Cigna Health Insurance Review

Cigna is an average health insurance company with cheap rates in most states, but most people have access to better options.

Find Cheap Health Insurance Quotes in Your Area

While Cigna has cheap rates for its Silver plans, the company's Bronze and Platinum plans are more expensive than average. And although Cigna has some useful extra perks, it also has poor customer satisfaction. Cigna is a middle-of-the-road option for health insurance, but you can probably find a better plan with another company.

Pros and cons

Pros

Cheap rates on Silver plans

Offers dental plans

Sells supplemental insurance

Cons

Bad customer service

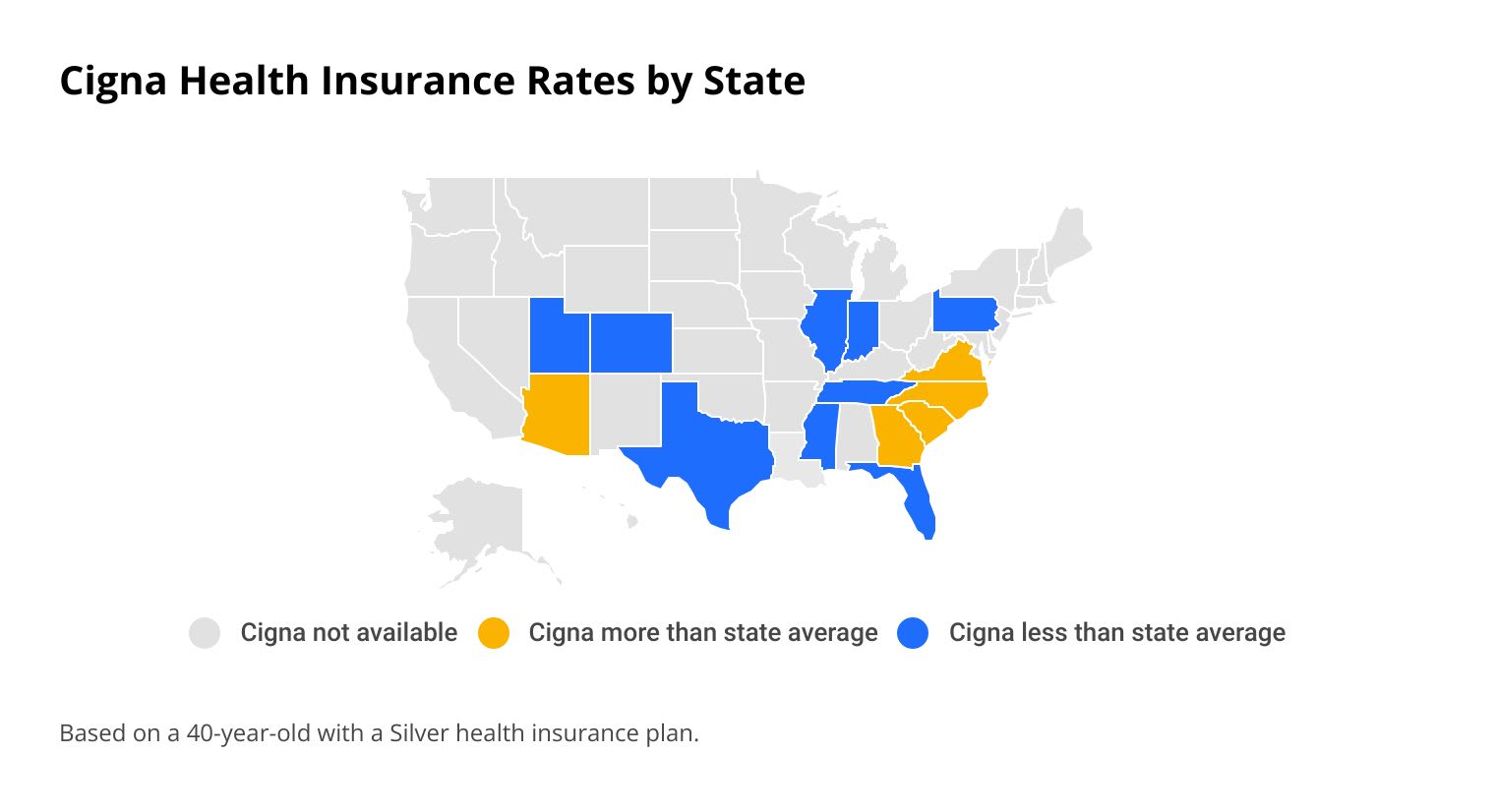

ACA plans are only in 14 states

Cost of Cigna health insurance

Cigna's rates are typically around average, but in some states, it's a cheap option.

