Best Cheap Health Insurance in Georgia (2025)

Kaiser Permanente sells the best health insurance in Georgia. The cheapest Silver plan from Kaiser costs $528 per month before discounts.

Find Cheap Health Insurance Quotes in Georgia

Best and cheapest health insurance in Georgia

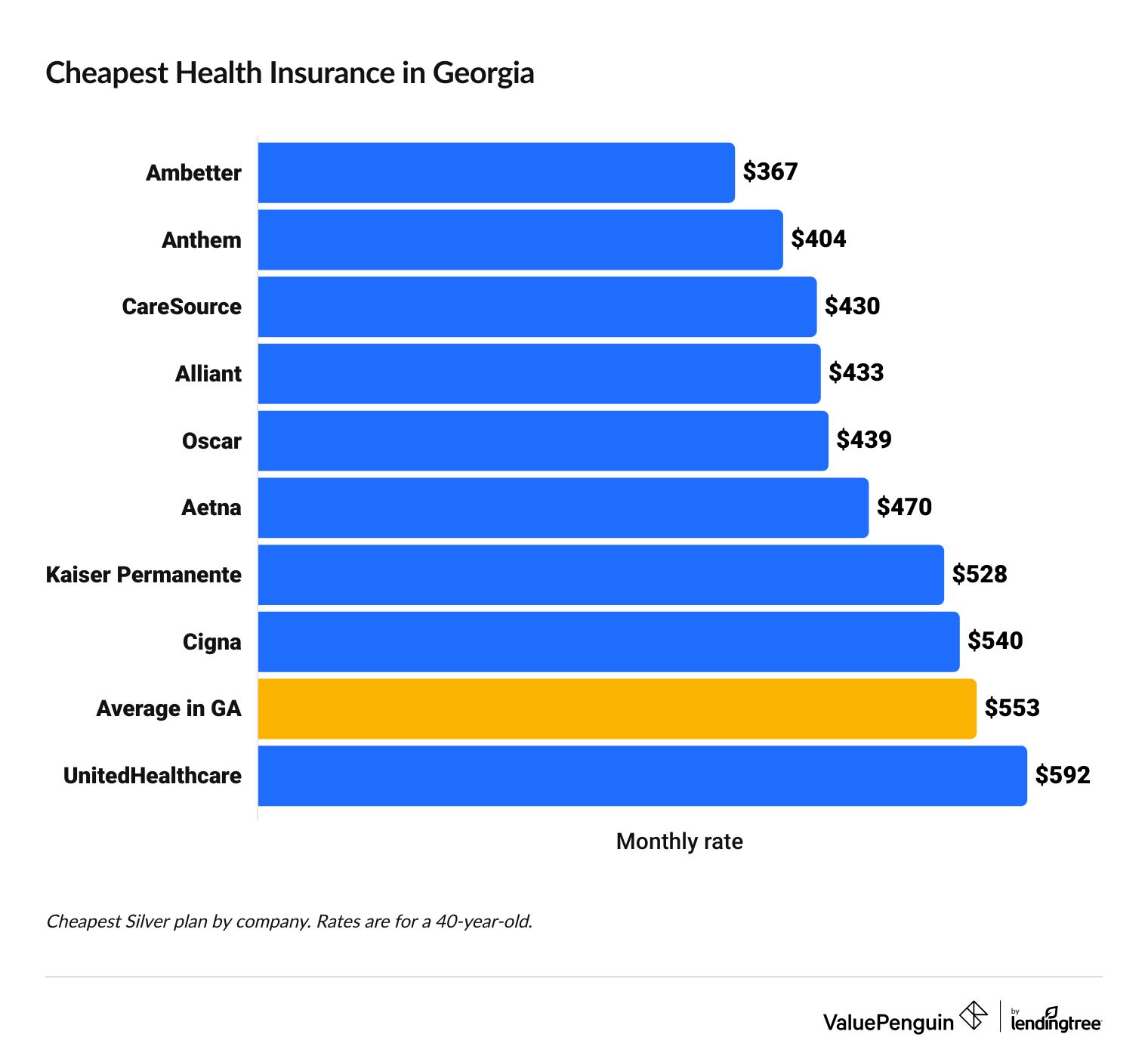

Cheapest health insurance companies in Georgia

Ambetter from Peach State Health Plan has the cheapest health insurance in Georgia. Silver plans start at $367 per month.

Find Cheap Health Insurance Quotes in Georgia

Affordable health insurance in Georgia

Company |

Cost

| |

|---|---|---|

| Ambetter | $367-$602 | |

| Anthem | $404-$840 | |

| CareSource | $430-$713 | |

| Alliant | $433-$688 | |

- Ambetter has the cheapest health insurance plan in Georgia, and it's also the cheapest option for about 63% of the state's population.

