Cheapest Car Insurance in Tennessee (Best Rates in 2024)

Erie has the cheapest full coverage quotes in Tennessee, with an average of $107 per month.

Find Cheap Auto Insurance Quotes in Tennessee

Best cheap car insurance companies in Tennessee

How we chose the top companies

Best and cheapest car insurance in Tennessee

- Cheapest full coverage: Erie, $107/mo

- Cheapest minimum liability: Farm Bureau, $33/mo

- Cheapest for young drivers: Erie, $85/mo

- Cheapest after a ticket: Erie, $117/mo

- Cheapest after an accident: State Farm, $126/mo

- Cheapest for teens after a ticket: Erie, $99/mo

- Cheapest after a DUI: Progressive, $150/mo

- Cheapest for poor credit: Farm Bureau, $158/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Erie and State Farm both have a great mix of reliable customer service and cheap rates in Tennessee. While Travelers and Progressive have affordable rates for some drivers, their customer service isn't as good as Erie or State Farm.

Cheapest car insurance in TN: Erie & State Farm

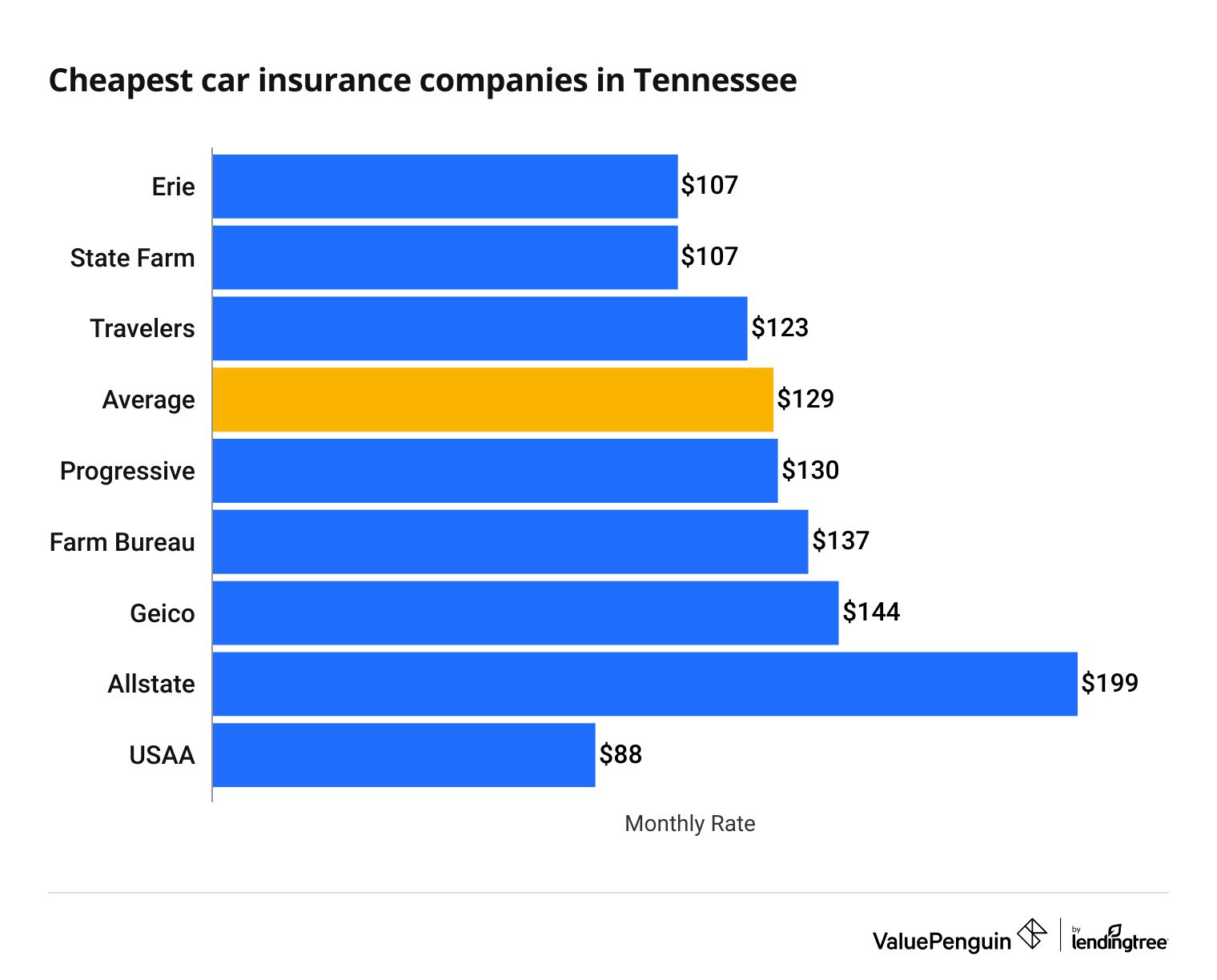

Erie and State Farm offer the most affordable full-coverage insurance in Tennessee.

At $107 per month, both companies charge 17% less than the TN state average. In Tennessee, car insurance costs an average of $129 per month for full coverage.

Erie and State Farm are also $16 per month cheaper than the next cheapest company, Travelers. On average, Erie is $1 per year cheaper than State Farm. Compare quotes from both companies to see which offers the best rates for you.

Find Cheap Auto Insurance Quotes in Tennessee

Tennessee drivers who are veterans or belong to a military family can get even cheaper car insurance from USAA. A full coverage policy from USAA costs $88 per month. That's 32% cheaper than the state average.

Best cheap full coverage car insurance quotes in TN

Company | Monthly rate | |

|---|---|---|

| Erie | $107 | |

| State Farm | $107 | |

| Travelers | $123 | |

| Progressive | $130 | |

| Farm Bureau | $137 |

*USAA is only available to current and former military members and their families.

Cheapest liability insurance in Tennessee: Farm Bureau

Farm Bureau has the cheapest minimum coverage car insurance in Tennessee.