Overall, Cigna's rates tend to be close to average. If you live in a state where its rates are higher than the state average, you can likely find a cheaper plan with another company. But if you live in a state where Cigna has cheaper-than-average rates, it might be worth getting a quote.

Find Cheap Health Insurance in Your Area

Keep in mind that even if Cigna is a cheap option in your state, you might be able to find a plan with similar cheap rates and better customer service.

Cigna health insurance rates by state

States where Cigna is cheap

States where Cigna is expensive

State | Cigna rate | State rate |

|---|---|---|

| Colorado | $434 | $535 |

| Florida | $587 | $613 |

| Illinois | $477 | $633 |

| Indiana | $428 | $436 |

| Mississippi | $500 | $511 |

Average monthly rates for a 40-year-old with a Silver plan.

States where Cigna is cheap

State | Cigna rate | State rate |

|---|---|---|

| Colorado | $434 | $535 |

| Florida | $587 | $613 |

| Illinois | $477 | $633 |

| Indiana | $428 | $436 |

| Mississippi | $500 | $511 |

Average monthly rates for a 40-year-old with a Silver plan.

States where Cigna is expensive

State | Cigna rate | State rate |

|---|---|---|

| Arizona | $590 | $517 |

| Georgia | $557 | $509 |

| North Carolina | $719 | $638 |

| South Carolina | $578 | $541 |

| Virginia | $410 | $409 |

Average monthly rates for a 40-year-old with a Silver plan.

If you live in Colorado or Mississippi, Cigna sells the cheapest Silver health insurance plan in your state.

When compared to the national average cost for health insurance, Cigna has cheaper rates for Silver plans but higher rates for Bronze and Platinum plans.

Plan tier | Cigna rate | National rate |

|---|---|---|

| Bronze | $481 | $462 |

| Silver | $566 | $584 |

| Gold | $697 | $641 |

Average monthly rates for a 40-year-old with a Silver plan.

