Best Cheap Health Insurance in Colorado (2025)

Kaiser Permanente is the best health insurance company in Colorado. The cheapest plan costs $449 per month before discounts.

Find Cheap Health Insurance Quotes in Colorado

Best and cheapest health insurance in Colorado

Cheapest health insurance companies in Colorado

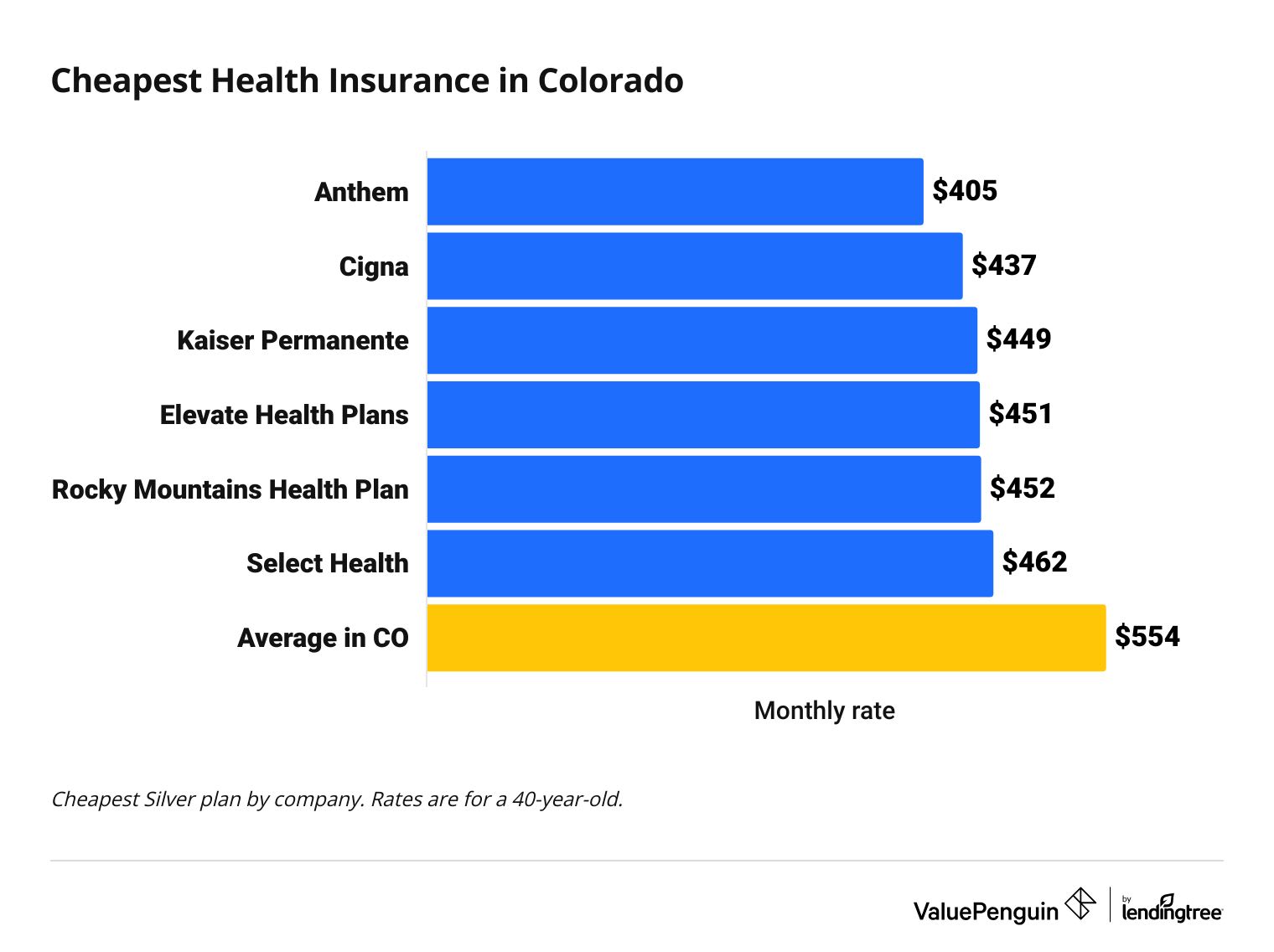

Anthem has the cheapest health insurance in Colorado. Plans start at $405 per month if you pay full price.