At $33 per month, a liability-only policy with Farm Bureau costs $9 per month less than the state average. State Farm, Progressive and Erie also have affordable minimum coverage quotes of less than $40 per month.

Cheap liability insurance in TN

Company | Monthly rate |

|---|---|

| Farm Bureau | $33 |

| State Farm | $35 |

| Progressive | $35 |

| Erie | $36 |

| Geico | $46 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Tennessee

Cheap auto insurance in TN for young drivers: Erie

Erie has the cheapest car insurance quotes in Tennessee for teen drivers.

A minimum coverage policy with Erie costs $85 per month for an 18-year-old. That's 40% cheaper than the Tennessee average. Erie also has the most affordable full coverage policy for most young drivers, at $245 per month.

USAA has even more affordable car insurance rates for 18-year-old drivers. Liability-only coverage from USAA costs $78 per month, and full coverage is $230 per month. However, only active-duty military members, veterans and some of their family members can get insurance from USAA.

Cheapest TN car insurance for teens

Company | Liability only | Full coverage |

|---|---|---|

| Erie | $85 | $245 |

| Farm Bureau | $109 | $391 |

| Geico | $116 | $323 |

| State Farm | $119 | $325 |

| Travelers | $133 | $335 |

In Tennessee, an 18-year-old can expect to pay more than three times as much for car insurance as a 30-year-old driver. That's because teens have less experience behind the wheel, which means they're more likely to cause a crash.

The best way for young drivers in Tennessee to get cheap insurance rates is by sharing a policy with their parents. Good student and driver safety course discounts can also help young drivers save on car insurance.

Cheap insurance in TN after a speeding ticket: Erie

Erie has the best quotes for Tennessee drivers with a recent speeding ticket. A full-coverage Erie policy costs $117 per month on average. That's $32 per month cheaper than the state average of $149 per month.

Coverage from State Farm costs only $1 per year more than a policy from Erie. So Tennessee drivers should compare quotes from both companies to find their best price.