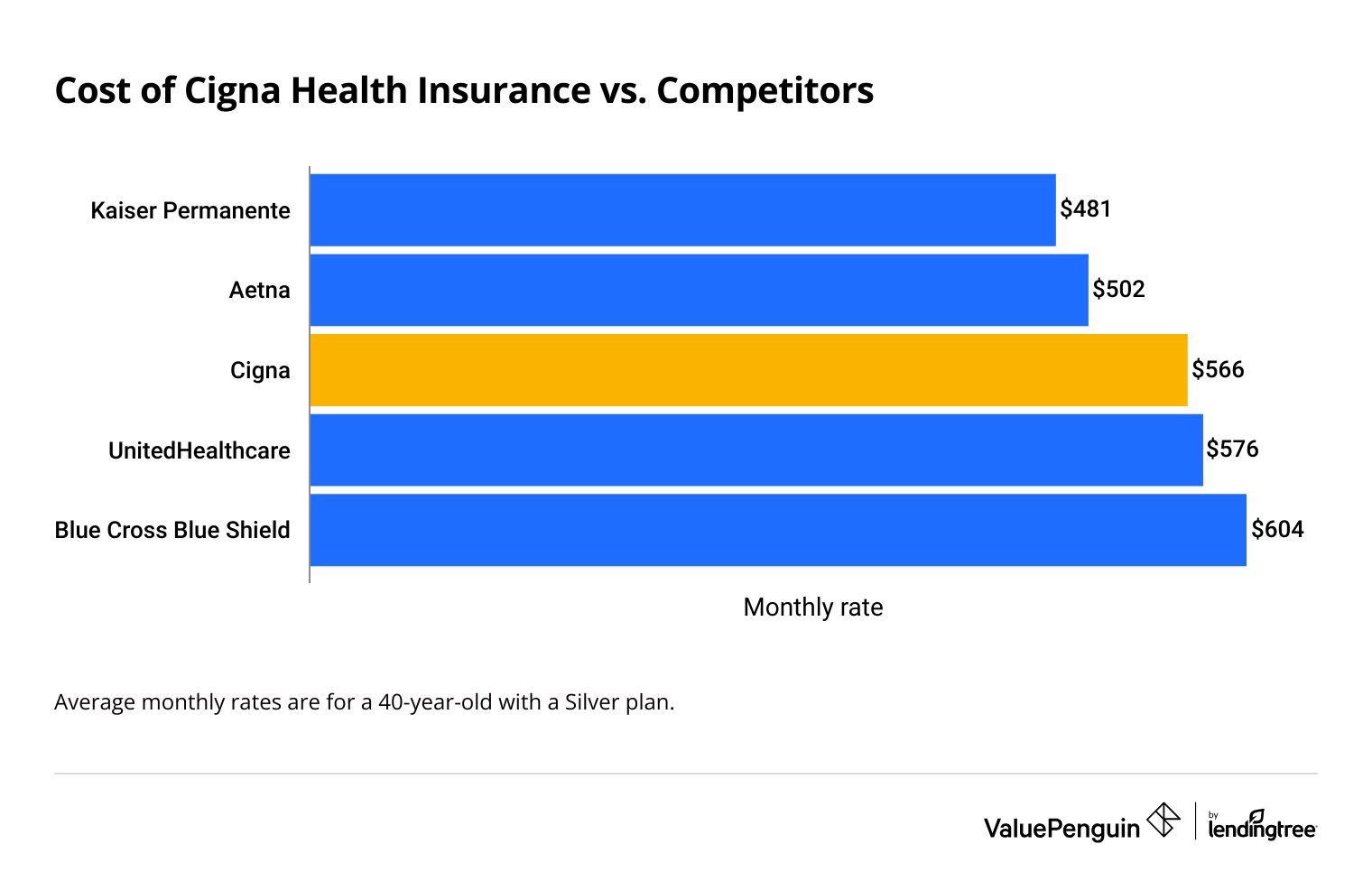

Cigna vs. competitors

Cigna's rates are average when compared to other large health insurance companies. If you're shopping for a Silver plan, Cigna tends to be slightly cheaper than Blue Cross Blue Shield and UnitedHealthcare, but more expensive than Aetna and Kaiser Permanente.

Find Cheap Health Insurance in Your Area

Health insurance rates change with several factors, including your age, where you live and how much coverage you buy. Your monthly rate from Cigna will likely be different from the national average or even the average in your state.

Cigna rates compared to other health insurance companies

Companies | Cigna rate | Competitor rate |

|---|---|---|

| Cigna vs. Kaiser | $566 | $481 |

| Cigna vs. Aetna | $566 | $502 |

| Cigna vs. UnitedHealthcare | $566 | $576 |

| Cigna vs. Blue Cross Blue Shield | $566 | $604 |

Average monthly rates for a 40-year-old with a Silver plan.

Cigna health insurance plans and options

Cigna sells Bronze, Silver and Gold health insurance plans as well as dental coverage and supplemental policies, which give you extra coverage on top of your normal health insurance. Your options will vary based on where you live.

Cigna individual health insurance

Cigna sells Bronze, Silver and Gold health insurance plans. You can't buy a Catastrophic plan or a Platinum plan from Cigna.

Silver plans are usually the best option for most people, and Cigna's coverage is standard. Each plan has its own specific features, and coverage also varies by state.

For example, in Illinois, you'll pay less before your coverage kicks in. That's because Cigna's Silver plans in Illinois usually have lower health insurance deductibles than other plans. In Texas, Cigna's deductibles are roughly average for Silver plans. But in Virginia, you'll pay nearly $300 more, on average, before your coverage kicks in compared to other Silver plans in the state.

You can buy Cigna individual health insurance in 14 states.

- Arizona

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Mississippi

- North Carolina

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Utah

- Virginia

But availability varies by county. In general, Cigna isn't available everywhere in a state and tends to offer plans in the most populated areas. In Pennsylvania, for example, you can only get Cigna in five counties in and around Philadelphia.

Cigna dental insurance

Cigna sells several different dental plans, and some of them include vision and hearing coverage. The plans fit into three categories: low-deductible plans, high-benefit plans and bundled plans.

Plan category | Plan name | Average monthly rate |

|---|---|---|

| Low-deductible plans | Cigna Dental Preventive | $19 |

| Cigna Dental 1000 | $33 | |

| Cigna Dental 1500 | $39 | |

| High-benefit plans | Cigna Dental 3000/100 | $32 |

| Bundled plans | Cigna Dental Vision 1000 | $32 |

Average monthly rates according to Cigna.

The Cigna Dental 1500 plan is the only policy with coverage for orthodontia. If you need braces, retainers or other orthodontic services, you'll have up to $1,000 total in coverage. This is a lifetime limit, so it doesn't reset every year. The plan will only pay up to $1,000 total for orthodontia costs.