- Anthem's health insurance plans cost a bit more, but they're the cheapest option in Atlanta.

- Kaiser Permanente is a more expensive choice, but its plans are the best in Georgia.

Best health insurance companies in Georgia

Kaiser Permanente tops the list of best health insurance companies in Georgia.

Kaiser Permanente is the only company in Georgia to get a perfect 5-star rating from HealthCare.gov. Plus, it has excellent customer service.

Best-rated health insurance companies in Georgia

Company |

Editor rating

|

ACA rating

|

|---|---|---|

| Kaiser Permanente | 5.0 | |

| Aetna | 3.0 | |

| Ambetter | 3.0 | |

| Anthem | 3.0 | |

| Alliant | 3.0 |

Find Cheap Health Insurance Quotes in Georgia

One catch with Kaiser Permanente is that you can only use its medical offices and hospitals. If you want more flexibility with what doctors you can see and which hospital you can go to, Alliant is a better option. It's the only company that sells PPO plans, which let you use any doctor you want and still have some coverage, even if they're outside the plan's network.

How much does health insurance cost in Georgia?

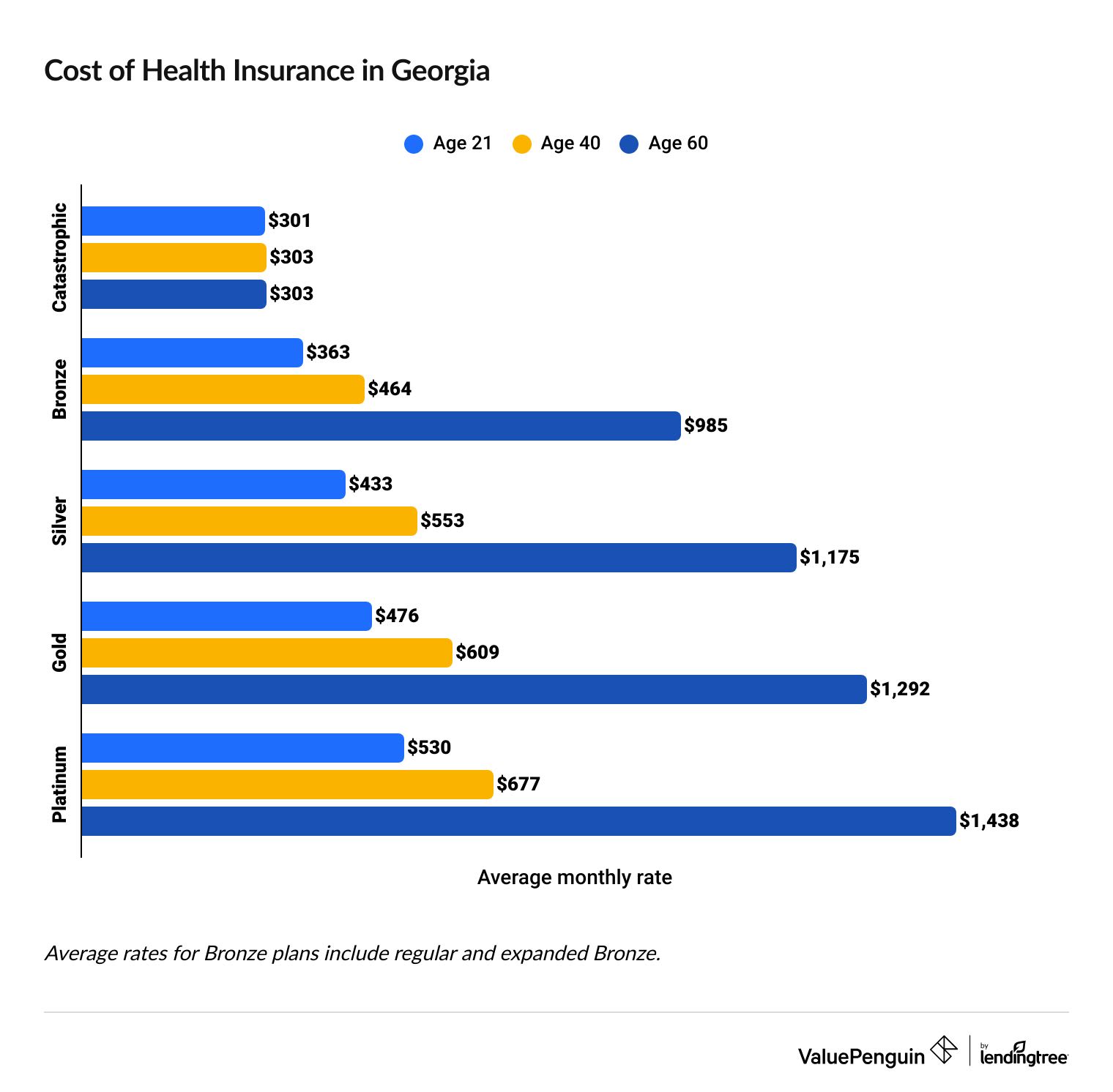

Health insurance in Georgia costs an average of $553 per month, but you'll pay an average of $52 per month if you qualify for discounts based on your income.