Cheap car insurance for Tennessee drivers with a speeding ticket

Company | Monthly rate |

|---|---|

| Erie | $117 |

| State Farm | $117 |

| Farm Bureau | $137 |

| Travelers | $163 |

| Progressive | $167 |

Tennessee drivers can expect to pay 15% more for auto insurance after a speeding ticket. That's an average increase of $20 per month for full coverage insurance.

Cheapest TN auto insurance after an accident: State Farm

State Farm has the best cheap Tennessee car insurance for drivers with an at-fault accident on their record. A full coverage policy from State Farm costs $126 per month after a crash, which is 33% cheaper than the statewide average.

Most affordable car insurance in Tennessee after an accident

Company | Monthly rate |

|---|---|

| State Farm | $126 |

| Farm Bureau | $137 |

| Erie | $146 |

| Travelers | $179 |

| Progressive | $215 |

Full coverage quotes in Tennessee increase by 46% after an at-fault accident, on average. However, each insurance company takes a different approach to accidents. Your rates may also depend on whether you have accident forgivenessor not.

For instance, Farm Bureau might not raise rates at all. The company offers the same average rate of $137 per month both before and after an accident. But Geico raises rates by 85% after an at-fault accident, from $144 per month to $267 for full coverage.

The wide range in cost between insurance companies is why it's so important to shop around to find the best rates, especially after your driving record has changed.

Cheapest TN car insurance for teens after a ticket: Erie

Erie has the most affordable rates in Tennessee for young drivers with a speeding ticket or accident on their record.

A minimum liability policy from Erie costs $99 per month for an 18-year-old after a speeding ticket. That's $60 per month cheaper than the Tennessee average.

Erie also has the cheapest quotes for teens after an accident. At $112 per month, minimum coverage from Erie costs $75 per month less than the statewide average.

Best quotes in TN for teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Erie | $99 | $112 |

| Farm Bureau | $109 | $121 |

| Geico | $132 | $198 |

| State Farm | $132 | $146 |

| Travelers | $172 | $196 |

Young drivers in Tennessee can expect their rates to go up by 12% after a speeding ticket, and 32% after an at-fault accident.

Cheapest auto insurance in Tennessee after a DUI: Progressive

Progressive has the best rates in Tennessee for drivers with a DUI. A full coverage policy from Progressive costs $150 per month. That's 28% cheaper than the state average of $209 per month.

Best price for TN car insurance after a DUI

Company | Monthly rate |

|---|---|

| Progressive | $150 |

| Erie | $175 |

| Travelers | $187 |

| Farm Bureau | $218 |

| State Farm | $238 |

Driving under the influence in Tennessee will raise your rates by an average of 61%. In addition, you may need to get SR-22 insurance after a DUI in Tennessee. An SR-22 filing can cost an extra $15 to $50.

Cheapest insurance in TN for drivers with poor credit: Farm Bureau

Farm Bureau has the most affordable full coverage insurance for Tennessee drivers with poor credit, at $158 per month. That's nearly $100 per month cheaper than the $251 per month state average.

Best car insurance in Tennessee if you have poor credit

Company | Monthly rate |

|---|---|

| Farm Bureau | $158 |

| Progressive | $215 |

| Travelers | $216 |

| Geico | $221 |

| Erie | $247 |

Car insurance in Tennessee costs nearly twice as much for drivers with bad credit versus those with good credit. You may pay more auto insurance if you have a low credit score. That's because companies believe that people with low credit scores file more claims than drivers with good credit on average.

Best car insurance in TN

USAA has the best auto insurance for Tennessee drivers, thanks to highly rated customer service and cheap quotes.

However, you can only get USAA car insurance as an active-duty military member, a veteran or their family member.

Tennessee drivers who can't buy a USAA policy should consider Erie, State Farm and Farm Bureau. All three companies earned high ratings from our experts based on their reliable customer service, useful coverage and affordable rates.

