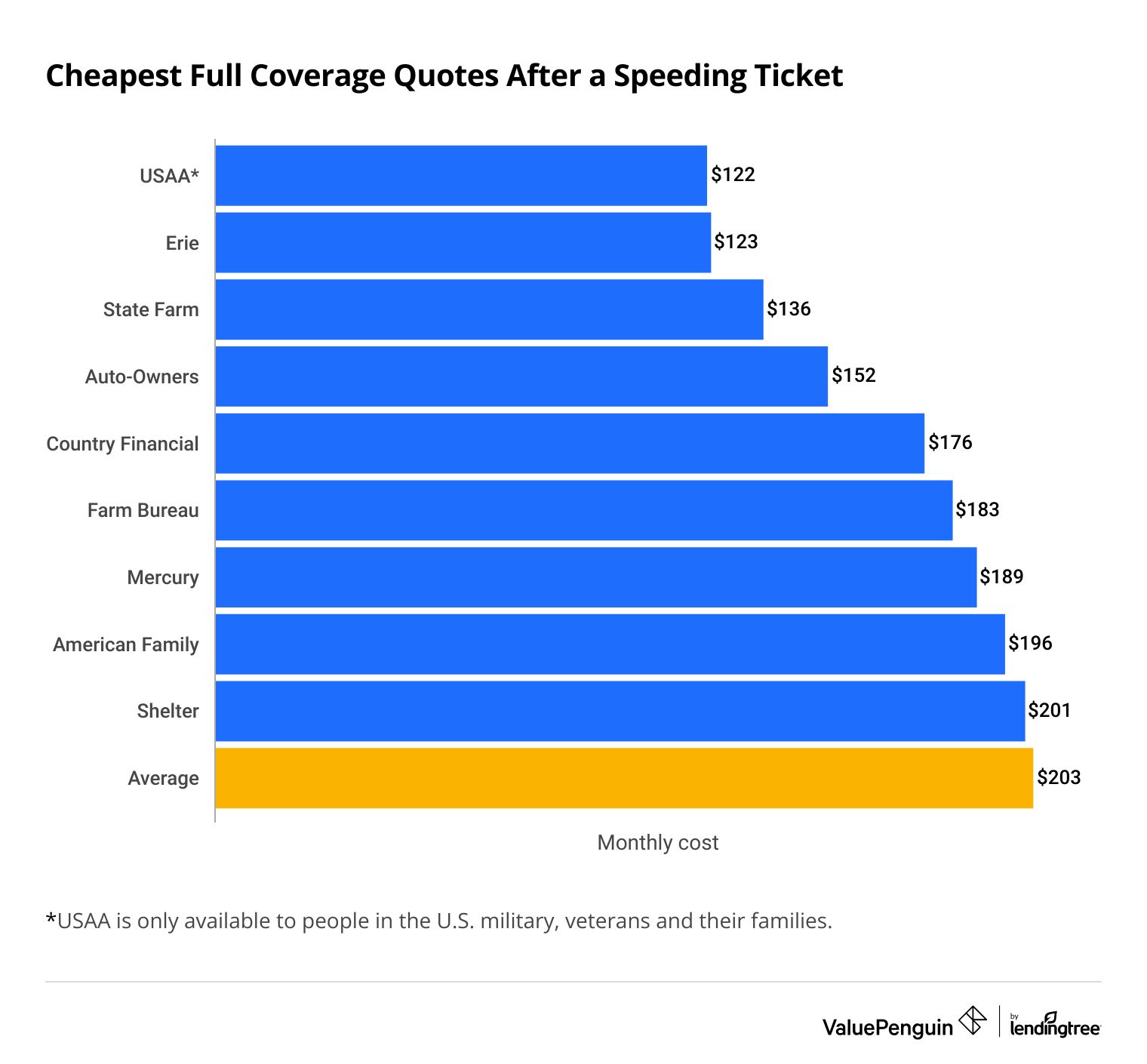

State Farm is the cheapest major car insurance company for drivers with an accident or speeding ticket on their record.