- Your age is a big factor that influences your health insurance quotes.

- In Georgia, you will pay 28% more as a 40-year-old compared to a 21-year-old for the same Silver policy.

- The largest age-related increases come as you enter middle age. An average 60-year-old in Georgia will pay more than twice as much as a 40-year-old for a Bronze, Silver, Gold or Platinum policy. That's because you're more likely to develop health issues and need more medical care as you get older.

Get affordable health insurance in Georgia with subsidies

Georgia health insurance costs $52 per month, on average, if you get discounts based on your income.

These discounts are called subsidies. About half of people who get an Obamacare plan in Georgia pay $10 or less per month for health insurance.

The lower your income, the more you'll save. As a single person, you have to make between $15,606 and $60,240 per year to qualify. For a family of four, the range is $31,200 to $124,800 per year. But if your income qualifies you for Medicaid, you can't get subsidies.

You can apply a subsidy to Bronze, Silver, Gold or Platinum plans from any company. But you can't use subsidies for Catastrophic plans.

Cheap Georgia health insurance plans by city

Ambetter has the cheapest health insurance in most of Georgia.

Health insurance plans and rates change based on where you live. That's why the cheapest Silver health insurance plan for you may be different from the cheapest plan in the state.

- In Atlanta, Anthem has the cheapest health insurance, at $530 per month for the Anthem Silver Blue Value X 4500 plan.

- In Savannah, the cheapest Silver health insurance plan is from Ambetter, at $509 per month.

- In Athens, GA, Alliant has the cheapest health insurance, and plans start at $569 per month.

Cheapest health insurance by GA county

County | Cheapest Silver plan | Monthly rate |

|---|---|---|

| Appling | Ambetter Clear Silver | $514 |

| Atkinson | Ambetter Clear Silver | $392 |

| Bacon | Anthem Silver Blue Value X 4500 | $404 |

| Baker | Ambetter Clear Silver | $463 |

| Baldwin | Ambetter Clear Silver | $440 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Georgia

Best health insurance by level of coverage

To find the best health insurance for you, think about your monthly budget and how much medical care you need.

Lower plan tiers, such as Bronze and Catastrophic, have low monthly rates but high costs when you visit the doctor or get a prescription filled. The higher plan tiers, Gold and Platinum, have the most expensive monthly rates but usually the lowest costs when you go to pay for medical care.

Gold and Platinum plans don't offer extra benefits or more types of coverage than a Bronze or Silver plan.

Platinum plans: Best for people with ongoing medical issues

| Platinum plans pay for about 90% of your medical care. |

Platinum plans have the highest rates of all the plan tiers, but they also pay out the greatest percentage for medical care. If you have a chronic, complex or expensive health issue that requires many doctor visits and tests, a Platinum plan is a good idea. You'll pay more each month, but you'll likely save overall since the plan will pay a higher share of your bills.

Platinum plans cost $677 per month, on average, in Georgia.

Gold plans: Best for people with frequent medical needs

| Gold plans pay for about 80% of your medical care. |

Gold plans cost less than Platinum plans, but they still pay for a large portion of your medical bills. If you go to the doctor often, a Gold plan might be worth it. A Gold plan could also be a good idea if you're generally healthy but have an expensive treatment coming up, like a surgery.

In Georgia, Gold plans cost an average of $609 per month.

Silver plans: Best for most people

| Silver plans pay for about 70% of your medical care. |

Silver plans strike a balance between affordable monthly rates and modest out-of-pocket costs. They're a good choice for most people since you won't face a high deductible and out-of-pocket maximum if you become sick or get injured. But, the monthly costs shouldn't be too much of a burden for the average household.

Silver plans cost an average of $553 per month in Georgia.

Bronze plans: Best for healthy people with emergency savings

| Bronze plans pay for about 60% of your medical care. |

Bronze plans have cheap rates but require you to pay for more of your medical bills. They can be a good idea if you're mostly healthy and on a budget. But you should make sure you have savings in the bank. That way, if you get seriously sick or hurt, you can afford to pay your share of the medical bills.

Bronze plans cost $464 per month, on average, in Georgia.

Catastrophic plans: Best as a last resort

Catastrophic plans have the lowest monthly rates for health insurance of any plan tier, but they also have the lowest level of coverage. If you get sick or injured, you will have to pay a very high deductible before your policy pays out. Catastrophic plans aren't the best idea for most people, unless they can't afford anything else.

You can only buy a Catastrophic plan if you're under the age of 30 or if you qualify for a special hardship exemption waiver. Hardship exemptions are usually only given to people who would struggle to afford a higher plan tier.