Best insurance companies in Tennessee

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 881 | A++ | |

| Erie | 871 | A+ | |

| State Farm | 842 | A++ | |

| Farm Bureau | NR | A | |

| Geico | 835 | A++ |

Customer service reviews are just as important as price when shopping for the best car insurance in Tennessee.

A company with great service will have a fast and easy claims process after an accident. On the other hand, a company with poor service may take longer to pay for car repairs.

Average cost of Tennessee auto insurance by city

Memphis has the most expensive car insurance in Tennessee, at $171 per month for full coverage.

Bristol and Walnut Hill, located on the Tennessee-Virginia border, have the cheapest rates in the state. You'll pay $109 per month in these cities on average.

Tennessee car insurance quotes by city

City | Monthly rate | % from average |

|---|---|---|

| Adams | $134 | 4% |

| Adamsville | $130 | 0% |

| Afton | $119 | -8% |

| Alamo | $131 | 1% |

| Alcoa | $122 | -6% |

Where you live can impact your car insurance rates as much as your driving habits. Full coverage rates in Tennessee vary by about $62 per month between the most and least expensive cities.

Large cities with more traffic and higher crime rates, like Memphis and Nashville, typically have more expensive car insurance rates. That's because of higher accident and auto theft rates tend to lead to more claims.

Minimum car insurance requirements in Tennessee

In Tennessee, state minimum car insurance includes bodily injury liability coverage and property damage liability coverage. Bodily injury pays for the other driver's injuries, while property damage pays for the other driver's repairs. You'll often see these requirements written as 25/50/25.

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $25,000 per accident

What's the best car insurance coverage for Tennessee drivers?

Full coverage car insurance includes comprehensive and collision coverages in addition to liability coverage.

- Comprehensive coverage pays for damage to your car caused by "acts of God," like theft and weather.

- Collision coverage pays for damage to your car after an at-fault accident.

If you have a car loan or lease, your lender will typically require you to have full coverage. You should also consider full coverage insurance if your car is worth more than $5,000 or is newer than 8 years old.

Minimum liability policies are the cheapest option in Tennessee. That's because they offer the least coverage you can legally have. Cheap rates might make liability only auto insurance seem like the best option if you're on a budget. But if you're in an accident, you could end up paying more in the long run.

A minimum coverage policy only pays for the other driver's injuries and property damage. It doesn't protect your car or pay for injuries to you and your passengers.

That's why most drivers should get full coverage auto insurance rather than the minimum limits. That's especially true if they have a long commute or a newer car.

Frequently asked questions

Who has the cheapest car insurance in Tennessee??

Erie is the cheapest insurance company for full coverage in Tennessee, with rates averaging $107 per month. The cheapest minimum coverage comes from Farm Bureau, which charges $33 per month.

How much is car insurance in Tennessee per month?

A minimum coverage policy costs $42 per month in TN on average. Full coverage costs $129 per month on average.

What type of car insurance does TN require?

Tennessee requires drivers to have bodily injury liability coverageof at least $25,000 per person and $50,000 per accident. You must also have a minimum of $25,000 of property damage liability coverage per accident.

Is car insurance expensive in Tennessee?

Car insurance rates in Tennessee are much cheaper compared to most other states. This is partially because of its low minimum insurance requirementsand low traffic congestion in most of the state. There are only 10 states that have a cheaper average rate for full coverage.

How much are car insurance quotes in Memphis, TN?

Full coverage car insurance in Memphis costs around $171 per month. That's roughly 32% more than the Tennessee state average. In comparison, full coverage car insurance in Nashville costs $140 per month. In Knoxville, it's $130 per month.

Methodology

To find the best cheap insurance in Tennessee, ValuePenguin collected thousands of rates from ZIP codes across TN for the largest insurance companies in the state. Rates are for a 30-year-old man with a 2015 Honda Civic EX and good credit.

Rates for a full coverage policy have higher liability limits than the state requirement, along with collision and comprehensive coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates came from insurance company filings. Use them for comparative purposes only. Your own quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.