Find Cheap Health Insurance Quotes in Colorado

Affordable health insurance in Colorado

Company |

Cost

| |

|---|---|---|

| Anthem | $405 - $716 | |

| Cigna | $437 - $507 | |

| Kaiser Permanente | $449 - $521 | |

| Elevate Health Plans | $451 - $575 | |

- Anthem has the cheapest plans for most people in Colorado. Plan options and rates change based on the county where you live. Anthem is the cheapest company in Denver, Fort Collins and other big cities. However, Kaiser Permanente has the most affordable plans in Colorado Springs, and Rocky Mountains Health Plan is the cheapest company in some rural counties.

- You can get cheaper rates on health insurance by choosing a plan with less coverage. Choosing a Bronze plan can lower your costs by about $100 per month, but you'll pay more at the doctor, so it's usually only worth it if you're young and healthy. That's why the best level of coverage depends on your health needs.

Best health insurance companies in Colorado

Kaiser Permanente is the best health insurance company in Colorado, earning a perfect 5-star rating from HealthCare.gov.

Best-rated health insurance companies in Colorado

Company |

Editor rating

|

ACA rating

|

|---|---|---|

| Kaiser Permanente | 5.0 | |

| Select Health | NA | |

| Elevate Health Plans by Denver Health Medical Plan | 4.0 | |

| Anthem | 3.0 | |

| Rocky Mountains Health Plan | 3.0 |

Find Cheap Health Insurance Quotes in Colorado

Kaiser Permanente has top-quality plans with high customer satisfaction and affordable rates. It's also the most popular health insurance company in Colorado with about half the health insurance plans in the state.

The downside of Kaiser Permanente is that you can usually only use the doctors at Kaiser's medical facilities.

Best health insurance in Colorado for quick coverage

Select Health has the best health insurance plans if you want to pay less before your coverage starts. That's because Select Health has the cheapest average deductibles in Colorado, at $3,301 for Silver plans. That's $818 less than the Colorado state average.

How much does individual health insurance cost in Colorado?

Health insurance in Colorado costs an average of $554 per month if you pay full price or $133 per month if you qualify for discounts based on your income.

Your health insurance costs are based on your age, the plan you choose and your income.

- Younger people typically pay less each month.

- Lower plan tiers like Bronze are usually cheaper but offer less coverage.

- If you qualify for subsidies, rates are on a sliding scale based on your income.

Find Cheap Health Insurance Quotes in Colorado

In Colorado, it usually costs more to buy a Silver plan than a Gold plan, even though the Gold plans have better coverage. If you're looking at a Silver plan, compare your options for Gold, too. You might find that you can get more coverage at a lower price. However, a Silver plan will be the best deal if your income qualifies you for discounts on your medical costs.

Get inexpensive health insurance in Colorado

Health insurance in Colorado costs an average of $133 per month if you qualify for subsidies.

Subsidies can make health insurance affordable, and 29% of Colorado shoppers pay less than $10 per month for a plan. Health insurance subsidies can be applied to Bronze, Silver or Gold plans from any company you choose.

Eligibility for discounted rates is based on your income. You can qualify if you earn less than roughly $60,000 as an individual or less than about $125,000 as a family of four. The lower your income, the more you'll save on a plan.

Cheap Colorado health insurance plans by city

The cost of health insurance changes depending on where you live.

- Anthem has the cheapest health insurance in Denver, at $437 per month.

- Kaiser Permanente has the cheapest health insurance in Colorado Springs, at $453 per month.

Cheapest health insurance by CO county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Adams | Anthem Silver Pathway Essentials | $437 |

| Alamosa | Anthem Colorado Option Silver Pathway | $525 |

| Arapahoe | Anthem Silver Pathway Essentials | $437 |

| Archuleta | Anthem Colorado Option Silver Mountain Enhanced | $520 |

| Baca | Anthem Colorado Option Silver Pathway | $525 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Colorado

Best health insurance by level of coverage

In Colorado, the best health insurance plan for you depends on your monthly budget and how much medical care you need.

Gold plans: Best if you need frequent medical care

| Gold plans pay for about 80% of your medical care. |

Gold plans have the best coverage. If you need ongoing or complex medical care, Gold plans can save you money overall.