Carefully consider the full cost of a Catastrophic plan before you buy. The high out-of-pocket costs mean they're rarely a good choice, especially if you qualify for a marketplace subsidy, which Catastrophic plans aren't eligible for.

Catastrophic plans cost an average of $303 per month in Georgia.

Cheap or free health insurance in Georgia if you have a low income

If you have a low income and can't afford health insurance or health care, there are a few options that can make things more affordable.

Medicaid in Georgia

Medicaid is a government-sponsored health insurance program for people with low incomes. Georgia has not expanded Medicaid for residents under the Affordable Care Act (ACA). That means in addition to having a low income, you must fall into one of the following categories:

- You are pregnant

- Age 18 or younger

- Age 65 or older

- Blind

- Have a qualifying disability

- In need of nursing home care

- Have breast or cervical cancer

You may also qualify for Medicaid in Georgia if you have a foster or adopted child. Families leaving the Temporary Assistance for Needy Families (TANF) program may also qualify, along with low-income families that have children under the age of 19. You may also be eligible for Medicaid in Georgia even if you don't meet the income and asset requirements if you have high medical bills.

Medicaid eligibility in Georgia can be complex. The Georgia Medicaid website suggests that you apply even if you don't think you'll qualify based on the above criteria.

Use cost-sharing reductions for cheaper medical care

If you buy a Silver plan, you might be eligible for discounts that lower what you have to pay for medical care. These are called cost-sharing reductions. The less you make each year, the less you could pay for health care if you qualify.

To qualify, you have to make between $15,060 and $37,650 per year if you're single or between $31,200 and $78,000 per year as a family of four.

Are health insurance rates going up in GA?

The average cost of health insurance went up by 5% in Georgia between 2024 and 2025.

Gold plans had the highest increase, costing 11% more for 2025 compared to 2024. Catastrophic plans actually went down in price and are 6% cheaper.

Tier | 2024 | 2025 | Change |

|---|---|---|---|

| Catastrophic | $323 | $303 | -6% |

| Bronze | $434 | $464 | 7% |

| Silver | $509 | $553 | 9% |

| Gold | $548 | $609 | 11% |

| Platinum | $661 | $677 | 3% |

Monthly costs are for a 40-year-old.

In Georgia, if you don't have health insurance through your employer, you can buy Affordable Care Act plans, also called "Obamacare" plans, from the state's marketplace site, Georgia Access. No matter what plan tier you choose, you'll have coverage for at least 10 medical situations:

- Doctor visits

- Preventive and wellness care

- Emergency care

- Hospital stays

- Prescription medications

- Lab services

- Pregnancy, maternity and newborn care

- Pediatric care

- Mental health and substance use care

- Rehab services

Lower-tier plans pay for less of your medical care, while higher-tier plans pay for more of it, but you're covered for the same medical situations. So for example, if you need blood work done, you'll pay more out-of-pocket for lab services if you have a Bronze plan than if you had a Gold plan.

Short-term health insurance in Georgia

In Georgia, if you're facing a gap in your regular health insurance coverage, you can buy a short-term health insurance policy. With it, you can get coverage for up to three months, with a possible one-month renewal.

Pros of short-term health insurance in Georgia

Cons of short-term health insurance in Georgia

Frequently asked questions

How much is health insurance in Georgia per month?

In Georgia, a Silver health insurance plan costs $553 per month on average for a 40-year-old. It's important to remember that your age, location and the plan tier and company you choose will all influence your

What health insurance is free in Georgia?

Health insurance is only free in Georgia if you qualify for Medicaid, a type of free and low-cost government health insurance. You may be eligible if you earn a low income and you're pregnant, disabled, a parent of a minor child, age 65 or older or in need of nursing home care. Georgia does not have expanded Medicaid, so you can't qualify for Medicaid solely because of your income.

What's the best health insurance in Georgia?

Kaiser Permanente scores highest for customer satisfaction and plan quality in Georgia according to ValuePenguin editors and HealthCare.gov. But if getting a cheap plan is your highest priority, consider Ambetter, Anthem and CareSource.

Methodology

To find the cheapest health insurance plans in Georgia, ValuePenguin used data from Georgia's state marketplace website, Georgia Access, to get 2025 health insurance rates. Average rates are for a 40-year-old with a Silver plan, unless otherwise noted.

Rates for plans with subsidies are based on Centers for Medicare & Medicaid Services (CMS) data for all shoppers during the 2024 open enrollment period who qualified for advance premium tax credits (APTCs) based on their incomes.

To choose the best health insurance in Georgia, ValuePenguin assigned each company a score based on rates, coverage, customer service and unique features.

Other sources include KFF, the National Association of Insurance Commissioners (NAIC) and S&P Global Capital IQ.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.