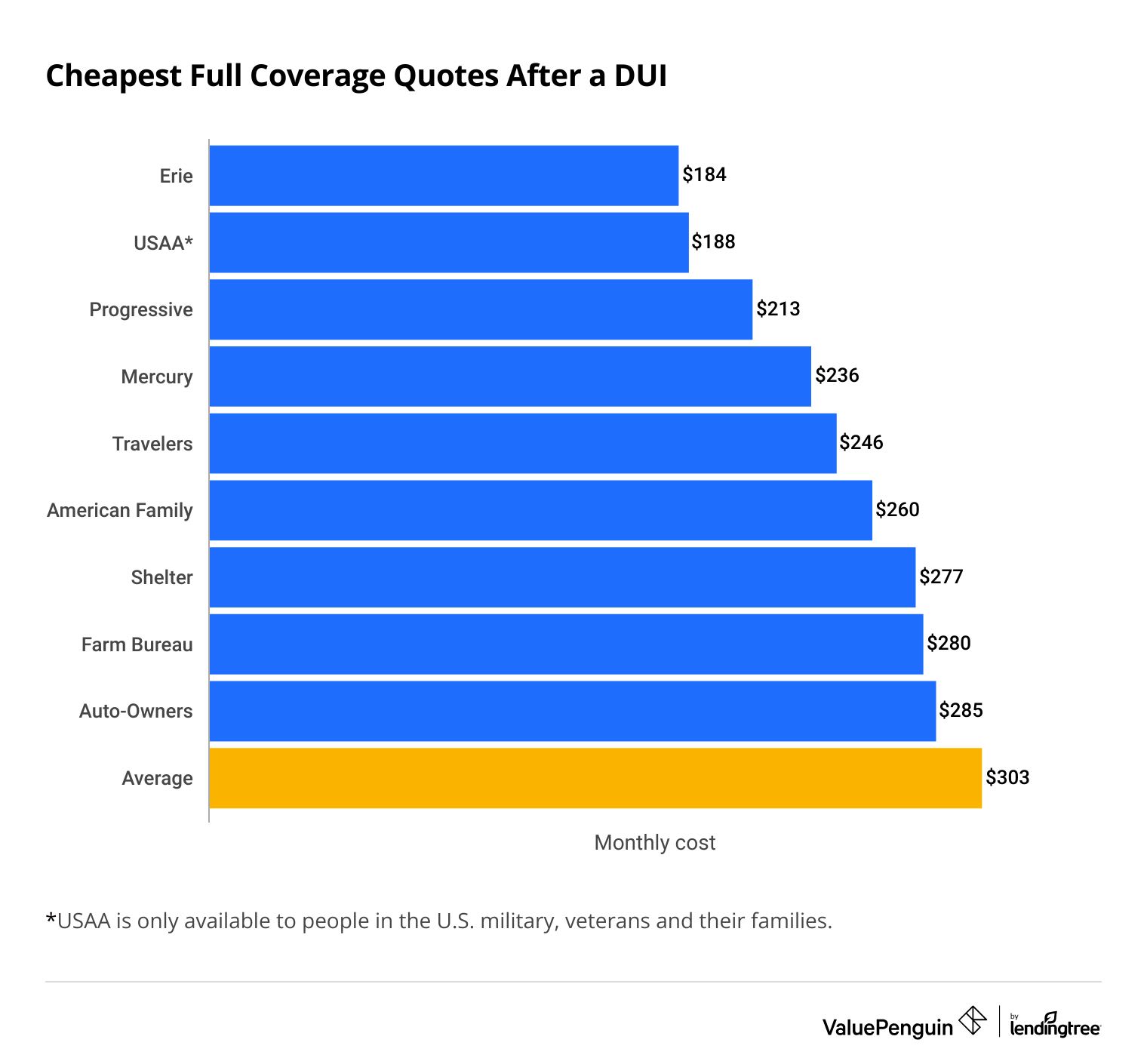

After an accident, State Farm costs 38% less than average. And after a ticket, it costs one-third less than average. Progressive is the cheapest company for most people after a DUI, at 30% less than average.

You may be able to get even cheaper rates from Erie or USAA. However, Erie is only available in 12 states and Washington, D.C. And USAA is only available for military members, veterans and their families.

Find Cheap Auto Insurance Quotes in Your Area

Car insurance rates vary widely after a driving incident. The most expensive company's coverage can cost four times more than the cheapest company, for full coverage car insurance.

The best way for high-risk drivers to get the lowest car insurance rates is to compare quotes from multiple companies.

Monthly full coverage rates for bad drivers

How does a bad driving record affect car insurance?

Typically, the more severe the driving incident, the more your car insurance rates will go up.

Minor issues usually cause a small rate increase. The average cost of full coverage car insurance increases by 13% after a speeding ticket or texting while driving.

However, car insurance rates can go up by more than 40% after a serious driving issue such as a DUI or reckless driving. That's an average increase of $77 per month for a full coverage policy.

Insurance companies believe that people with a bad driving record are more likely to cause an accident in the future. So they raise your rates to help pay for potential claims.

Incidents that happened more than three years ago usually won't usually affect your rates.

A bad driving history won't impact your auto insurance rates forever. Insurance companies typically only consider accidents and traffic tickets from the past three years. However, DUIs could affect your car insurance rates for up to five years because they're a more serious violation.

How to get auto insurance for bad drivers

Frequently asked questions

Is there an auto insurance company that doesn't check your driving record?

No, most every insurance company will consider your driving record when setting insurance rates. However, some companies are more forgiving than others when it comes to driving history, like State Farm and Erie.

What is the cheapest insurance for drivers with accidents on their records?

State Farm is the cheapest insurance company after an at-fault accident. At $125 per month, its full coverage rates are 43% cheaper than average.

What is the best insurance for a bad driving record?

State Farm is the best national insurance company for drivers with an accident or speeding ticket. It has cheap rates, lots of discounts, and good customer service. Progressive is the best major company for drivers with a DUI. Its cheap rates will save you about $1,000 per year, on average, and its accident forgiveness program can prevent your rates from going up after a crash.

How does a bad driving record affect my insurance rates?

A bad driving record will cause your insurance rates to go up. That's because companies believe you're more likely to cause an accident in the future. Rates typically increase by 13% for minor issues such as speeding or texting while driving. However, the worse your driving record is, the more that insurance companies will raise your rates.

Methodology

To find the best cheap car insurance for bad drivers, ValuePenguin gathered thousands of quotes from all residential ZIP codes across the country. Quotes are for a 30-year-old man with good credit who drives a 2015 Honda Civic EX.

All rates are for a full coverage policy, which includes comprehensive and collision coverage, along with the following limits:

- Bodily injury liability: $50,000 per person; $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist liability: $50,000 per person; $100,000 per accident

- Comprehensive and collision: $500 deductible

Rates were provided by Quadrant Information Services and sourced from public insurer filings. Your rates will likely be different, as these are for comparison purposes only.

To determine the impact of different driving incidents, full coverage car insurance rates were collected from six major insurance companies across all residential ZIP codes in Texas.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.