Cigna dental insurance plans are available in all 50 states and Washington, D.C. The plans available vary based on where you live, but you'll have access to at least one type of Cigna dental plan.

You can see any dentist, even if they aren't in the plan's network. That's because all Cigna dental plans use PPO networks. You'll pay more at out-of-network offices, which means your benefits won't go as far, but you'll still have some coverage.

Cigna supplemental insurance

Cigna sells five types of supplemental health insurance. These plans are designed to give you extra coverage for specific situations.

- Lump Sum Heart Attack and Stroke Insurance

- Lump Sum Cancer Insurance

- Cancer Treatment Insurance

- Hospital Indemnity Insurance

- Accident Treatment Insurance

Supplemental health insurance works differently than your primary health insurance plan. Instead of paying a medical office, these plans pay you directly. You can then use the money to pay for your treatment, or for other costs like household bills or childcare.

Cigna Medicare

If you are 65 or older, or if you qualify for Medicare due to a disability or health condition, Cigna has a few plan options. Cigna sells Medicare Advantage and Medicare Supplement plans. But even for Medicare, Cigna's plans still aren't the best options for most people.

Cigna is selling its Medicare plans, including Medicare Advantage, Supplement and Part D, to Health Care Service Corp. (HCSC), which is a part of Blue Cross Blue Shield. The sale is expected to be final in 2025. If you have a Cigna Medicare plan, your coverage will stay with Cigna for at least the rest of 2024. But keep an eye out for information about your plan going into 2025.

Perks and unique features

Cigna provides free or low-cost preventive care and 24/7 access to virtual care. If you take prescription medications, you might want to consider Cigna's recurring medication delivery through Express Scripts. Pharmacists are available to answer questions and fill prescriptions 24/7.

Cigna has a rewards program called Take Control Rewards. You earn points, up to $325, by completing simple tasks like watching informational videos and reading articles about health and wellness. You can then use the points for merchandise, or redeem them as a debit card and spend them however you want.

If you buy a Cigna health, dental or supplemental plan, you'll have access to an online portal and the myCigna mobile app. You can use these tools to monitor claims, view your health ID cards and find in-network doctors.

Customer reviews and satisfaction

Cigna's customer service is generally rated below average.

Two of the biggest companies within the Cigna family have more complaints about individual and family health insurance than an average company their size, according to the National Association of Insurance Commissioners (NAIC). The customer service you get will depend on the specific Cigna company in your state. But generally, Cigna customers aren't completely satisfied.

Cigna also has an average customer satisfaction rating of 2.8 out of 5.0 according to the National Committee for Quality Assurance (NCQA). The score was based on a review of customer opinions about the medical care they received while on a Cigna plan, the coverage their plan provided and the quality of the doctors in Cigna's network.

Frequently asked questions

Is Cigna good insurance?

Cigna is a good insurance company, but it isn't usually the best option for most people. Even in the states where its rates are cheaper than the state average, Cigna usually isn't the cheapest health insurance. And its customer satisfaction is typically lower than average. There are worse companies, but there are also better ones.

How much does Cigna cost?

Nationally, a Silver plan from Cigna costs $566 per month. That is $18 cheaper per month than the national cost of a Silver plan, $584 per month. But in five of the 14 states where Cigna sells health insurance plans, its rates are more expensive than the state average. In Arizona, Georgia, North Carolina, South Carolina and Virginia, Cigna isn't a cheap option.

Which is better, Cigna or UnitedHealthcare?

Overall, UnitedHealthcare is a better health insurance company for most people than Cigna. UnitedHealthcare has better customer satisfaction than Cigna. Plus, UntiedHealthcare offers more plan options than Cigna, since it sells Catastrophic and Platinum plans and Cigna doesn't. However, Cigna's average rate for a Silver plan is $10 cheaper per month compared to UnitedHealthcare. So Cigna may be a better option for budget shoppers.

Methodology

ValuePenguin used 2024 health insurance rates and data from the Public Use Files (PUFs) on the Centers for Medicare & Medicaid Services (CMS) government website. Our experts used this data to calculate average rates, deductibles and more. Plans and providers for which county-level data was included in the CMS Crosswalk file were used in our analysis; those excluded from this data set may not appear.

Dental insurance rates are from Cigna. Rates are national monthly averages and were last updated by Cigna in February 2023. Other sources include Cigna, the National Association of Insurance Commissioners (NAIC) and the National Committee for Quality Assurance (NCQA).

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.