Gold plans cost an average of $505 per month in Colorado. They'll help you save on medical costs because of their low deductibles, coinsurance and copays.

Silver plans: Best if you have a low income to get discounts

| Silver plans will pay 73% to 94% of your medical costs if you have a low income. |

If you earn less than about $38,000 per year as an individual or $78,000 per year as a family of four, you'll usually get the best deal with a Silver plan because of a program where you can get discounts on your medical bills.

The cost-sharing reductions program improves your medical coverage if you qualify. But the program is only available if you choose a Silver plan.

In Colorado, Silver plans cost an average of $554 per month. This means that Silver plans can sometimes be more expensive than Gold. So if you don't qualify for medical cost reductions, check if a Gold plan is more affordable than Silver in your area.

Bronze plans: Best if you're young and healthy

| Bronze plans pay for about 60% of your medical care. |

Bronze plans can be good if you are healthy and don't need much medical care. They have the cheapest monthly rates, costing an average of $445 per month. But you'll have to pay a larger part of your medical bills.

A Bronze plan will help you save overall if you only go to the doctor a few times per year. You'll also get free preventive care and your medical bills will be capped if you get very sick or badly injured.

However, your costs for expensive treatment can be high before the plan's full benefits kick in. Be sure you have enough savings to pay for a medical emergency if you choose a Bronze plan.

Medicaid: Free health insurance if you have a low income

If you make less than about $21,000 as a single person or $44,000 as a family of four, Medicaid is the best health insurance option. You'll get great coverage for free or very little cost.

Medicaid is a federal program for people with low incomes. Even if you have a higher household income, you might still qualify for Medicaid if you are pregnant or under age 19.

You can apply for Medicaid in Colorado through the Health First Colorado, where you can also check your benefits or find a doctor after you're enrolled.

Are health insurance rates going up in Colorado?

The average cost of health insurance in Colorado increased by about 9% on average between 2024 and 2025.

Tier | 2024 | 2025 | Change |

|---|---|---|---|

| Bronze | $386 | $445 | 15% |

| Silver | $535 | $554 | 4% |

| Gold | $459 | $505 | 10% |

Monthly costs are for a 40-year-old.

Bronze and Gold plan rates increased the most, by an average of 15% and 10% respectively. Silver plan prices rose by only 4% on average.

Colorado insurance marketplace: Connect for Health

All marketplace health insurance plans provide important benefits to protect your health and finances.

- You get free checkups and preventive care as soon as the plan begins.

- You won't be denied coverage or pay more for a plan if you have a pre-existing condition.

- All plans protect you from major medical debt through the out-of-pocket maximum.

Short-term health insurance in Colorado

You can't buy short-term health insurance in Colorado. The state changed its rules for short-term health insurance in 2019. Although short-term health insurance is allowed in Colorado, no insurance companies sell short-term policies.

Frequently asked questions

What is the cheapest health insurance in Colorado?

Anthem has the cheapest Silver plan in Colorado, at $405 per month. That's 27% cheaper than the CO state average.

Anthem has the most affordable coverage for more than four out of every five people in Colorado.

What is the best health insurance company in Colorado?

Kaiser Permanente is the best health insurance company in CO. It has a perfect five-star rating from HealthCare.gov and consistently high customer satisfaction reviews. Kaiser Permanente also has low rates, with a Silver plan costing an average of $449 per month in CO. And Kaiser Permanente is the most popular health insurance company in Colorado. Its plans make up nearly half of all health insurance plans in the state.

How much does Obamacare cost in Colorado?

A Silver policy from Colorado's state marketplace costs an average of $554 per month. Gold plans cost $505 per month, which makes them a better deal if you don't qualify for cost-sharing reductions.

Plans sold on the Connect for Health Colorado site are often called Obamacare plans or Affordable Care Act plans. These plans are often the best health insurance if you don't get coverage from a job or qualify for Medicare or Medicaid.

Methodology

The average cost of health insurance is based on a 40-year-old buying a Silver plan, unless otherwise specified. All rates and plan information come from the Connect for Health Colorado state health insurance exchange. Using the premiums, averages were determined for variables such as metal tier, age and county.

Additional sources include KFF, S&P Global and NAIC (National Association of Insurance Commissioners).

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.